On Monday, the overall volume traded on the S&P500 was about 50% of the average daily volumes of the past 3 months. What about the Nasdaq100? Incredibly, the volume traded on the index on Monday was ~14% of the average traded volume of the past 3 months. Let’s look a little bit more around:

- $SPY traded 48.42M shares / 75.36M the past 3 months daily average

- $QQQ: 27.05M / 44.72M

- $IWM: 19.44M / 39.66M

- $AAPL: 53.90M / 60.62M

- $MSFT: 17.85M / 22.72M

- $GOOG: 15.09M / 22.86M

- $AMZN: 29.24M / 44.15M

- $META: 8.34M / 18M

- $TSLA: 73.91M / 103.66M

Well, clearly we see a pattern now. Pretty unusually low volume for the last Monday before not only month-end close but also quarter close, isn’t it? Isn’t this supposed to be the time when many portfolio managers out there are busy “window dressing” their funds?

Of course, there was an exception to this, the usual one. $NVDA traded 54.61M shares on Monday compared to 52.36M daily average in the past 3 months.

At the end of the Monday morning #stocks trading session in Asia, I asked this question: “Is it just going to be an incredibly boring day in markets or is liquidity drying up quickly?”

Well, clearly the answer to that question was that liquidity is drying up across the board, from #Asia to #Europe to the #US.

Let me be clear, the definition of “liquidity” with regard to #stocks is the number of shares a trader can buy/sell at any point in time without impact on the stock price itself. Why is this important to understand? Because a shockingly large amount of people out there believe “liquidity” is the freshly printed money Central Banks across the Globe keep injecting into the financial system and they erroneously associate this with a false impression there will always be a bid to inflate the value of their assets.

I’m afraid, but that’s not how it works and not understanding what really drives the market can become dangerous. By definition, a stock price is set at a specific level when a trade is completed. A TRADE ALWAYS REQUIRES ONE BUYER AND ONE SELLER, consequently, whoever believes “no one is selling his stock because it is going to the moon” by definition is a fool.

Now, what happens when buyers and sellers start to be in disagreement on the price? Fewer transactions are going to be completed in the market resulting in lower trading volume. This is exactly what happened on Monday.

What happens when the current shareholders see the number of willing buyers lining up to bid their shares dwindling? They start to worry they might not be able to cash out as easily as they thought when their need to do so surfaces.

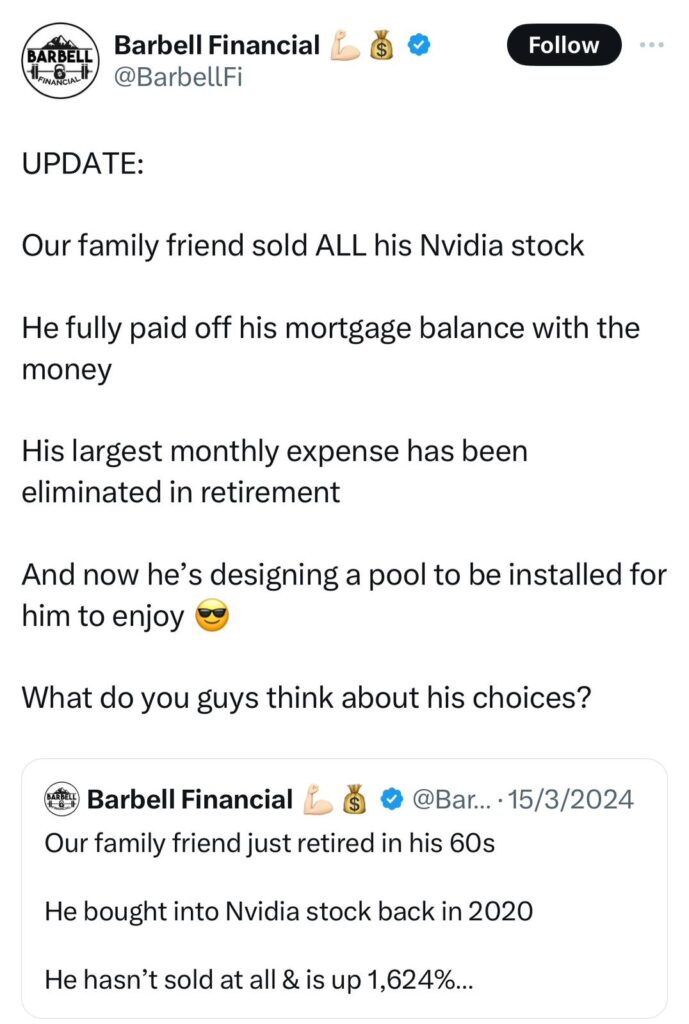

What happens when people start cashing out in a market with lower and lower liquidity? Prices quickly move lower and lower. Furthermore, add the psychological pressure building up on people sitting on massive gains, but also carrying massive debt that those gains would help to repay. It doesn’t take long for panic selling to trigger if you have a large enough amount of people in the very same situation. This post below is the perfect example of what I am talking about.

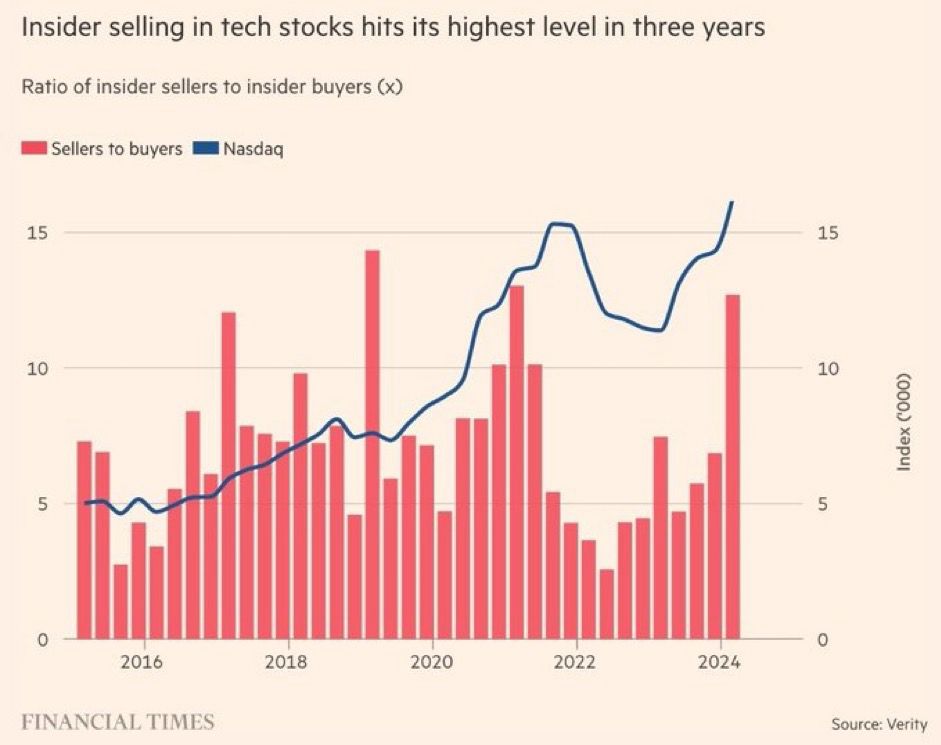

What about tech companies insiders? Beware, they have been cashing out at the fastest pace of the past… 3 years.

As if all I described wasn’t enough already to raise your alert levels, the very unique element of this current bubble everyone fails to appreciate is the overwhelming impact on markets and price actions of High-Frequency Trading algorithms. How many times have we joked about hundreds of billions of market capitalization companies trading like penny #stocks? Well, it might be time to stop joking about it and start to seriously appreciate that because of HFTs, by the time the concerns for the dwindling liquidity start spreading in the market the algorithms would have already mopped away all that was available leaving everyone else staring at a massive black hole in their investment portfolio.

Never forget, your stock or asset is only worth the price someone is willing to pay to purchase it from you. At this stage, more and more people are finally figuring out the extent and the danger of this bubble hence stepping out of the game. You better not be caught swimming naked by the retreating tides….