Q2 US bank earnings reported so far paint such a rosy picture of CRE loan risk. Yes, they admit there will be an uptick in losses (maybe), but banks barely show any concern.

So why are CRE landlords panicking, not being shy with the press, describing the situation as “apocalyptic” or “a Cat 5 Hurricane”? 🤔

This is how the BIS, the “central bank of central banks,” defines CRE loan risk: “the prospects for servicing the loan materially depend on the cash flows generated by the property securing the loan rather than on the underlying capacity of the borrower to service the debt from other sources.”

According to this (flawed) metric, as long as the property has enough tenants to cover the interests, then the loan wouldn’t be considered problematic. This valuation approach applies to “Close-end residential loans” (CERL) where the borrower is typically a corporate landlord that rents the properties. Hence, these assets are as well materially dependent on the ability of these to generate enough income to cover interests.

Here is the mind-blowing fact: despite what happened in 2008, banks still need to appraise the principal value of real estate collateral only if they are the principal occupant of the property. 🙄 Remember what triggered the 2008 GFC? Yes, interest-only loans… 🤯

So when will CRE ($2.9T) and CERL ($2.3T) start to be a problem for US banks? Most of these loans are “non-recurring,” meaning the landlord can hand over the keys to the lender and walk away.

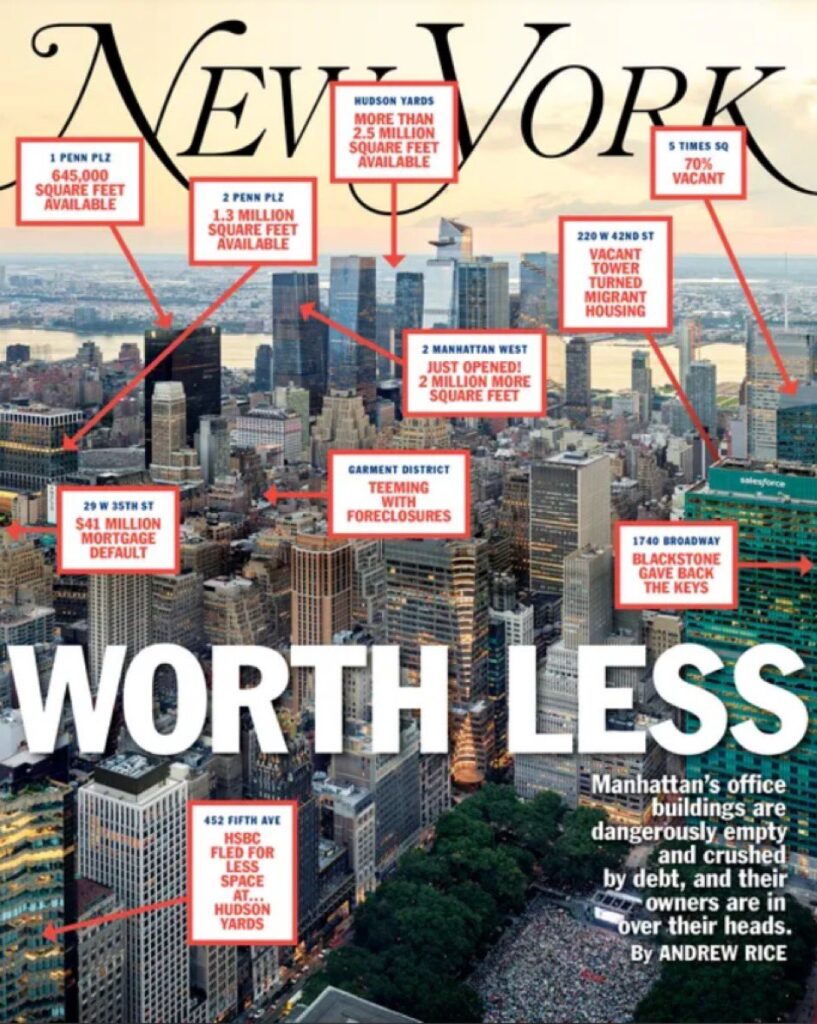

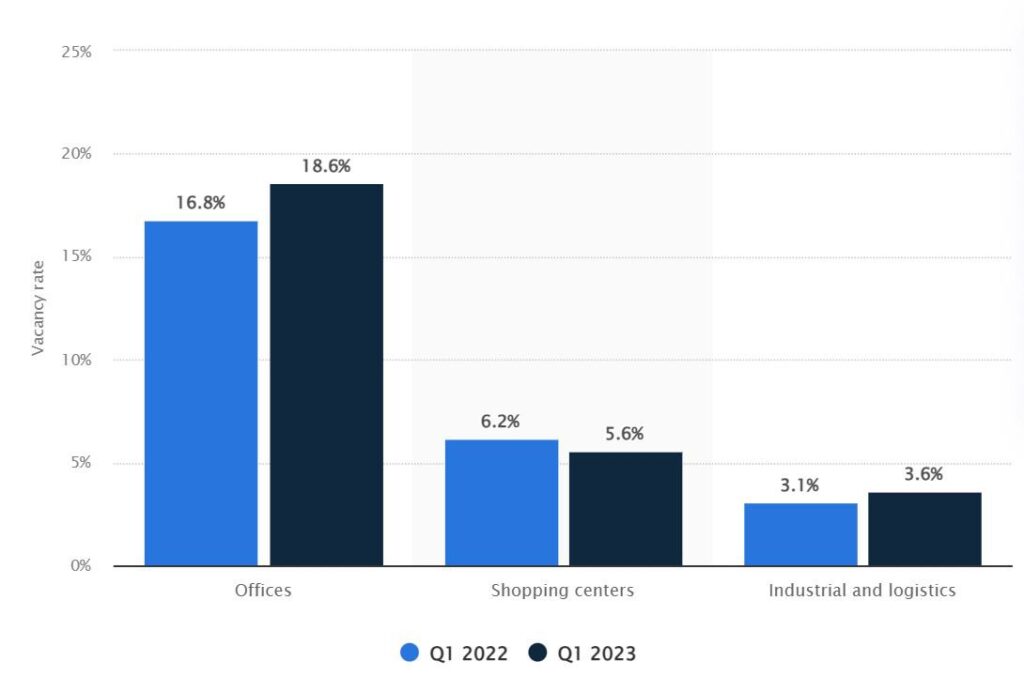

While, as of now, CERL properties’ vacancy rates are still at historical average ( $BREIT investors can take a sigh of relief), CRE vacancy rates are increasing fast and currently at 18.6%, a level seen last time during the CRE glut of the early ’90s. This is an aggregated number, though. If we split it into Cat A, Cat B, and Cat C CRE office buildings, according to CRE office landlords, the vacancy for the last two categories is already at 50% and 70% in some prime locations like NYC, LA, and SF, with many Cat C buildings already completely empty, badly in need of heavy renovations, and practically worthless. Then it shouldn’t come as a surprise that big landlords like Brookfield and Starwood started to default on their CRE loans and hand over the properties to banks.

Why are CRE landlords so catastrophic? Because the trend is spreading to Cat A buildings with sub-lease availability climbing fast, signaling tenants’ intention to downsize as soon as their agreements expire (unless they walk away earlier than that). Accounting for the current sublease rates reported by CBRE, the real vacancy rate of CRE is already beyond 25% in aggregate 😳

When the banks get hold of a property, they need to start assessing its “value,” but again here no problem on the surface since prices are holding up pretty well… in aggregate!

What about Cat B and Cat C? The latest transactions reported a drop in prices already up to 35% in the first category and up to 60% for the second one 🥶 during the GFC, CRE property prices declined ~30% at the bottom of the crisis… now the crisis didn’t even start! ⚠️

Considering the average LTV for a CRE loan is ~75%, banks are already “losing” on their principal, and this is only the beginning 🥵

It’s impossible to make forecasts at this stage, but banks (and regulators) are dangerously ignoring the risk banks will end up holding a huge amount of Cat B and Cat C worthless CRE. Isn’t this what’s exactly happening in China? Look at how things are going there, with even state-backed developers defaulting on their debt (#Wanda and #Greenland), and #stocks already trading at the same levels as during the GFC 🚨

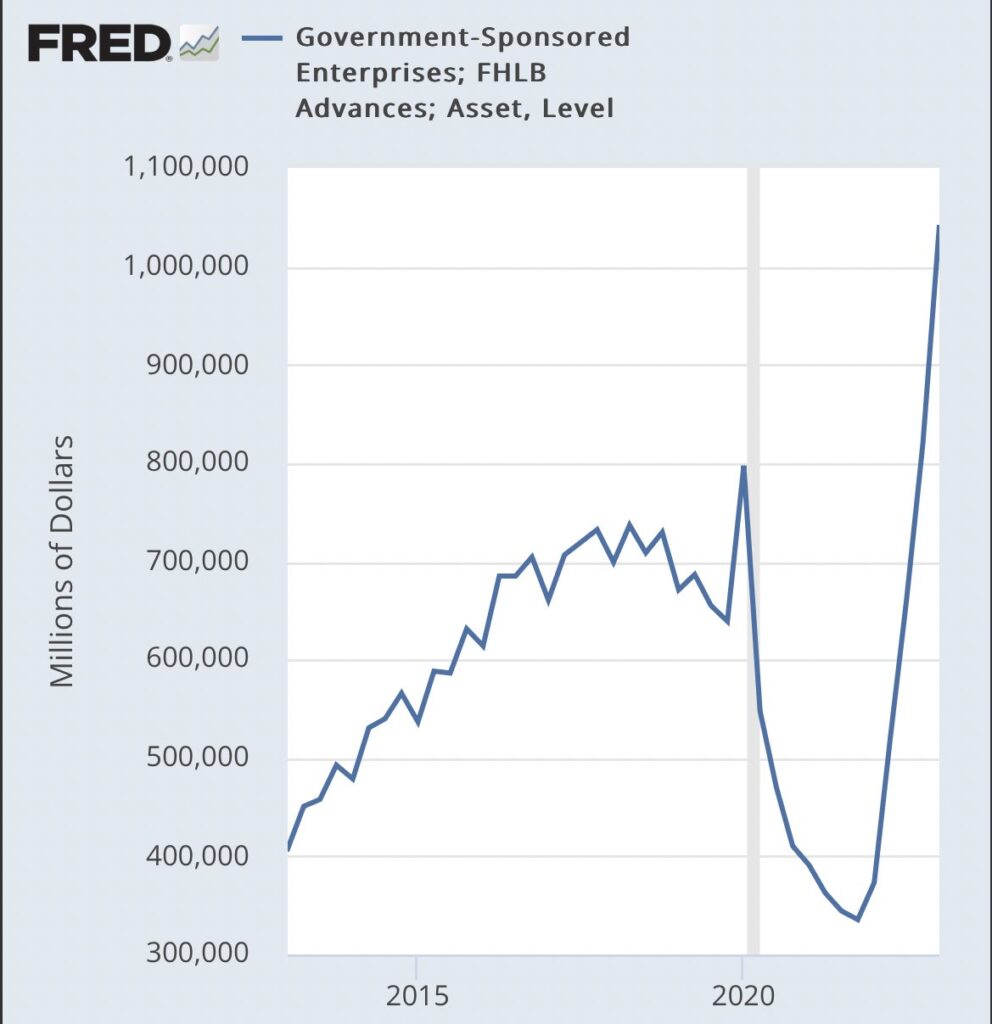

Add to this banks’ mounting liquidity problems, with FHLB advances already at ATH beyond GFC levels and an ongoing deposits hemorrhage, and you have the perfect setup for the mother of all banking crises. 🤯

Read on TwitterX