Did anyone expect HSBC CEO Noel Quinn to step down yesterday? Clearly not:

- “HSBC chief executive unexpectedly steps down” – BBC

- “HSBC’s CEO Steps Down After More Than Four Years” – WSJ

- “HSBC says chief executive Noel Quinn ‘to retire’” – RTHK

- “HSBC CEO Noel Quinn to Retire in Surprise Announcement” – Bloomberg

- “’An intense five years’: Read HSBC CEO Noel Quinn’s surprise resignation statement” – CNBC

However, a 3 billion$ buyback plus a 21c special dividend announcement sweetened the bitter pill of the CEO’s resignation so much that the investors’ sugar-high reaction was quite remarkable, with the stock closing up 4% and now (hilariously) not that far anymore from the highs reached during the GFC.

If everything is as awesome at #HSBC as we are led to believe, why did the bank’s current CEO decide to step down right when he is supposed to be able to reap the fruits of his remarkable work and cash-fat paychecks and bonuses for himself? I’ll tell you why, because #HSBC Q1-24 results were horrible, but the bank keeps plugging holes in its revenue line by selling pieces of its business (France last year, Canada this year).

Did perhaps Noel Quinn figure out there is nothing left to sell and soon the brutal reality of #HSBC operations is going to surface? What’s worse is that, instead of strengthening its capital base to cover ballooning losses (hidden) in #HSBC books, Noel Quinn distributed the cash from special disposals to #HSBC shareholders who still haven’t figured out there will not be any more freebies in the future.

We already saw a few months ago to what extent the bank has been bending and stretching the laws of accounting gravity in order to showcase financial statements that would not show what is really going on inside #HSBC (Article_1 and Article_2), but in Q1-24 the bank management truly achieved levels of financial accounting shenanigans that I cannot think of a better word than “mystic” to describe how unrealistic #HSBC numbers now are.

Let’s start with the appetizer I shared in this Twitter/X post yesterday.

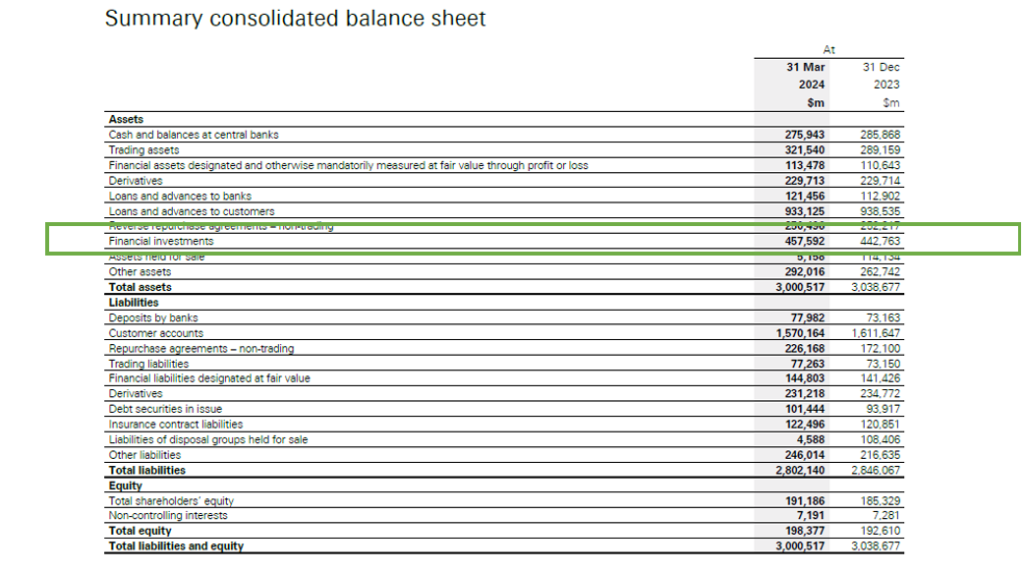

🚩 – Not only did #HSBC lose money in Q1-24 because they hedged their interest rate risk in the wrong direction (if that had been done correctly they should have made money on derivative hedges while rates increased), but #HSBC wants us to believe that interest rate increases never had an impact on their fixed income investments, accounted for in the “Financial Investments” book, and where the bank claims there is only an $800m unreported loss due to rates out of…. $457bn of assets. Translated, while #HSBC cannot even hedge their interest rates risk properly, they want us to believe they are only losing (on paper) 0.17% on their reported fixed-income investments. And no, I did not even have to do much digging or use any forensic accounting technique here, it is all written there in #HSBC’s Q1-24 financial report.

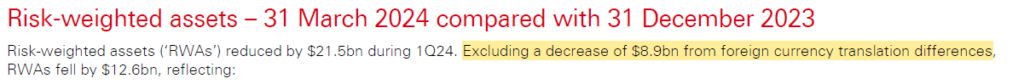

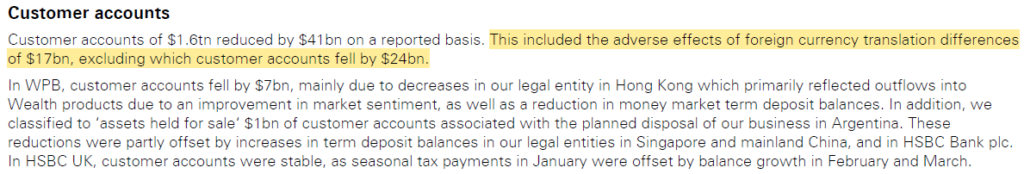

🚩 – Another “mystic” thing in #HSBC’s financial statements? Apparently, in #HSBC’s world, there were no currency movements in Q1-24 as you can see highlighted below considering every single number reported at the FX rates at the quarter end is absolutely identical, digit by digit, assuming constant currency levels for 3 months.

And in case you wonder if that was a mistake, I am afraid it wasn’t since as you can see below #HSBC wants us to believe FX rates in Q1-24 did not have any impact whatsoever to its operations….

🚩 – How can we not take a closer look at what’s going on in #HSBC’s FX business? Well, carefully buried in the footnotes we discover that the sale of HSBC Canada did not only generate one-off revenues for the bank this quarter, but conveniently it also generated $1.3bn of FX gains from hedging, recycling losses, and recycling reserves on losses. What? Sorry but these aren’t my words, they are #HSBC’s as you can see.

What are the chances all that FX recycling ends up offsetting the $1.1bn of losses HSBC expects to incur in selling their business in Argentina? You tell me…

Isn’t it generally quite puzzling that while #HSBC tables do not report any FX impact, the bank in reality discloses significant negative FX impact to their business as you can see in these extracts?

🚩 – In #HSBC’s mystic world, things in the Real Estate sector are going so well that the bank only set aside $700m ECL this quarter thanks to a reduction in charges related to… the commercial real estate sector in #China! You gotta be kidding me… No, it’s not a joke as you can see.

Isn’t this incredibly hilarious if you consider that Evergrande was officially put in liquidation in Q1-24, Country Garden is expected to follow the same fate soon and #HSBC holds significant exposures not only towards these 2 names but also towards all other giant Chinese real estate developers now falling out of grace one after the other since China government decided to stop “helicopter money” bailouts.

Frankly speaking, if we can dig out already so much from 54 pages of a slim quarterly report I wonder what we should expect when full 450+ pages financial statements will be delivered later this year. Perhaps that might have been what truly scared Noel Quinn to the point he decided to, unexpectedly, abandon the ship….