As I write, NVIDIA is the most valuable company in the world while a key component of its supply chain (to not always use the words “Ponzi scheme”) is on the verge of being delisted from the NASDAQ only a few months after being included in the S&P500 on March 18th this year.

“The Securities and Exchange Commission today charged Super Micro Computer, Inc., a producer of computer servers, and its former CFO, Howard Hideshima, with prematurely recognizing revenue and understating expenses over a period of at least three years” is the beginning of the SEC press release that outlined in detail all SMCI fraudulent accounting prior to 2020.

Why was SMCI cheating in its accounts? The SEC itself answered the question: “Reporting revenue in the wrong period gives investors a distorted view of a company’s financial condition”

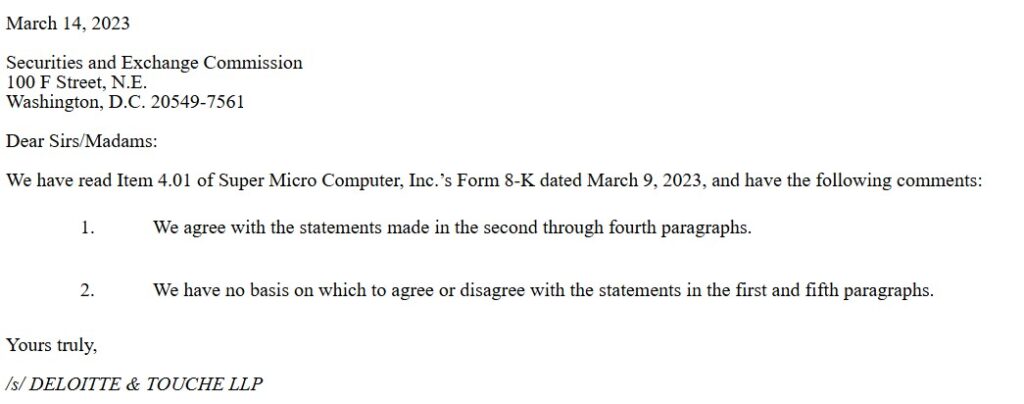

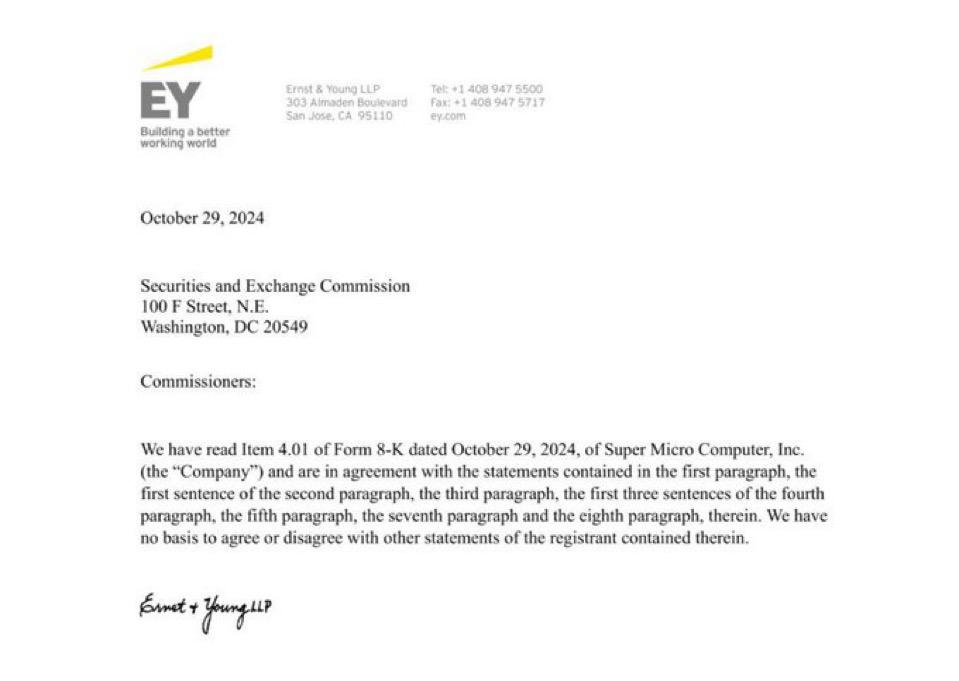

Fast forward to today, prior to Ernst & Young’s abrupt resignation a few weeks ago, one piece of news was completely overlooked by investors: the resignation of its previous auditor, Deloitte, in March 2023.

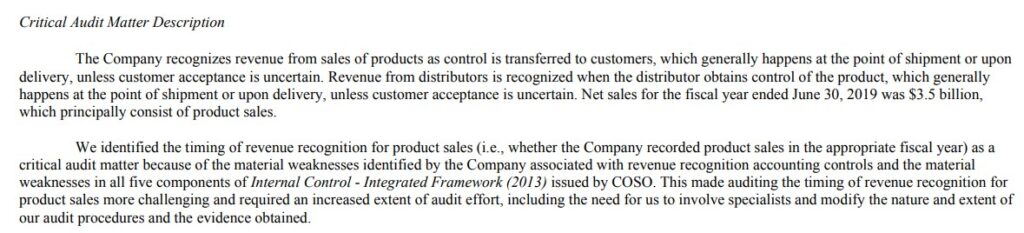

Here’s the funny thing: Deloitte was SMCI’s auditor since 2003 and resigned in 2018 due to disagreement with SMCI management with regards to their revenue recognition accounting, as you can clearly read in the filing at that time.

Which company was appointed at that time to clean up the mess that ended up with a settlement with the SEC? Ernst & Young, which was then replaced by Deloitte in 2020.

Does any of this sound familiar? As a matter of fact, what is happening today is the exact same story once again with one difference: this time around, Ernst & Young wasn’t eager to clean up the SMCI mess and has been quite vocal about it.

Let’s take a look at NVIDIA’s history with the SEC now:

- 2003 Accounting Fraud charges: Litigation Release No. 18343 / September 11, 2003

- 2014 NVIDIA Employee Insider Trading Charges: SEC Charges Technology Company Insider in California With Tipping Confidential Information Exploited by Hedge Funds

- 2018 Charges for Misleading Disclosures: SEC Charges NVIDIA Corporation with Inadequate Disclosures about Impact of Cryptomining

To summarize, NVIDIA has a history of cooking the books, providing misleading statements on its revenue growth potential, and having disloyal employees tipping hedge funds that made a killing trading the stock (~500m USD in 2009-2010).

Despite PwC certifying the latest NVIDIA 10-K annual report (as it has done since 2004 despite all the troubles with the SEC), the auditor highlighted a “Critical Audit Matter” in the financial statements. What was this about? Valuation of Inventories – Provisions for Excess or Obsolete Inventories and Excess Product Purchase Commitments

Here is where things become interesting, let’s take a look at what PwC had to say about that “critical matter”

“As described in Notes 1, 10 and 13 to the consolidated financial statements, the Company charges cost of sales for inventory provisions to write-down inventory for excess or obsolete inventory and for excess product purchase commitments. Most of the Company’s inventory provisions relate to excess quantities of products, based on the Company’s inventory levels and future product purchase commitments compared to assumptions about future demand and market conditions. As of January 28, 2024, the Company’s consolidated inventories balance was $5.3 billion and the Company’s consolidated outstanding inventory purchase and long-term supply and capacity obligations balance was $16.1 billion, of which a significant portion relates to inventory purchase obligations.”

“The principal considerations for our determination that performing procedures relating to the valuation of inventories, specifically the provisions for excess or obsolete inventories and excess product purchase commitments, is a critical audit matter are the significant judgment by management when developing provisions for excess or obsolete inventories and excess product purchase commitments, including developing assumptions related to future demand and market conditions. This in turn led to significant auditor judgment, subjectivity, and effort in performing procedures and evaluating management’s assumptions related to future demand and market conditions.“

Hold on a second, and please feel free to correct me if my English understanding is wrong, but isn’t PwC saying here that the amount of future purchase commitments that NVIDIA reports in its financial statements are based on management’s subjective assumptions on future demand? To me it looks like it is the case isn’t it? Furthermore, the degree of subjectivity looks like quite significant considering that, as we can read in the highlighted part of the disclaimer, PwC itself stated they had to rely on “significant judgment, subjectivity, and effort”.

So on one side, you have SMCI that was critical in NVIDIA’s supply chain since their cooling server technology (according to them) was critical to running NVIDIA GPUs efficiently, while on the other side, there is NVIDIA that was effectively relying on SMCI to build the servers so its GPUs could be delivered and the sale completed. There is one thing these companies have in common though: both have been caught cooking the books, lying to investors, and having disloyal employees before.

Fair question now: how many future orders for NVIDIA GPUs were linked to SMCI? As per information I shared 2 months ago in “SMCI – THE NUCLEAR NOTHING BURGER THAT CAN EXPOSE NVIDIA SHENANIGANS” SMCI alone officially accounted for one quarter of all the future orders of Blackwell GPUs.

Second fair question: if NVIDIA is now diverting GPUs deliveries away from SMCI (NVIDIA Starts Diverting Orders Away From Super Micro Computer (SMCI) As A Potential Delisting And DOJ Investigation Loom Large) what is going to happen to all future orders NVIDIA management, based on its “assumptions” estimated with regard to this relationship? Clearly, these future orders have to be restated.

Third fair question: if it is confirmed that SMCI again accounted as revenues products and services that weren’t instead delivered and paid for by its customers, isn’t it logical that this is going to impact NVIDIA’s 14 billion USD of accounts receivable reported in the latest 10-Q since SMCI won’t be able to pay for the GPUs NVIDIA delivered before?

Don’t worry though, NVIDIA does have time until January before its next audited 10-K is due, and you can trust the company will do all it can to steer clear of SMCI troubles. However, will its auditor still be on board with certifying all the value of the business done in the past with SMCI and all the future orders “subjectively” tagged by NVIDIA management on this business relationship? I will leave this question open for now.

Fun fact, there was another case in the past when an auditor allowed a company to include in its financial statements revenues and future orders based on subjective company management assumptions: ENRON.

JustDario on X | JustDario on Instagram | JustDario on YouTube