Last Friday, a few minutes after the Tokyo stock exchange closed for the week, news about Shigeru Ishiba winning the LDP party leadership elections, making him virtually the next Prime Minister, jolted Japan’s futures and FX markets. Why did Japan stock futures crash more than 7% after the news? Because he is supportive of a less accommodating BOJ monetary policy (those who keep calling that “tightening” should go check the meaning of the word in the vocabulary and compare it with what the BOJ is really doing), and because among the initiatives he is bringing to the table to deal with Japan’s government deficit, he is supportive of higher capital gains taxes. This is what the official narrative wants us to believe, overlooking a very important aspect: when markets are just “disappointed” they don’t crash 7%.

Another remarkable thing that was completely overlooked last Friday was the total absence of reaction in either European or US markets to what was unfolding in Japan-linked stock index derivatives and FX markets, with the JPY strengthening more than 4 full big figures against the USD.

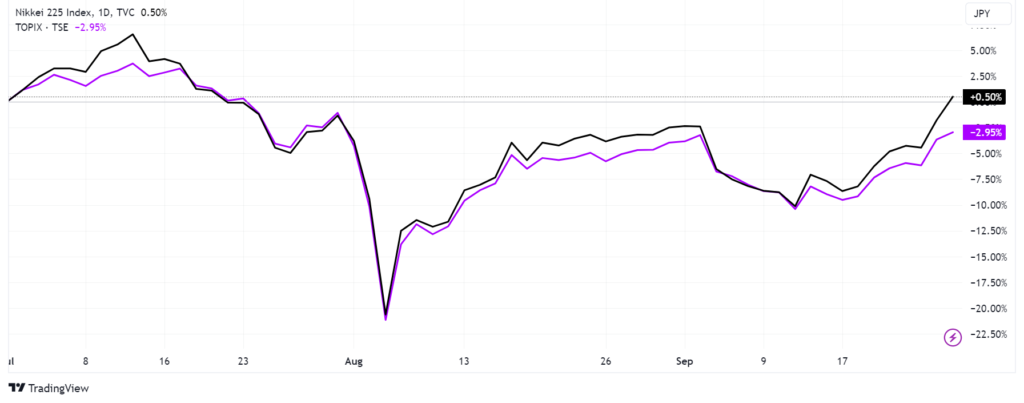

To give you an idea, these kinds of moves between the USD and the JPY and stock index futures crashing 7% in a few hours statistically speaking should only happen with a 1 in 31,560 frequency. The fact that we are seeing a sharp increase in their frequency should be worrying people instead of being broadly ignored as it is (so far). Why, among all other problems significantly threatening financial market stability (like the mountains of billions in loan losses hidden in banks’ hold-to-maturity books), do investors now ignore this one too? Very simple answer: recency bias. A little less than 2 months ago, Japan stocks went through the worst crash since 1987, and since then US and European indexes not only recovered the losses suffered but marched towards new all-time highs thanks to the FED and its fellow central banks’ series of coordinated interventions (“WHAT IF BANKS ARE COORDINATING WITH THE FED TO LIQUIDATE TENS OF BILLIONS OF TROUBLED JPY CARRY TRADE POSITIONS?“) that culminated with a reckless, unless you are the incumbent US administration struggling in the polls then it’s another story, 50bp cut of the Federal Fund rate (“FED ACTION TODAY MARKS THE BEGINNING OF THE END OF THE FIAT MONETARY SYSTEM EXPERIMENT“).

This time around, though, the situation isn’t exactly the same as the one on the 5th of August. What is the big difference? That Monday will coincide not only with the last trading session of the month but also with the last trading session of the third quarter of 2024. How do banks, brokers, and asset managers usually prepare to “window dress” their books? Let’s quickly have a look at it since it will help us to understand what can potentially happen tomorrow and in the following days.

Banks engage in window dressing to optimize their balance sheets, liquidity ratios, and risk-weighted assets, often to meet regulatory requirements and present themselves as more financially sound. Key practices include:

- Balance Sheet Management: Reducing risky assets or loans and increasing high-quality liquid assets (HQLA) to improve liquidity coverage ratios (LCR). This may involve selling off riskier assets or temporarily drawing down credit lines.

- Short-Term Funding Adjustments: Reducing short-term borrowing or repo agreements that might inflate liabilities on the balance sheet.

- Managing Risk-Weighted Assets (RWA): Adjusting the portfolio to reduce exposure to risk-weighted assets, thereby improving capital adequacy ratios.

- Swapping Out Risky Securities: Replacing underperforming or higher-risk securities with safer, more liquid ones (e.g., government bonds) to present a more conservative portfolio.

Brokers primarily focus on managing their inventory and positioning to optimize their financial reporting:

- Reducing Risk Exposure: Closing or hedging positions to reduce exposure to volatile assets, thereby minimizing the risk of sudden losses impacting quarter-end results.

- Optimizing Trading Books: Rebalancing positions to show stronger returns, reducing inventory in underperforming stocks, and increasing holdings in assets that have performed well over the quarter.

- Client Window Dressing: Assisting institutional clients in rebalancing their portfolios, often providing more liquidity or facilitating the sale and purchase of securities as clients engage in window dressing themselves.

Asset managers are particularly active in quarter-end window dressing since they aim to improve the appearance of their portfolios to enhance performance metrics that will be reported to clients. Common window dressing strategies usually implemented are:

- Selling Underperformers: Selling off underperforming stocks to avoid showing them in the portfolio, thus removing the “losers” from the quarter-end holdings report.

- Buying Winners (aka “performance chasing”): Adding positions in top-performing or popular stocks just before quarter-end to make it appear that the manager had been invested in them.

- Sector and Style Rotation: Shifting holdings to align with the best-performing sectors or styles (e.g., growth, value) to create the impression of an effective investment strategy.

- Rebalancing for Benchmark Compliance: Adjusting the portfolio to better match the benchmark or index they are compared against, ensuring the tracking error looks minimal.

- Enhancing Cash Positions: Increasing cash holdings at quarter-end to improve liquidity ratios or make the portfolio look more defensively positioned.

- Engaging in Repo Transactions: Entering into repurchase agreements to temporarily offload securities from the balance sheet, only to repurchase them after the quarter-end reporting period.

Now that we have a better idea of how the major market players position heading into the “window dressing” and we are mindful that being quarter-end everyone is going to be very active, not only asset managers, what do you think is going to be the reaction in a few hours when Japan stocks are going to open anywhere between -5% and -7% when, as you can see from the chart below, they were able to almost fully recover the worst losses since 1987? Of course, there is likely going to be a selling stampede at the open.

At this point, it is certain that both the BOJ and the GPIF will step in to support the market once again. As we have seen in “HOW COULD JAPAN RECOVER SO FAST FROM THE WORST CRASH SINCE 1987? THANKS TO ITS GPIF ANGEL” Japan GPIF runs an asset allocation split 50:50 between stocks and bonds and within stocks a 50:50 allocation between domestic and foreign stocks. As a consequence, while asset managers through their beloved algorithms are going to dump in force, you can expect GPIF to show up with a pretty strong bid. The real question is, will GPIF’s bid be enough to support the whole market?

- If yes, then with a high chance we will see indexes grinding higher throughout the day, also thanks to the BOJ doing all it can to devalue the JPY in support of the move (a domestic currency losing value is like for like beneficial to support its local stocks since it makes them cheaper for foreign buyers). This will eventually be the same scenario we already saw at play several weeks ago (“WILL BOJ AND GPIF BE ABLE TO SAVE JAPAN FROM ANOTHER BLACK MONDAY?“).

- If not, then you better be ready for a Black Monday in Japan and the consequent ripple effects throughout the globe.

It doesn’t take much imagination to project what’s going to happen if Japan indexes start slicing through support levels since not only the carry trade but in particular the structured derivative positions will likely trigger automatic selling:

- A TRAVELER GUIDE TO NAVIGATE THE BANK OF JAPAN MESS [Carry Trades structure]

- IN JAPAN IT WILL BE A MESSY MONDAY, BUT NOT A BLACK ONE (YET) [Structured Derivatives structure]

Those in particular danger will be the Japanese banks that did not recover at all from the 5th of August as the broader index did, and if they break the recent lows, the chances of an all-out chaos with up to 25% losses from the current level are significant this time, as you can see in this chart.

With Japanese banks already in very bad shape (“NOT ONLY IS NORINCHUKIN ABOUT TO LIVE THROUGH THE 2008 NIGHTMARE AGAIN, BUT MANY JAPANESE BANKS ARE IN THE SAME SITUATION“), especially Norinchukin (“NORINCHUKIN BANK CHAOS CAN TRIGGER AT ANY MOMENT“), if this scenario unfolds there is only one way the BOJ can intervene: delivering an emergency rate cut (THE LONGER THE BOJ TAKES TO CUT RATES BACK TO ZERO THE GREATER THE DAMAGE TO JAPAN’S BANKING SYSTEM). I know it all sounds too catastrophic, but unfortunately, this is what data and market setup are portraying like it or not. However, will the incoming new prime minister support such an extreme action from the BOJ after he vowed to support a normalization of its monetary policy? This is the key, and unfortunately, the answer is not so straightforward. Personally, I believe he will fold; otherwise, his tenure as PM will likely be the shortest in the history of the country.

What about other markets if such a situation truly develops? Everyone will quickly turn to a hard risk-off mode exacerbated by the quarter-end day. Needless to say, the ones suffering the most will be the banks since the global financial system is deeply connected throughout the globe. Don’t worry though, I do not think an all-out sell-off will trigger yet because neither the ECB nor the FED (or Secretary Yellen) will allow that to happen just one month prior to the US elections. Expect repo lines to spike, but banks have been preparing for it well in advance as I flagged in this post. Needless to say that in such chaos, despite US and European indexes closing on Friday near all-time highs, you will quickly see calls for a FED emergency rate cut to save everyone’s butt again.

Was China foreseeing all this, and is this why it unleashed a set of significant policy measures in support of the economy last week (A BIG BANK IS ON LIFE SUPPORT, CHINA KNOWS IT AND IS PREPARING TO WITHSTAND THE SHOCK – IS THIS BULLISH?)? Likely yes.

To conclude, be ready for a chaotic opening in Japan and then for a Black Monday to potentially trigger if the sell-off does not quickly stabilize a few minutes after opening.