When you go from “Japan’s Nikkei average closes at all-time high, breaks March record” to “Japan stocks take largest dive since Black Monday of 1987” in the span of a month, it already creates the type of roundtrip that leaves everyone pretty dizzy. The problem is the trip is far from over.

The Nikkei index closed at 35,917.50 on Friday, down almost ~6% in a single day. However, Nikkei September Futures kept trading during US hours last Friday and ended the week at the 34,860 mark. This means in about ~24h, Japanese stocks are reasonably going to resume trading ~2.7% lower than where they ended on Friday. Does it sound like the beginning of a “Black Monday”? The answer is no, but with the USD/JPY slicing through 148 and 147 levels to close the week at 146.58, there will surely be more liquidations warming up this weekend.

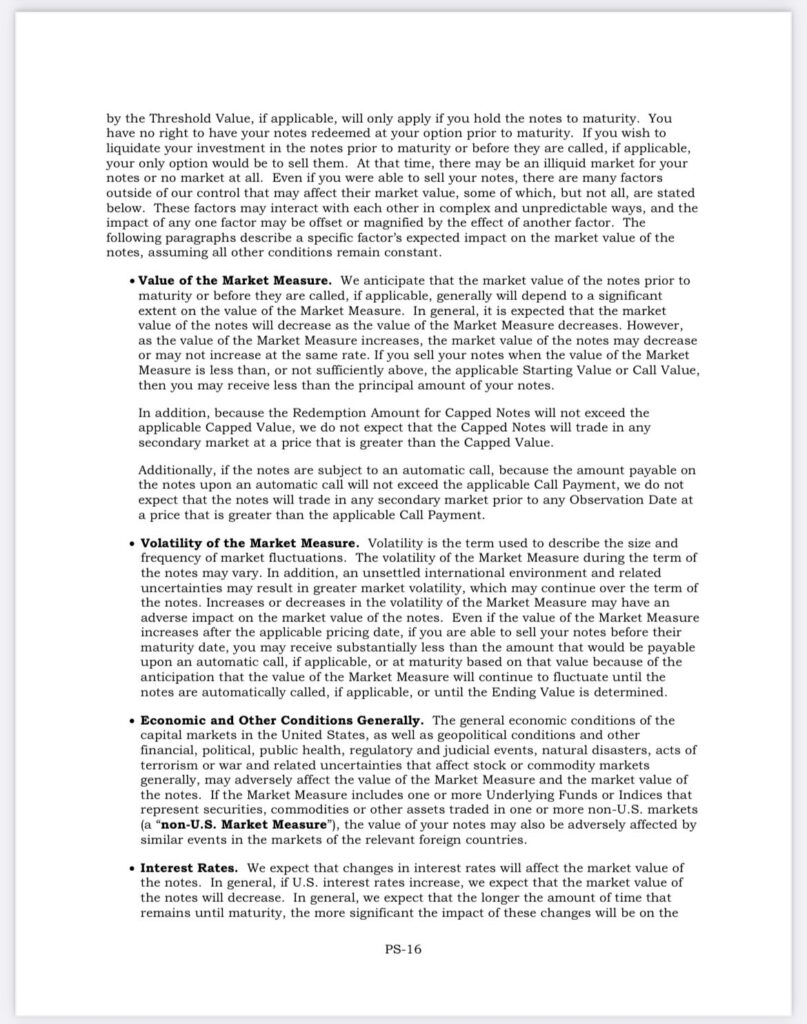

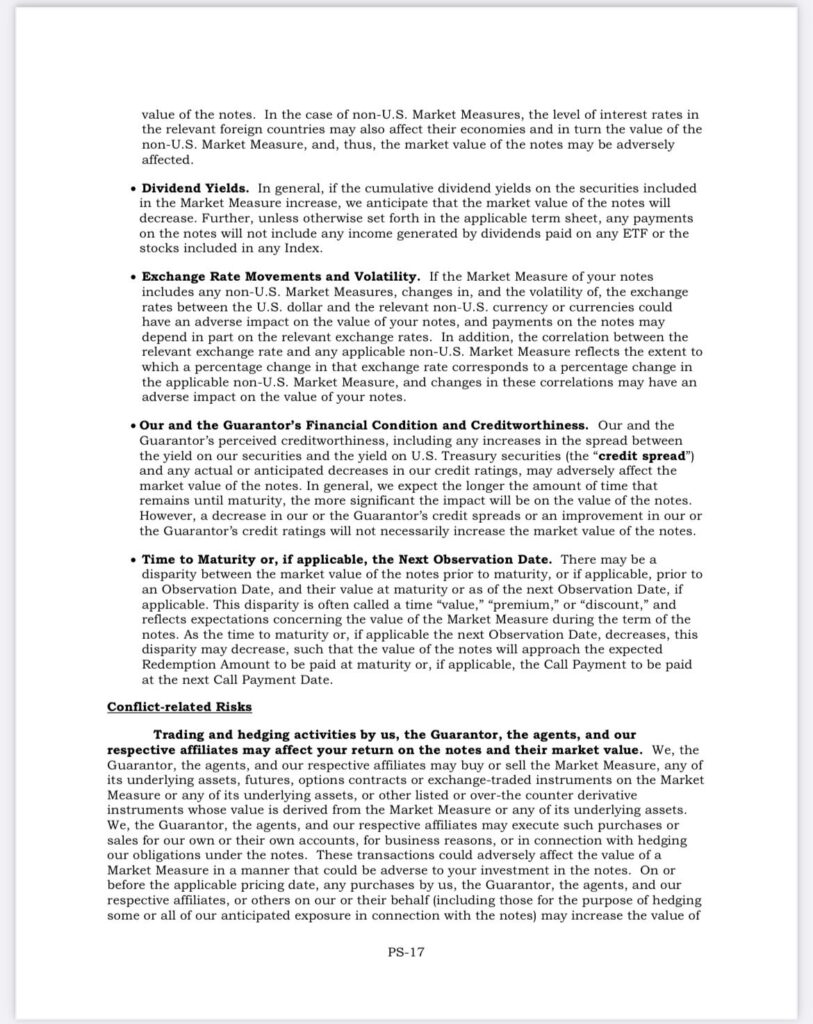

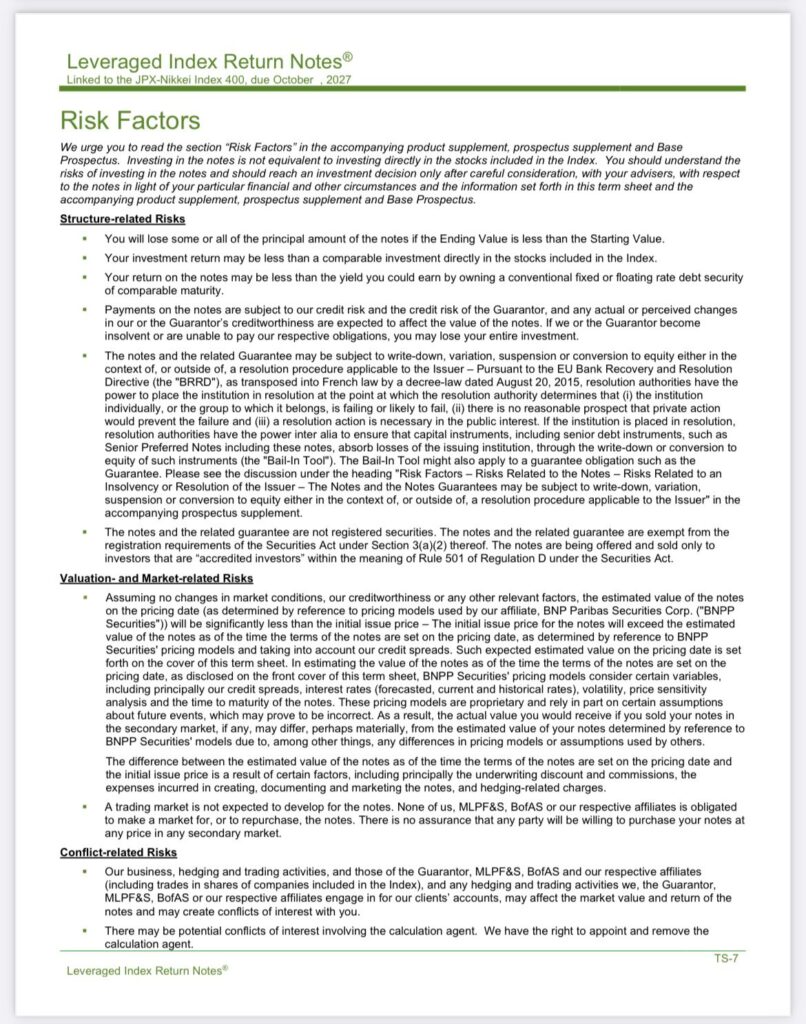

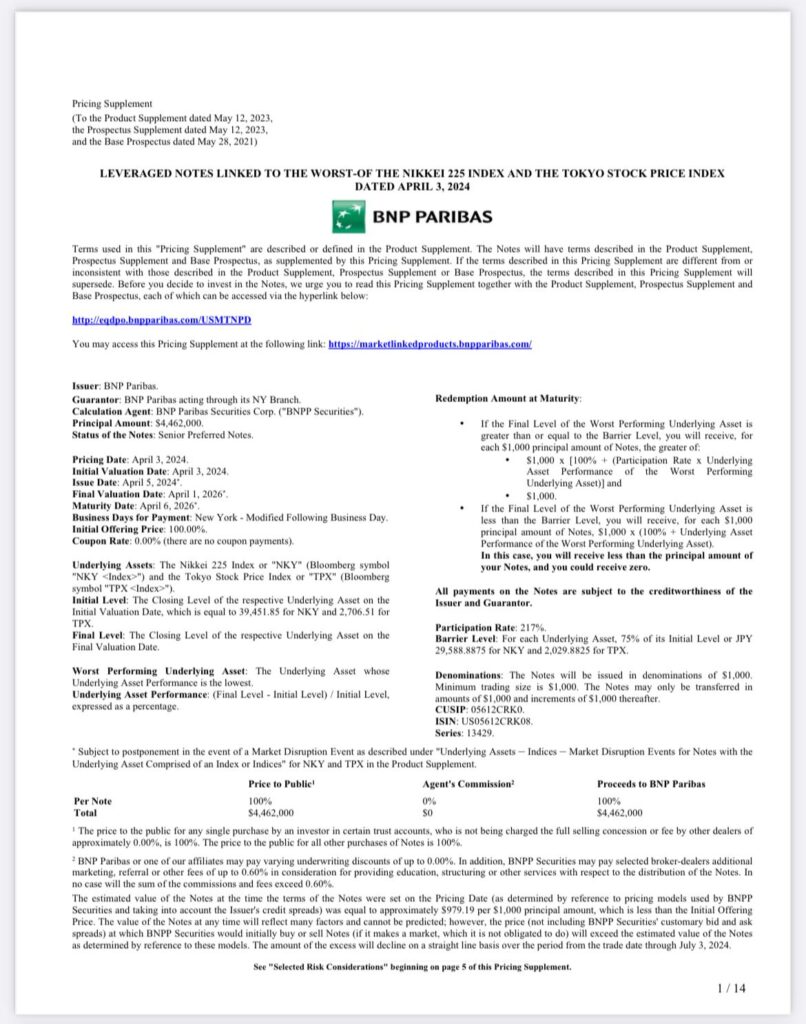

So far, it feels like I described an incoming bad day, but not a messy one, right? Correct, but here is what can really mess things up: a sustained breach of 35,000 in the Nikkei has a good chance of triggering a wave of unwinding on equity structured derivatives and structured notes. Why? Because, of course, in the great #FOMO run of 2023 into Japanese stocks, many brokers began to market leveraged investments to their clients, both rich and retail, issuing plenty of index-linked notes like this.

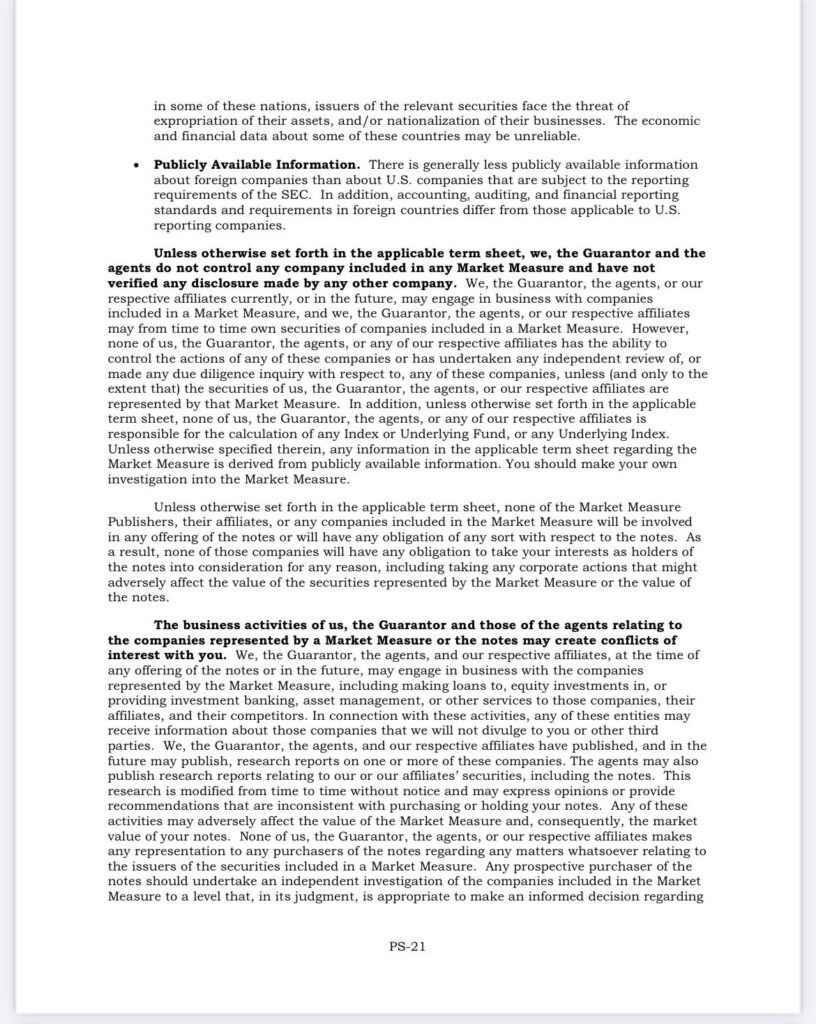

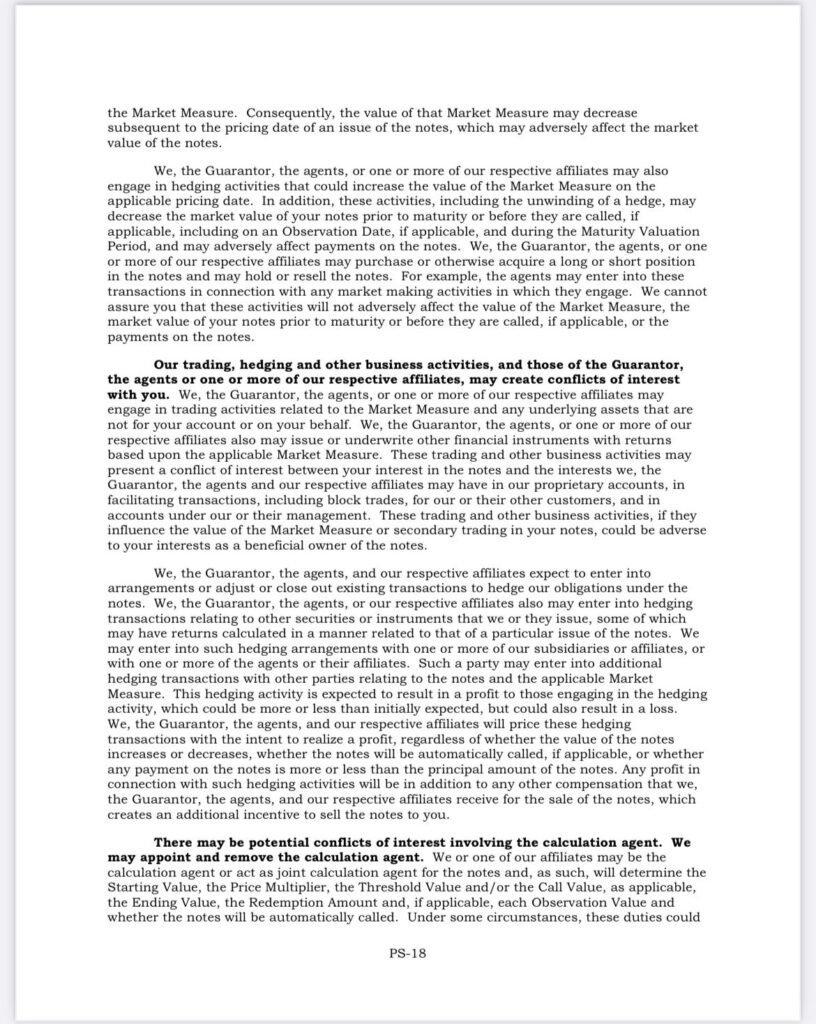

And of course, during the latest dip in Japanese stocks, banks helped their clients to double down, marketing a new batch of leveraged notes like this.

In the equity derivatives world, “round numbers” barriers are very popular, particularly when structuring notes and investments targeting a retail client base. This is why for every 500-1,000 points drop on the way down in Japan indexes, there is a risk of blowing a good chunk of derivative positions up.

This is a point I didn’t touch upon on purpose in “A TRAVELER GUIDE TO NAVIGATE THE BANK OF JAPAN MESS” article last Friday to avoid overcomplicating things and instead of helping my readers navigate the Bank of Japan mess, I didn’t want to confuse them even more.

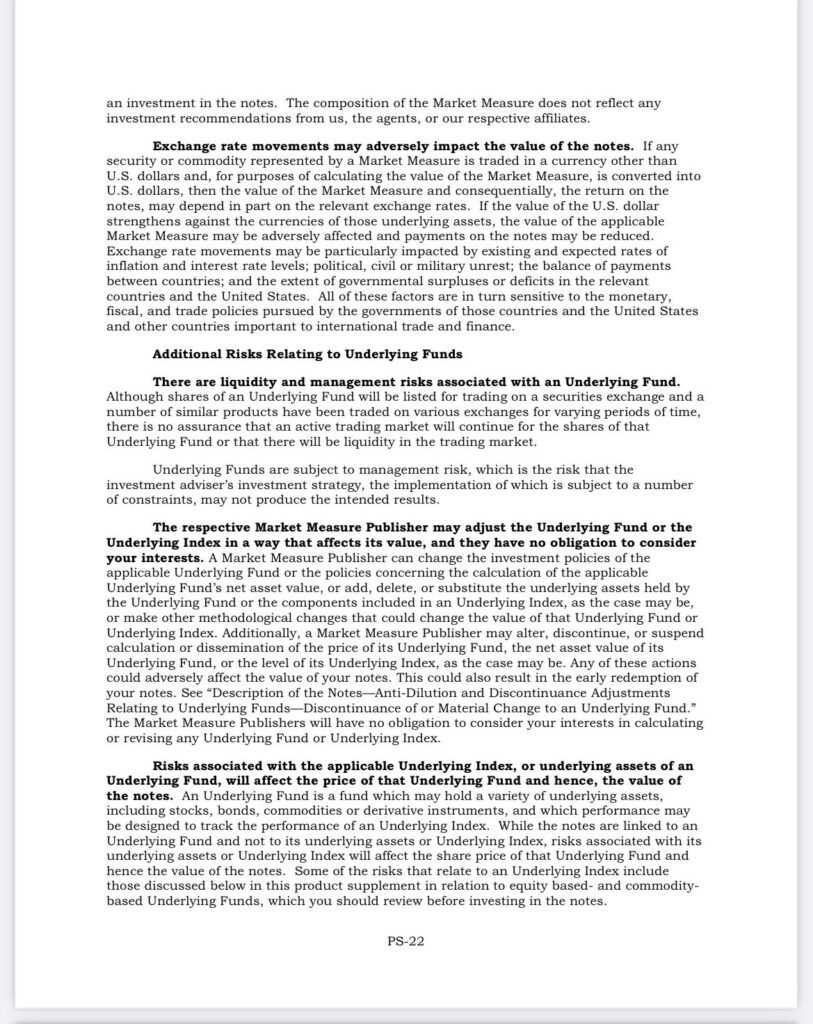

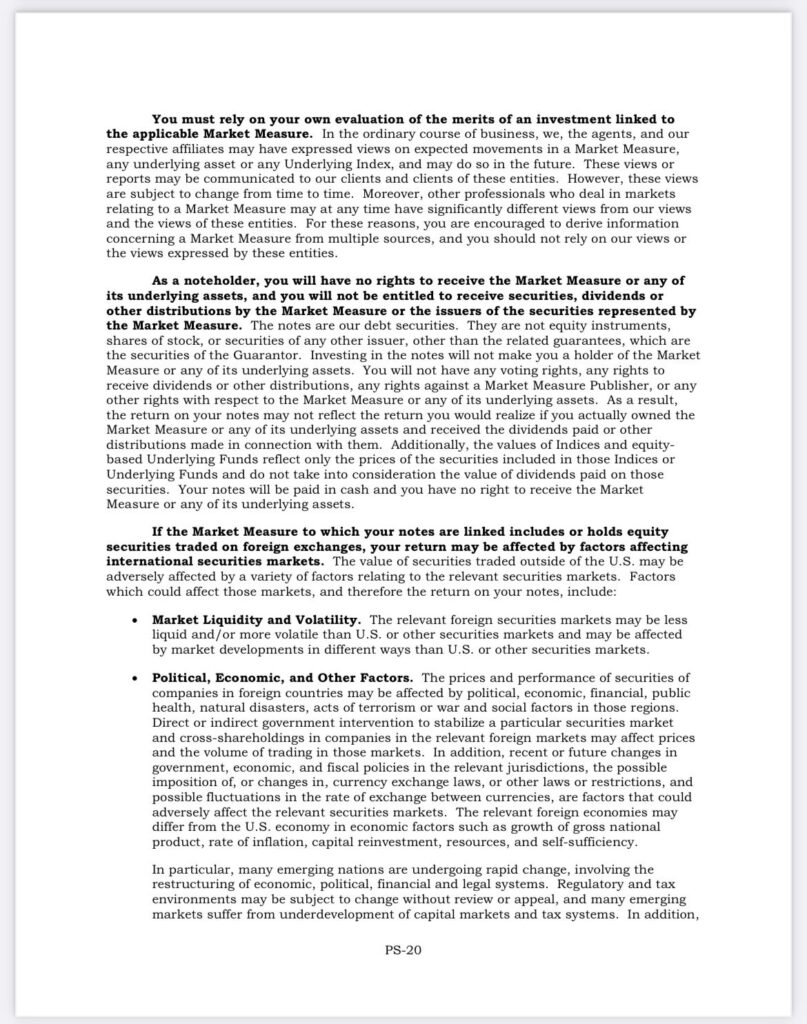

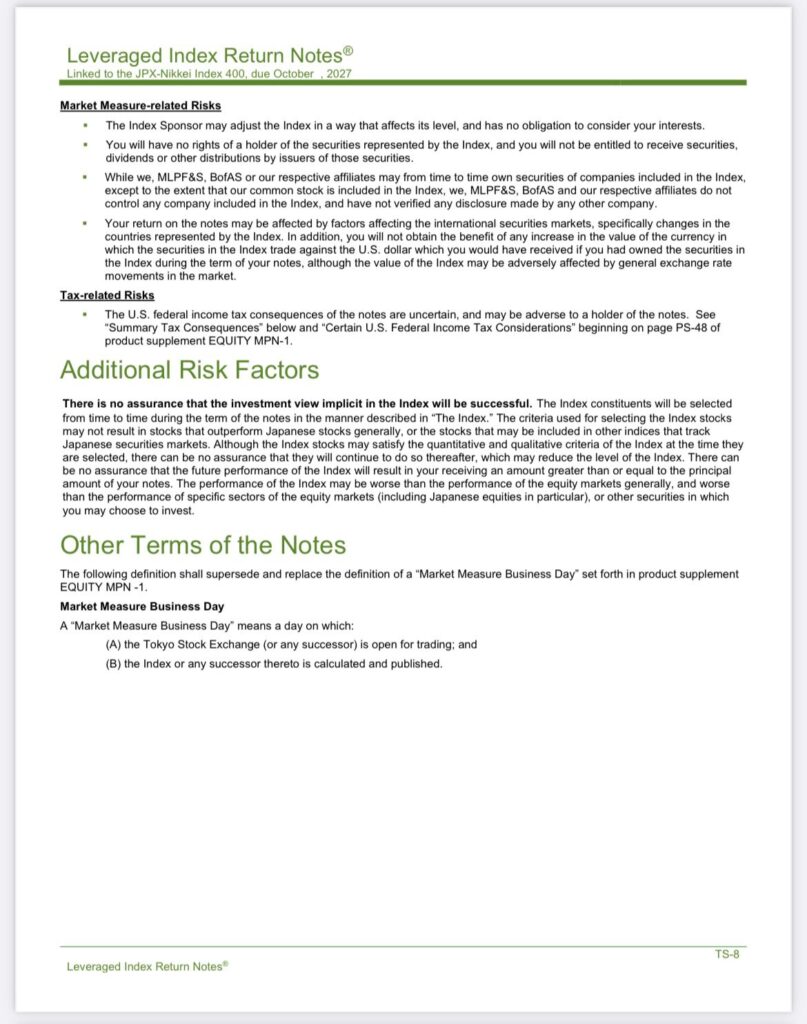

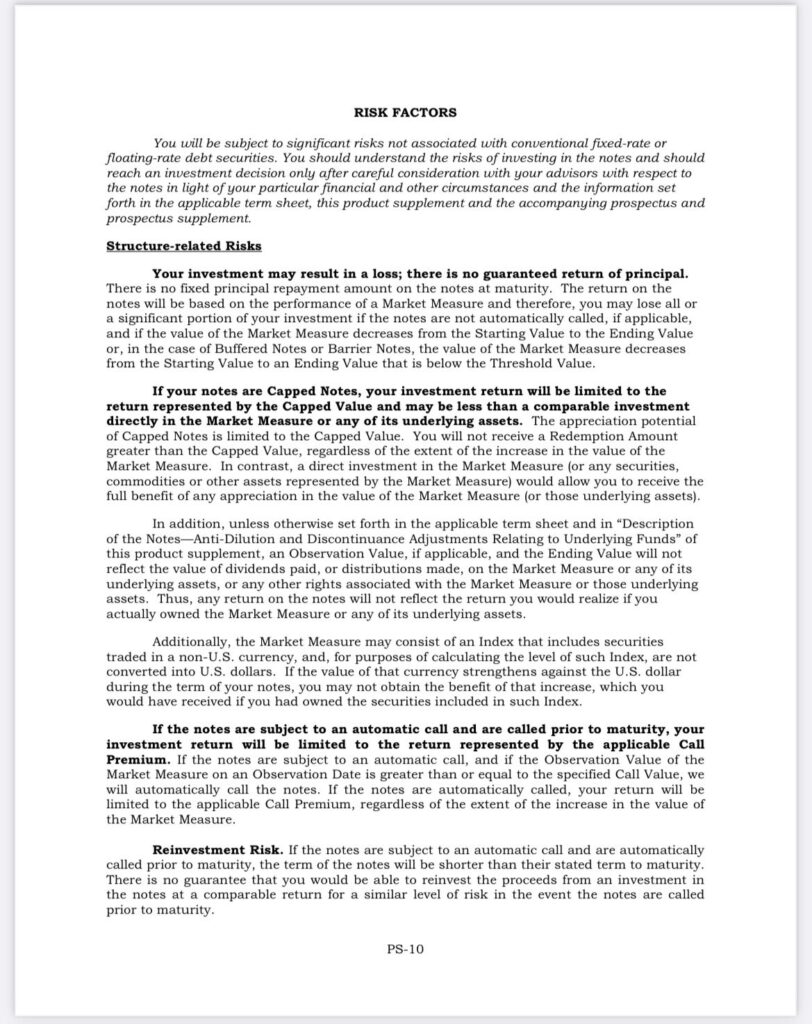

To conclude, on top of the 4 types of “carry trades” we discussed last Friday, now we should consider the big chunk of derivatives attached to every kind of investment marketed by brokers to their clients to profit from the #FOMO in Japanese #stocks that began mid last year. It is pretty intuitive how the selling pressure coming from that front will continue throwing gasoline on the fire that the BOJ sparked. These products also have so many dark corners and ramifications that troubles with them can have unforeseen repercussions elsewhere in the global financial system chessboard. To give you an idea of the magnitude of “unknown unknowns,” below you can find the whole list of “risk factors” attached to one of the notes I shared as an example for this article.

At this point, you might wonder what can spark a “Black Monday” type of crash in Japan. The answer is: that you will need a big credit even to trigger for that to unfold (and there are so many good candidates in Japan to unleash that), but we are not there yet.