What’s going to happen now to #GME? A straight answer to this question is going to be quite technical and boring, which is why I decided to borrow a bit from George Lucas’s Star Wars saga today to have some fun with it.

Episode 1: “The Phantom Menace”

If you think about GME as “the republic”, it does not take much imagination to associate the Sith Master with Citadel and its apprentice with Melvin Capital. While the (Citadel) master schemed in the background to undermine the (GME) republic, the (Melvin) apprentice was executing the “dirty job”. However, in the early months of 2021, the republic wins [First GME Jump] , the apprentice is killed [Melvin goes bust] , but the (Citadel) Master Sith survives and starts plotting his revenge.

Episode 2: “Attack Of The Clones”

Again, similar to the movie, the “dark forces” manage to defuse the first GME spike [The “Confederacy of Independent Systems” starts going against the republic] , but then the republic comes in control of a formidable army of clones and strikes back [the second GME spike after the US Congressional hearings] .

Episode 3: “Revenge Of The Sith”

The (Citadel) Sith Master manages to become emperor, with his new power he takes control of the whole system and crashes the (GME) republic into oblivion. However, the Jedi (Roaring Kitty) don’t go extinct but go into exile in mid-2021.

Episode 4: “A New Hope”

On May 17, 2024, the new “Star Wars” saga begins with this Tweet. After years of hiding in a cave, like Obi-Wan or Master Yoda, Roaring Kitty resurfaces, gathers the rebels around him, and strikes the (Citadel) empire’s Dark Star, destroying it [GME first jump of 2024] .

Episode 5: “The Empire Strikes Back”

Doesn’t GME’s first crash due to the 45m at the market shares issue, subsequent rebound, and second 75m at the market shares issue followed by another GME shares crash resemble the Empire chasing the Rebel Alliance to planet Hoth, being defeated by the rebels who manage to escape, but ultimately succeeding in delivering a (non-fatal) blow to the Rebel Alliance?

Episode 6: “The Return Of The Jedi”

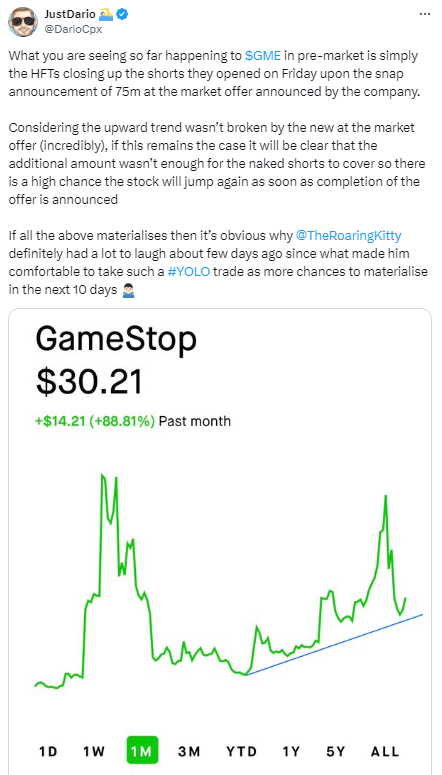

Here we are today with GME’s second 75m shares offer in a span of a few weeks being completed (announcement) and the shares jumping up 22.80% on the day to close at $30.49, to the astonishment of many “expert” commentators out there who spent all the past weekend singing death songs towards the stock, while this is what I posted on TwitterX:

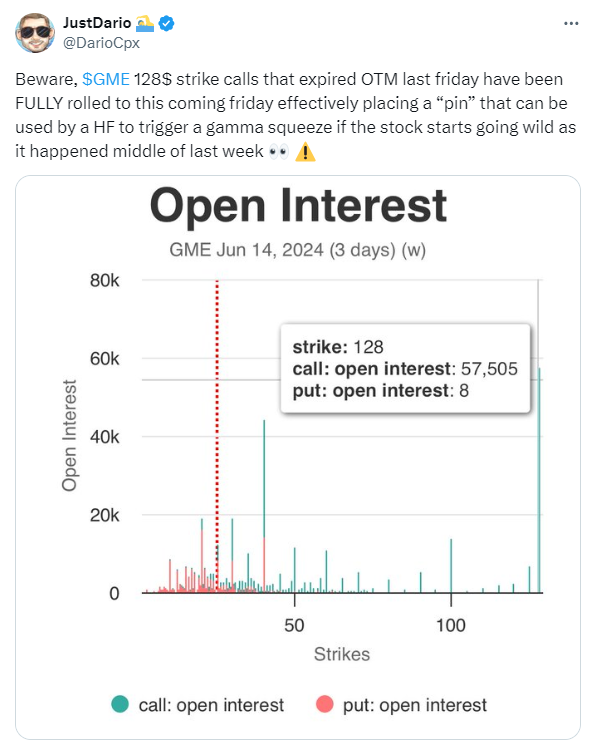

It looks like I wasn’t alone in believing that, considering that the hedge fund that tried to squeeze the stock toward $128 last Friday came back this week again:

What happened in the last trading session has nothing to do with retail activity since the frenzy has been “killed” after the first GME spike subdued. As I explained last week, to any (real) expert observer what’s going on here is clearly a clash between (at least) two big institutional investors (“WHY GME IS NOT A “DAVID VS GOLIATH” STORY, BUT A “GODZILLA VS KONG” ONE). Likewise, it is clear that Roaring Kitty alone (the Jedi) could not single-handedly defeat the Empire, but like in Star Wars episode 6 he might have contributed to bringing down the shield of the second Dark Star. Now let’s have a look at the chances the Rebel Alliance has to destroy the second Dark Star and ultimately defeat the Sith for control of the Galaxy.

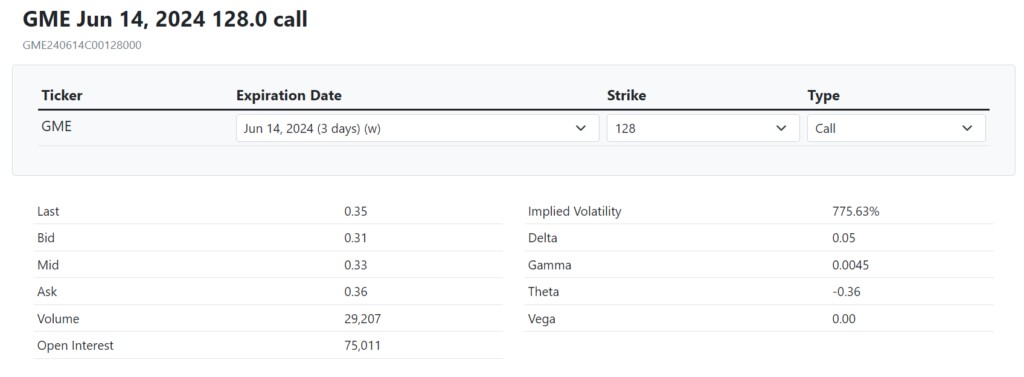

1 – GME $128 Strike Calls increased to $75k now after a 29k piece trading volume in the last session. Whoever is positioning themselves so much OTM is paying an incredibly expensive price to do so considering that at $0.35c the Implied Volatility is ~775%. This is by far not the way “retail” trades, as a matter of fact, only institutions with access to prime brokers can scoop up so much volume without sending the derivative price to the moon (because of the simple law of demand/supply). As I shared before, I strongly believe there is a big institutional trader laying down the ground for a potentially extreme gamma squeeze on the stock.

2 – At the current price, only ~74k GME call options expiring in the next 72 hours are ITM, guess how many are still OTM? ~266k Call options from $31 to $128 strike price. To give you a better sense of what I am talking about here, consider this:

- 232k Options are above $40 Strike

- 67k Of those are between $40 and $50 strike while the rest is above

- At $40 strike the option Delta is 0.36 while at $50 is 0.23. This means that on average a Market Maker only holds 0.3 GME shares to hedge the risk call options between $40 and $50 strike become ITM and are exercised.

- All-in-all I estimate Market Makers are only holding ~4M GME shares to hedge their delta for call options expiring in the next 72 hours. This means that if the gamma squeeze triggers, on this maturity alone they will need to find up to 30M GME shares ASAP in the market to cover their risk.

3 – The setup is incredibly similar for call options with 21st of June expiry out of which ~243k are currently OTM up to $125 strike where yet again we find a “whale” positioned there (~40k options Open Interest). Considering the proximity of this expiry, a sharp increase in price will force market makers to reasonably find ~20M additional GME shares in the open market. So if things go bananas market makers will have to buy up to ~55M GME shares in the next 72 hours.

4 – Beyond 21st June strike options positioning would not be as impactful as what I just described in the previous 2 points.

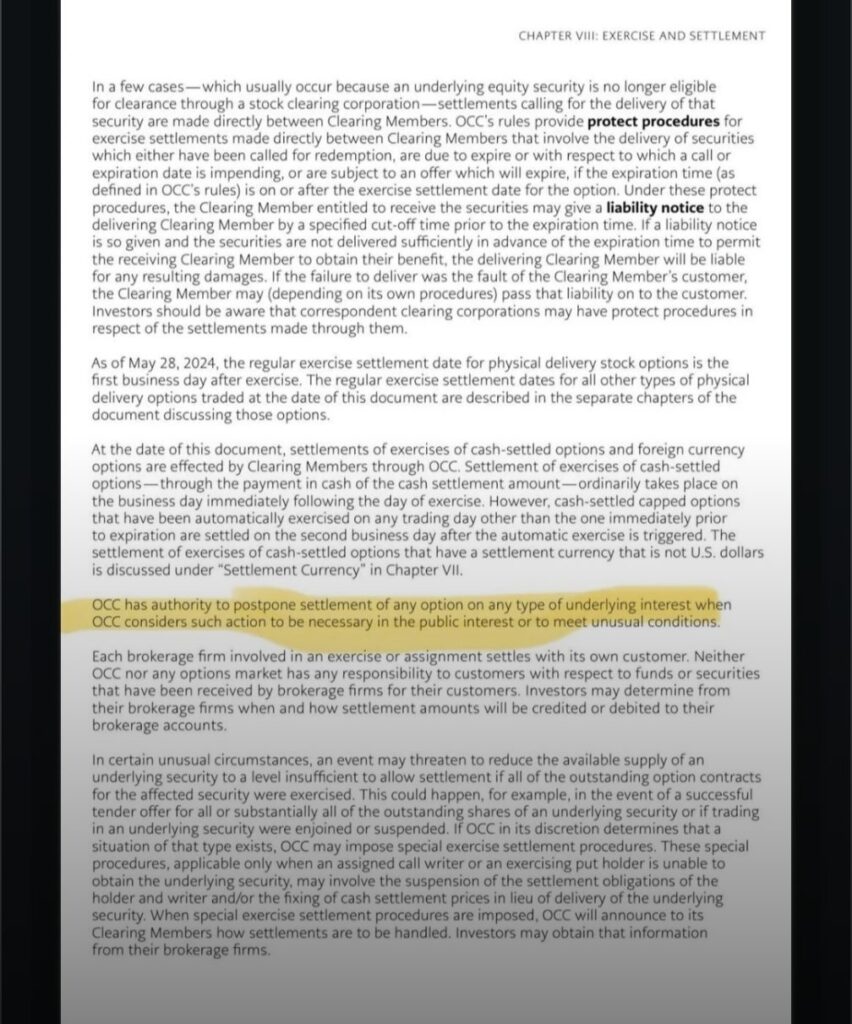

All in all, this is the perfect setup for a gamma squeeze, but why is everything so concentrated in the next 10 days? As I highlighted in my previous article and in this post here during the weekend, I have a strong suspicion that some big traders are aware a lot of underwater equity swaps are about to hit a stone wall and all those sitting on deep underwater short positions (a lot of them likely “naked”) will have no alternative than to close them up at a loss. This will be potentially such a mess, but no worries the OCC (“Options Clearing Corporation”) already made sure they have a backup plan in place as you can see below (credit: @FinanceLancelot).

Shocking isn’t it? Effectively the OCC can unilaterally decide to pull the plug “in the public interest” if something goes wrong. I am not so sure how much this is in the public interest or in the interest of the “few” as it happened in 2021.

5 – Beware, GME the company can continue issuing more shares since they have plenty of room left till the 1 billion cap the board is authorized to issue. Will they do it and crush the price again? Here we need to borrow a bit of game theory to analyze the scenarios:

- Another at the market equity offer will definitely bring more cash into a company that already has plenty of it, the public backlash of doing this might be significant in this situation and considering the company is so reliant on public support to keep its business afloat I feel the chances they issue more shares is quite low now

- Currently, GME is being controlled by Ryan Cohen who holds ~8.5% of the shares, if he dilutes himself too much the company will be an easier target for “hostile” actions why not even a potential hostile takeover from the naked shorts that at that point will be able to get out of trouble once and for all.

- If the company is effectively taking advantage of a manipulative price action, like a pump and dump, to raise more cash it might face legal consequences even if it were not directly involved in the scheme since it behaved against the interest of its own shareholders that at that point will have a strong legal ground to bring forward a class action and claim the cash in the company belly to cover their damages

6 – The extent of the naked shorts out there is unknown, if it is ultimately much less than what is being envisioned the gamma squeeze will not be successful in triggering a short squeeze and the closer all those options above get to maturity the more delta hedging will be dumped by market markers. This will push the price down ultimately resulting in more options falling OTM and consequently more delta hedging being dumped in the open market in a feedback loop that can ultimately crash GME price significantly in the next 10 days.

To conclude, the stage is set to see a showdown between the Rebel Alliance and the Empire in the next 10 days, potentially in the next 72 hours, and surely whatever is coming is going to be incredibly wild and eventful.