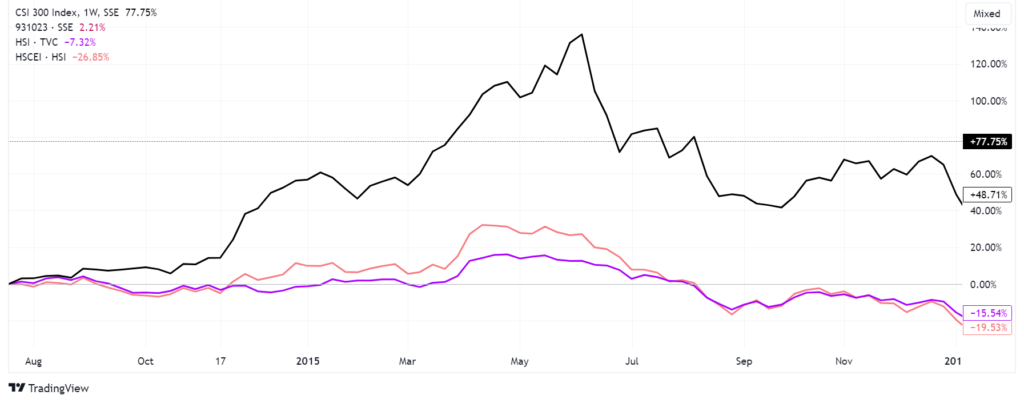

Victory lap after victory lap, my sincere congratulations to all those who jumped onto this rally. Just remember profits only become real once you cash out, but clearly, this is not on anyone’s mind at the moment. Let me share a story with you first: I landed in Hong Kong on July 19, 2014, and two days later I set foot for the first time onto Citigroup’s trading floor. From the chart below, you can see what happened during my first year here in Asia.

A few months after I settled in, China became a “no-brainer” investment. Not Hong Kong (not many Chinese mainland stocks were part of the HSI at that time, FYI) as you can see, but Chinese stocks directly that in a few months rose more than 130%. At that time, every single institutional investor was doing two simple things:

- raise leverage

- buy stocks

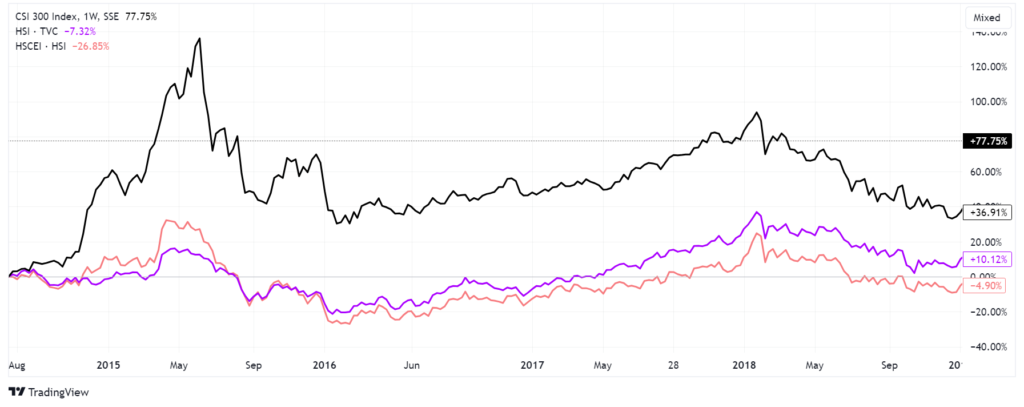

I remember that in order to slow down the mania, the Chinese government first set circuit breakers on the way up, something unheard of anywhere before, but it was not enough. What really stopped the mania and citizens jumping into the mania gambling all their savings was the government’s direct order to SOEs to start selling stocks in the open market. What happened shortly after was complete panic. At that time, I learned a very important lesson: the higher the prices go up, the more people jump into the market, and volumes hit their apex around the top. This means that the bulk of the leverage was set in place too late. The unwinding was frantic, many positions quickly fell underwater, and in order to repay margin calls, many of my clients could not repay the money they borrowed in full in the first place. As you can see in the chart below, this depressed the market for a whole year despite a short-lived rally when the government this time instructed SOEs to start buying stocks instead.

It took 2 years for things to begin to normalize when Chinese stocks began to benefit from the widespread rally ongoing in Europe and the US, along with resilient growth of the Chinese economy (mostly due to growth in the real estate sector).

Fast forward to today, the situation is not just similar, but worse. Why? Because this time, the US and Europe are currently at the apex of their stock bubble, their local economies are slowing down with large countries like Germany already falling into recession, and the Chinese economy has tons of toxic debt to digest from the system. Most of this debt is tied to excessive real estate development which was where everyone in China rushed to invest their savings in the aftermath of the 2015 bubble when no one wanted to hear about stocks anymore. I have addressed the various problems within the Chinese economy and markets extensively already:

- A LESSON FROM #CHINA’S MIDDLE CLASS: PAY YOUR DEBTS UNTIL YOU CAN AFFORD TO DO SO. THE ALTERNATIVE? DEBT SLAVERY

- CHINA’S ECONOMIC RESTRUCTURING RECIPE: CAPITALISTIC COMMUNISM

- CHINA HAS BEEN THE FIRST ONE TO ABANDON THE QE ABERRATION, WHO IS GOING TO BE NEXT?

- THE TWO KEY PRINCIPLES UPON WHICH CHINA IS REBOOTING ITS ECONOMY (AND THAT THE WEST DOESN’T UNDERSTAND)

To everyone living here and to anyone paying attention (“China’s Weak Factory Activity Shows Urgency of Stimulus Push“) two things are very clear:

- It will take a long time for the economy to reboot

- the government is against market speculation that can result in damaging the savings of the population as it happened in 2015 (since those are the ones always left holding the bags after the locust hedge funds cash out as fast as they came in).

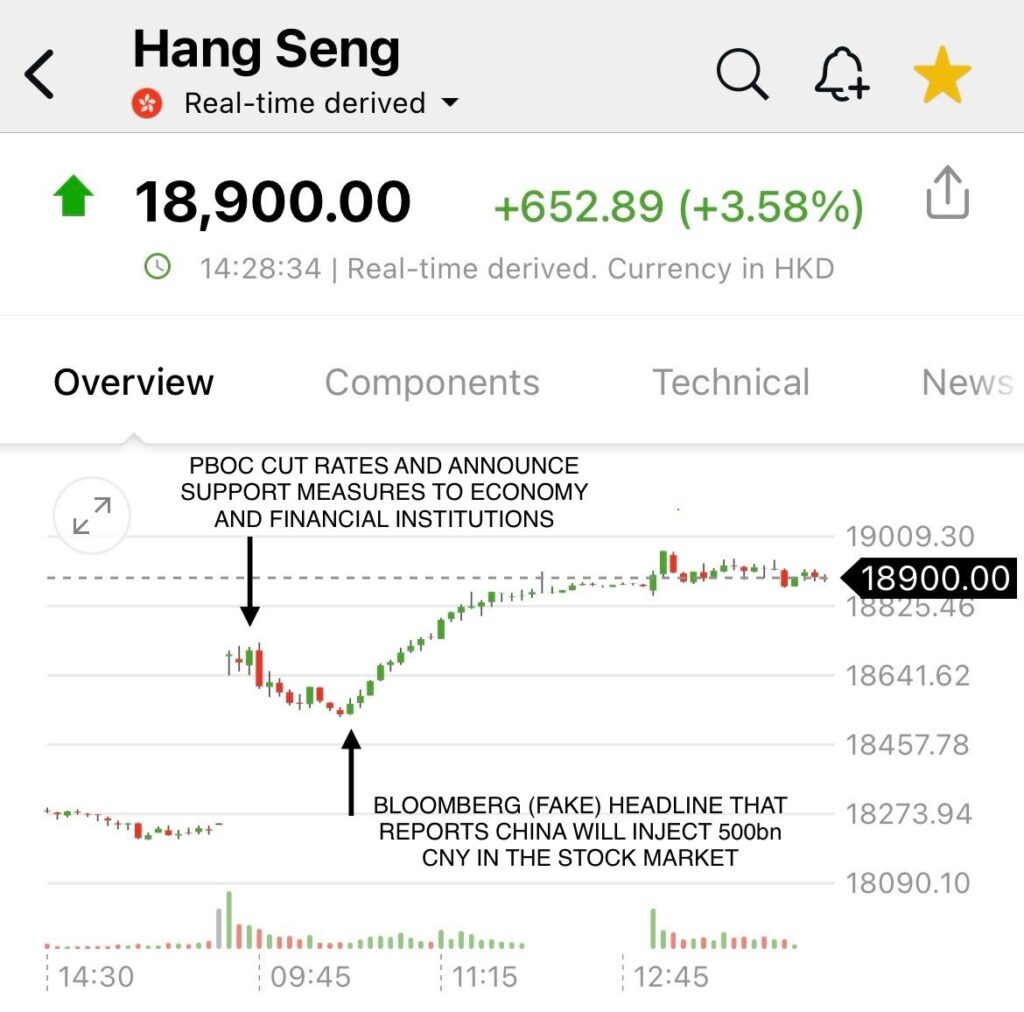

The current reaction to the latest stimulus plan has nothing to do with the stimulus itself (A BIG BANK IS ON LIFE SUPPORT, CHINA KNOWS IT AND IS PREPARING TO WITHSTAND THE SHOCK – IS THIS BULLISH?), but is clearly being engineered abroad. What makes me think about that? Let’s look at the events objectively:

- China announces stimulus to support the economy and to recapitalize banks

- The market doesn’t react positively (see the chart below I posted the 18th of September)

- Bloomberg issued a “misleading”news headline claiming brokers can borrow from the PBOC to buy stocks (“China Mulls Stock Stability Fund, Unlocks $113 Billion From PBOC“). This is something Bloomberg already did back in January to ignite the first FOMO rally earlier this year, but everyone forgot about that apparently (“China Weighs Stock Market Rescue Package Backed by $278 Billion“).

- Algorithms start the ramp exactly at the moment the Bloomberg headline comes out

- David Tepper goes on CNBC saying he is buying everything in China while in reality he has been holding the same position for 6 months and was underwater (David Tepper’s big bet after the Fed rate cut was to buy ‘everything’ related to China). This ignited the retail FOMO (mainly US-driven).

- Rumors of a Large Hedge fund flooded by margin calls start spreading as the squeeze intensifies (Quant Hedge Funds Trapped in Short Squeeze After China Glitch)

Today the HSI Volatility Index (the HSI VIX) closed above 40 and no one noticed that in the Twittersphere or MSM world. Yes, the VIX has been rising INTO A RALLY meaning all you are seeing is the result of a massive coordinated action to propel a gamma squeeze of gigantic proportions. A coordinated action that obviously knew some large hedge fund out there built a significant short position likely on Futures and China Stocks ADRs since every single day the rally in Chinese stocks started in US markets, not in China. This translated into Hong Kong and China stock openings with a significant gap higher due to market makers quickly rebalancing their books to reflect the overnight jump in futures and ADR stocks. The activity in instruments like the FXI ETF doesn’t leave any doubt about this short puts + long OTM call options activity that you can see in other instruments and single stock China ADRs.

As I flagged in the title of this article, at this pace Chinese stocks are on their way to hitting all-time highs in 3 weeks. Yes, this can happen, but do you think that such a market move, for the most part, driven by a gamma squeeze that is forcing market makers to keep buying stock on the way up to delta hedge, is sustainable? Furthermore, once the US hedge funds coordinating on this decide it’s time to cash out, what do you think is going to happen to those stocks held in market makers’ bellies? Of course, they will dump them super fast. That will put the market in a similar situation to 2015 when for weeks stocks could not find a bottom and the lower they went, the more stop losses and margin calls were triggered in a vicious circle that made the crash worse and worse.

Again, kudos to those who jumped into this market move, but if you believe that this will go on for long, I’m afraid both the numbers, the setup, and history are against you. Remember profits are on paper until you cash out, and if you believe you will be able to beat HFT algorithms in terms of speed when the momentum turns, you’d better change your mind quickly.

Comment

Comments are closed.