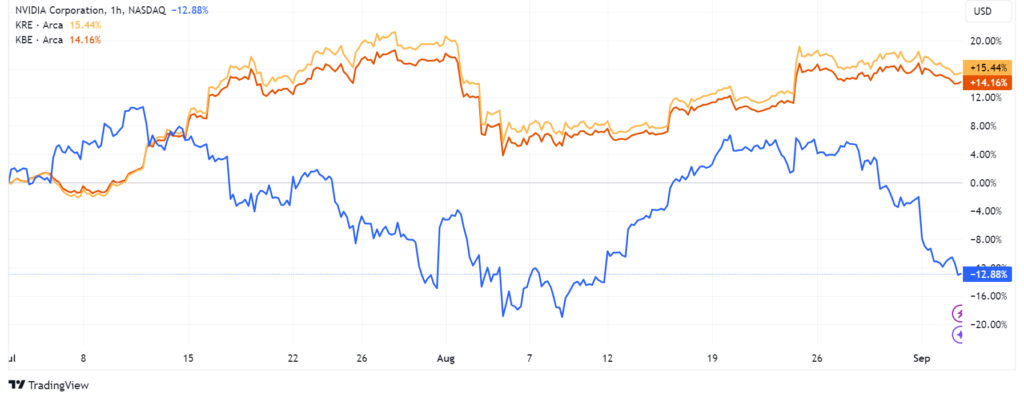

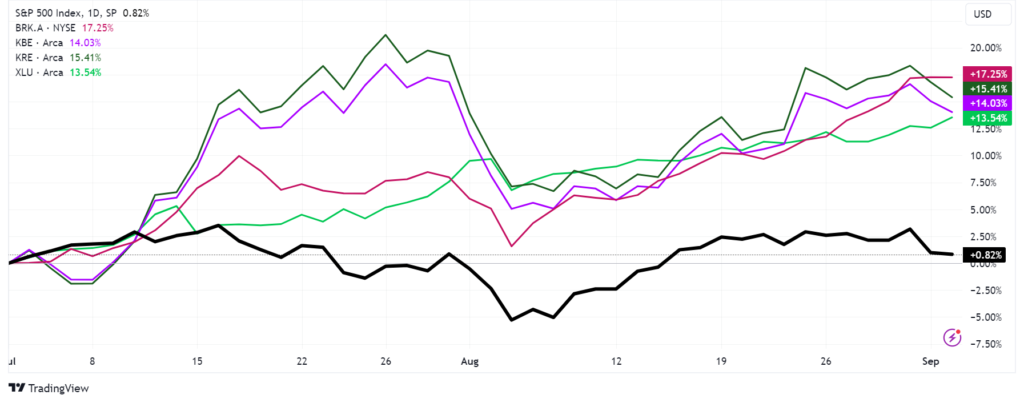

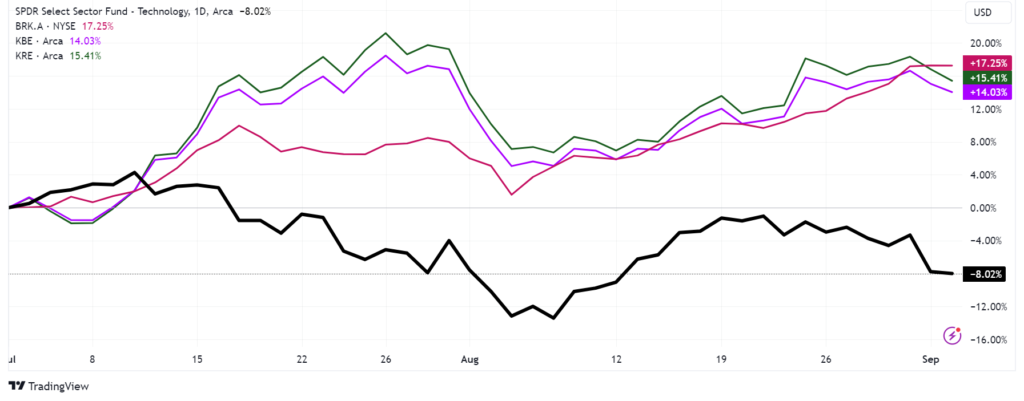

I bet very few noticed this: while NVIDIA and fellow bubbly tech stocks are having quite a hard time, banks, especially large ones, are actually showing remarkable strength in the 3rd quarter of 2024. Shocking, isn’t it?

Back in February when I wrote “WE HAVE NO ALTERNATIVE BUT TO RIDE STOCKS UNTIL THEY RUN”, the goal was to emphasize how the vast majority of money managers, including those claiming to do “active investing”, are in reality hostages of a market dynamic that effectively turns all of them into passive investors tracking benchmark indexes. They have no room to step out of the bubble craziness because if their competitors stay in and show relative outperformance, those who decide to be more prudent will lose their jobs. Considering that these asset managers aren’t investing their personal savings in the funds, ETFs, or portfolios they manage and that acting in the interest of their investors and having more prudent risk management will cost them their jobs in this market, there is no incentive whatsoever for any of them not to keep riding this bubble till the very end.

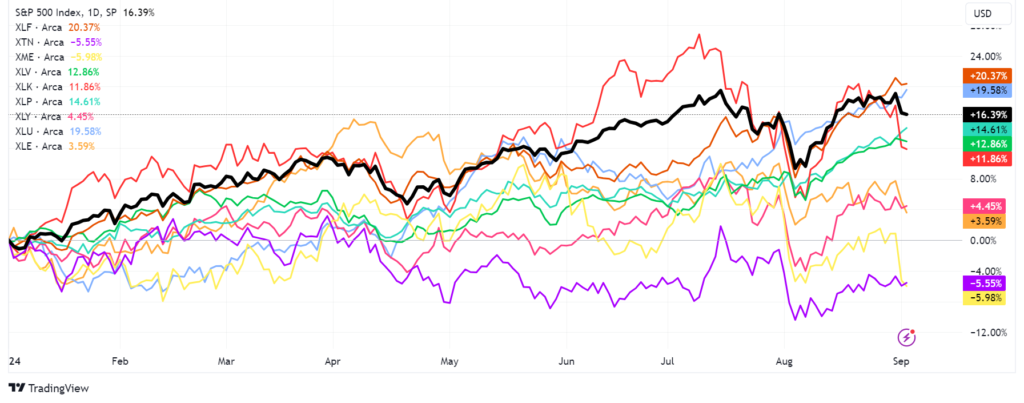

So what are these people going to do if the NVIDIA locomotive stops carrying the stock bubble higher and higher? They will “rotate” and jump onto another locomotive as long as the overall market momentum remains positive. As a matter of fact, this rotation has been ongoing for several months now to the point that year-to-date, the financial sector has been the BEST performer so far. No, I am not joking, XLF and XLU (utilities) are YTD the only two sectors outperforming the S&P500 (SPX).

- XLF +20.37%

- XLU +19.58%

- S&P500 [Black bold line] +16.39%

- XLP (Consumer staples) + 14.61%

- XLV (Health) + 12.86%

- XLK (Tech) +11.86%

- XLY (Consumer discretionary) +4.45%

- XLE (Energy) + 3.59%

- XTN (Transportation) -5.55%

- XME (Metals) – 5.98%

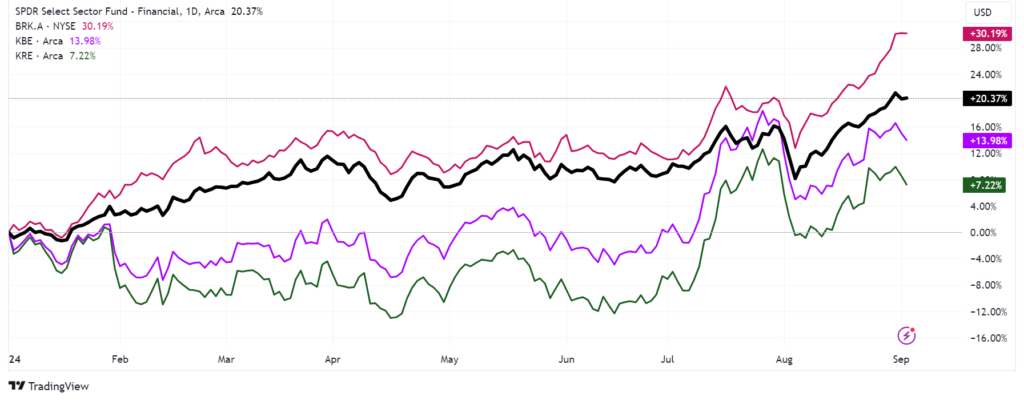

Yes, my dear reader, while Warren Buffett is unloading his Bank of America shares as fast as he can (source), everyone else is piling into financial stocks. True, a big amount of XLF gains are due to Warren Buffett’s BRK.A stock gains YTD; however, as we saw in the first chart, banks are being great beneficiaries of the positive momentum.

What we are observing here is exactly the consequence of widespread passive investing behavior, but this very same behavior is creating an incredible paradox, isn’t it? Follow me here:

- Warren Buffett keeps dumping stocks and piling up cash to the point where he now owns more T-Bills than the FED (“Warren Buffett now owns more T-bills than the Federal Reserve“) exactly because he is the white in the bubble eye and he is trying to de-risk as fast as he can;

- Investors buy BRK.A stocks because they trust Warren Buffett; this creates a “passive” bid for XLF, so all stocks included benefit from BRK.A’s tailwind.

- The bid in XLF then trickles down in the same fashion into a bid for KBE and KRE.

- So, while Buffett is dumping Bank of America shares, at the same time he is creating a bid for them, effectively selling at a much better price than what should be the case when such a large and prominent shareholder starts selling. Beautiful, simply beautiful.

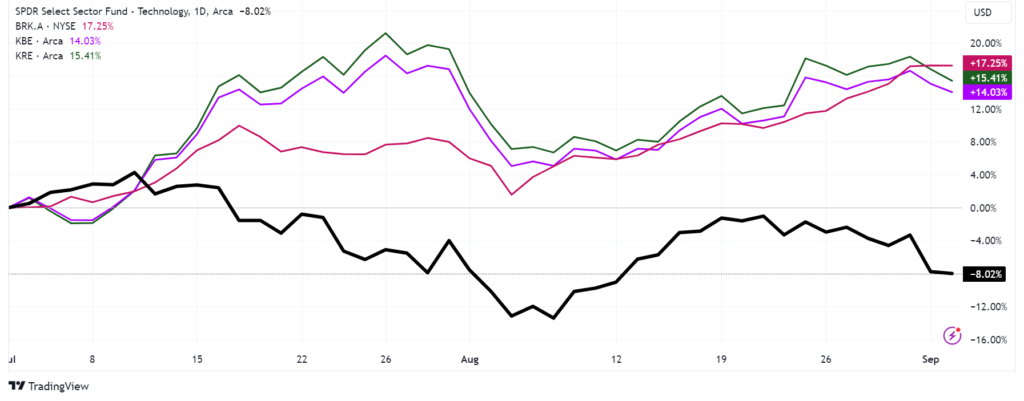

Suppose we watch closer though and consider that Tech sector troubles started at the beginning of July and not on August 5th. In that case, we can see how investors’ rotation from Tech to Financials accelerated at that moment, despite banks notoriously sitting on a huge pile of unrealized losses and their balance sheets becoming more and more fragile (“WILL BANKS MANAGE TO HIDE THEIR MOUNTAIN OF LOSSES FOR ONE MORE QUARTER?“). This is why I picked the “NVIDIA WON’T CRASH MARKETS TOO MUCH BECAUSE TRADERS HAVE A BURNING HOUSE STILL STANDING WHERE THEY CAN HIDE” title for this article.

As we can observe in the last chart below, financials and utilities have been greatly outperforming the S&P500 since July 1st, clearly a sign that as soon as investors started to smell something burning in the tech sector, they began rotating into what have historically been “defensive” sectors (at least according to the very popular “back-testing” used by many to justify their strategies and algorithmic trading). Furthermore, the big expectation for a FED rate cut coming in a few weeks threw gasoline on this under the false premise that this will be a big support for banks, even if such a move will instead have a high chance of triggering a second broad market crash in 2024 and reigniting inflation (“IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS“).

Yes, my dear reader, investors are behaving completely illogically in perhaps the greatest display of how broken financial markets are right now as a result of many years of (reckless) Quantitative Easing, Government bailouts, loose regulation, and relaxed oversight on banks’ balance sheet risks. I hope at this point you will agree with me that NVIDIA’s incoming demise is just the “appetizer” of a broad-based crash; the real big one will only happen after when banks won’t be able to “hide till maturity” their losses and insolvencies anymore, as I warned in my very first article of 2024: “2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS“