In the article “How Japan’s farmers and fishermen backed the leveraged loan boom” published more than 5 years ago, the FT tried, through the teeth, to sound the alarm on #Norinchukin Bank’s out-of-control buying spree of Collateralized Loan Obligations (CLOs). The bank was such a key player in the market that it was even nicknamed the “CLOs Whale”. Let me share some examples:

“Over the first six weeks of the year, Nochu bought up the top tranches of every European CLO raised, according to people familiar with the deals.”

“Regulators around the world may have sounded the alarm on the loosening protections and credit standards in the world of CLOs, but managers of the vehicles argue only catastrophically high loss rates could touch their AAA tranches.”

“Many [CLO managers] privately grumble about the ways Japanese money is distorting the asset class. CLOs seeking to launch without Norinchukin’s help are having to offer significantly higher yields on their AAA tranches.”

I know, all of the above sounds very similar, if not identical, to the setup that ended up ballooning the size of the CDO market that ultimately triggered the GFC in 2008. Hilariously, Norinchukin rushed to raise emergency capital in 2008 to cover the losses on their huge CDOs and CDOs squared book. However, at that time they took ZERO losses on their AAA CLO tranches. Likely, even in their case (WHO ARE TODAY’S “NINJA” SUBPRIME LENDERS? SHOCKINGLY… PENSION FUNDS), this is the reason why after they were done clearing up their GFC mess, they resumed buying CLOs AAA tranches as if there was no tomorrow.

The problem is that Norinchukin made a big mistake that was even highlighted in the FT article. The Japanese banks pretended to set a cap on the amount of “covenant-lite” loans that could be included in the CLOs they were buying, paradoxically forcing CLO managers to buy much riskier “covenant-heavy” ones. Hold on a second, isn’t this counterintuitive? No, if you consider that during ZIRP+endless QE years across the globe, there was such an abundance of liquidity in the market that the bargaining power shifted from lenders to borrowers. Here I talk from personal direct experience too.

As a matter of fact, corporates with strong balance sheets could negotiate incredibly favorable terms on debt facilities, often with minimal covenants (hence “covenant-lite”), because banks flooded with cash were outbidding each other out of desperation to deploy their huge piles of cash in anything that could yield something and did not come with a heavy capital burden. The flip side of this was that the corporates that were struggling to raise cash even in those years because of their shaky finances were those open to compromise on highly restrictive covenants that on paper offered a higher degree of protection to the lender. Furthermore, Norinchukin overlooked another risk that was instead well known to CLO traders: those loans they were gulping in huge sizes were very illiquid. The situation became so ridiculous that at some stage if Norinchukin was the “anchor” buyer of a CLO, committing to take part of or even all the AAA tranche, banks could not find investors for the lower-rated tranches since they knew those repackaged loans were much riskier than what it was perceived.

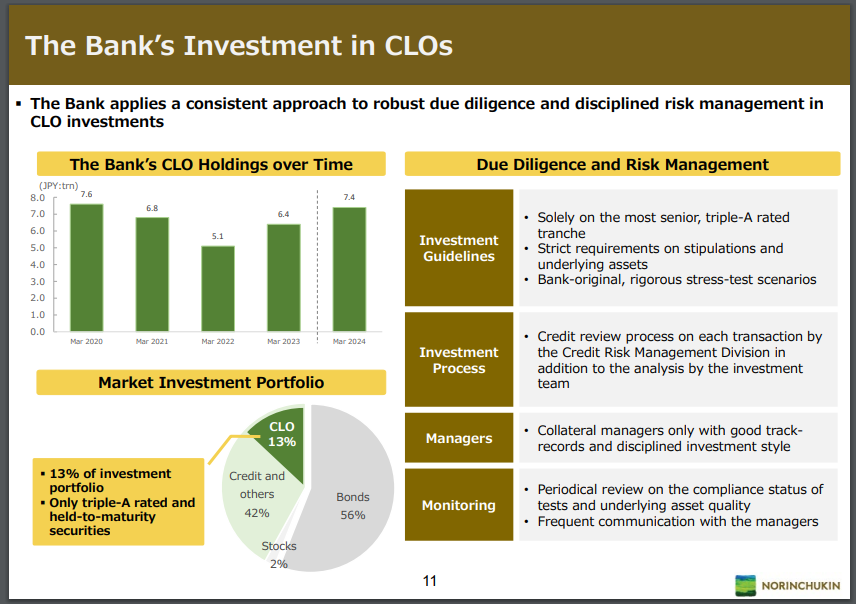

As you can see in the below slide from their latest available report, Norinchukin remains or pretends to remain, clueless about the true risk and quality of its CLO portfolio alone represents 13% of the total assets of the lender and is almost double the size of its total equity (7.4 trillion JPY vs 4.4 trillion JPY).

Beware, the potential losses that are making headlines lately are related to Norinchukin’s bond portfolio NOT the Credit or CLO ones (“Norinchukin’s planned foreign bond divestment will hurt profits”).

Do you think other Japanese banks were sitting at the window just admiring Norinchukin’s deal-making? Of course not. Not only did they want to join the arena, but if Norinchukin was in a deal or building a trade, they were stampeding one on top of the other trying to get a piece of it. Here again, I talk from direct experience.

What I find really troubling about this whole situation is that no one is talking about it, but now I hope you agree with me this whole mess is an incredible threat not only to the Japanese financial system but to the global one.