Three months ago, right after SoftBank’s quarterly results for the three months ended in September 2024, I wrote “SOFTBANK IS RUNNING OUT OF CASH, BUT NO WORRIES NVIDIA IS TRYING TO RESCUE IT,” highlighting how Masaponzi Son’s company continues to burn significant amounts of cash. However, a timely announcement of a partnership with Nvidia convinced investors to keep ignoring fundamentals and remain committed to Masaponzi’s “vision”. Since I wrote the last article, Masaponzi literally went on an announcements spree:

- OpenAI Investment [1.5bn USD tender offer to existing employees willing to cash out].

- Cristal Intelligence Partnership [3bn USD Annual commitment to OpenAI enterprise AI].

- NVIDIA Collaboration – AI-RAN and supercomputing initiatives

- Stargate Investment Program [500bn USD total investment commitment of which 100bn USD done immediately].

- OpenAI Investment Announcement [40bn USD investment at 260bn USD valuation]

Anyone familiar with SoftBank Group’s financials knew Masaponzi had just a fraction of the money needed to back his promises, but every single announcement was music to investors’ ears, who could not buy SoftBank stock fast enough.

Yesterday, SoftBank Group released its latest financial earnings, and here is the headline of the breaking news: “SoftBank falls to $2.4bn loss amid plans for huge AI investments“

Before diving into the latest numbers, let me ask a few open questions to you, my dear reader:

- How is it possible that SoftBank funds and direct investments keep losing so much money while the whole market, especially the tech sector that is theoretically where SoftBank focused, keeps churning out new all-time high records every other day?

- Considering the Mark-to-Market of SoftBank’s unlisted investments (the vast majority of the portfolio) is done by SoftBank itself, hence customarily reflecting higher valuations than the real market value, how bad is the situation really if they themselves cannot hide the mess from surfacing anymore?

- How can SoftBank possibly survive a bear market (or perhaps even a less bullish one) when it is already in such a situation right now?

I believe all of the above are fair questions, and it just takes some basic logic to answer them, right? Alright, now let’s go beyond the basic logic and take a look at the latest numbers.

This quarter, SoftBank reported 4.66 Trillion JPY of “Cash and Cash Equivalents,” slightly up from 4.48 Trillion from the end of the prior quarter. Good news then? Not really. This result has been achieved by raising 350 Billion JPY of additional debt during the quarter (increase in the difference between “Proceeds from interest-bearing debt” minus “Repayments of interest-bearing debt”) that compensated for the cash drain on other fronts. What about investing activities? SoftBank only invested 80bn JPY more in the quarter, equivalent to ~500m USD. Hold on a second, does this mean that the 1.5bn USD tender offer made to OpenAI employees wasn’t as successful as Masaponzi claimed? Or did he perhaps commit a lower amount while declaring a higher one (as he usually does for the benefit of the media)? Surely the numbers are clashing a bit with what has been fed to news outlets.

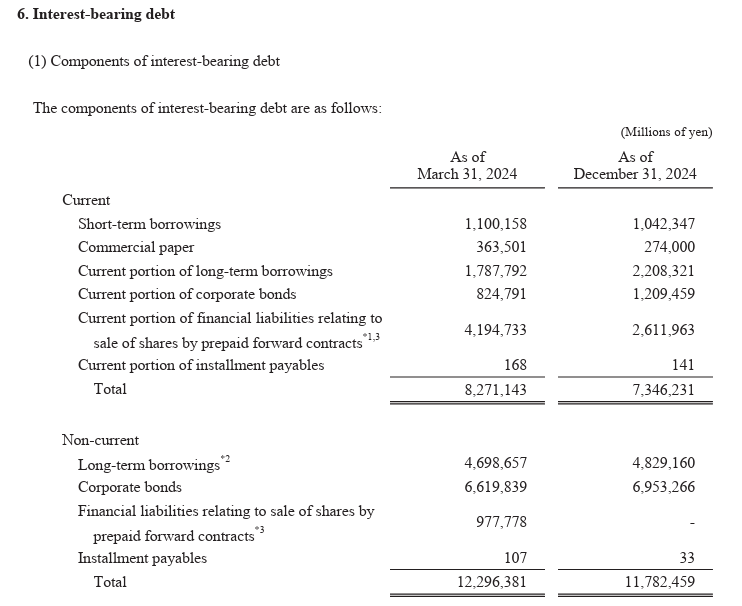

I know what you’re thinking right now: how can SoftBank pledge hundreds of billions of USD in investments when it only holds ~30bn USD of cash and cash equivalents in its accounts? Let me blow your mind a little more because the reality is actually worse. As you can see from the table below, SoftBank has 7.3 trillion JPY of interest-bearing debt “current,” meaning that it will mature in less than one year.

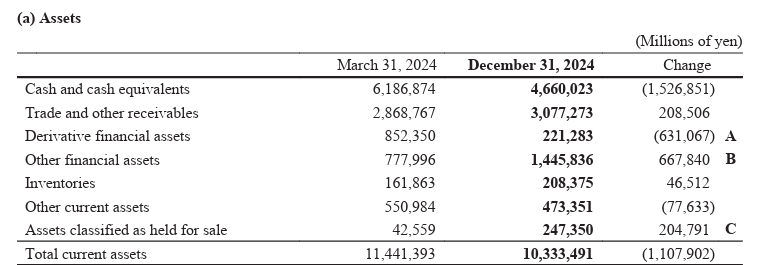

What about current assets? In appearance, SoftBank can cover its short-term interest-bearing debt repayments; however, if we take a closer look, it does not take long to realize that there is a liquidity problem with all other current assets besides cash and cash equivalents.

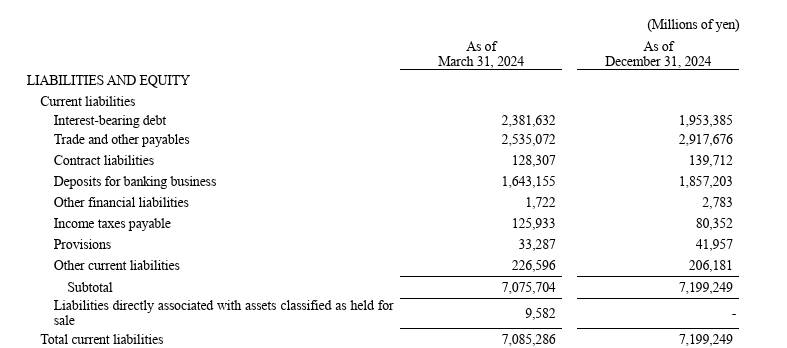

However, we need to take a look at its SoftBank Corp subsidiary to better understand what’s going on, and here is where things begin to become murky. SoftBank Corp is the main business operation of SoftBank Group, and as of December 31, 2024, it reported ~5.43 Trillion JPY of Current assets (among them ~1.9 trillion JPY of cash and equivalents) against ~7.2 Trillion JPY of Current Liabilities. Let me blow your mind now; please take a look at the table below:

~1.9 Trillion JPY of current liabilities are deposits from “banking business,” which means that all SoftBank Corp cash is tied to those that can be withdrawn at any time. This amount is being consolidated in SoftBank Group, meaning that SoftBank’s real amount of cash available is NOT ~4.66 trillion JPY because, for banking regulation, they need to have a significant amount of it tied to the deposits they collect from the public. Considering that besides cash and cash equivalents in assets and interest-bearing debt in the liabilities, all other items match themselves, the total shortfall between Total Current assets (~10.33 Trillion JPY) and Total Current liabilities (~13.5 Trillion JPY) of ~3 trillion JPY is related to SoftBank’s short-term interest-bearing debt.

Clearly, SoftBank not only does not have cash (by far) to back its promises of hundreds of billions of USD of investments but is also fast approaching a liquidity crisis THIS YEAR unless it manages to keep rolling its short-term debt forward. The only MSM that had the guts to question all this charade was Forbes (although it was shortly lived): SoftBank’s $100 Billion Promise To Trump Is More Than Its Entire Market Cap

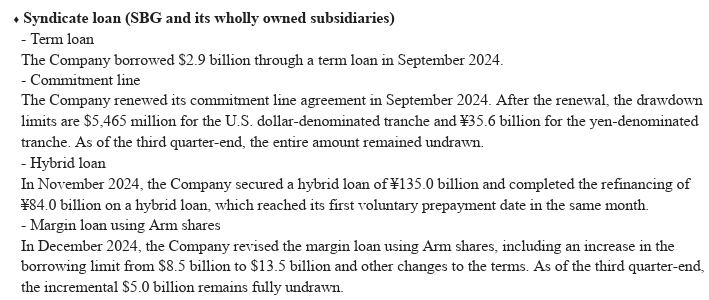

How is SoftBank fighting its liquidity crisis? At this point, it should not come as a surprise that SoftBank borrowed more money against its ARM shares; however, banks aren’t as naive as SoftBank wishes them to be since it is so obvious how ARM shares’ value is being artificially inflated, hence it’s fair to assume they are lending at a very high LTV. ARM being included in the S&P500 is definitely SoftBank’s goal on this front since without it, there are not enough bag holders to liquidate the shares when SoftBank holds 90% of them, and the banks know it: IS SOFTBANK TRYING TO SQUEEZE ARM INTO MAJOR INDEXES TO FORCE PASSIVE INVESTING BIDS AND LIQUIDATE THE STOCK WITHOUT CRASHING IT?. As a result, SoftBank only managed to increase its “hybrid loan” against ARM shares in December by 5bn USD, an amount that will be available to repay maturing short-term debt (definitely not to cover hundreds of billions of investments it pledged).

Does SoftBank only have a liquidity problem, or is it overall insolvent? I showed in my previous articles how SoftBank is already insolvent, and the latest results showcasing a steep loss of value of its investments made the situation worse, not better. Mr. Market is not naive either, since as of now, this is what he thinks about SoftBank:

- SoftBank Market cap ~91 Billion USD

- ARM Market cap ~163 Billion USD

- SoftBank owns ~90% of ARM equivalent to ~147 Billion USD

- This means that NET of ARM shares (whose value is massively hyper-inflated, which is why banks only gave SoftBank a 13.5bn USD credit line against them as collateral) Mr. Market values all the remaining SoftBank business at NEGATIVE 56 Billion USD

JustDario on X | JustDario on Instagram | JustDario on YouTube