Pension funds, already deeply underwater on their illiquid private equity investments that they piled into during #ZIRP years, are now taking up hundreds of billions in leverage to invest in $NVDA, $INTC, and other “hot” names. So far, no one has managed to convincingly rationalize this idiocy.

Real estate developers’ #stocks are trading back at all-time high levels while the activity of the construction sector is crashing through the floor (euphemism). Nope, haven’t come across anyone lucky enough to make sense of this either.

People piling up credit card and consumer debt while the economy is supposedly strong and inflation is fading; another great “mystery” no one can find a serious explanation for.

What about the endless amount of money that continues to bid on #stocks and #stocks call options as if they’re going out of fashion? For every transaction, there must be a buyer and a seller at all times. It is a rule that cannot be broken unless… the buyer doesn’t pay, but that’s a story for another day.

Well, not sure if you’ve noticed, but more and more people are starting to become uncomfortable out there and they’re asking themselves “how is all of this even possible?”. The tides are now shifting so significantly that even #hardcore #stocks shilling charts factories “bulls” are beginning to warn it might be better to start being careful.

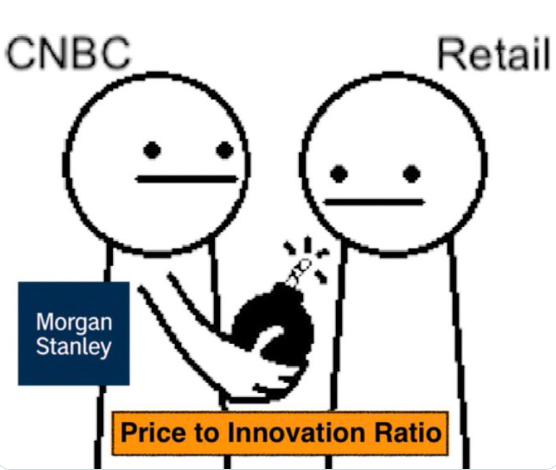

If even the evangelists of irrational exuberance can’t in their own way rationalize what’s happening anymore, then it’s time to take a moment to think deeply about an exit strategy here (or at least a contingency plan) because clearly the farce is ending and even the attempt to keep the illusion going under a new “Price To Innovation” predicament has failed.

To this day, no one can still explain what triggered the 1929 crash, but if you think about it, at that time things reached a point that simply couldn’t be rationalized anymore, even stretching imagination to the extreme limit.

A couple of weeks ago, I made the parallel between the current market and February 2020, mentioning $NVDA results as the key event to watch out for as a potential turning point (TwitterX). Personally, I think $NVDA will continue perpetrating its accounting shenanigans, but for the first time in all these years of madness, people are starting to doubt things that are too good to be true. Perhaps, like in 1929, that will be the moment the kid will scream at the naked king, ending years of farce.

Read on TwitterX