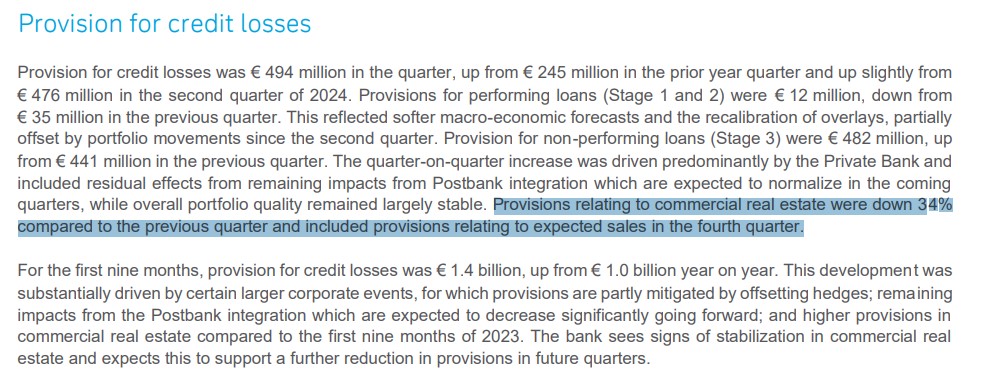

How is it possible that Deutsche Bank’s provisions for credit losses related to Commercial Real Estate (CRE) loans DECREASED by 34% compared to Q2-24? No, I am not joking; it is right there hidden in the fine print of the bank’s Q3-24 report as you can see below. Furthermore, “The bank sees signs of stabilization in commercial real estate and expects this to support a further reduction in provisions in future quarters”.

Well, DB accountants might have some serious schizophrenia issues since if you go down in the same report, the picture they paint for CRE is quite different.

“Commercial Real Estate (CRE) markets continue to face headwinds due to the impacts of higher interest rates, reduced market liquidity combined with tightened lending conditions, and structural changes in the office sector. The market stress has been more pronounced in the U.S. where property price indices show a more substantial decline of CRE asset values from recent peaks compared to Europe and APAC. Especially, within the office segment, the market weakness is most evident in the U.S., reflected in subdued leasing activity and higher vacancy rates compared to Europe”

Here’s the catch though: “Market data indicate some stabilization year-to-date for the wider sector. For example, a key CRE price index curve in the U.S. has flattened over the past nine months, indicating property market values in the U.S. have bottomed out on a broad average while some value decline can still be observed in weak office submarkets. In Europe, signs of stabilization are emerging particularly in residential, logistics and hospitality property sectors”.

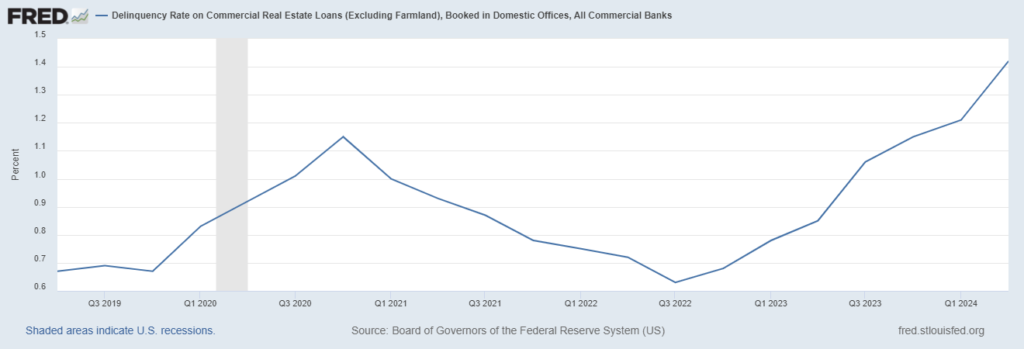

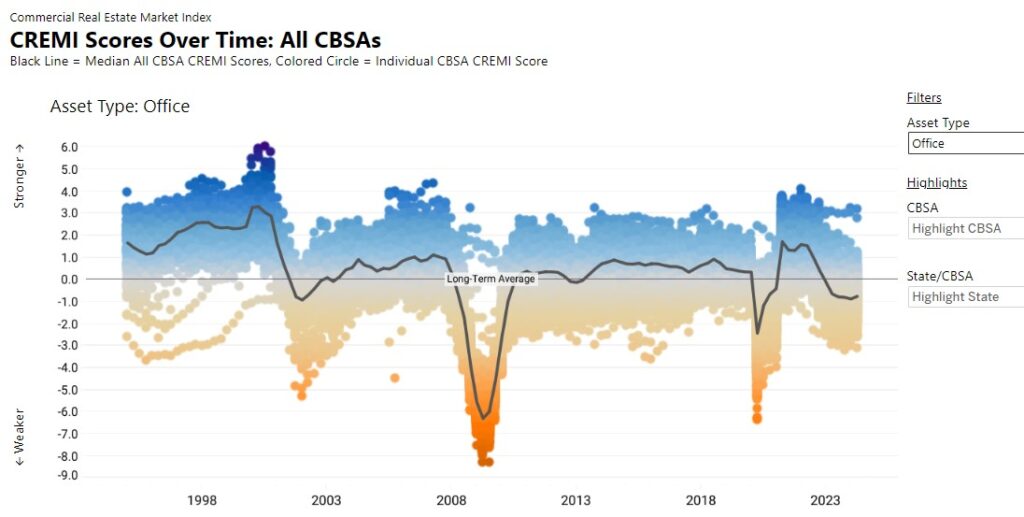

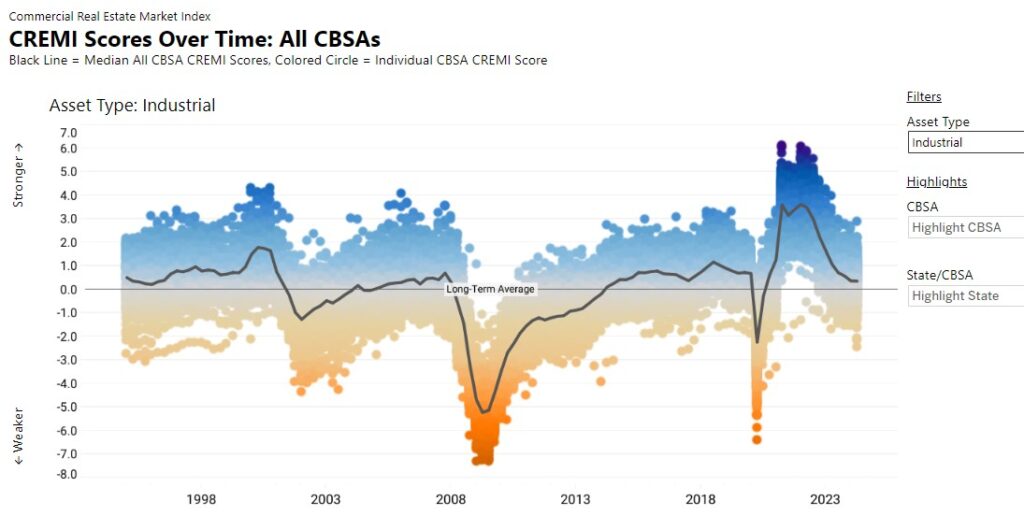

What kind of “market data” is DB referring to? As you can see, the latest “market data” related to the US CRE (the biggest exposure in DB Books) show no signs whatsoever of bottoming.

Paradoxically, DB itself highlights the risk of further deterioration in those “market data” that they conveniently consider “bullish”

“In the current environment, the main risk for the portfolio is related to refinancing and extension of maturing loans. CRE loans often have a significant portion of principal payable at maturity. Under current market conditions, borrowers may have difficulty obtaining a new loan to repay the maturing debt or to meet conditions that allow extension of loans. This risk is further amplified for loans in the office segment due to increased uncertainty about letting prospects for office properties. Deutsche Bank is closely monitoring the CRE portfolio for development of such risks”

In a nutshell, DB is saying that if banks manage to continue kicking the can down the road and extend the maturities on toxic CRE loans, then things won’t turn sour. The risks related to this behavior, which is simply postponing losses, are so big and hard to hide at this point that even the NY FED couldn’t avoid warning about them anymore: NY Fed says banks obscuring commercial real estate risks by extending loan terms

Basically, as long as banks are allowed to continue cheating on the mark-to-market of their books, “everything will be fine” and DB is very much involved in the effort as per their own words:

“The Group continues to proactively work with borrowers to address upcoming maturities to establish terms for loan amendments and extensions, which in many cases, are classified as forbearance triggering Stage 2 classification under IFRS 9 but are not always deemed modifications under IFRS. However, in certain cases, no agreement can be reached on loan extensions or loan amendments and the borrower’s inability to restructure or refinance leads to a default. This has resulted in higher Stage 3 ECL’s in 2023, a development which continued into the first nine months of 2024. Overall, uncertainty remains with respect to future defaults and the timing of a full recovery in the CRE markets.”

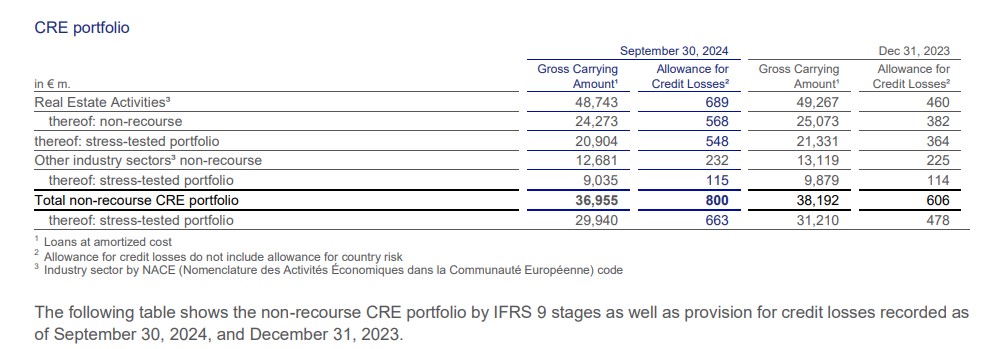

After considering all we just saw, I believe you agree with me that DB putting aside only 2% of provision for credit losses against its CRE portfolio is a ridiculously low number.

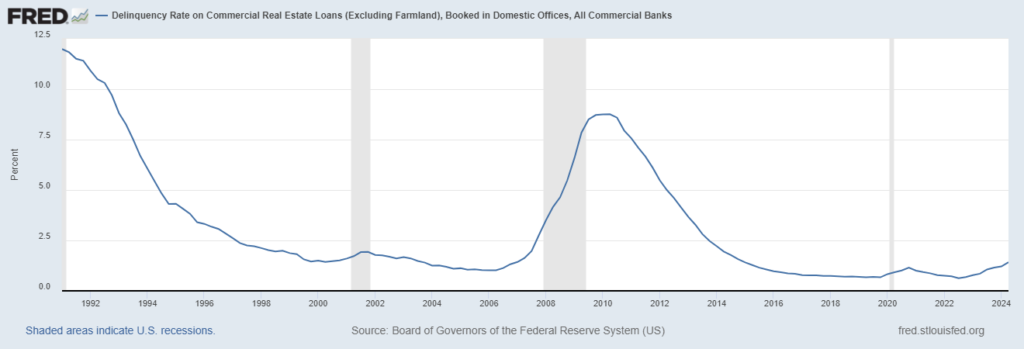

Furthermore, let’s take a look at where CRE delinquencies stood during the GFC when the situation for this segment of the real estate sector wasn’t as grim as it is today. Clearly, the numbers in DB Q3-24 do not add up at all here with DB forecasting 1.2bn EUR of total losses in multiple years across all their CRE portfolio according to their stress tests that clearly aren’t “stressed” at all.

How can DB then justify that “market data” suggests the CRE market is bottoming? Because in their assumptions they use the US CRE Index calculated by the Atlanta FED based on data provided by CRE realtors that, of course, have all the incentive to showcase higher values than what the real transaction prices in the market as documented by many and more reliable sources: U.S. Commercial Real Estate Is Headed Toward a Crisis. As you can see below this index still portrays how the US CRE market is “strong”, funny isn’t it?

What about residential real estate, especially in Germany where DB has a significant exposure? DB doesn’t flag any risk whatsoever in its report despite the situation being increasingly dramatic:

- 16 February: THE INCOMING GERMAN REAL ESTATE MAYHEM

- 8 July: HOW DO YOU SAY “NINJA MORTGAGE” IN GERMAN? THE BREWING CRISIS NO ONE IS FORESEEING

To conclude, it is very clear to what extent banks are now stretching all possible accounting metrics and leveraging every possible regulatory loophole available to hide the mounting crisis in the real estate market, starting from CRE. At the moment, regulators are fine with it (TODAY “EVERYTHING WILL BE AWESOME” FOR BANK OF AMERICA), but how long will they all be able to coordinate to hide the truth from the public?

JustDario on X | JustDario on Instagram