Finally, the 10-Q of Bank of America has been filed, and it is now time to check how things look in reality beyond the cheerful and “everything is awesome” press release and management call of a few weeks ago when the bank, as expected, beat market expectations (TODAY “EVERYTHING WILL BE AWESOME” FOR BANK OF AMERICA).

As you can understand from the title I chose for this article, Bank of America’s problems are growing, not the opposite. However, I have to admit, at first glance, the numbers looked in better shape until an item usually not that relevant stood out: repurchase agreements.

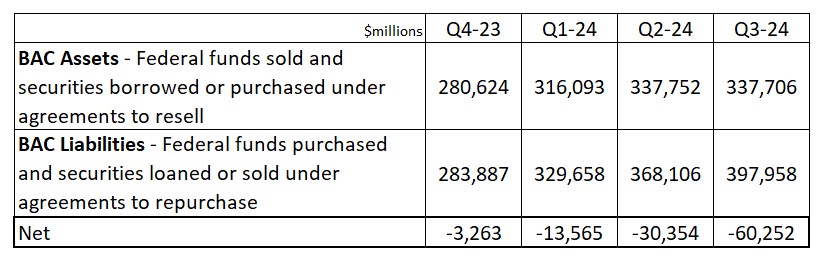

How do repurchase agreements (aka REPOs) work? In a nutshell, these instruments are generally used by financial institutions to lend or borrow money in the very short term. Usually, the net amounts of money lent and borrowed are fairly the same, and a bank tends to make money using its better credit standing to borrow at a lower rate to then lend at a slightly higher rate to weaker counterparties. The rate is “slightly” higher because REPO operations are always collateralized and often with high-quality government or corporate securities. The typical warning sign of something going wrong with a bank, in particular with its liquidity positions, is when the net amounts borrowed through REPO operations are unusually high. Please take a look at the table below where I aggregated the REPO operation amounts reported by Bank of America in the past 4 quarters.

Shocking, isn’t it? The amount of liquidity Bank of America borrowed from the REPO market has been DOUBLING in the past 3 quarters to reach a staggering 60 billion USD net balance. How many MSM or Wall Street analysts did you hear flagging this “small” detail? ZERO.

Furthermore, Bank of America isn’t just using REPO agreements to transfer assets off its books and fetch liquidity. As you can read in their own disclosure below, they are doing the same through derivatives using assets that are hard to pledge in the REPO market like non-US Agency MBS.

Transfers of Financial Assets with Risk Retained through Derivatives

The Corporation enters into certain transactions involving the transfer of financial assets that are accounted for as sales where substantially all of the economic exposure to the transferred financial assets is retained through derivatives (e.g., interest rate and/or credit), but the Corporation does not retain control over the assets transferred. At September 30, 2024 and December 31, 2023, the Corporation had transferred $3.9 billion and $4.1 billion of non-U.S. government-guaranteed mortgage-backed securities (MBS) to a third-party trust and retained economic exposure to the transferred assets through derivative contracts. In connection with these transfers, the Corporation received gross cash proceeds of $4.0 billion and $4.2 billion at the transfer dates. At September 30, 2024 and December 31, 2023, the fair value of the transferred securities was $3.9 billion and $4.1 billion.

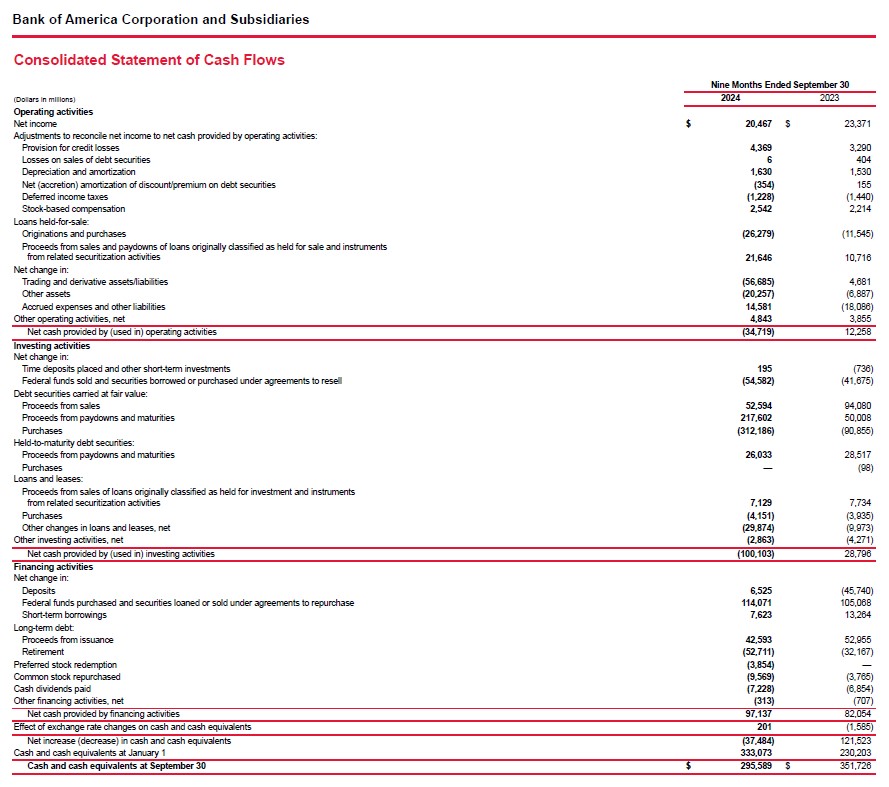

Despite these incredible amounts of liquidity borrowed through REPOs and Credit Derivatives and customer deposits increasing from 1,910 billion USD in Q2 to 1,930 billion USD in Q3, Bank of America cash and equivalents DECREASED from 321 billion USD in Q2 to 296 billion USD in Q3.

Bank of America is clearly bleeding liquidity, and if you factor the imbalances above into Bank of America’s cash flow statement, the bank would have lost more than 100 billion USD of liquidity or one-third of the one it held as of the end of 2023

After digging out all of this, I have such a strong suspicion Bank of America might have been the bank that borrowed 2.6 billion USD from the FED Standing Repo Facility at the end of September (IF “EVERYTHING IS AWESOME” WHY THERE IS AT LEAST ONE LARGE BANK THAT COULDN’T FIND LIQUIDITY IN THE OPEN MARKET AND NEEDED IT FROM THE FED?).

Now that we all agree that Bank of America is facing significant liquidity problems, let’s address the elephant in the room that is so big not even MSM could totally ignore it: unrealized losses in Bank of America’s HTM books.

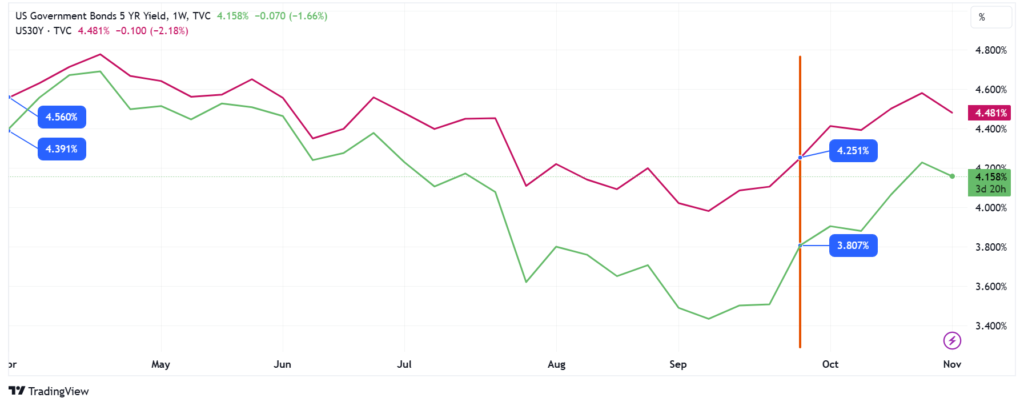

If we take a superficial look at the “fair values” assigned by the bank to its securities held in the HTM books, the situation improved in the past 3 months with “paper losses” standing at 89.4 billion USD from 114.8 billion USD in the previous quarter. Needless to say, all this move was due to the market embracing the FED-sponsored narrative of rate cuts bringing down the yield on US Treasuries.

Why did I specifically highlight 5Y treasury and 30Y treasury yields? Because those are the maturities where Bank of America specifically holds the bulk of its US Treasuries and US Agency MBS respectively. Clearly, all the improvement in the fair values was due to 5Y and 30Y yields going down ~60bp and ~30bp respectively during the quarter. As you can easily notice, most of the move has already been reversed in October, consequently Bank of America’s “paper losses” are once again above 100 billion USD

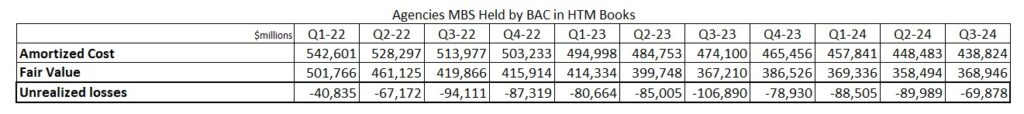

The real problems for Bank of America, though, lie in its MBS books. Now, as of the 30th of September, the Bank reported a net interest income of 3% for its Debt Securities book, over which more than half is MBS. As everyone knows, the bank bought a massive amount of MBS between 2020 and 2021 with the value slowly coming down ever since, so the ballpark interest of those MBS is likely in the ~4% area.

Here is where the numbers are not adding up at all. If we take as a reference US 20-year mortgage rates that stood at 6% at the end of September and roughly have a similar duration to the MBS in Bank of America’s HTM books, the losses aren’t only 16% of the amortized purchase cost but more like ~32% of it for a total of 140 billion USD.

Putting all together, Bank of America is sitting on a total amount of ~180 billion USD of unrealized losses using correct fair value calculation. How much shareholder equity does the bank have on its own balance sheet? ~295 billion USD. Let me be clear, these are only losses on its HTM securities books. If we consider the rest, like the 10 billion USD losses in the derivatives book, the total amount of unrealized losses is greater than 200 billion USD or more than two-thirds of the total Bank of America tangible capital. How much “Goodwill” did the bank report among its assets? ~70 billion USD, a value that is notoriously made up and has not been assessed for years. All in all, it is very clear how, according to its own numbers, Bank of America is very close to being insolvent, and at this point, it should not come as a surprise anymore that Warren Buffett is trying to sell the BAC shares BRK.A holds as fast as he can.

JustDario on X | JustDario on Instagram | JustDario on YouTube