As you know, I recently took a trip to Germany. As always, I mixed pleasure with business, aiming to visit relatives and better understand the German real estate market. I was particularly interested in determining if the on-the-ground situation was as dire as the statistical data suggested, which I previously discussed in “THE INCOMING GERMAN REAL ESTATE MAYHEM”.

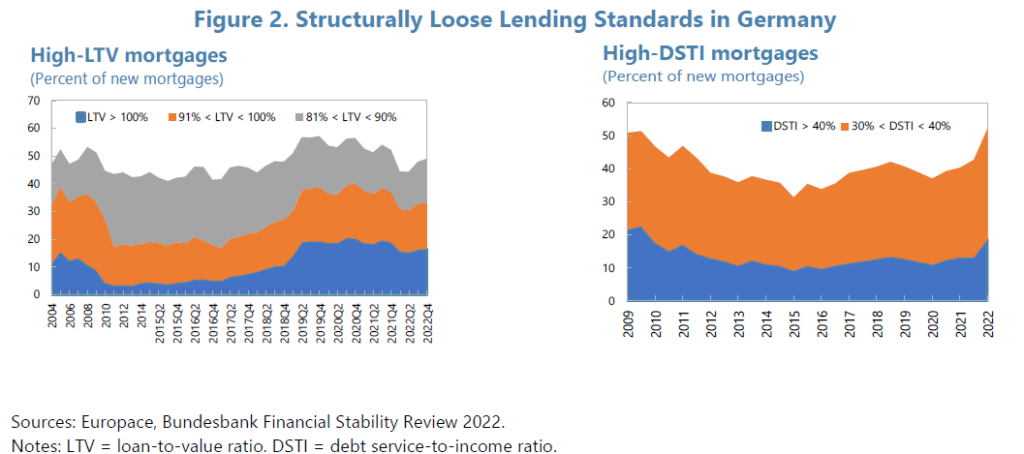

I expected many things on this field trip, but discovering a significant market for “NINJA” mortgages—or more accurately, “quasi-NINJA”—in Germany was surprising. What do I mean by this? In Germany, as long as you have “a job” and “an income,” regardless of whether it’s full-time or part-time, highly paid or poorly paid, and you can cover all the costs and taxes associated with purchasing a real estate asset (taxes, notary registration, real estate agent fees, etc.), banks are more than happy to underwrite mortgages that cover 100% of the purchase value. In some cases, they even cover 110%. I refer to these loans as “quasi-NINJA” because they have become very popular among those who can barely meet the requirements for a mortgage. For an example, check out this blog post: “Germany offers 110% mortgages”.

Here’s what you need to get a 100% mortgage in Germany:

- A valid residence permit that allows you to work.

- Current employment in Germany.

- Your employer or business is based in Germany and pays taxes there.

- Your income is paid in euros.

- You can cover closing costs with your own equity, up to 15% of the purchase price.

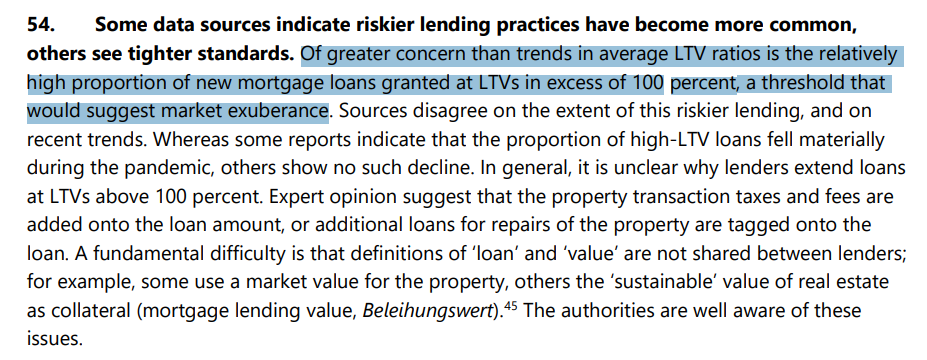

The IMF also identified the potential risk of 100% mortgages being granted in Germany back in 2022 (report).

Naturally, I tried to dig up some data about this. Of course, there is nothing directly available to gauge the size of this market and its trend over time. Consequently, we will have to look for alternative data to understand the potential magnitude of this problem. Why are 100% mortgages a problem?

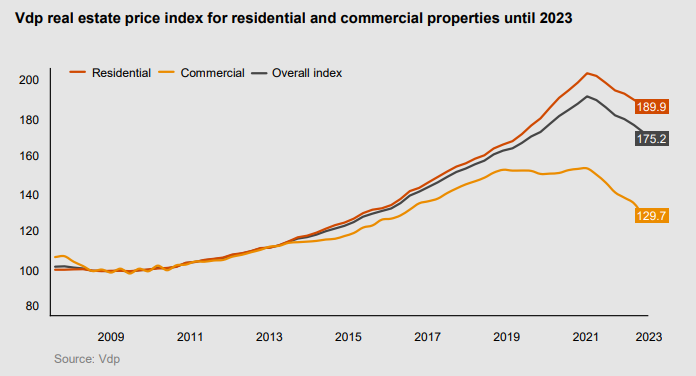

When house prices are collapsing, as they are in Germany right now, it doesn’t take long for over-leveraged borrowers to fall into negative equity (meaning the debt owed is greater than the value of the asset purchased).

From a bank’s perspective, as long as the borrower continues to pay the monthly installments, there’s nothing to worry about. However, if they become unable to do so, these residential real estate mortgages will quickly become toxic assets on the banks’ books, much like what happened in 2007 (Surge in 100% mortgages means thousands risk negative equity). This will occur just as German banks are already dealing with the implosion of the commercial real estate (CRE) market (‘Greatest real estate crisis since the financial crisis’: German bank alerts the market on exposure to commercial real estate).

Now, let’s try to figure out the size of this German “quasi-NINJA” mortgage market. The first clue comes from another IMF report published in 2023.

As you can see in the first table on the left, in Q2 2017, the proportion of 100% LTV mortgages began to increase steadily from ~5% to ~10% in Q4 2018. It then accelerated to ~20% of the total from Q2 2019 to Q2 2021 (yes, banks did not step back even during COVID), stabilizing at ~15% afterward. To give you an idea, during the GFC, “NINJA” loans in the US briefly peaked at 20% in 2016…

By analyzing data on German residential lending regularly published by VDP (report) and applying the percentages above, we can estimate that from 2017 till the end of 2023, a total of 266.35 billion EUR of 100% LTV (or higher) mortgages have been granted in Germany.

Why were German banks so comfortable granting such loose mortgage conditions? Because in the German real estate sector, delinquency rates have traditionally been low, around ~1%. However, that was also the case for the commercial real estate sector, where non-performing loan (NPL) rates have now jumped to almost 10% (Commercial real estate loans in a crisis: Is Germany facing a non-performing loan wave?). Are we going to see something similar in the residential real estate market? Considering German inflation and skyrocketing bankruptcy filings (Germany sees company bankruptcies soar), I’d say there’s a high chance of it happening soon, along with rising unemployment and increasingly expensive living costs (it’s an open secret that Germany’s actual inflation rate is much higher than the official ~2.5%).

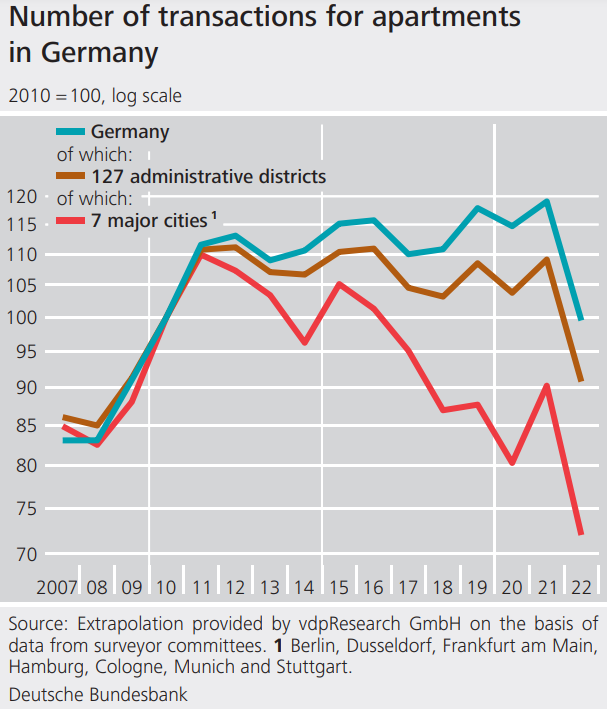

Moreover, considering the trend in prices and the fact that “quasi-NINJA” loans have a 20-year average life, most of those outstanding are currently in negative equity. It should come as no surprise that residential real estate transactions in Germany have plummeted, with people trapped in homes they can barely afford, facing potential financial ruin if they try to leave.