“Apple Card” was officially launched on the 20th of August 2019 with great fanfare, as usual (announcement). Who was #Apple’s partner? The one and only Goldman Sachs.

With such a match made in heaven, what could go wrong? Apparently, a lot, considering Apple completely removed any mention of Credit Cards and Apple Deposits in its latest 10-Q reports. Below is all you can find on page 2 of its latest 10-K report.

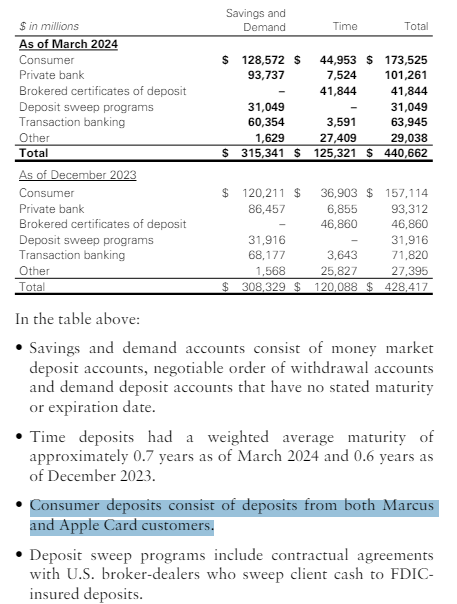

What about Goldman Sachs’ disclosures? Not much luck there either, considering this is all you can find in the whole report.

Hold on a second, weren’t the Apple Card and Apple Deposits such a success? “Apple Card’s Savings account by Goldman Sachs reaches over $10 billion in deposits”. Apparently not, considering the two companies have been now actively trying to find a way to break their partnership for a while:

- “Goldman Sachs faces rocky exit from Apple credit card partnership”

- “Apple seeks to end its credit card and savings account partnership with Goldman Sachs”.

Things become even weirder if you consider that Apple itself proudly announced in January of this year: “Apple Card is helping more than 12 million cardholders live healthier financial lives”

Hold on a second, let’s zoom into the last PR: “Users earned more than $1 billion in Daily Cash from spending on Apple Card last year”

According to my knowledge, $1bn in subsidy costs for a product is a pretty large figure, isn’t it? Why aren’t both companies making any financial disclosure about that? You tell me…

Furthermore, assuming the information shared by Apple is genuine, considering there are 12 million Apple card holders out there and the average credit card debt in the US is $6,360, this means there are presumably $76,320,000,000 of Credit Card Consumer Assets that aren’t being disclosed neither by Apple nor by Goldman Sachs. SEVENTY-SIX BILLION DOLLARS.

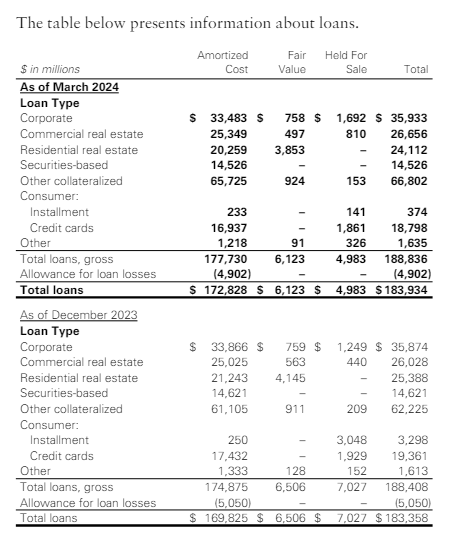

How many Credit Card loans does Goldman Sachs disclose in its financial statements? As of the latest 10-Q, 18 billion dollars.

If I am not mistaken, $76.3bn minus $18.8bn is equivalent to $57.5bn of Credit Card loan assets missing here (assuming that $ 18.8 bn in Goldman’s belly are all related to Apple card which, as we know, is nearly impossible). Let’s see if we can find them anywhere.

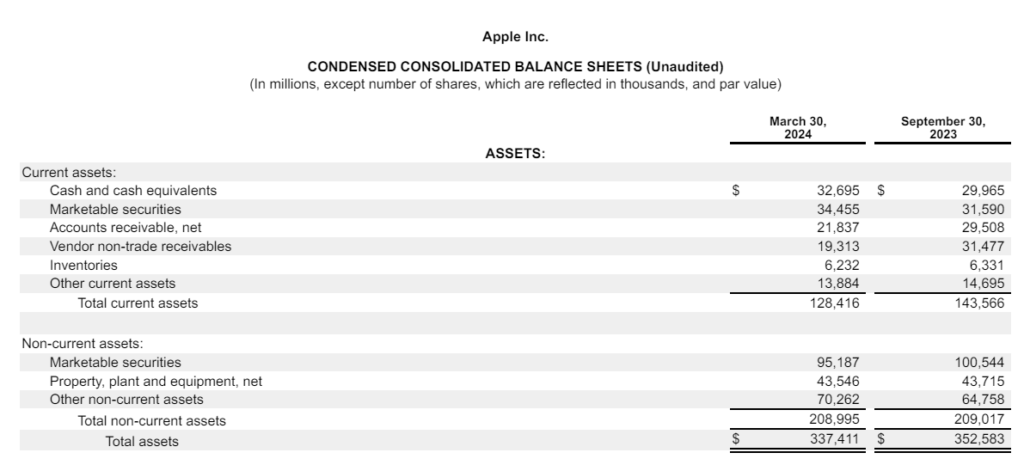

This is the latest Apple Balance Sheet. As you can see, there is nothing in “Current Assets” that can be linked to what we are looking for.

Even if from an accounting perspective that classification would be wrong, by definition, the only figure that can hold that amount is “other non-current assets” listed for $70.2bn as of March 2024. Why would this be a wrong classification? Because credit card loans have a duration of less than 1 year unless… they mature in more than 1 year (or, they are in default).

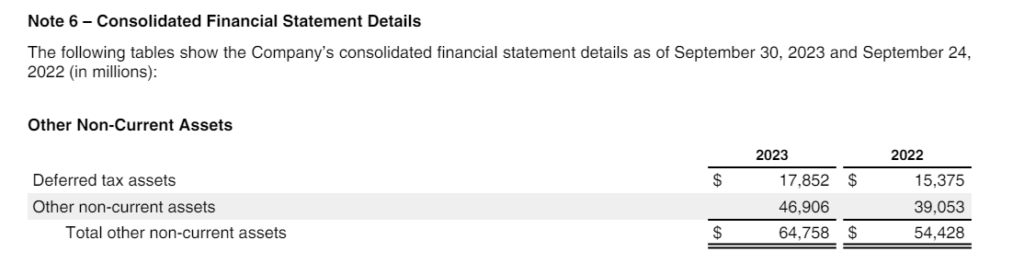

In the latest two 10-Q reports, Apple provides absolutely zero disclosure on what “Other Non-current assets” are, but we find a clue in the 10-K.

Clue 1

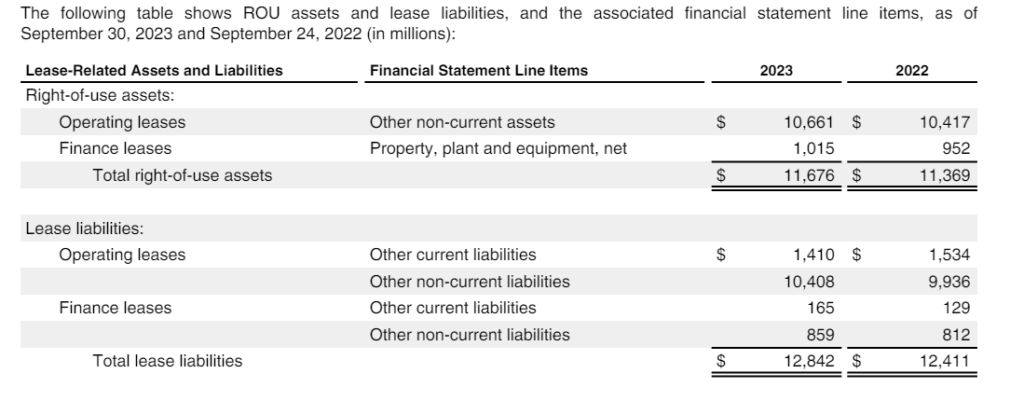

Clue 2

So doing a quick math here, out of $64.758bn as of December 2023, if we deduct $17.852bn of “Deferred Tax Assets” and $10.60bn of “Operating Leases”, we are left with $36bn that Apple does not absolutely say anything about or 55% of their “other non-current assets”. If we apply the same percentage to the latest 10-Q, the result is $39.2bn of unexplained “other non-current” assets. Drawing a line, this means that there are $18.3bn of Apple Credit card assets nowhere to be found, even stretching imagination and assumptions to the highest degree.

As if what I just showed you wasn’t mind-blowing already, assuming the latest ~8% delinquency rate reported on Credit Cards, that implies $6bn of potential losses that are nowhere to be found in the disclosures.

I will conclude this article with a few open questions:

- Why is there no disclosure whatsoever on Apple Credit Card Loans balances considering they are potentially a very large amount?

- Assuming the company is burying the Credit Card balances in “other non-current” assets, why are they doing that?

- Why are both Apple and Goldman Sachs very tight-lipped on the extent of the losses this business is obviously generating?

Beware, I am still assuming all those Apple Credit Card balances and customers are real and not used by the company to artificially inflate their sales…although this might explain a lot of things about Apple’s constant sales growth despite major headwinds like in China (“iPhone sales drop 19% in China as Huawei demand soars”) and general deterioration of consumers purchasing power due to inflation in the past years (consumers that apparently weren’t bothered much by Apple products absurd price tag)