I have to admit, yesterday was one of those days when I personally struggled quite a bit. While I was going through #UBS financial statements, finding something incredible (if not shocking) on every other page, #UBS share price was skyrocketing in the market (UBS Q1-24 RESULTS REVIEW – THE “LA LA LAND” BANK). I decided not to throw in the towel because I believe people deserve to be presented with the full picture of what’s going on, not only what’s convenient for the company management and mainstream media. I know it sounds like a silly “mission,” but I feel better knowing I did all I could to provide as much information as possible to inform people. Then it’s up to them to decide what to do. If they enjoy trading, they should trade. If they enjoy investing, they should invest. If they enjoy gambling, they should gamble. If they enjoy donating that extra cash that would have otherwise fallen into the pockets of a hedge fund somewhere, they should donate.

Furthermore, I’d love to remind you, that #stocks and stock derivatives are not the only asset class out there. It is not even the biggest one (by far). The more you inform yourself, even going beyond your comfort zone, the higher the quality of your decisions will be. This is a law of nature. If you see a headline and you feel the urge to act, that isn’t an informed decision but an instinctive reaction. Why are you assured to be a loser if you act instinctively nowadays? Because a high-frequency trading hedge fund somewhere in New Jersey already took advantage of that extra piece of information long before your eyes finished reading it.

What about financial statements? That’s where your advantage is and will be for a very long time because #AI is generations away from becoming AGI and hence capable of producing critical thinking. Beware, if you invest in a stock without reading the company’s financial statements, it’s the equivalent of buying a used car without making sure the brakes, the engine, and all the inner structures are in good shape and worth the asking price. If you don’t read financial statements, that is the equivalent of simply buying a used car because of its shape and color which you can only see from 100 meters away. You might argue financial statements are boring and difficult to understand, that an auditor and regulators will make sure all is fine, and so on. Again, would you buy a used car if someone else you never met personally before tells you that it’s a good car and you should have nothing to worry about?

What worries me a lot these days is that the extent of financial engineering used by companies has reached unimaginable limits. Instead of investing in things of the past like R&D and employee welfare, companies nowadays are ultra-focused on maximizing shareholder value in the very short term. What’s wrong with that? Well… if you happen to become a shareholder once everything that could be milked out of the company has been milked out, you will be a “bagholder” not a shareholder. Financial engineering is immoral, but legal. Personally, I have a problem with management stepping up their game into financial fraud after they cannot (legally) milk their companies anymore.

Financial engineering isn’t that different from a used car dealer showing you the safety certifications of a used car, that do not look great while stressing how the new paint and seat cover look great and make the car a bargain. Financial fraud is when the used car dealer shows you fake documents, keeps pointing your attention to the great-looking exteriors, and how the price he is offering you is a “steal”. Trust me, no one would be selling you something if they thought they would be getting a good deal out of it first. This is why I find it very hilarious to see investors buying shares of companies where their management consistently exercises their stock options and then liquidates the stocks shortly after in the market. I find it even more hilarious to see investors buying stocks of companies that consistently perform share buybacks in the market when prices are expensive, not the opposite. Isn’t this counterintuitive? With all the insider information they have, the management should be buying back stocks of their own company when these are cheap, not the opposite, right? Well… but when the stock is at the top, it’s the best time to cash out their bonuses paid in shares…

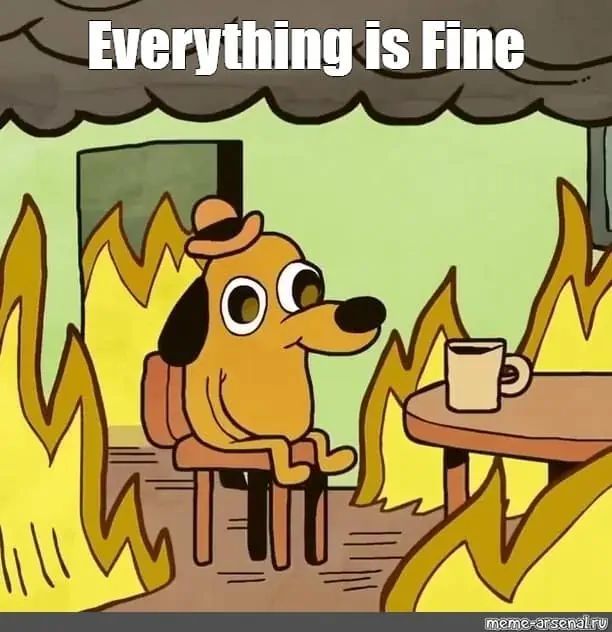

Feel free to disagree with me, but we’ve come to a point where investors are acting in the market against their own interests without realizing how their actions are counterintuitive in their nature. We’ve even seen extremes equivalent to investors buying a used car that was being set on fire in the parking lot. Why? Because they knew there is a buyer lining up right behind them that is willing to buy that too so if they bid first they could then resell it at a higher price, making a profit in the process.

How could all of this be sustainable and end well?