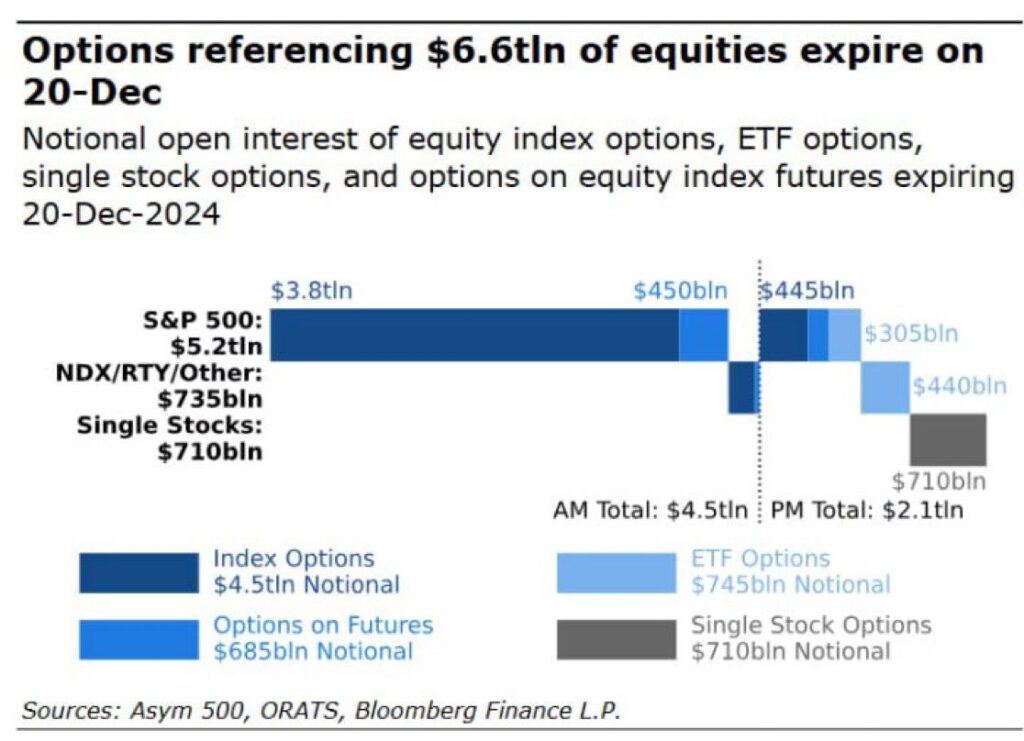

What can go wrong when call options written on $6 trillion worth of notional expire simultaneously?

Today will be the largest OPEX expiry ever, with equity options tied to a total of $6.6 trillion worth of notional expiring simultaneously. What’s special about this OPEX besides its enormous size? For every 10 call options, there is only 1 put option expiring.

Understanding “delta hedging” is particularly important today. Delta hedging for call options involves market makers adjusting their stock holdings to counteract the risk of price changes in the options they’ve sold. If the stock price rises, the option’s delta increases, prompting market makers to buy more stock to hedge, which can push the stock price higher. If the price falls, the delta decreases, leading them to sell stock, possibly pushing the price down further. Small price changes result in minor adjustments, but large movements can trigger significant buying or selling to rebalance, potentially amplifying the initial price movement, especially around expiration dates when options trading is high.

As I highlighted in the article “MARKETS ARE QUIET – TOO QUIET,” nobody expected a spike in volatility into year-end. In particular, nobody doubted Papa Powell would cut rates and print more money to “sponsor” a great Santa Rally party to wrap up a record 2024. However, I highlighted that the market was heading into year-end in exactly the same conditions as prior to the 2018 Volmageddon.

In the recent past, the market came close to a Volmageddon event several times, as I previously documented through my posts on X and in articles like “IS IT FINALLY VIX SHOWTIME?“. Fortunately, Central Banks managed to coordinate to suppress volatility and defuse its detonation successfully. August 5th was a close call, but they managed to intervene in the market at the very last minute with the VIX trading above 60 ahead of US stocks cash trading open. How did they achieve that? It wasn’t just a coincidence that many popular commentators rushed on TV to call for a 75bp emergency rate cut despite stocks trading near all-time highs. Central bankers and finance ministers likely agreed to “send a message” to the market, which listened and stopped panic selling, with traders quickly unwinding their hedging, contributing to a sharp collapse of the VIX from dangerously high levels.

What about today? As mentioned at the beginning, the market is positioned at such an extreme that a spike in volatility can not only trigger a nasty feedback loop but can potentially happen very quickly, making the likelihood of a “flash crash” objectively significant. Why? Because delta hedging dynamics force market makers to sell equity underlying if options are being cashed out instead of being exercised or rolled forward. It’s intuitive how an avalanche of selling can trigger if enough volume of delta hedging unwinding starts impacting the P&L on outstanding call option positions that will quickly decrease in value.

Personally, I believe the US PCE data release might be used to balance the damage done by Jerome Burns during Wednesday’s FOMC. A US PCE reported conveniently below expectations could easily reignite the narrative around the FED cutting rates more aggressively in 2025 since “inflation is under control” and “to support the economy,” ultimately calming traders’ nerves as everyone will be less worried about the liquidity gravy train coming to an abrupt halt. What if the US PCE comes in “hot”? In that case, fasten your seatbelts and prepare a good amount of popcorn (or toilet paper if you’re all-in stocks) because I don’t know what can stop a Volmageddon from triggering this time, sorry.

JustDario on X | JustDario on Instagram | JustDario on YouTube