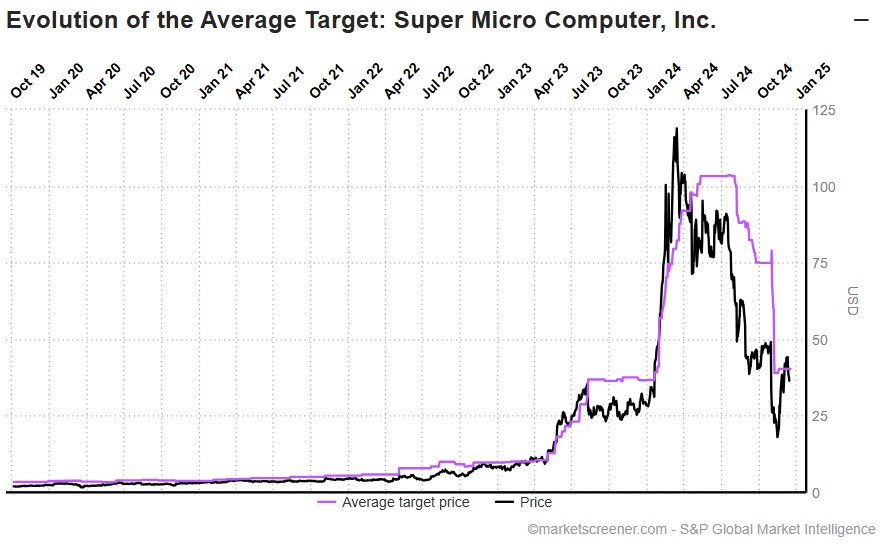

At the beginning of the year, something very interesting happened around SMCI that no one, including myself, paid attention to: despite the stock hitting an all-time high of $118.81 (post-split) on March 13th and falling hard to $75 in just a month, Wall Street analysts kept increasing their target prices on the company up to a ~$105 average consensus that stood in place until the end of August when the Hindenburg report appeared and, despite being initially dismissed, anticipated the company’s announcement of a delay in filing its audited financials that triggered the implosion of the stock.

Why is this dynamic very interesting? Contrary to all other semiconductor companies, SMCI effectively started to buck the uber-bullish trend of the whole sector while being a key component of all the “AI Narrative” Wall Street embraced all along until very recently:

- Integration with AI and Data Center Infrastructure:

- SMCI specializes in high-performance server technology, particularly servers optimized for AI and data center applications. SMCI’s solutions were often defined as “vital” in this space since no one else could provide the infrastructure where advanced semiconductor chips could run efficiently.

- Partnerships with Leading Chip Manufacturers:

- SMCI never lost the chance to emphasize its strong relationships with major semiconductor companies like NVIDIA, AMD, and Intel. These partnerships allowed SMCI to integrate the latest and most advanced GPUs and CPUs into their server systems, leaving, in theory, competitors like DELL far behind.

- SMCI Meteoric Growth:

- SMCI showed significant growth in the AI server market, and its revenue growth reflected the increasing reliance on its high-performance computing environments that use cutting-edge semiconductor components (as the narrative built around it claimed).

- SMCI Adaptability:

- SMCI, unlike its competitors, not only could adapt incredibly quickly in incorporating new semiconductor technologies into its server infrastructure, but it claimed to be able to do so profitably, which somewhat clashed with an increase in expenses that never materialized like it did for the likes of DELL (Shares of Dell fall 18% as AI servers are sold at ‘near-zero margins’)

- Strategic Importance:

- Data centers are deemed increasingly central to modern computing, and SMCI’s servers have become the “must-have” for all those companies seeking to quickly scale up their infrastructure. However, no one ever noticed how SMCI claimed it could install and operationally make large server infrastructures in an unusually quick way compared to its peers.

With the benefit of hindsight, I believe we can agree that SMCI’s story was too good to be true, right? This is why going back and observing what happened since the beginning of the year, it’s becoming clear someone either figured this out and jumped ship while Wall Street was busy advising its clients to buy the stock, or they got hold of inside information that was diametrically different from the public image the company so carefully crafted for itself.

Another thing no one noticed, but in this case I did, was how similar SMCI’s questionable practices were to other heavyweight companies in the sector, especially NVIDIA: “HYPERSCALERS” OR “HYPERCHEATERS”? – ADDING HINDENBURG PIECE TO THE BIG PONZI PUZZLE WE HAVE BEEN PUTTING TOGETHER TILL NOW WHILE WAITING FOR NVIDIA EARNINGS

This week SMCI will be removed from the Nasdaq-100 only after it was officially included a few months ago, and as I highlighted during the weekend, it is more than reasonable to expect them to be kicked out of the S&P 500 soon too. Hilariously, the company was included in the Nasdaq-100 on July 22nd while it was added to the S&P 500 on March 18th.

Hold on a second – when did SMCI peak and start to inexorably decline without looking back? March 13th. When was the company added to the S&P 500, forcing an army of passive investors to buy the stock? March 18th. What a coincidence, right? It’s also quite incredible that the stock never rejoined the constant bullish trend of the whole semiconductor sector. Again, with the benefit of hindsight, this becomes incredibly suspicious, as if this stock, which started to rise vertically cementing the whole AI Narrative, was instead being actively sold in the market despite everyone from the media to Wall Street recommending it as a no-brainer. Funny enough, the second leg down of the stock price started shortly after the inclusion in the Nasdaq-100 when another army of passive investors was forced to buy in.

What are the chances that the same gameplay was used with other companies in the sector while mainstream media was fed gasoline to throw on the FOMO fire? I will leave this question open, but it is clear that the SMCI canary stopped singing a long time ago, and considering how crucial this company was to the whole semiconductor ecosystem, I would not make the mistake of thinking its fall from grace will not impact all other high-flier names that never failed to stress their ties to SMCI throughout 2024.

JustDario on X | JustDario on Instagram | JustDario on YouTube