I started to cover Norinchukin Bank many months ago already (“WHY IS THE FED PREPARING TO BAIL OUT A JAPANESE BANK? BECAUSE OF THE “NORINCHUKIN” DANGER”) and since then the situation of one of the biggest Japanese banks has become worse and worse:

- May 20 – NORINCHUKIN BANK OFFICIALLY JOINS THE LIST OF BANK OF JAPAN’S NIGHTMARES

- July 12 – NOT ONLY IS NORINCHUKIN ABOUT TO LIVE THROUGH THE 2008 NIGHTMARE AGAIN, BUT MANY JAPANESE BANKS ARE IN THE SAME SITUATION

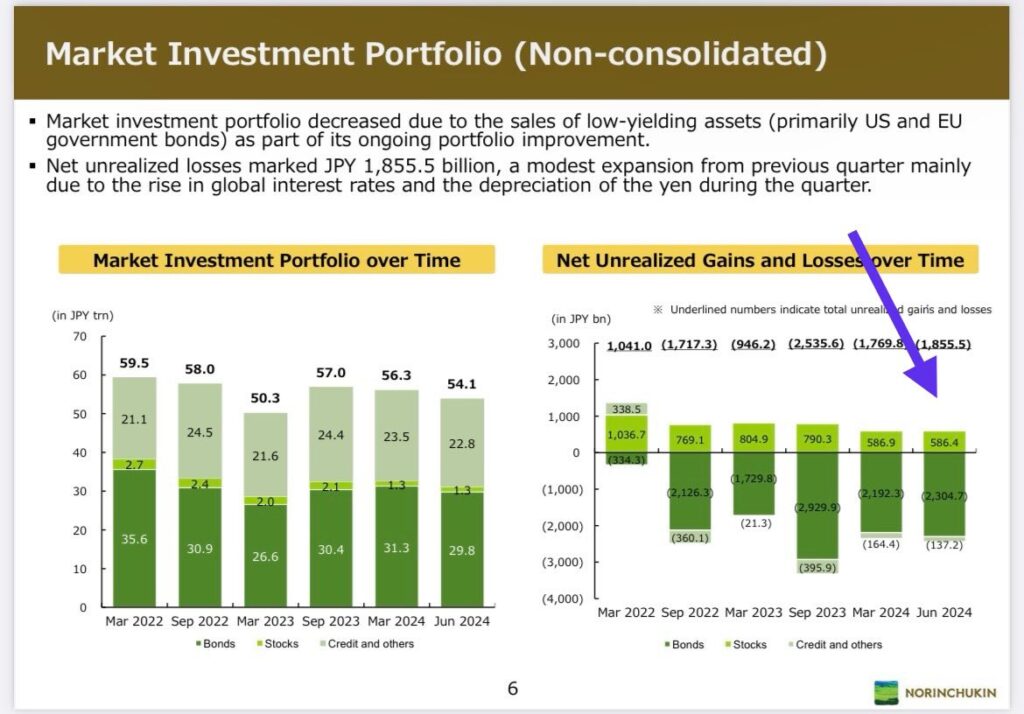

A few weeks ago Norinchukin released its latest earnings report, disclosing 1,855.5 billion JPY of unrealized losses in its investment portfolio, but shortly I am going to show you how that amount is much bigger.

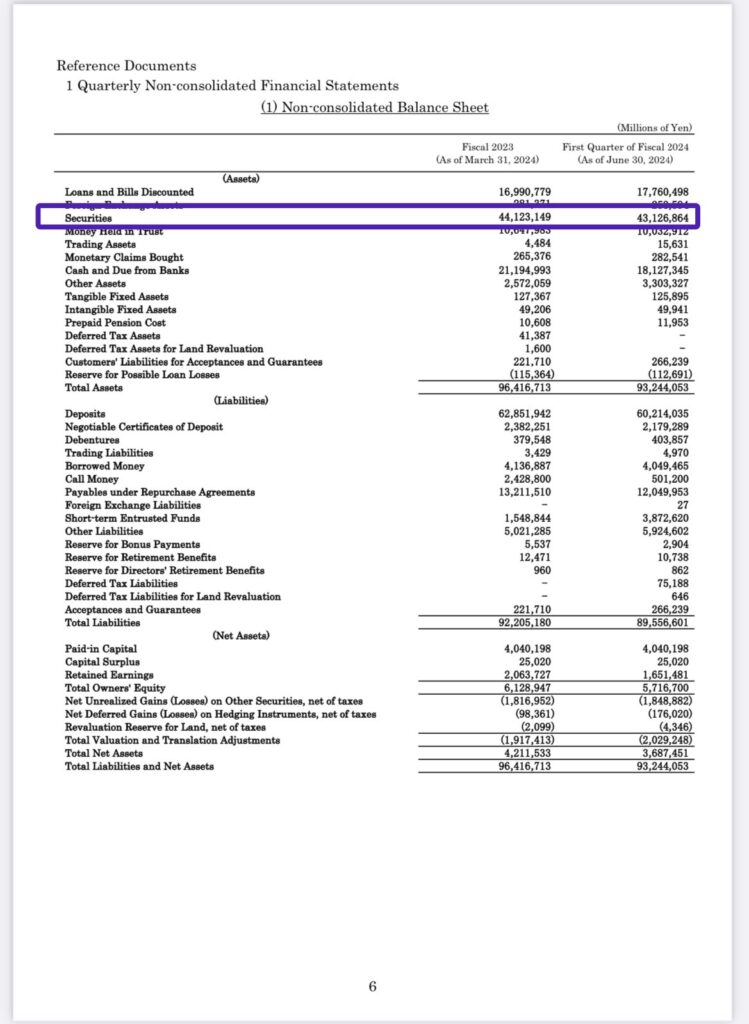

As you can observe from the latest balance sheet snapshot below, Norinchukin sold ~ 1 trillion JPY of securities during the last quarter.

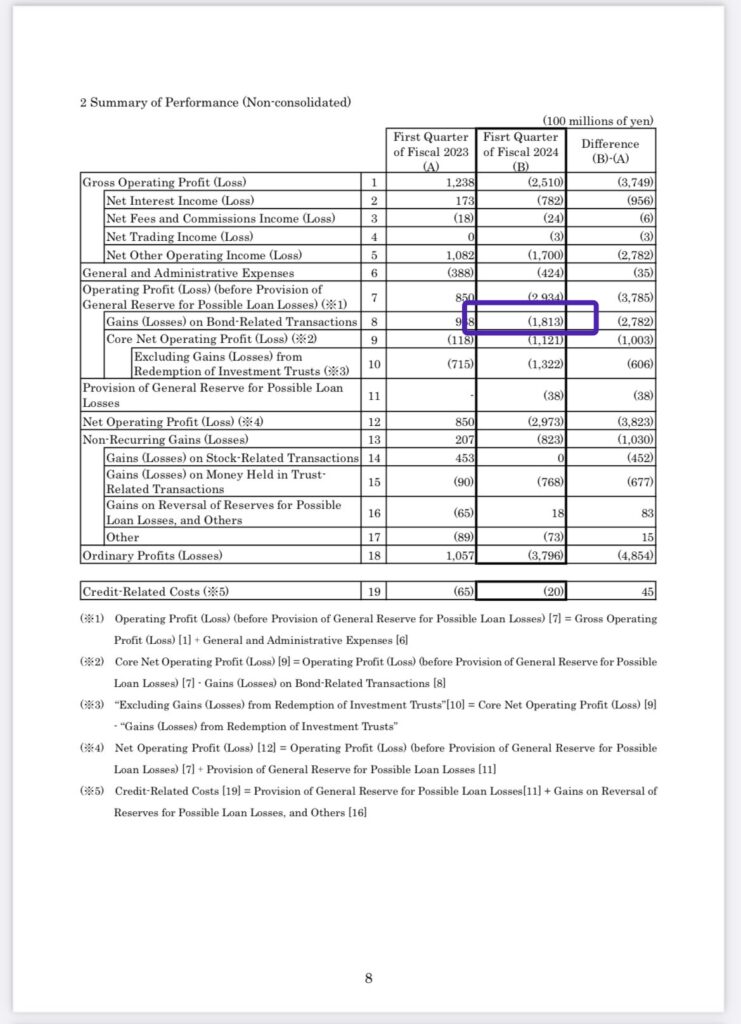

How much money did Norinchukin lose in selling those securities? 181,300,000,000 JPY

Applying some very easy math, we can quickly calculate that Norinchukin lost ~18% in principal in the process of unloading those assets.

Now, logically speaking, do you expect that Norinchukin managed to sell the most illiquid and underwater securities in its portfolio or the most liquid ones that could fetch a fair bid in the market? Of course, we are in the second scenario. Wait, does this mean that the losses on the rest of the securities portfolio are worse than ~18% of the principal value reported in the books? It doesn’t take an extensive understanding of fixed income markets to confirm this assumption. However, we don’t want to be too harsh with Norinchukin today, so let’s only assume they are losing ~18% on average on the remaining securities in its investment portfolio.

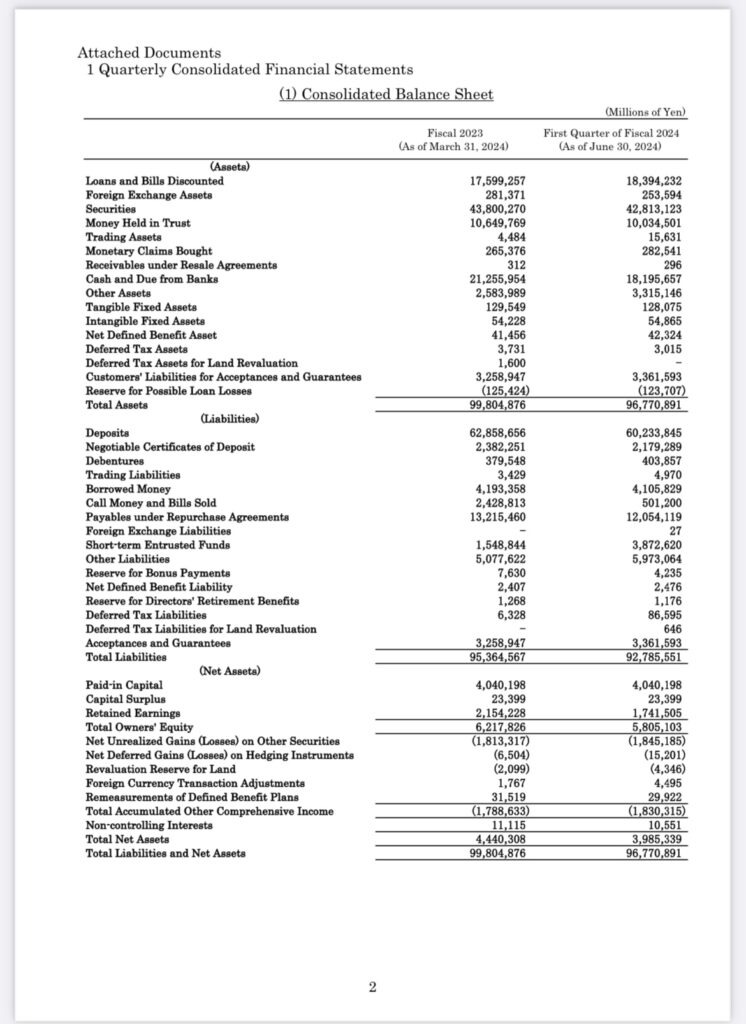

Considering Norinchukin still holds ~43 trillion JPY, this means that the real unrealized losses are ~ 7.74 trillion JPY. How much is Norinchukin shareholders’ equity at the moment? ~5.7 trillion JPY. Yes, my dear readers, we can say with a high degree of confidence that Norinchukin is now a bankrupt bank.

As we know well, insolvent banks can continue operating till they remain liquid. This is why Norinchukin hasn’t imploded yet. However, the bank can have liquidity issues at any moment and at that point, the collapse will be simply inevitable.

Norinchukin holds ~60 trillion JPY of deposits in its liabilities against ~18 trillion JPY of cash and ~10 trillion JPY in money held in trust. ~18 trillion are “Loans and Bills Discounted”; these cannot be liquidated right away for cash. Again, we don’t want to be too harsh with Norinchukin, so let’s assume they can only take a 5% loss in a fire sale of this book, collecting ~17 trillion JPY of extra cash.

Putting it all together, we have: 60 trillion -18 trillion – 10 trillion – 17 trillion = 15 trillion DEFICIT

Well, it shouldn’t come as a surprise anymore that in the last quarter some wise customers pulled out 2.5 trillion JPY from Norinchukin already.

If the picture wasn’t dire already, besides deposits, Norinchukin is also heavily relying on other forms of very short-term funding that can disappear quickly:

- ~12 trillion JPY in Net payables REPO

- ~ 2 trillion JPY in Certificate of Deposits

- ~4 trillion JPY in Short-Term Entrusted funds

- ~3 trillion JPY in Guarantees

Considering the incredibly bad shape of its balance sheet, why hasn’t a run on Norinchukin Bank triggered already then? Here I believe the answer is most of the deposits are in reality held on behalf of other smaller regional Japanese banks that all together are the major shareholders of Norinchukin itself. This is a perfect “prisoner’s dilemma” situation where the best outcome for all involved can be achieved by effectively doing nothing. Incredibly, pulling deposits from Norinchukin may end up bankrupting a great number of regional Japanese banks, triggering unmanageable financial chaos in Japan. How long will the system trust the BOJ (and its FED godfather) to rescue everyone again like they did in 2008? Hard to say, but the more time goes by, the more difficult it will be to hold everyone’s nerves together. I believe it should come as a surprise anymore that in the past 3 months Norinchukin has been unsuccessful in raising fresh capital to stay afloat (“Norinchukin Weighs $7.7 Billion Fundraise to Cover Bond Loss”), perhaps those who received the pitch deck didn’t need much effort to see the bank stands little chance to survive and putting any more money in will be equivalent to throwing it into a bonfire.