This week #FED and #BOJ have a lot to lose and very little to gain, a situation they put themselves into and that nobody tried to stop them from falling into. The money printer made so many people happy since the aftermath of the GFC, no motivation for anyone getting rich today at the expense of future generations to stop that endless gravy train of liquidity after all.

The side effects of many years of reckless monetary policy are becoming harder and harder to control, and we are coming very close to a point where Central Banks won’t be able to fight on every front. Clearly, the health of the economy and price stability are battles. The Fed and BOJ decided to withdraw long ago to focus almost solely on keeping asset prices elevated, particularly stocks. This is, frankly, pretty understandable since the moment the whole bubble in asset prices pops the excuse the Nobel laureate Ben Bernanke used to “sell” the QE dream many years ago (goosing asset prices so the economy could benefit from the “trickle-down” effect) will reveal its true nature: A BLATANT LIE.

So what is reasonable to expect from FED and BOJ, now the “Stan and Ollie” of the financial system, this week knowing there is no chance they will let the current bubble, in particular the one in stocks, pop without trying all they can?

Jerome Burns will take the stage on Wednesday reiterating rates will remain higher for longer, but I have a gut feeling that like he did in October 2023, he will try to pull off a “phantom pivot”. Yes, the one that got everyone and their dogs mouth-watering about the prospect of 6 FED rate cuts in 2024 and the consequent injection of fresh liquidity into a financial system completely dependent on it like a human body is dependent on oxygen.

Traders are already sure the FED will deliver at least 2 rate cuts before the end of the year, something that has ZERO chance of happening unless something very important breaks in the financial system and forces the FED to deliver emergency cuts (post). All Jerome Burns needs to do is use the right words to make traders believe they are right (like he did last year) and trigger a stampede into bonds that will push medium and longer-term rates lower. Wait, won’t this re-accentuate the US Treasuries yield curve inversion? Bingo!

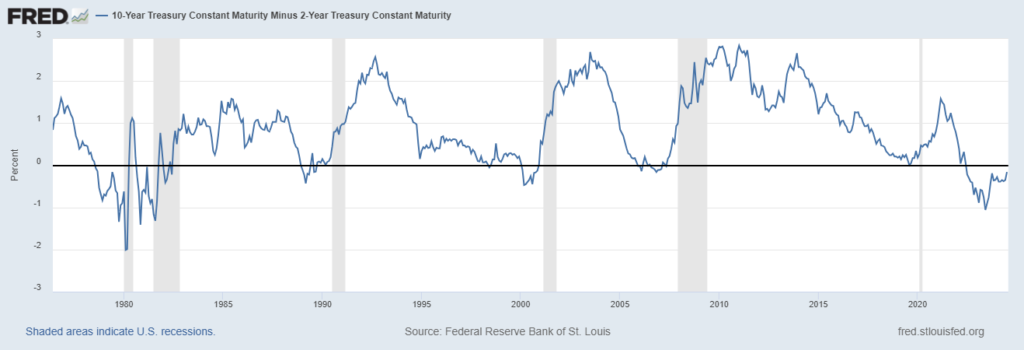

That’s the real deal, not Fed Fund rates, and Jerome Burns knows very well the moment the US Treasuries yield curve flips back to be upward sloping (as it should be in a world not heavily manipulated by central banks) it’s game over for stocks (“An inverted yield curve: why investors are watching closely“) since as you can see from the chart below the bubble always pops shortly after. Sorry, but this time, it won’t be different.

I know, you might argue the current monetary aberration cannot last forever. That’s correct, furthermore, there is clearly not even an exit plan, reason why when the FED withdraws even from this last front the reckoning for many traders is going to be brutal like dealing with a hangover after (years) of drinking alcohol non-stop.

A few hours before Jerome takes the stage, it will be BOJ’s turn to make sure nothing is going to spoil Jerome’s efforts. That’s why, on top of the many reasons I pointed out so far like here, or here, or here, as far as I am concerned I realistically see ZERO chances the BOJ hike rates. Look at what happened to Japanese stocks in the past weeks since the latest intervention kicked off, do you think that a bit of (temporary) relief on the currency front while stocks crash is going to make the Japanese government happy? Of course not. And if this wasn’t enough, there is an even bigger problem, a further artificial strengthening of the JPY, made more acute by hedge funds liquidations, will force all those institutions flooded by margin calls on their carry trades to unwind delivering a direct hit to foreign stocks especially US stocks.

Now, considering the FED is going to do all they can to keep the stocks bubble afloat, how do you think Japan’s main “sponsor” will react to BOJ actions going against its plans? Easy answer here right?

To summarize:

1 – The BOJ has clear boundaries of intervention in the FX market and if they try to distort its equilibrium artificially strengthening the JPY too much they end up undermining the financial system stability elsewhere.

2 – Further losses in the Nikkei, paradoxically hurting the BOJ itself too since they own ~70 trillion JPY worth of stocks ETFs (“What should the Bank of Japan do with its huge stock portfolio?”), will add pressure to a Japanese government already struggling with record-low levels of satisfaction.

3 – As if the previous 2 points weren’t enough, raising Japan rates will consequently increase the cost of funding and liquidity problems for Japanese banks potentially accelerating their reckoning with the mountain of losses hidden in their hold-to-maturity books (“NOT ONLY IS NORINCHUKIN ABOUT TO LIVE THROUGH THE 2008 NIGHTMARE AGAIN, BUT MANY JAPANESE BANKS ARE IN THE SAME SITUATION”).

Not much else to add at this point, the only thing to do is fasten your seatbelt because if things don’t go according to FED and BOJ plans the market’s rollercoaster ride that began two weeks ago might enter the section where the car is sent on a steep dive.