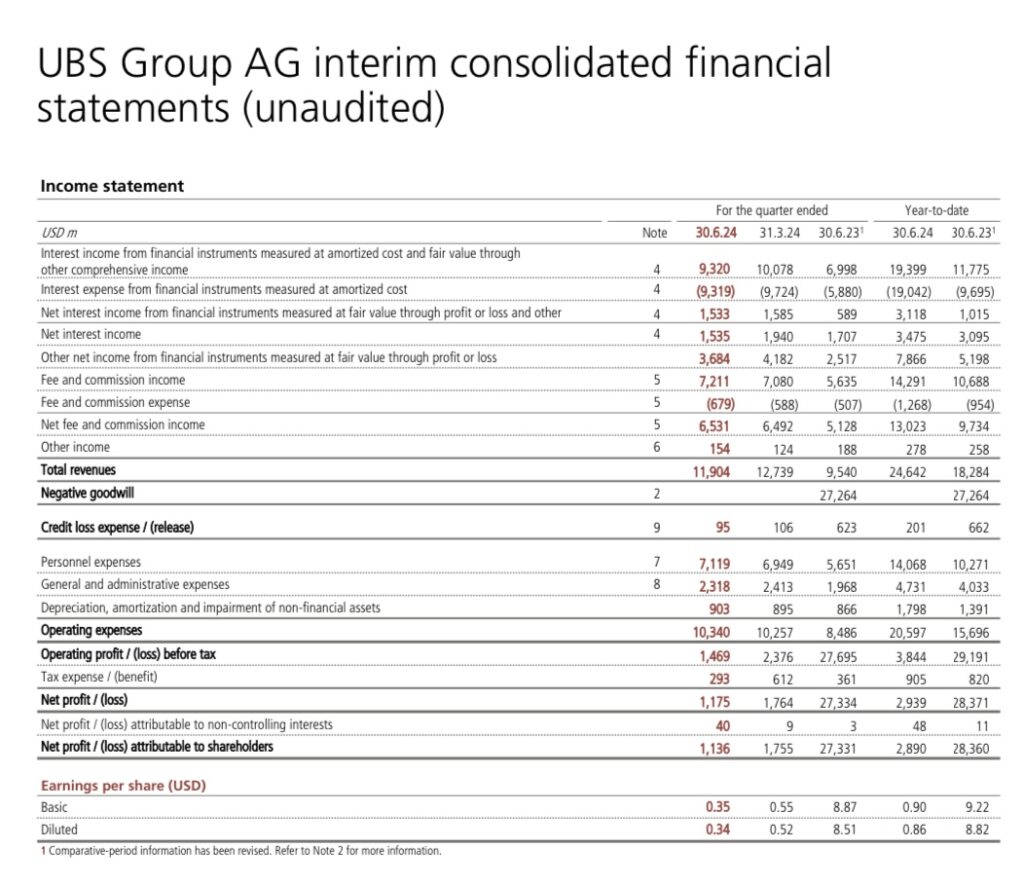

UBS reported its Q2-24 earnings, and after a brief moment of selling pressure at the open, the stock started soaring, ending the day up more than 5%. Yes, on the surface, UBS reported a net profit more than double what Wall Street analysts expected, and that was enough to feed jubilant headlines and give a cover to trading algorithms that so blatantly helped the stock grind higher for the whole day with barely a pinch of volatility.

Another part that looked “too good to be true” in UBS results? The bank reported ~95m$ of Credit Loss Expenses for the quarter. No, I didn’t leave a zero behind; UBS just reported ninety-five million USD of credit losses while fellow major banks are reporting several hundred million if not billions.

⚠️ I have a question for you now, how is it possible that UBS does so well at doing its job as a bank (negligible credit losses) if it doesn’t make money being a bank?

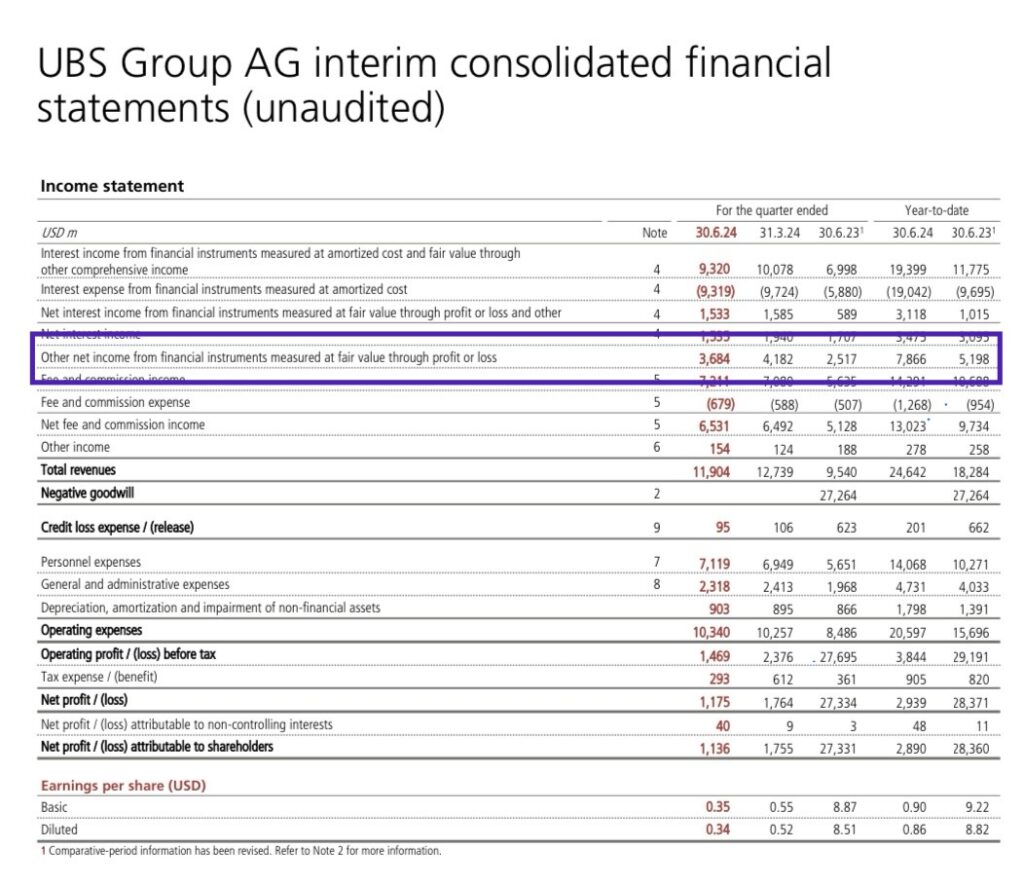

Please have a look at the first 2 lines of UBS consolidated financial statements. Do you notice anything strange? Yes, in the last quarter, UBS earned a ~9.32bn interest income from Loans and Fixed Income securities that are not Marked to Market, while UBS paid ~9.32bn$ in cost of funding. As a result, in the whole quarter, UBS made 2m$ of net interest income on 1.5 Trillion worth of Assets within the accounting category taken into consideration and 1.081 Trillion worth of Liabilities measured at amortized cost. Wait, what?

- UBS earned 9.32bn$ out of 1.5T$ of assets

- UBS paid 9.32bn$ out of 1.08T$ of liabilities

Yeah, I know what you are thinking now: “WTF?!” 😳

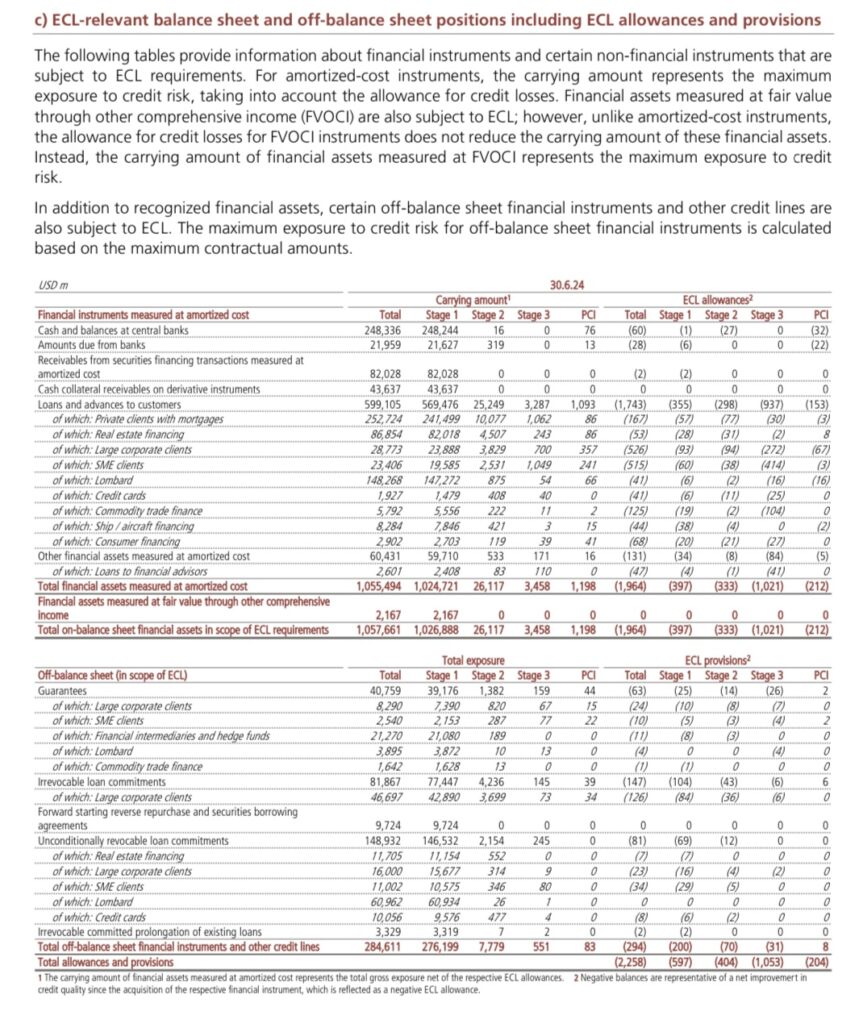

Now let me tell you what’s obviously happening here, UBS borrowers aren’t paying interest as they should, but the bank is doing its best to hide it. The moment a bank categorizes an asset as Non-Performing, it would have a series of consequences ultimately resulting in the bank being unable to avoid allowances for Credit Losses, hence taking a direct hit on its Net Income. Not surprisingly, as you can see in the section below, UBS has a small fraction of assets categorized in Stage 2 and Stage 3.

Now, let’s have some Algebra fun, shall we?

Assuming UBS earns the same percentage of interest between its assets and liabilities of the same nature, even though logically speaking, UBS should earn a higher yield on its assets:

1 – 9.32/1080 = 0.86%

2 – 0.86%*1500 = 12.9bn$

3 – 12.9bn$ – 9.32bn$ = ~3.58bn$

So assuming a bank lends at the same rate it borrows money, there are 3.58bn$ of Interest Revenues missing here, which is equivalent to 27.7% of the total interest stack related to those assets. Let me stress again here, that we are making very conservative assumptions to help out UBS a little bit.

My dear reader, please let me know how it is possible that while there are 3.58bn$ of revenues missing, UBS pretends to report 95m$ of Provisions for Credit Losses for the quarter. Personally speaking, it looks clear to me that the bank should report much, much higher Provisions for Credit Losses considering how bad its investments are performing.

If we dig a little deeper into UBS numbers, we find even more “Stranger Things”.

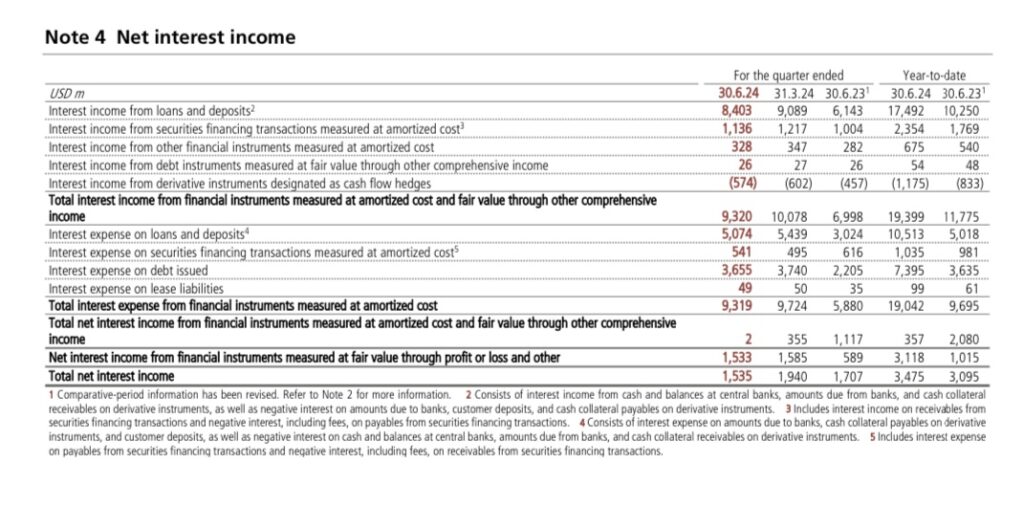

Please have a look at the first line “Interest Income from loans and deposits” where the bank reports 8.4bn$ in revenues. Hold on, there is a small (2) note attached to it. Let’s see what this note says:

“Consists of interest income from cash and balances at central banks, amounts due from banks, and cash collateral receivables on derivative instruments as well as negative interest on amounts due to banks, customer deposits and cash collateral payables on derivative instruments”

These are literally UBS words, not mine, and as far as my understanding goes, what’s written means that 8.4bn$ amount isn’t even all equivalent to interest earned on Loans, right? Doesn’t this mean that UBS is making even less on its loans? Furthermore, doesn’t this mean that UBS is being supported by Central Banks and fellow banks to fill the bigger and bigger holes in its balance sheet?

At this point, it is so obvious that the 95m$ amount earmarked for expected credit losses is simply ridiculous. 🤷🏻♂️

Do you think I am done here? Nope, there is even more juice if we dig a little deeper.

In the last quarter, UBS reported in its revenues “Other Net Income From Financial Instruments Measured At Fair Value Through Profit or Loss And Other” equivalent to ~3.6bn$.

Waaaait a second, isn’t this the exact same amount of interests “missing” we calculated before? Yes, it is, my dear reader. Does UBS provide any detail about the source of these revenues in the 107 pages of its financial statements? Nope, ZERO.

Why do I have a gut feeling we just found the accounting trick the bank is using to fake its financial statements… 🤔 Isn’t this something similar to the infamous Lehman REPO 105 book the bank was using to cover a ~50bn$ hole in its balance sheet during the GFC?

To conclude, clearly, the math doesn’t add up, and when UBS revenues from fees, commissions, and trading (that’s only where the bank makes money, or so they claim) aren’t enough to cover all its losses in its toxic books, the bank is clearly using an elaborate accounting scheme to give the market the impression everything is fine. That the Credit Suisse merger is going so smoothly. In reality, the numbers portray the reality of a bank more and more in trouble (and this is even aligned with the feedback that many frustrated insiders are so adamantly sharing nowadays).