Three months ago, before Q1-24 banks’ earnings season kicked off, I collected all feedback gathered from bank insiders in “GET READY, INSIDERS TOLD ME A HORRIBLE BANKS’ EARNINGS SEASON IS ABOUT TO BEGIN”. However, banks put on a great show of accounting acrobatics and magic tricks to make sure they could buy more time to fix their mounting problems.

Clearly, the very same is happening this quarter with banks playing a great game of smoke and mirrors to disguise their problems from the public eye:

- GOLDMAN SACHS Q2-24: WHAT A (RIDICULOUS) FAIRY TALE

- IS WARREN BUFFETT STARTING TO BE WORRIED ABOUT BANK OF AMERICA’S SOLVENCY?

Meanwhile, banks’ management carry on with their farce. I thought to run a status check among bank insiders three months later after my first article on the topic.

Investment Banking – M&A and Advisory

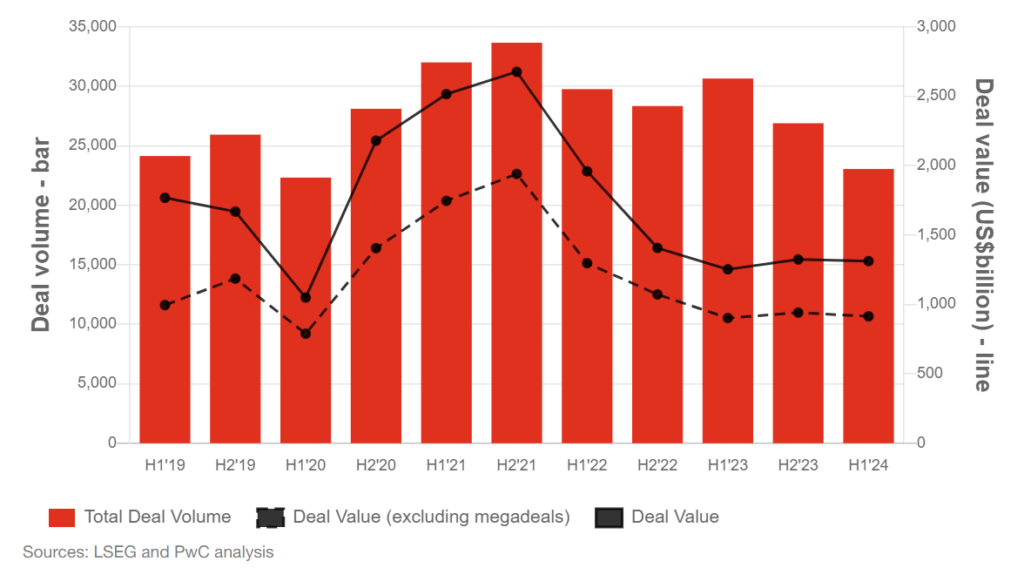

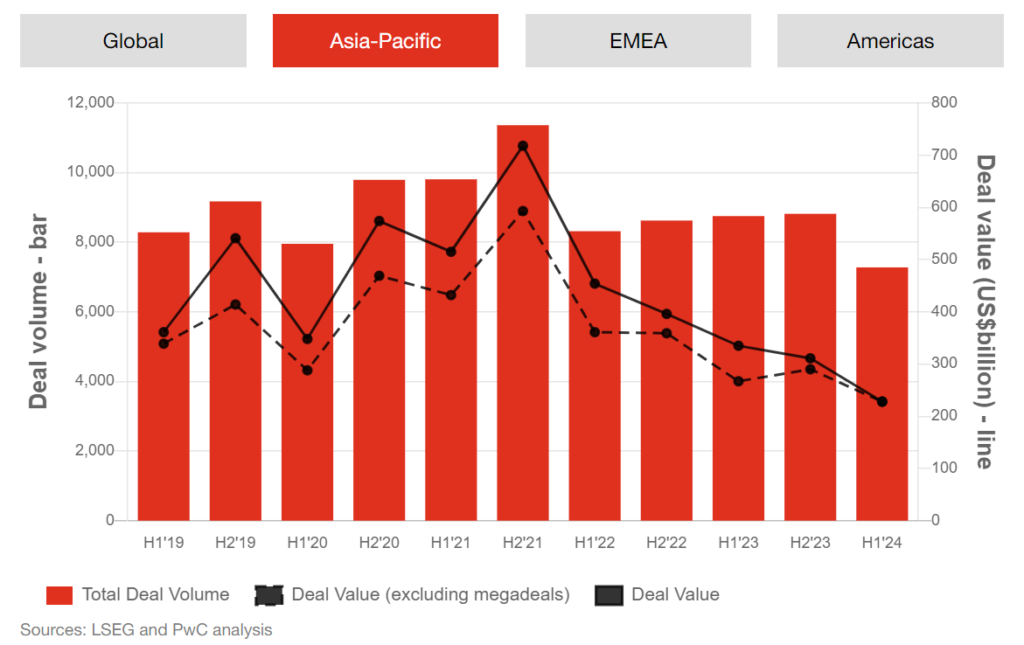

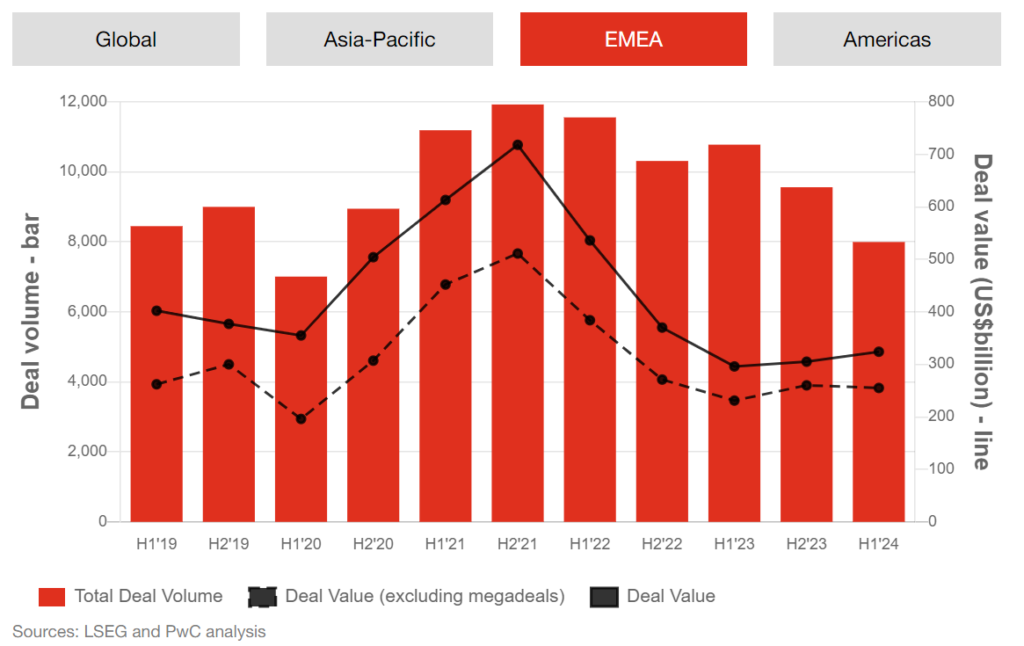

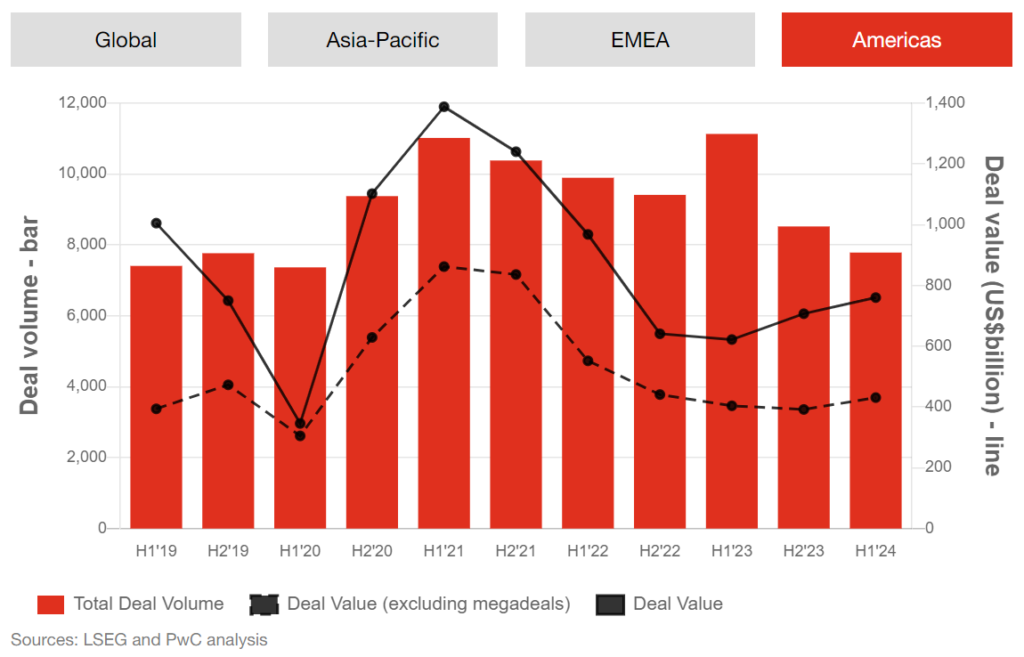

Talking to M&A bankers these days, particularly the very senior ones, feels like talking to a WWII veteran. Everyone recalls the glorious past, the humongous amount of hours spent at the office working on mergers that would have made headlines and would have been celebrated with great parties (at the expense of the bank) after closing. If you ask them to talk about today, the answer is always the same across continents: “We have very little to do and competition is fierce for everything that comes up.” This means volumes are shrinking while fees are decreasing too due to increased competition to win a slice of a smaller pie. In “The M&A show must go on. Save the Date” report by PwC, the snapshot taken of the industry is aligned with the feedback I keep collecting.

Investment Banking – Capital Markets

Here we shall make a distinction between ECM bankers (those who mainly work on IPOs) and DCM bankers (those who work on helping companies to raise debt).

In the ECM world, to be fair, the morale isn’t that low in the States. Deal flow isn’t that high yet, but everyone claims they are sitting on a pretty big pipeline of IPOs that is just waiting for a good window of opportunity to be executed in the market. At this point in the conversation, my question always was, “Aren’t stocks at all-time highs? That should be quite a boon for IPOs, no?” Are you curious about the answer I consistently got? “IPO Institutional Investors don’t want to buy at the top.” What about other regions? Oh dear, if you have some depression issues, please do not talk to an ECM banker working in London or Hong Kong.

In the DCM world, the consensus across the globe is that most of the jobs are becoming “clerical.” What does this mean? If you exclude Asia for obvious reasons, Europe and the US carry such an amount of debt to be rolled year after year (because most of it cannot be repaid, but that’s a story for another day) that all bankers have to do is sit there and rubber stamp bond issuances and loan rollovers, clipping minimum fees. Why is this business not that profitable despite volumes remaining sustained? Because borrowers figured out all banks are doing is “copy-pasting” transactions without anything extra being done (no underwriting, not much balance sheet left to provide liquidity, …). Do you think banks are willing to pay bonuses when they can replace a rubber-stamping banker with another one doing exactly the same thing? Of course not.

One exception in this field is Leveraged Finance, where the business seems booming. Why? Mostly due to the need for Private Equities to refinance the debt they loaded their portfolio companies with during ZIRP years and that now cannot be repaid because profits aren’t coming through as expected and they cannot even dump those companies in the market because, as we just saw, IPOs are still shut. Who is buying all this (radioactive) leveraged debt? Like it or not, the biggest demand is from pension funds in desperate need of “high yields” to make sure they receive coupons to sustain pension disbursements with great ignorance of the risk being undertaken here.

Global Markets

I swear I do not know anyone working on a trading floor right now who is not sending CVs around.

If you talk to equity people, from cash to Delta1 to Exotics, everyone complains about all the business shifting to the electronic platform that charges a fraction of the fees per transaction. Traders’ inventories are kept to the very minimum, and if a large derivative trade request comes through, they are hardly allowed to deal with the full notional, letting competitors share the risk. In this environment, clients are squeezing trading spreads to the bare minimum; often trades are even executed below the minimum since smaller brokers are quite desperate to “capture volume” to remain relevant. So far, the Equity part of the global markets business has been the one that suffered the biggest headcount cuts and “juniorization” push. Frankly, this is understandable considering the job is mostly becoming watching a screen all day long and troubleshooting system glitches when they (very often) appear.

Rates traders and sales (Rates derivatives and Government Bonds) are those that, to be fair, complain the least. Even if the good old days of ZIRP are gone, yes they were making much more money at that time because the big need of “structured” deals to increase IRR, flow trading, and derivatives hedging restructuring business is still allowing them to float.

The story is completely different for Credit Traders, with credit spreads still at rock bottom across the globe and across the credit rating spectrum. The only exception is China Real Estate and “High Yield” bonds, but after the scorching losses of 2022, banks aren’t allowing their traders to play that much with them anymore.

Global Markets – Distressed Assets

This is an area of business that is starting to pick up steam and people working in this sector are “happily busy.” However, I am not sure this is a good thing. What do they do all day long? Repacking distressed debt (i.e. toxic assets) into SPVs and selling them to captive investors, especially pension funds and credit-focused private equities.

Wealth Management

Yes, thanks to endless money printing AUM values keep inflating, but do you expect HNWI to pay the same amount of fees on a higher amount that increases not because of the skills of their private banker but simply as a factor of assets value inflation? Of course not. Furthermore, Private Banking is now very careful in providing Margin Loans, Lombard Loans, and loans on pre-IPO stocks (how to blame them) that instead have been all the rage till 2021. In this area of the business, many high-profile private bankers are going solo, setting up advisory firms and multi-family offices, and taking their clients out with them. This is pretty understandable considering the commissions they earn in a major bank are lower and lower.

Bank Treasury Management

What do you think a bank treasurer is doing all day long these days? The lion’s share of their activity is borrowing money from central banks and either lending it back to them for a tiny profit or investing it in government bills still for a tiny “risk-free” profit. Those lucky to work for a large commercial bank have the luxury of doing the same with vast amounts of deposits. Boring, isn’t it? Yes, and do you think there is any incentive from management to reward fat bonuses to treasurers these days? Of course not.

Human Resources

I kept Human Resources last since it is the busiest part of a bank workforce these days. All the focus is on cutting costs, sometimes to the extreme.

- Internship classes are being significantly downsized if not shut completely in some regions

- Graduate Analysts from the 2023 internship intake will likely find themselves without a permanent job after their “rotations”

- Associates are the ones most active in looking for jobs and leaving, but here HR is still trying to retain them considering they can often do a VP or Director job for much less compensation.

- VPs and Directors not in a manager role are celebrating every month-end salary coupon they see landing in their bank accounts. There is virtually zero employment market for them outside banking and the vast majority are simply waiting for their redundancy package delivered by HR in an orange envelope to have some months of cash buffer they can use to support their expensive lifestyles while trying to reinvent themselves often in the corporate world.

- Directors in a manager seat and “junior” MDs spend half of their time managing team expenses trying to keep them as low as possible and updating the redundancies list they submit every month to HR. The other half of their time is spent gathering political support behind them so they can survive the next round of layoffs.

- Senior MDs are busy trying to keep the morale high, with limited success, to make sure not too many people leave beyond the planned headcount reductions, otherwise, revenues will start to suffer, their business line will lose market share and ultimately they end up in the firing line themselves too.