When was the last time you remember a bank losing $5bn in a quarter, after making $1-1.5bn on average in all recent ones, and jumping almost 5% in price as soon as its #stocks start trading? That’s what happened with $TFC yesterday and in case you haven’t figured it out yet, that was a pre-engineered short squeeze.

Sadly for whoever had “bad intentions” here and despite $TFC management putting tons of lipstick on their results, Mr. Market pushed back sending $TFC stock into the red almost 2% at some point during the last session. $TFC closed the day at 35.98, up 0.56% thanks to successful shorts cashing out their daily gains.

The situation must be very bad in $TFC if they couldn’t manage to hide their mess even in non-regulatory financial documents for Q4-23. As you can read in the post below, last quarter we had to wait for their 10-Q filing with the SEC (where it is much harder to use accounting tricks) to have a better sense of the extent of their problems.

Let’s start with addressing the “Goodwill” elephant in the room.

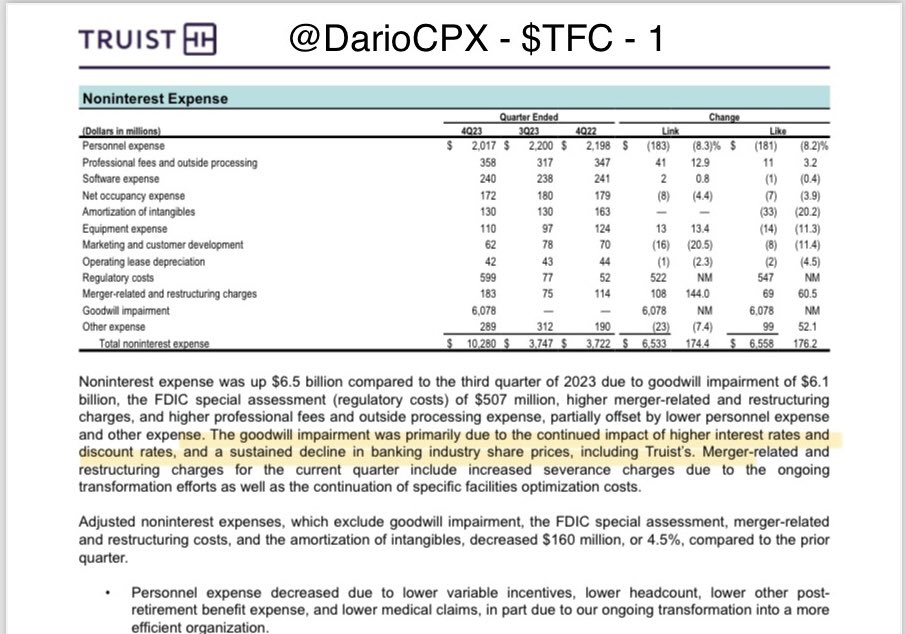

This is what $TFC management tells us (Picture 1): “The goodwill impairment was primarily due to the continued impact of higher interest rates and discount rates, and a sustained decline in banking industry share prices, including Truist’s”

And this is the rule $TFC management followed to write down a good chunk of goodwill as per their forward-looking statements disclosures: “ accounting policies and processes require management to make estimates about matters that are uncertain, including the potential write down to goodwill if there is an elongated period of decline in market value for Truist’s stock and adverse economic conditions are sustained over a period of time or if there is a decline in a reporting unit’s forecasted net income”.

Well… considering $TFC’s own words, why then did the protracted “adverse economic conditions and higher rates” only impact the future profitability hence the “value of their operations” and not the present value of their assets?!

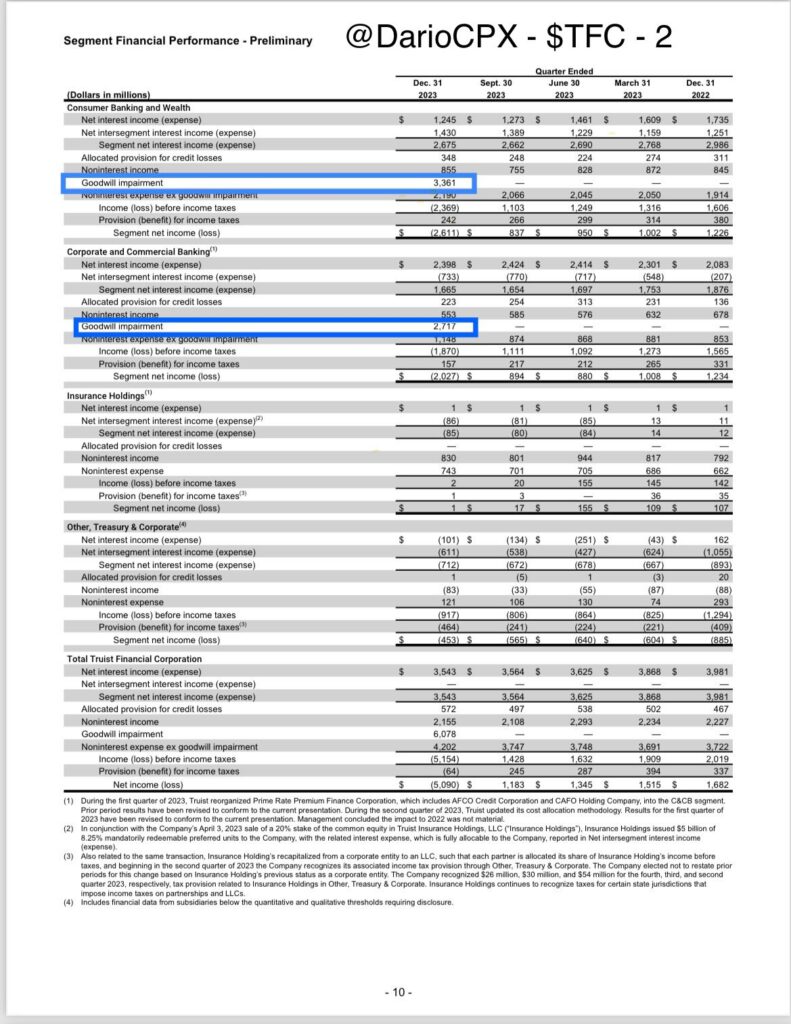

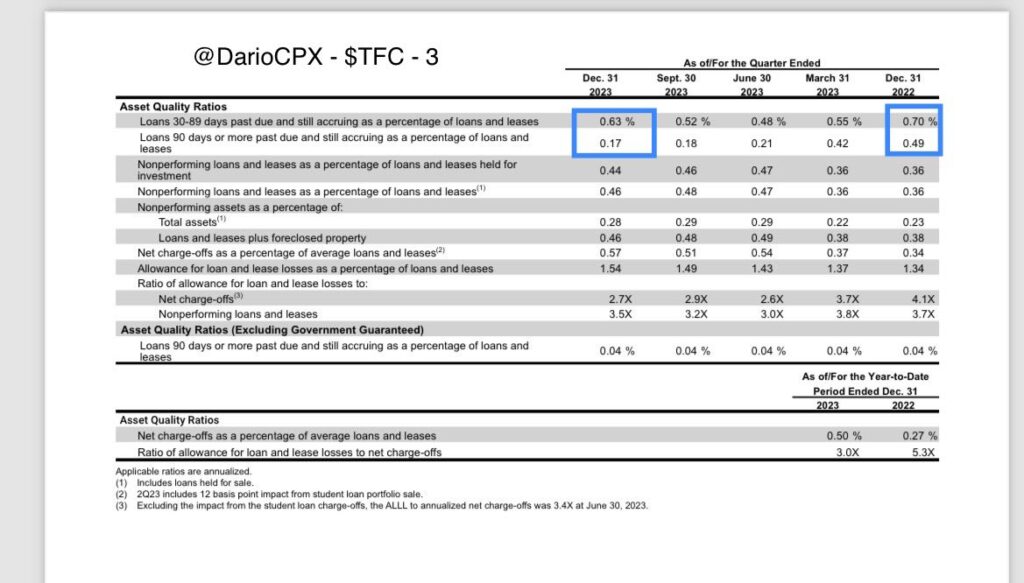

Or to put it another way, on one side $TFC is telling us they expect to make less money in the future for a long enough period of time that their Consumer Operations are worth $3.3bn less and their Corporate Operations $2.7bn less (Picture 2) because rates and credit losses will be higher. On the other side, because of rates going down in Q4-23, $TFC reports an increase in fair value of their “Securities Available For Sale at Fair Value” from $65.1bn to $67.4bn and an improvement in their Loans Non-Performing Loan ratios (meaning improvement in credit conditions) compared to 2022! (Picture 3)

Basically $TFC management is calling bs on market consensus that the #FED will cut rates, long terms rates will sustainably come down and a “soft landing” will be accomplished while holding #bullish Mark To Markets exactly because of the very same market view.

Hopefully, now you agree with me in calling $TFC Q4-24 numbers “schizophrenic”.

I would like to conclude with a simplistic, but meaningful calculation. Before impairment, the total $TFC goodwill was ~$27bn, which means a 22% decrease in value in Q4-23. As we discussed in October, if we applied the same FHLB discount to $TFC’s loan value, the result was a ~$180bn loss. Let’s be less brutal this time and instead of the FHLB discount, we apply $TFC’s own management one. Currently, $TFC’s Net Loans (meaning already deducting allowance for credit losses) are equivalent to $308.5bn, what is 22% of that? $67.87bn.

What is the total equity of $TFC as of Q4-23? $59.2bn.

No need for further comments, I guess. The numbers speak for themselves.