A few weeks ago Goldman Sachs (#GS) performed poorly in the #FED annual stress tests, and since then, the bank has been fighting against its regulator’s request to increase the capital being held on the balance sheet (Goldman Sachs faces uphill battle in dispute with Federal Reserve over stress test).

Today the bank released its Q2-24 earnings and (how surprising!) beat analyst expectations across the board:

- Net Revenue: $12.73B (est $12.39B)

- FICC Sales & Trading Revenue: $3.18B (est $3.02B)

- Assets Under Management: $2.93T (est $2.91T)

- Equities Sales & Trading Revenue: $3.17B (est $3.08B)

- Net Interest Income: $2.24B (est $1.47B)

Alright, how can it be possible that GS looked quite bad in the eyes of its regulators while it looked so great in the eyes of investors that sent the stock to fresh all-time record highs after its latest earnings release? The answer to this question will blow your mind…

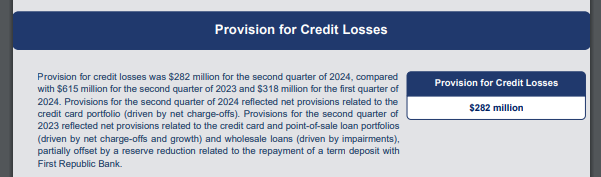

🚩 While corporate bankruptcy filings hit multi-year highs, #CRE prices are crashing through the floor, and other major banks began to warn about “stress” among consumers (Big US banks warn of stress among lower-income consumers), Goldman Sachs reported net provisions for credit losses 54% LOWER than one year ago to $282m.

Yes, while the FED considered GS’s balance sheet health concerning enough to request the bank to hold more capital, the bank claims the very same balance sheet is rock solid. So rock solid that the bank announced a 9% increase in its quarterly dividend to $3.

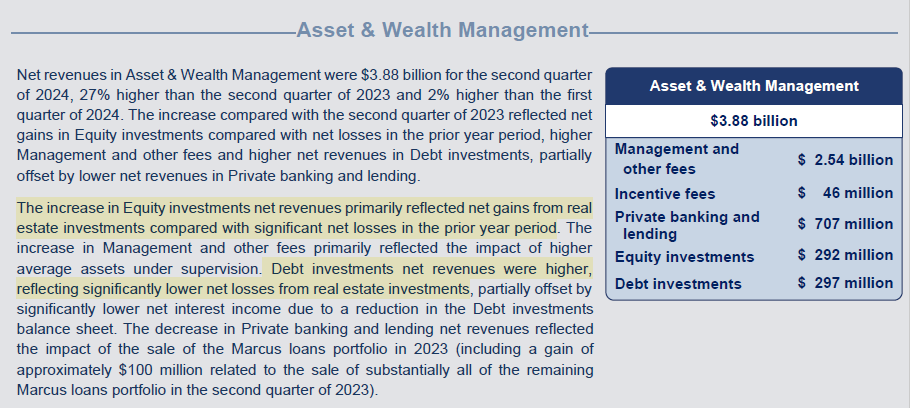

🚩 I bet you noticed no mention whatsoever of real estate-related credit risk in the GS provision for credit losses assessment. Are you curious to know why? Because, contrary to the rest of the world, while we have to wait for the 10-Q for more details, as you can read below, GS already gives us a clue of their assessment of the real estate business in the asset and wealth management division (where it also book the revenues from its proprietary investments). Incredibly, they claim they are actually doing great in the real estate business with gains on the equity front and significantly lower losses on the debt type of exposure.

Yes, I know what you are thinking. Besides the fact it is pretty odd the bank completely swims against the current like “Salomons” (not a typo) do compared to what’s happening in the real world, how is it possible they are making money on the riskier equity tranches while still booking losses on the lower-risk (in theory) real estate linked debt tranches? These sort of things only happen in fairy tales…

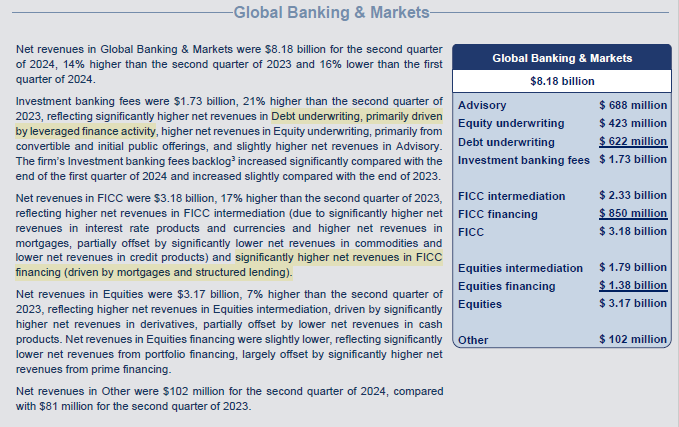

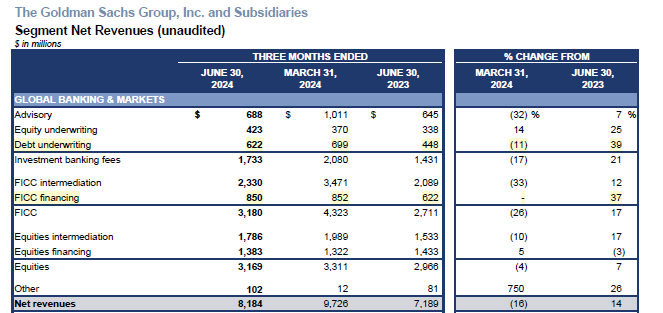

🚩 As if what I described wasn’t mind-blowing enough already, an obvious underreporting of provisions for credit losses wasn’t the only trick the bank pulled to boost its net revenues. In the last quarter, while corporate bankruptcy filings were hitting multi-year record highs and concerns for an economic system piling up on unsustainable leverage:

- GS doubled down on its Investment Banking Debt Underwriting business where Leveraged Finance deals (the riskiest of the pack) were the main driver of a 39% increase in revenues to $622m from the year before.

- GS doubled down as well on Mortgages and Structured Lending businesses within its FICC division recording 37% higher revenues than the same period of the year before to $850m.

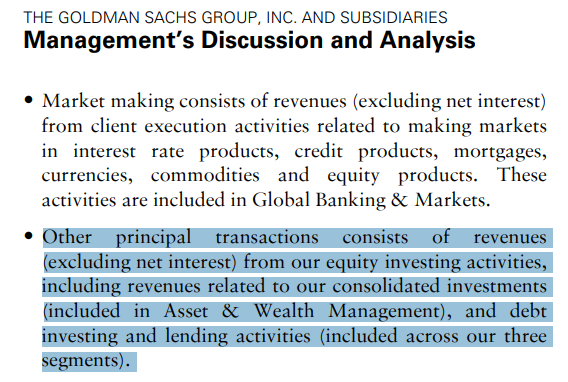

Even more interesting is how well Goldman Sachs is doing in everything they report as “Other Principal Transactions.” What are these about? No need to try to find an explanation in today’s earnings release, but this is how the bank defines revenues booked under this category in its previous 10-Q:

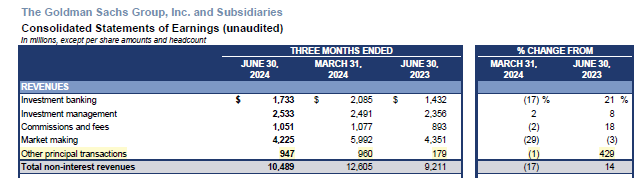

I wonder what kind of “fair value” assessment GS performed to record an increase in revenues from “Other Principal Transactions” of 429% (not a typo) from one year ago to $947m.

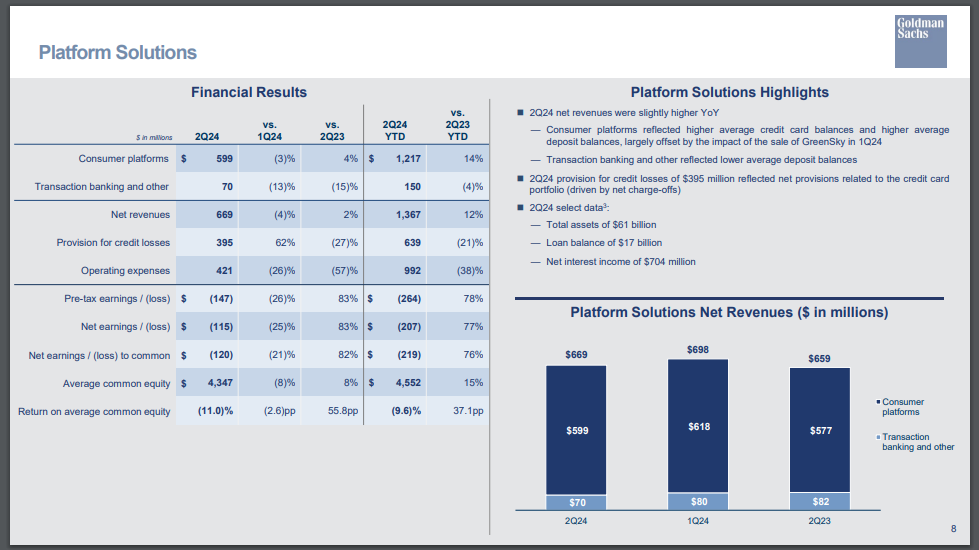

🚩 What about GS consumer lending business on which #FED itself raised concerns and within which the partnership with Apple in the credit card segment is doing so bad that GS itself has been trying hard to break for a while (APPLE CREDIT CARD – THE (RADIOACTIVE) WORM INSIDE THE APPLE?)? As you can read in GS’s own presentation, the $395m provisions for credit losses made for the business are 21% LOWER than one year ago when the health of this business line was objectively BETTER. Amazing isn’t it?

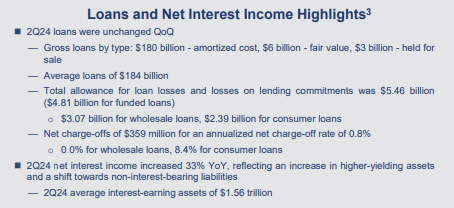

🚩 What about the GS wholesale lending business? The bank reported ZERO net charge-offs related to it at the same time corporate bankruptcy filings are at multi-year highs. Incredible isn’t it?

After everything we observed in this article, I hope we agree on the fact that GS Q2-24’s “fairy tale” of a bank thriving in the current riskiest businesses is completely ridiculous.