Since my first article on the topic several days ago (WHO ARE TODAY’S “NINJA” SUBPRIME LENDERS? SHOCKINGLY… PENSION FUNDS), where I focused on the fact that pension funds are shockingly the predominant buyers of “Buy Now Pay Later” CLOs, I have continued my investigation into this incredibly obscure part of the global financial system. This has led to the point that Bloomberg published this article one month ago: “Americans Are Racking Up ‘Phantom Debt’ That Wall Street Can’t Track”. Today, I have more to share with you.

Let’s start with the size of the market. According to an investment banker directly involved with #BNPL CLOs, his bank estimates the current BNPL market to be ~250bn$ in size. This is fairly aligned with the calculations I shared in my previous article, and it has been growing at more than a 50% CAGR. This figure is also aligned with the “Buy Now Pay Later Market Report 2024” here, where it is being estimated that the global BNPL will grow above 1 trillion dollars in global size by 2028. However, according to him, the figure is much larger than that considering the volume of securitization business they deal with. From his side, the volume is now almost half of the Credit Card Loans securitization one, so applying the same proportions he believes the real figure is at least 40-50% higher or almost ~400bn$.

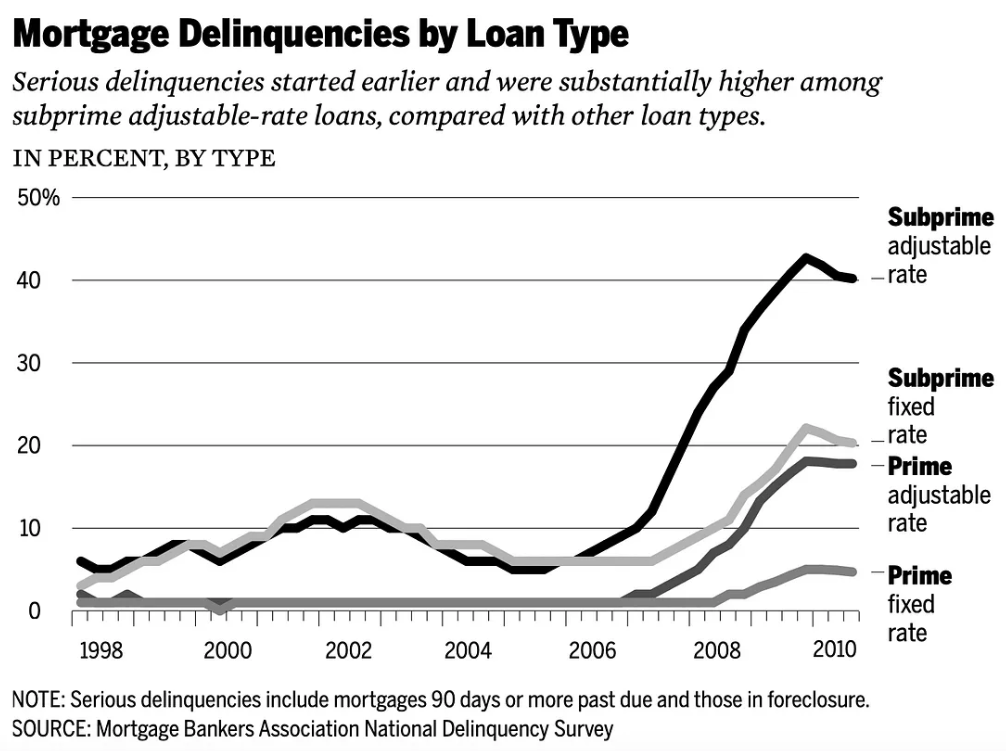

Just to give you an idea, in 2008 the Subprime Adjustable Rate Mortgages market in the US was about 500bn$, but only about ~30% of those were “NINJA” loans (Meaning No Income, No Jobs, No Assets). So as a matter of fact, the BNPL market today is potentially DOUBLE in size than the infamous ultra-toxic mortgages of the GFC.

This is what happened to the Subprime ARM loans delinquency rates in 2008.

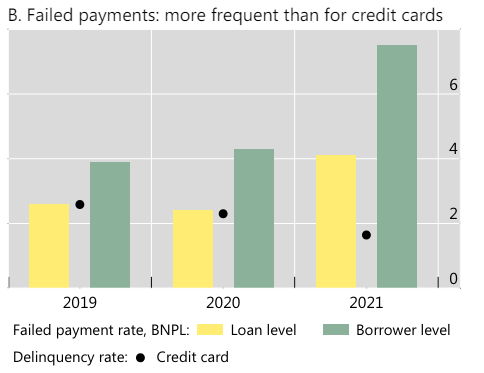

This is what’s happening today as reported by the BIS here

Comparing the two charts above, we are potentially in “2006” when delinquency rates started rising at a faster pace, although no one at that time started to be concerned. Then what happened in 2007 after the rate crossed ~10%? It started to go up vertically.

Hold on a second, how come companies like Affirm can declare the delinquency rate of BNPL loans in their books is below 3%? The answer is because they cherry-pick the BNPL loans that are being securitized (hence dumped to external investors through SPVs), keeping the ones in the best shape for them according to my contact. So, what is the real delinquency rate of BNPL loans ending up in the belly of pension funds, foundations, and insurances? If the BIS estimates a ~7% average, applying basic math then the result is ~11%. Yes, above the threshold after which the Subprime ARM mortgages delinquency rate started to go up vertically in 2008.

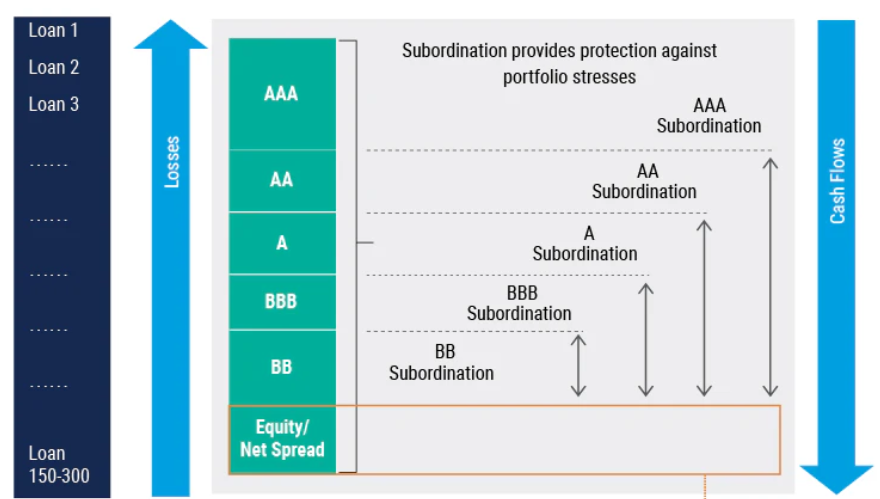

Now, have a look at this presentation from Pinebridge Investments here. What is the debt/equity proportion in a CLO SPV? 90%/10%. Yes, this means that the buyers of the “debt tranches” of BNPL CLOs are likely starting to be hit by losses.

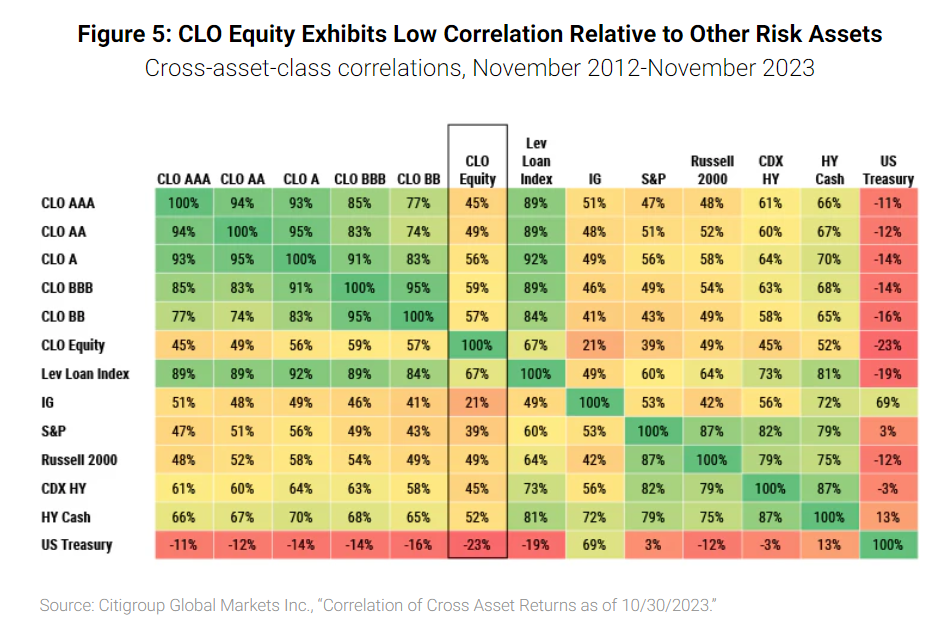

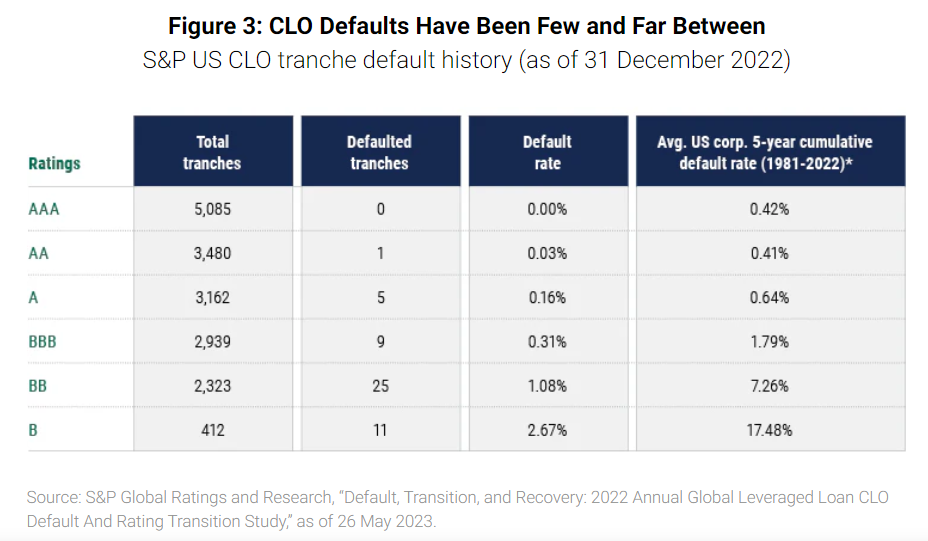

At this point, you may ask yourself, how is it possible that supposedly “low risk” investors bought so much of this debt in the first place? The answer is in the same presentation I mentioned, and as you can see in the tables below, CLOs have been “historically” a low-risk investment with a low correlation to other asset classes.

Yes, I know what you are thinking: “Oh my God, that’s 2008 all over again”. To be fair, what is happening today is “2008 on steroids” since at that time stocks were not in a massive bubble as well while today they are in the US, Europe, and Japan.

Enjoy the party while it lasts, because this time when the music stops, those who kept dancing till the end will be facing a financial catastrophe of unquantifiable proportions that no infinite Central Banks money printing will be able to rescue. This is because if they dare to do it this time, the whole fiat currency system objectively will not survive.