First of all, let’s do a quick recap of how we got here:

- On the 11th of July at 10 pm Tokyo time, the Bank of Japan (#BOJ) kicked off its latest round of direct interventions in the FX market to stop the JPY from falling below 162 against the USD.

- Instead of focusing on fixing the structural problems of the Japanese economy, the government decided to blame “speculators” for the JPY weakness with the explicit goal of squeezing them out of their positions.

- The BOJ went bananas in the FX market for a whole week till the 18th of July and succeeded in squeezing the “lightweight” hedge funds out of their positions. At this point, with the FX at ~155.5, the BOJ should have stopped, but the currency resumed selling off again towards ~157.5.

- Now the BOJ decided to go after the “heavyweight” speculators, and on the 22nd of July, its hammer started hitting markets again. However, here the BOJ overlooked one big risk: hedge funds are never only outright long or short something, but to earn “alpha” (so they say) if they are long on one asset they are always short on another asset. This not only allows them to trade on what they perceive is a distortion in the market, but it also allows them to build incredible leverage (when they short sell, that money is then used to settle the long positions). As if this wasn’t enough, in order to access even more leverage, these kinds of trades are nowadays more often than not done through derivatives that by themselves carry an implied leverage of 10x to 100x depending on the type used.

- On the 24th of July at 12 pm Tokyo time, the BOJ managed to push the #JPY FX rate below 155, triggering “heavyweight” hedge funds’ liquidations. How can we be certain about this? First of all, you see no more BOJ “hammer” on the chart but an increasingly fast “avalanche” (the more the FX goes down, the more stops are triggered, the higher the volume in the market, the higher the speed of the fall).

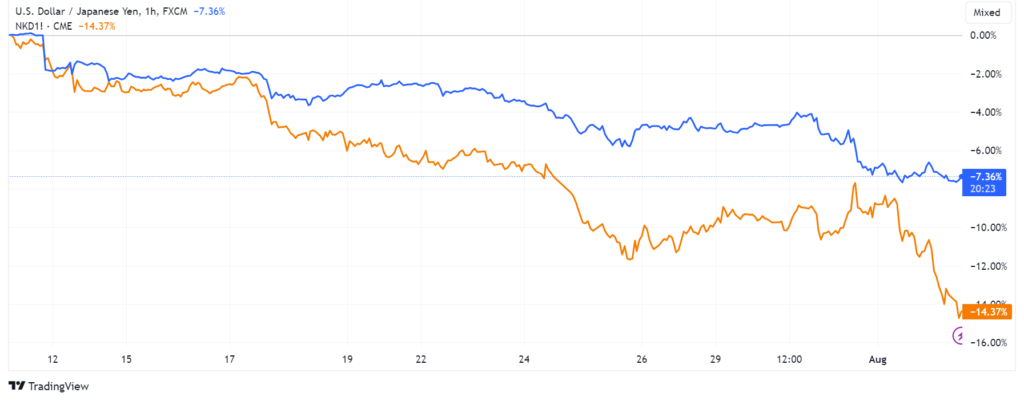

- Now, if the JPY short positions were coming off the table, what was the other side of the trade forced to drop too? Similar to how lightweight hedge funds were positioned, heavyweight ones too were clearly long NASDAQ stocks (especially mega caps), and they quickly started to sell their positions. The chart is as clear as spring water.

At this point, something very important happens. On the 30th of July, right after US stocks opened for cash trading, someone very big was clearly being margin called and liquidated as I warned in this post here and comments thereafter. Why did someone suddenly get margin called while everyone already planned to sit on their hands waiting for the #FED and BOJ to kick off the next bull run right into a month-end window dressing party already staged? (FED AND BOJ WILL DO EVERYTHING THEY CAN THIS WEEK TO SAVE THE STOCKS BUBBLE ONCE AGAIN)

Here is my feeling: liquidity problems. Yes, #stocks like to party at month-ends to dress nicely for asset managers’ performance reports (upon which they clip their fees), but banks and brokers’ treasuries departments are more often than not under liquidity tension mainly due to a spike of corporate payments. As I believe, a broker could not shoulder its client’s positions anymore, and seeing no more collateral coming its way (that the broker would have repoed in the market for month-end liquidity), they decided to pull the plug. Here again, the chart is as clear as spring water.

The following day, on the 31st of July, the #BOJ and the #FED delivered what markets wanted to hear from them, triggering a #FOMO rally across the board, particularly in #Nikkei and US stocks, on top of which window dressers threw as much gasoline as they could. But not everything went according to plan.

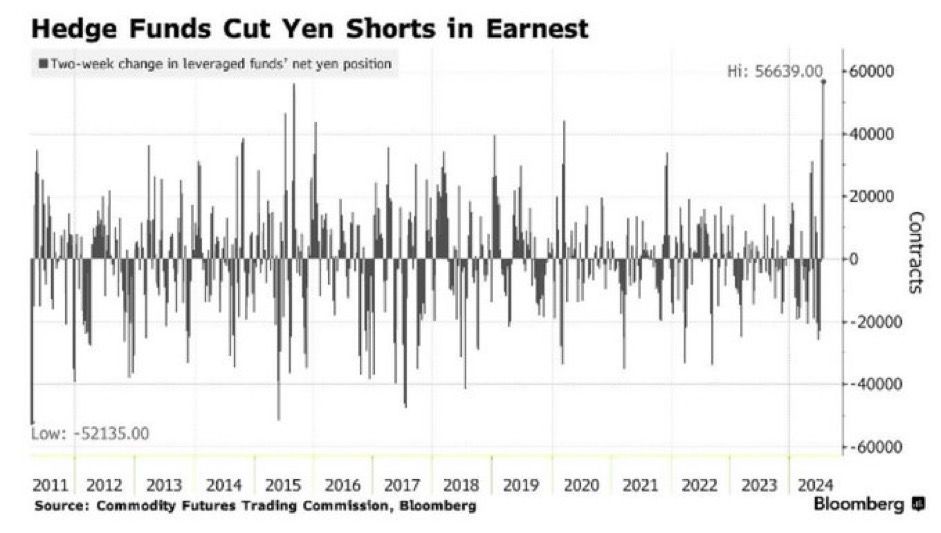

The BOJ, not pleased with its manipulation performance of the past 3 weeks, wanted to make a big statement and clearly enjoy celebratory headlines for having saved both Japan’s currency and its stock market, so they went for one last blow on the JPY to shake out whoever was still left holding onto their shorts. Very few, as you can see from this chart.

At this point, a loud “CRACK!” was heard in financial markets as soon as the JPY fell below 152.

Jerome was scheduled to speak later in the day. No one was really trading much in markets across the board, and liquidity was so poor. Everyone was waiting for the next shoe to drop, but it looked like the shoe was so big the brokers decided to wait one more day to kick off liquidations (also not to spoil the window dressing!).

Ok, recap done, now let’s see what’s going on.

Between 152 and 150 you could see the hedge funds left standing being taken out in the woods and beaten up. However, in particular, after breaking 149, something else happened and I am sure neither the BOJ nor the Japanese government meant to go after these kinds of “speculators.”

As you can read in the very well-written article “Japanese stock market miracle more financial than real” starting from August 2023, a very popular trade gained traction among non-Japanese investors: borrowing JPY and then investing these into Japanese stocks.

Pay attention here. If you are a foreign investor and the foreign currency you borrowed appreciates ~7.5% while the value of the assets you invested in loses ~14.5% faster, what happens to your position? You quickly go underwater due to the leverage factor.

The first move was clearly a shakeout of the foreign investors who “bought the last dip” before Nikkei’s last run to all-time highs.

As you know, the BOJ bought ~70 trillion JPY worth of Japanese stocks through ETFs, effectively making the market significantly illiquid. What happens when a significant amount of forced sellers come online into an illiquid market? Yes, Kaboom. So now the Nikkei losses are starting to hurt the profits of those who jumped early into one of the greatest speculations of 2023.

A lot of people like to talk about “the great unwinding of the JPY carry trade” and expect this will lead to a big JPY appreciation (in the short term), however, they fail to recognize there are 4 types of “carry trade”:

- Japanese investors borrow JPY to buy foreign assets. In this case, more often than not, as we saw in the cases of SoftBank or Norinchukin before, Japanese investors tend not to hedge much of the FX risk since they have been used to enjoying a stable FX rate for decades. Why spend money to hedge the risk, having lower returns, when there is no need? Yep…

- Foreign investors borrow JPY to invest in foreign assets. This cohort of people hedges the FX risk tightly instead (but not the rates risk, otherwise, there is no carry trade “pick up”), this means that when their trades do come offline, the impact on the JPY is almost minimal (hence, no impact on the FX rate).

- Hedge funds, especially HFTs, place short/long positions often unhedged for FX and rates risk (those costs will “kill” their alpha). When these trades come offline, you see the impact on the FX, but that will ultimately be short-lived since the cohort of hedge funds is very small in the grand scheme of foreign financial markets.

- Foreign investors borrow JPY to invest in JPY-denominated assets (like Nikkei stocks). Here, the “carry trade” is implied since these people’s funding and P&L calculation currency is different from JPY. When these trades come offline, the impact on the FX is zero, andthe money borrowed as leverage is simply returned to the Japanese lenders.

After reading all I wrote, it should now be straightforward to understand that the JPY carry trade unwinding impact on JPY FX will be very (very) limited and short-lived. As a matter of fact, all we are seeing developing right now is a great market distortion engineered by the BOJ.

For good record and to close the circle, let me put black on white here what I shared in this post.

In finance, there are 4 approaches regardless of the sub-sector:

- Short Term

- Medium Term

- Long Term

- Ultra Long Term

In the case of JPY:

- Short term: the BOJ is actively trading against hedge funds and running a short squeeze actively

- Medium Term: Today’s decision effectively didn’t move away from their “loose” policy of using JGB purchases to maintain financial conditions loose

- Long term: Japan is currently in RECESSION, exports aren’t recovering (and a stronger JPY won’t help) while imports are under pressure because of rising prices of everything they need to buy from abroad

- Ultra Long Term: Japan is depleting its reserves, Debt/GDP is already the HIGHEST in the world at 240% and will keep rising, inflation is eroding the purchasing power of the local population and many parts of the economy, like banking or RE, are effectively zombies on life support for 30+ years now.

Now, you need to understand that spikes in volatility like the ones we saw today and not caused by the underlying economy (that doesn’t heal in one day) create big ripple effects across the globe. If you consider JPY to be a currency commanding trillions of leverage in the system, the consequences across the time spectrum are very different.

So don’t fall into the mistake of misunderstanding a short-term picture with a medium or longer-term one. BOJ’s actions lately and decisions today didn’t change anything in the economy, if anything, they are making things worse in the future (“A PEEK INTO THE FUTURE: USD/JPY ROAD TO 300”).

On the other side, they are clearly causing damage in the global financial system equilibrium, and believe me once these losses surface you will understand what I am talking about.

To conclude, it is clear that the BOJ ultimately managed to break something in the financial system, now is yet to see the extent of the damage and rest assured the FED and Janet Yellen will not watch this unfolding sitting on the benches in particular when banks’ stability is clearly at risk and the risk of an “avalanche” of selling ignited by derivatives positions exploding 1987 style trigger. There will be a rescue attempt at some point, although the more they kick the can down the road, the harder it is to keep this ginormous bubble inflated, in particular when central banks are virtually insolvent themselves (HOW CAN THE #FED BAILOUT BANKS WHEN THIS TIME IT NEEDS A BAILOUT ITSELF TO BEGIN WITH?). Will our heroes succeed in kicking the can down the road long enough for US elections to pass? I am looking forward to enjoying the show.