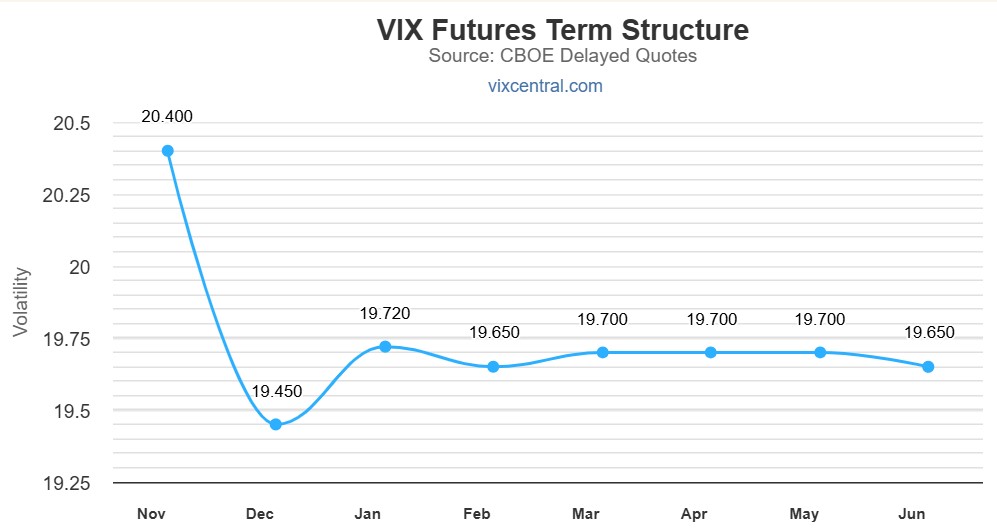

Finally, here we are with only one day left until the end of the most tragicomic US Presidential campaign ever. So far, investors do not seem too concerned about it, considering the shape of the VIX curve. Yes, some have put some hedging in place, but as you can see, futures are currently pricing a rather smooth transition of power to the next US President.

However, I am not very confident the VIX is any longer a reliable indicator of true market expectations, considering in every corner of the globe people have built significant short positions on volatility because “harvesting volatility” has been one of the most profitable and reliable trades in the past few years. What’s a more reliable indicator then? The MOVE index.

As you can see in the second chart below, the volatility of US Treasuries is already above and beyond this year’s previous peak hit on the 5th of August.

What’s striking though is the comparison between the current MOVE and VIX indexes today against the same in 2020. As you can see, back at that time, the stock market and the bond market agreed there wasn’t much risk on the horizon.

The current disagreement of these two fundamental parts of the market has raised a few eyebrows already (not in the MSM media that ignored it), but surely did not trigger much of a warning in investors’ minds while in reality, the situation deserves attention.

First of all, investors in the bond market are surely showing concern for the state of the US economy in the near future that, regardless of who is going to win the elections, is objectively very bad: HOW THE BIDEN ADMINISTRATION SET UP MINE FIELDS ALL OVER THE US ECONOMY TO UNDERMINE THE FUTURE GOVERNMENT IN CASE THEY LOSE ELECTIONS. The latest NFP BLS report did not help to ease their concerns; if anything, it increased them with no jobs added in the last month and significant downward revisions in the previous ones (again): Nonfarm Payrolls increase by 12,000 in October vs. 113,000 expected

Secondly, the US deficit and total debt are going to increase in the short term regardless of who is going to be elected as president. This should be no news, but there is a detail that many overlooked: there is less and less demand for medium and long-term US Treasuries. Why? Because banks’ and brokers’ capital allocation into treasuries is becoming more and more stretched (THE FED’S HIDDEN QE: HOW BANKS ARE PROPPING UP ASSET PRICES AT THE COST OF FUTURE INFLATION) and the US Treasury “buyback program” side effects are starting to surface even if it was intended to improve the liquidity in the market, not the opposite: Treasury’s Frost Says Buybacks Improve Liquidity in Old Debt. Why? What the US Treasury is effectively doing is “swapping” long-term debt for short-term debt, effectively frontloading the amounts the US Treasury is due to repay (in theory) in the near future with a staggering one-third of the total US debt now due in the next 12 months. This very short-sighted move is clearly part of a plan to significantly reduce the cost of servicing debt assuming the FED will steadily cut rates in the following years, but as we discussed before in “IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS” the FED is in no position to do so and likely they will be forced to pause after one more (reckless) 25bp rate cut due to be delivered by the FOMC this week. Not surprisingly to me, but to many apparently, US Treasury yields have been steadily rising since the FED cut rates and it’s now trickling into the MSM already that the FED cuts cycle is likely short-lived: The Fed is likely to disappoint markets with just one more rate cut this year amid global inflation, BlackRock CEO says. Clearly, things aren’t going in the direction the US Treasury hoped for, but as I anticipated, the side effects of its buyback program will soon start to show up. In particular, contrary to what they aimed for, the liquidity in US Treasuries is DETERIORATING, not the opposite. Why? Simply because the US Treasury is removing supply from the long-term portion of the market.

In order for liquidity to improve, instead of frontloading the long-term debt into short-term one, the US Treasury should instead swap “old” treasuries, issuing an equivalent amount in the “on the run” tranches creating a deeper market. Paradoxically again, this action would even DECREASE US debt servicing costs, with long-term US Treasuries trading at a lower yield than short-term ones. Instead of catching this opportunity, Janet Yellen decided to bet the house on the ability of the FED to cut rates in a move that is more and more resulting as wrong. With less and less supply in the market and banks’ ability to support market making on it deteriorating, it is more than justified for the MOVE index to be elevated nevertheless. Now, tell me, what do you think is going to happen if the US Presidential elections don’t run smoothly? Of course, investors, especially foreign ones, will start to sell US Treasuries, and doing so in size and in an illiquid market has a high chance of triggering a yield shock.

How would stocks react to such a scenario that is objectively more likely than a smooth transition? Initially, you can bet they will be ignoring it, especially when the likes of NVIDIA will enjoy a big bid from passive investors heading to the 8th of November when the company will replace Intel in the DJIA. However, a yield shock will materially increase the cost of funding leverage and in a market that is running an amount of leverage never seen before, forced de-risking is expected to unfold. No worries though, I don’t think stocks will crash yet. Mostly because after the FOMC all FED speakers circus will resume operations and you can bet they will try to ease fixed-income investors’ nerves and try to buy time into year-end.

What can truly create a big market shock isn’t even a Trump win, but if the unthinkable happens: Trump flips California. This is the true “black swan” event that can suddenly spread its wings during the US Presidential elections. How do you expect stocks to react to such a debacle of the incumbent Democratic administration? Not well, of course. If California becomes “republican” say goodbye to the FOMO bid that has been supporting all tech stocks so far since Trump will have such a strong mandate to rein over the incredible freedom, against all free market logic, that these companies enjoyed so till today. This will eventually happen at the same time the current regulators will be forced to manage the fallout from SMCI implosion that, like it or not, is going to hit all the companies that have been “AI washing” their financial statements in the recent past. With Nvidia due to report its latest quarter on the 19th of November in such a situation, you can expect big swings in the market.

What if Kamala Harris wins against all odds despite the latest attempt to manipulate the very same odds in the betting market? In that case, volatility will be delayed to Q1-25 when it will be very hard for banks to keep hiding the astounding amount of loan losses in their books:

- MARKET EUPHORIA VS. ECONOMIC REALITY: GLOBAL STOCKS SOAR AS CRACKS DEEPEN BENEATH

- CRE CRISIS: HIDDEN LOSSES AND QUESTIONABLE OPTIMISM IN DEUTSCHE BANK’S Q3-24 REPORT

- HOW LONG WILL THIS BUBBLE LAST? IT LOOKS LIKE TILL Q1-2025

All in all, it is clear even to those still doing their best to deny it, that this market is living on borrowed time and no matter what happens in the following days you better get prepared to ride some serious volatility sooner or later with my personal expectation that investors will seek shelter in precious metals, especially gold, and Bitcoin that like it or not is going to be a winner regardless of the outcome of the elections since both candidates showed their support for the growing sector – perhaps on the back of a lobbying effort of the likes of BlackRock in the background: IS THIS BLACKROCK’S MASTER PLAN FOR BITCOIN?

JustDario on X | JustDario on Instagram | JustDario on YouTube