I always pay attention to the reactions and comments on my posts and articles since no one is perfect, there is always room for improvement, and from time to time I make mistakes myself that I amend when brought to my attention. However, in the past couple of days, I noticed many comments and reactions had 3 things in common: exuberance, greed, and denial.

How does the dictionary define “investors’ exuberance”?

Investor exuberance refers to an intense, often irrational, enthusiasm in financial markets, where investors drive up asset prices beyond their intrinsic value due to optimism, speculation, or herd behavior. This behavior can lead to asset bubbles, as prices increase quickly and significantly without fundamental support, often ending in sharp corrections or market crashes.

What about “greed”?

Greed is an intense desire for more of something, typically wealth, power, or possessions, than is necessary or reasonable. In financial contexts, it often drives excessive risk-taking and can lead to unethical behavior or decision-making focused solely on personal gain, sometimes at the expense of others.

And “denial”?

Denial is a psychological defense mechanism where a person refuses to accept reality or facts, blocking external information that is uncomfortable or threatening. In this state, individuals avoid acknowledging truths that may cause distress, often to protect their self-image or sense of security.

When investors exhibit exuberance, greed, and denial simultaneously, they face significant dangers, in particular:

- Ignoring Overvaluation: Exuberance can lead to irrational optimism, pushing investors to drive asset prices well above their intrinsic value.

- Excessive Risk-Taking: Greed encourages chasing higher returns without fully assessing the associated risks, potentially leading to over-leveraging or poor diversification.

- Ignoring Warning Signs: Denial prevents investors from acknowledging red flags, such as deteriorating market fundamentals or external economic pressures, which could signal a market downturn.

- Emotional Decision-Making: The combination fosters impulsive actions driven by unrealistic expectations, rather than rational analysis.

- Erosion of Long-Term Goals: These traits shift focus from disciplined, goal-oriented investing to short-term speculation, jeopardizing investors’ financial stability and long-term objectives.

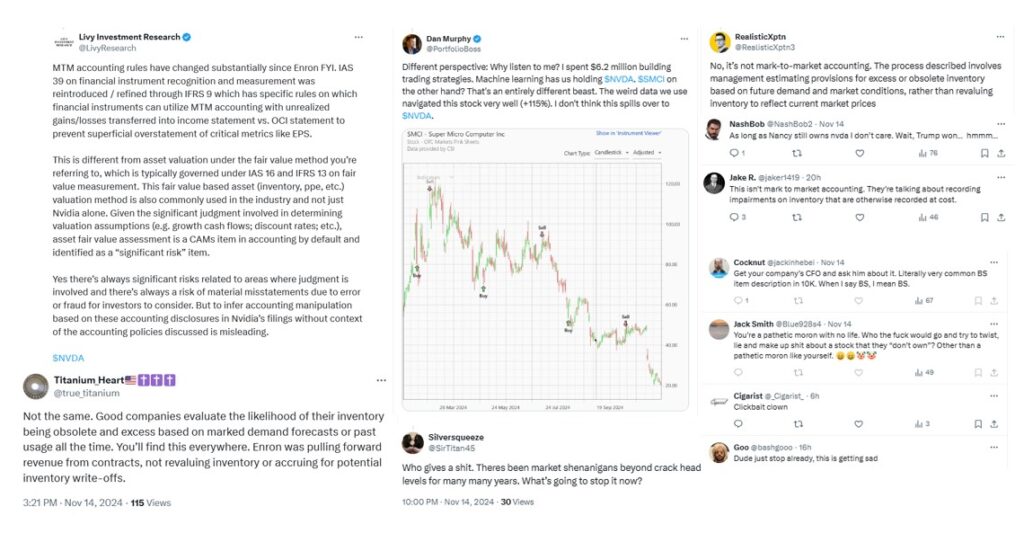

In order to help you visualize what I am talking about, let me share some examples from the comments I received on this post on X.

This post is another perfect example of what we are discussing today as well since it does not take much to figure out how the two sentences “Essentially, IBM would be renting the GPU compute from Amazon’s web services over 5 years without needing to actually buy the GPUs from Nvidia” and “This is why Nvidia continues to have demand” are contradicting each other.

When investors are simultaneously driven by greed, exuberance, and denial, they create a highly dangerous mix that can lead to disastrous financial outcomes. Greed fuels a relentless pursuit of higher returns, pushing investors to take excessive risks without due regard for the potential downsides. Exuberance amplifies this effect, as overconfidence and optimism lead to inflated asset prices and speculative investments, often beyond realistic valuations. Denial compounds these risks by preventing investors from acknowledging warning signs, such as unsustainable valuations or market instability. Together, these behaviors encourage a cycle of unchecked optimism and risk-taking that can inflate market bubbles. When these bubbles inevitably burst, the financial damage can be severe, resulting in steep losses and a prolonged period of recovery.

Usually, these 3 elements manifest together close to the very peak of a bubble, and the similarities between what’s happening today compared to the GFC or the DotCom bubbles are striking.

1. The Dot-Com Bubble:

- Greed: Investors were captivated by the rapid growth of internet companies, many of which had little to no earnings. They speculated heavily, chasing astronomical returns.

- Exuberance: There was widespread overconfidence in the transformative potential of the internet, leading to excessive valuations of technology stocks, many with unproven business models.

- Denial: As signs of overvaluation and unsustainable business practices emerged, many ignored them, believing the “new economy” would defy traditional financial principles. The bubble burst in 2000, wiping out trillions in market value.

2. The Great Financial Crisis:

- Greed: Lenders, investors, and homebuyers pursued massive profits and leveraged themselves heavily in real estate, driven by rising property values.

- Exuberance: There was a widespread belief that housing prices would continue to rise indefinitely, leading to risky lending practices like subprime mortgages.

- Denial: Warning signs, such as unsustainable debt levels and inflated property values, were dismissed by many, including policymakers and financial institutions. The bubble collapsed in 2008, triggering the global financial crisis.

Apologies for being repetitive, but there is only one way to get through the incredibly volatile times ahead of us as a winner: BE A BUYER WHEN THERE IS NO HOPE LEFT IN MARKETS. Anything else you hear is just intellectual garbage, and you should really be careful because these markets are living on borrowed time (HOW LONG WILL THIS BUBBLE LAST? IT LOOKS LIKE TILL Q1-2025)

JustDario on X | JustDario on Instagram | JustDario on YouTube