Do you remember the scene from “The Big Short” movie when Charlie and Jamie, the dynamic duo of the “bedroom hedge fund” Brownfield, stumble across Jared Vennet’s pitch in the JP Morgan lobby? If you don’t, here is the link for a quick refresher.

Keith Gill, also known as @TheRoaringKitty, was the 2021 equivalent of Charlie and Jamie from the movie. He was a smart, brave, and fortunate person who, instead of stumbling upon a pitch showing how rotten the housing market was, discovered #GME (the fortunate part), understood it was set to skyrocket (the smart part), and held on to his positions even when the profits were already life-changing for him (the brave part).

So, how much money did Keith Gill make in 2021? Approximately 34 million dollars.

What about the Hedge Fund Senvest Management? They made around 700 million dollars, as reported by This Hedge Fund Made $700 Million on GameStop

But why wasn’t anyone from Senvest Management called to testify in front of the US Congress? Didn’t they trade exactly with the same rationale as Keith Gill? I personally have no idea, but I do know that a “David vs Goliath” story headline is far more attractive for mainstream media advertisers than a “Godzilla vs Kong” one.

Now, let me share a couple of insights with you:

- The Hedge Fund business is a highly competitive one where various firms fight to “win” and “keep” LP investors.

- A Hedge Fund going under means their LP investors will be up for grabs.

- Hedge Funds are not “lone wolves” but more like “wolf packs” that every now and then clash against each other to win market share (i.e., LP investors’ money).

- Brokers love hedge funds because they trade a lot and often trade complex instruments, generating a substantial amount of “fee” revenues for them. Sometimes, they can also become very cozy…

Here is an example of what I am talking about: “The Two Tiger Cubs at the Center of Friday’s $35 Billion Meltdown”

And if the previous example wasn’t enough, here’s another one: “Tiger Asia Pleads Guilty, Pays $60 Million in Insider Probe”

Please keep all of the above in mind as it will make it easier to understand what comes next.

Fast forward to 2024, do you think anything has changed compared to 2021? Can Keith Gill single-handedly make GME skyrocket by buying 120k Call Options, 5 million shares, and posting a handful of memes on X? Of course not.

Before the at-the-market share offer that GME pulled off a few weeks ago following the first spike in GME price (announcement here), GME had a total of approximately 305 million shares outstanding. Keith Gill bought 5 million shares plus 120k Call Options at a 20 dollars strike, right? According to my calculations, the “delta” of those options was 0.55-0.60 when he bought them, meaning the market maker who sold those calls to him had these three options to cover its risk:

-

Buy 120k Calls from the market

- They will, of course, never do this since it will ultimately generate a loss for the trading desk

-

Delta Hedge the position

- In this case, the market maker should have bought between 6.6 million and 7.2 million GME shares. We cannot say whether the market maker did it or not, but we can surely say that it would have taken several days to hedge that position, considering that before GME 2.0 started, the volumes were between 2.5 million to 4 million shares per day.

-

Remain Naked Short on those call options

- Please refer to my previous article on the topic (THE CRITICAL LOOPHOLES IN THE LAW THAT MAKE NAKED SHORT-SELLING “LEGAL”) for more details.

Isn’t it pretty obvious that in none of the scenarios I described could Keith Gill single-handedly move the market that much? At this time, you might argue that he then started posting memes to #FOMO retail buyers back on GME. If you look at the volumes, that is plausible since retail tends to usually buy at open, and then volumes fade towards the close if there is not institutional activity. However, after crashing from 60 dollars+ to below 20 dollars (so Keith Gill was losing money on his options, FYI), any retail #FOMO quickly faded, as was very obvious on social networks. At this point, why do you think the GME stock run-up resumed? If you look at the volumes, which were very concentrated towards the close, it is quite undeniable that those buyers are institutional investors (and it looks like pretty big ones).

So, at this point, we know three things:

- Keith Gill could not move the market

- Retail #FOMO only had a very brief impact on GME

- Big Institutions are in the arena.

One thing that hedge funds learned very well after 2021 was to “hide” their positions to make sure you couldn’t bump anymore into a 147% shares shorted like in the 2021 GME case, but for the rest, do you think anything changed? Of course not, because business is business and Hedge Funds have to make money, just like brokers have to generate revenue fees.

In the very specific case of GME, the losses that the system suffered in 2021 were very obviously much higher than those that were disclosed to the public. How did they manage to hide them, perhaps till now? I wouldn’t be shocked if at some point we discover brokers converted hedge fund losses on their complex derivatives into “loans”. This is not very difficult to do:

- The broker closes the derivatives at a big loss from the Hedge Fund

- If the broker liquidates the Hedge Fund’s collateral then it will put its (lucrative) client out of business.

- So, instead of “killing” its client, the broker can agree with its client to convert the loss on the derivative into a debenture-like loan and shift the collateral to a new position. In that case, neither the Broker nor its client will effectively book a loss in their net income, but simply the liability change in the Balance Sheet and effectively push the losses into the future.

However, in the case above, it would be hard for the hedge fund to recover the losses, right? So this is what I think happened: the brokers agreed to extend the maturity on GME equity swaps so Hedge Funds could keep their shorts open. Considering that pretty much any institutional investor assigns a very high chance that GME goes bust, doing so will ultimately result in:

- Brokers are not required to liquidate their clients and eventually take losses if they did not have enough collateral

- Hedge Funds would be recovering their losses and keep trading with their brokers (making them happy)

A small problem is your risk department might sign off on this once, but hardly twice. Knowing that hedge funds started to short GME in 2019, we can see from the chart below that till before Keith Gill resurfaced they were still far from recovering their losses while their “novated” contracts were likely coming close to expiry.

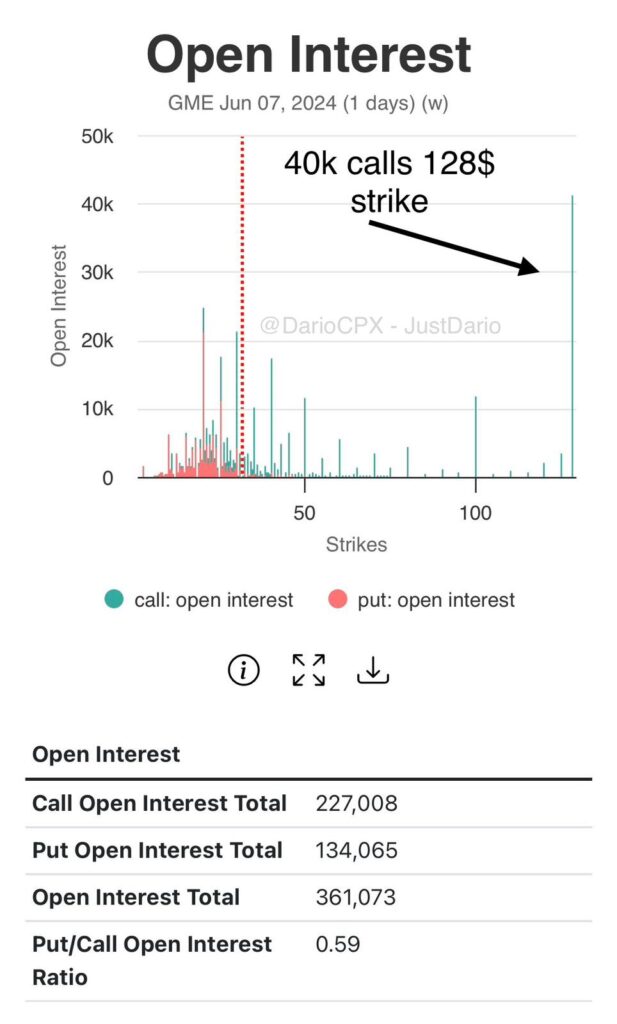

Hedge Funds and brokers are a very small community and here I see a high chance other institutional investors were aware of the type of arrangements I described above so they started to position in advance to turn the screw against their competitors likely increasing the naked short positions carried by brokers and market makers. 48 hours ago, someone might have decided to pull the trigger placing this large 40k+ 128 dollar Strike call options trade maturity in the next 24 hours. That’s the very typical first move Hedge Funds do when they are about to trigger a gamma squeeze that effectively is now happening.

How is this going to end? We will know soon but I hope by now this is a story of “Godzilla vs Kong” where for once retail is positioned on the right side of the battlefield.