Yield harvesting through options selling, a trade now popular even with grandmas growing pumpkins in their backyard is one of those “sure things” that the more popular it becomes, the more it creates price distortions. These distortions can end up giving a false sense of safety to many people while the environment around them warrants the complete opposite.

The most distorted metric in markets right now is by far price volatility, particularly for stock indexes. The king of volatility indicators, the #VIX, has never been so obviously distorted. The main cause of this is the incredible popularity of short volatility trades. The famous Warren Buffet’s quote “price is what you pay and value is what you get” does not apply to stock prices only, but applies to pretty much any financial instrument. In our case, the great supply and demand imbalance created by option premium harvesters, which inflated options supply above and beyond their natural volumes dictated by the size of the options underlying, resulted in an artificial compression of volatility measures across the board. However, what I just described did not make risk disappear from the system, it instead distorted the perception of it. There is nothing more dangerous for a human being than becoming numb to danger. No matter the field taken under consideration, if you do not manage risk, then risk will manage you.

Some people still have respect for the #VIX and clearly have familiarity with tail risk hedging. Someone even decided to bet on the “impossible” to happen by buying 180 strike call options on the #VIX, as you can see in this post here

Of course, #VIX can hit 180 and fly even beyond mathematically speaking, but historically speaking this has never happened, even during the infamous 1987 stock market crash. The highest close reached by the #VIX that we know today was hit on the 24th of October 2008 at 89.53, while the highest intraday spike was reached a few days earlier on the 10th of October 2008 at 103.41. For reference, the highest intraday #VIX in recent years was hit on the 18th of March 2020 at 101.02. The CBOE published data for the “old #VIX” aka VXO until September 2021, and surprisingly, the highest intraday volatility wasn’t hit during the 1987 Black Monday, but the day after when VXO reached 172.79. Of course, the highest VXO close was during Black Monday when the indicator finished the day at 150.19, a record +113.2 spike in one single day.

However, suppose you are a fan of statistics, as I am. In that case, you can quickly realize that by counting the number of days between the 1st January 1987 and today and comparing the result with the number of times #VIX traded above 100 (10 in total), you can quickly calculate that the historical probability of VIX trading above 100 is about 0.10%. Do you know what is the probability of winning a lottery jackpot like the Powerball one? 0.00000034%!

Yes, the probability of VIX trading above 100 is statistically speaking 294,118 times higher than winning the Powerball jackpot!

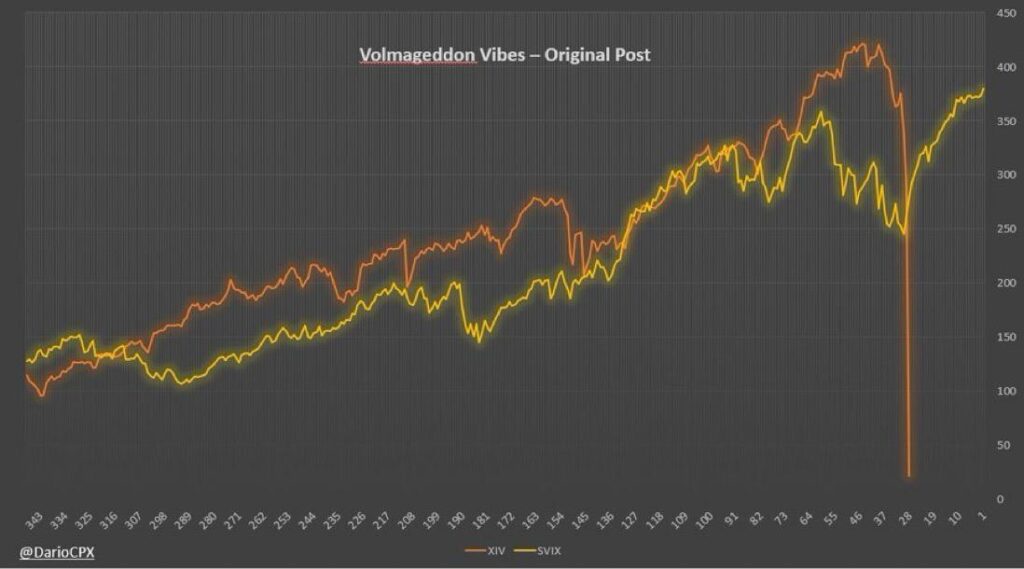

For those of you who have followed me for a while, you know I have already compared today’s #VIX dynamics with the 2018 “Volmageddon” ones many times, gathering all the studies in the comparison chart below. If you want to know more about the structure of this study, it is all in this post here

It is no mystery that the #FED and other Central Banks are monitoring the stock bubble very closely (THE NEW #FOMC MANDATE IS NOW OFFICIAL: SAVE THE #STOCKS BUBBLE AT ALL COSTS!), especially the #VIX and other key volatility measures like the MOVE (the “VIX of US Treasuries”). Every single time the #VIX started to rise to alarming levels for the stock market bubble stability, central banks coordinated to intervene, injecting liquidity into the market to lower yields and to defuse the risk of a Volmageddon, as you can see in the chart below.

Will the Central Bank succeed again in defusing a Volmageddon risk or is it finally #VIX showtime? The answer will come very soon and, just in case, I suggest buying insurance while it’s still available to be purchased…