Alright, ladies and gentlemen, it’s about time to get a few things straight about what’s going on with #BABA.

First of all, the stock itself has a significant problem called “SoftBank”. In the post quoted below, I explained a while ago why SoftBank’s derivatives shenanigans have been hammering BABA’s stock, which ended up trading at depressed multiples.

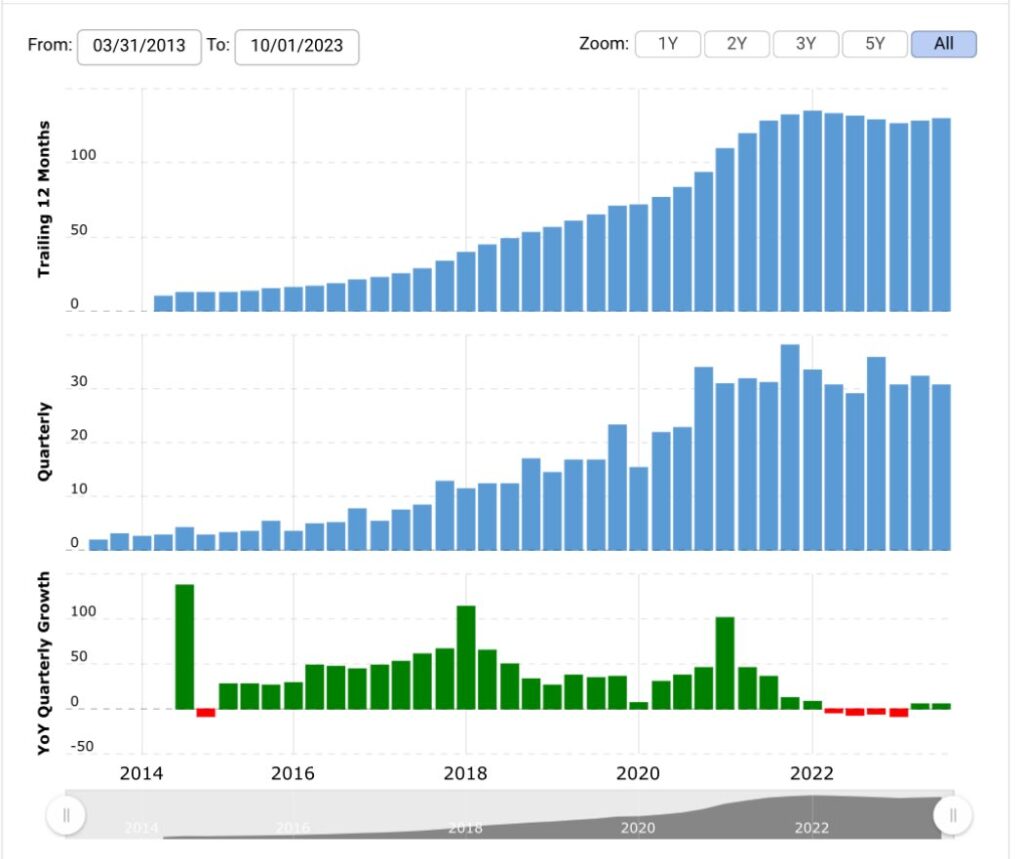

Secondly, #BABA‘s fundamentals, yes, are still strong, but #PDD is literally devouring #BABA‘s market share away from them. In the last quarter, #PDD reported ~9.6bn #$USD eqv. revenues, a stunning +94% YoY, while #BABA reported ~31.3bn$ only, up 9% YoY. Both good, right? Well, if you add up the previous 12 months from Q3, #BABA recorded a total of 129.78bn$ in revenues, a -1.21% decline YoY, while #PDD in the same timeframe recorded 27.62bn$ in revenues, equivalent to a 54.36% growth YoY. Uh oh, now things don’t look fundamentally as good for #BABA, right?

Beware, growth is all that matters for long-term investments. A company that grows in line with inflation, or worse, stops growing, will have a hard time, by definition, to convince investors they are worthy of “high premiums” priced in fast-growing businesses. As you can see from the chart in Picture 1, #BABA‘s growth hit a brick wall in early 2022.

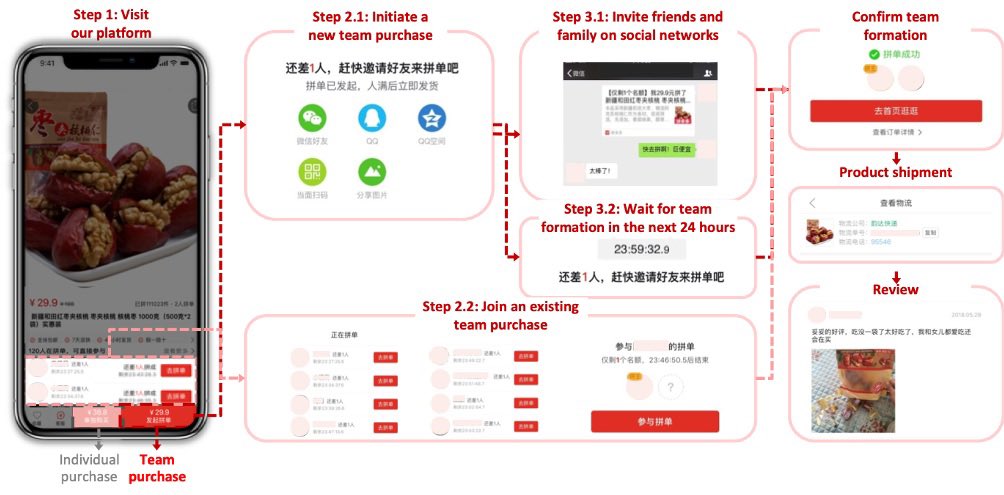

At this point, I bet all of you are eager to understand what the hell #PDD is doing so special to be so successful and send #BABA into a soul-searching crisis. 2 words: SOCIAL E-COMMERCE.

- In #PDD, customers can form “Teams” and then negotiate as big purchase groups against vendors, often achieving significant discounts for volumes (Picture 2).

- “Daily Check-Ins” was a brilliant idea from #PDD, and this created continuous engagement between the users and the platform that are still up to pay money for a good bargain, even if they weren’t necessarily in need of that specific good that day (Picture 3).

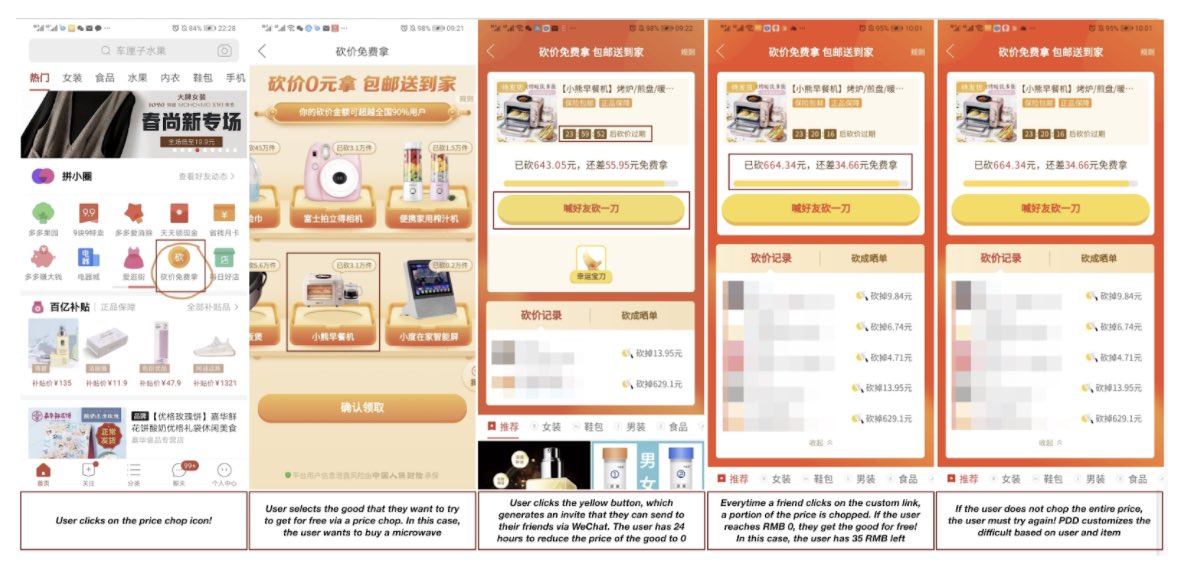

- “Price Chop” is another feature that made #PDD fortunes. Basically, a user selects a product available on the feature and then receives a product link. At that point, the customer has 24h to share the link with as many friends as possible, and they will be rewarded with a discount based on their engagement (i.e., clicking on the link), even if a purchase by their friends isn’t completed. The discounts are incremental to the point that “hardcore” #PDD users do even manage to get products for free! (Picture 4)

- Coupon Sharing” is another very unique feature of #PDD. Everyone in China receives coupons constantly, literally from every direction, nothing new here, it’s a thing as old as time. However, once this went digital, there was a problem that the “paper” coupons didn’t have: digital coupons couldn’t move from a user to another. #PDD has been the first to figure this out, and as such, many of its users can now exchange and accumulate coupons, managing to obtain higher discounts than with a single one.

- #PDD also introduced “Minigames” to engage with the younger generation. In #PDD, young users can play games to earn discounts or coupons, with even the possibility to obtain products for free for the most engaged and successful young players.

From a direct personal experience here (I live in HK and travel weekly to China), I can confirm that #PDD is literally spreading like wildfire among the population. Many are still using #BABA simply because the number of vendors and the efficiency of the deliveries is something #PDD didn’t match yet.

Furthermore, many have a “VIP status” on #BABA‘s e-commerce platforms, which, similar to airline miles programs, is a great hook to hold back clients from moving elsewhere. However, the strong bet on combining social networks and e-commerce by #PDD is paying off handsomely and completely blindsided #BABA management, which was once standing comfortably above everyone in their high ivory tower.