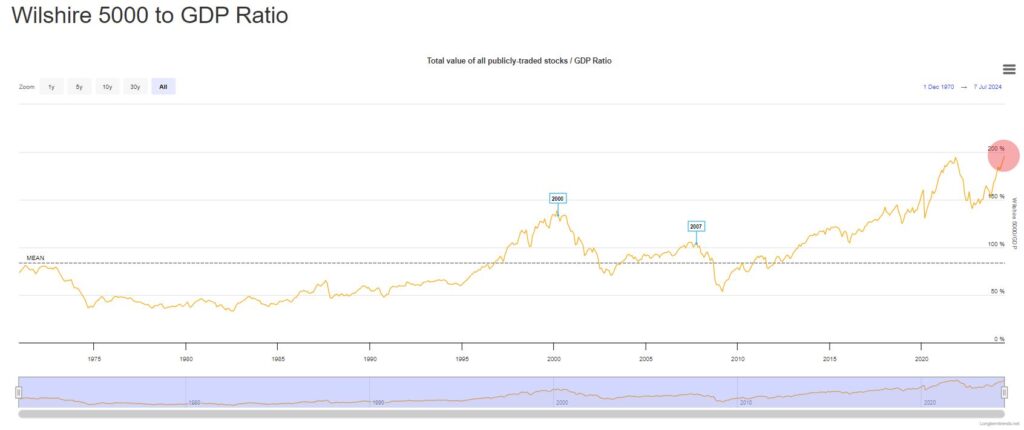

The previous quarter, banks truly stretched any possible accounting and regulatory standard to the limit to kick the can down the road, hoping a #FED rate cut could give them some relief. Unfortunately for them, not only did this not happen, but today our dear Jerome Burns reminded everyone that rates will stay higher for longer. Seriously, what else could he say when this is the biggest bubble on record according to any metric like the Buffet Indicator?

As proof that banks are in bad need for rates to come down to lift the value of their deeply underwater holdings so far kept well hidden in their HTM books (that changed meaning from “hold to maturity” to “hide till maturity”), Citi published the last plea for rate cuts begging for SIX of them: “Fed rate cuts: Expect 200 points of easing as economy slows more sharply”

A few days ago, I published “WHICH BANKS ARE AT RISK OF GOING BUST IN A LIQUIDITY CRISIS? – EPISODE 2” to share a more realistic estimate of the amount of losses sitting in major banks’ books. My goal today is to have a look at which bank has the best chances to keep hiding the reality and which one might shock the markets in the following days.

JP MORGAN

I frankly expect little surprise here, even if the bank admitted the latest #FED stress tests were effectively a joke (JPMorgan Chase says its stress test losses should be higher than what the Fed disclosed). The bank has plenty of liquidity on hand and they managed their risk more wisely than the rest of the market. Furthermore, they have been particularly successful in unloading toxic CRE loan portfolio risk into Hedge Funds (that underwrote plenty of CDS) and Private Equity Funds (that scooped up many of those assets outright).

CITI

Unfortunately, I am not able to share much about my former employer, but from what has already made it into the press, it’s fair to expect that Jane Fraser will do her best to show the progress made in her restructuring efforts on the cost front while the profitability will likely show a hit. Is the market going to like that? Soon we will know.

GOLDMAN SACHS

The king of investment banking just failed the FED stress tests despite the bar being set so low an ant could jump over it (Goldman Sachs faces uphill battle in dispute with Federal Reserve over stress test). What went wrong at Goldman? From the last quarter, we already know Goldman is dealing with a worsening liquidity problem (GOLDMAN SACHS CASH BLEED WON’T ALLOW THEM TO KEEP HIDING THEIR LOSSES FOREVER). However, the latest FED stress tests brought the spotlight onto their troubled consumer lending business that is potentially facing up to ~57.5bn$ in losses related to their unfortunate partnership with Apple (APPLE CREDIT CARD – THE (RADIOACTIVE) WORM INSIDE THE APPLE?)

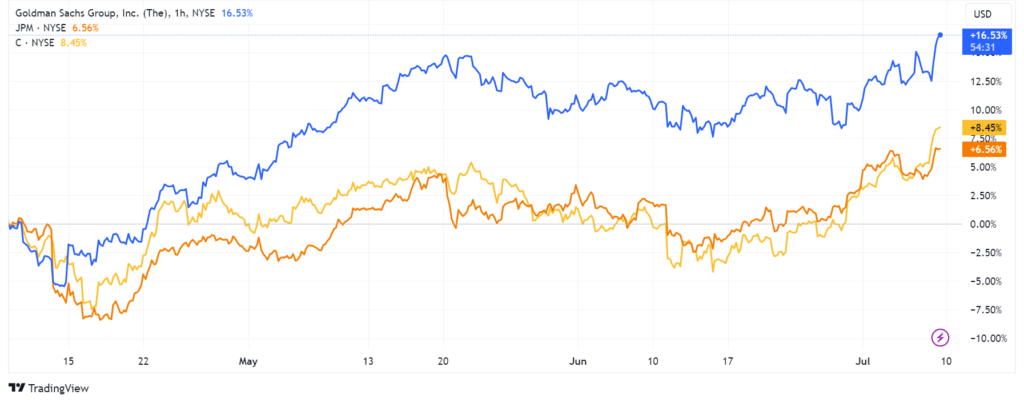

Paradoxically, GS is the bank that so far had the best market performance in the last 3 months and the market even ignored the outcome of FED stress tests

HSBC

This is the bank I believe has the highest chance to shock the markets that conveniently ignored all the warning signs in their latest quarter starting from the surprise announcement of its CEO departure (IS HSBC CEO “UNEXPECTEDLY” LEAVING BECAUSE THE BANK WON’T BE ABLE TO HIDE ITS PROBLEMS FOR MUCH LONGER?). What did the market like in the last quarter? HSBC announced a special dividend and an increase in its stock buyback program, that’s it.

Do not forget, last quarter the bank claimed an improvement in the China Real Estate sector as a reason for them CUTTING their reserves for expected credit losses in the related book. The bank was completely wrong and it will be hard to claim the same in their next earnings release…

- China’s Housing Market Crash Intensifies

- China Home Prices Slump Despite More Property Market Stimulus

- China’s glut of idle property causes headache for the government

I believe the market is starting to sniff that something is wrong with HSBC considering the bank has been underperforming both China and Hong Kong stock indexes in the last period, something that incredibly has not made any headlines so far while plenty of ink has been used to write about the troubles in the economies where, let’s not forget, the bank makes ~70% of its revenues.

UBS

This is the bank I am craving the most to see their latest earnings figure, in particular after the ton of lipstick they used in the past quarter (UBS Q1-24 RESULTS REVIEW – THE “LA LA LAND” BANK)

From my direct contacts still within the bank (although they are trying their best to leave), describing the situation as “grim” does not yet give an idea of how bad things are there. Worse than what I already described few months ago in “EVERYONE IN UBS IS LOOKING FOR A LIFEBOAT TO ESCAPE THE SINKING TITANIC“

Most of the blame, not surprisingly, is given to the Credit Suisse acquisition which has been the equivalent of buying the Titanic when it was already at the bottom of the ocean with the hope it could be floated back up (DID CREDIT SUISSE BAIL OUT $UBS?), UBS is also dealing with its very own legacy problems related to its Investment Banking business. The situation is clearly so dire that the Swiss regulator itself is now asking the banks to raise their cash buffers and capital as fast as possible (Switzerland says UBS may need more cash. The bank is fuming).

US REGIONAL BANKS

There is not much to say here, even after the FDIC itself isn’t pretending anymore the sector is not in big trouble: Higher interest rates have created 63 ‘problem banks’ and $517 billion in unrealized losses, FDIC says. However, on this front, it looks like the market isn’t turning a blind eye to the risk and the KRE ETF chart is quite clear on this…

While many are already on holiday or with their head on the beach sipping a mojito, I have a feeling they’d better keep their laptops nearby because by the look of it, it isn’t going to be a “chilled” summer unless you are Jamie Dimon.