Is it possible for a bank to continue operating while being insolvent? The answer is yes, and Norinchukin Bank is the best example of it at the moment.

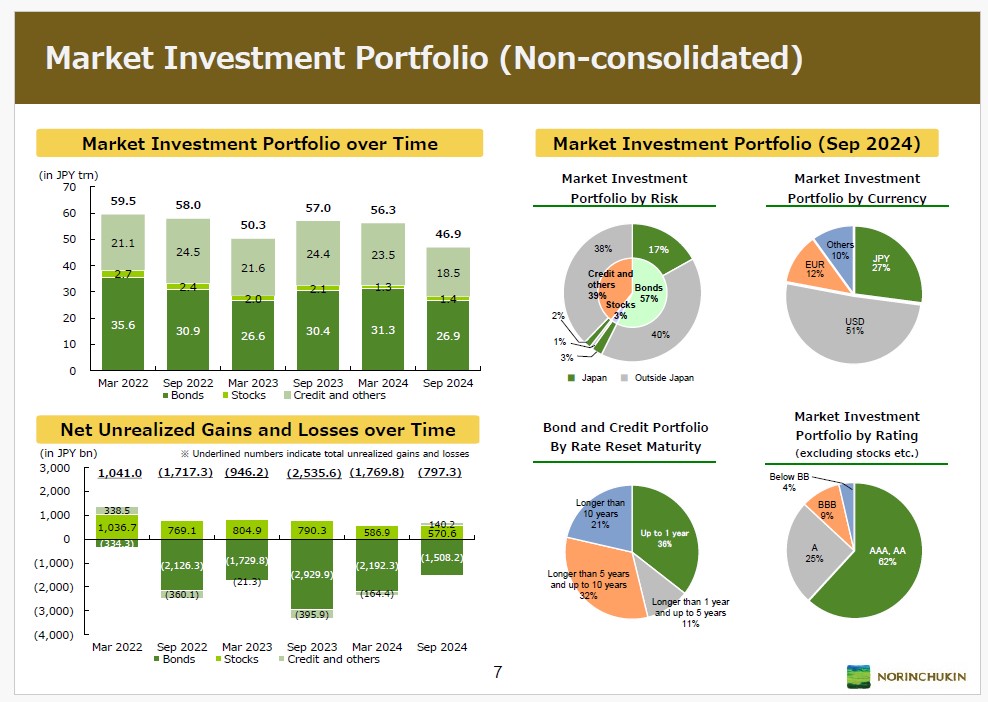

I started to follow Norinchukin closely a long time ago (article) and the reason why I continue is because this little-known bank outside Japan is among the biggest players in the global financial system, not just in Japan. In the latest article about it, NORINCHUKIN BANK CHAOS CAN TRIGGER AT ANY MOMENT, I argued the bank was on the verge of imploding under a mountain of (unreported) losses. However, a sharp decrease in yield after June 30th (the end of the previous reporting period) rescued them by increasing the “Mark To Market” value of the billions of toxic fixed-income assets on its books. Furthermore, as we are going to see later, the bank took the opportunity to sell a good chunk of its assets, limiting the losses (euphemism). Unfortunately for Norinchukin, as you can see from the chart below (we use 10y US Treasury Yield as a proxy), rates today are back where they were on June 30th. This means that the lower mark-to-market losses they just reported as of September 30th are more than double now only because of the move in rates.

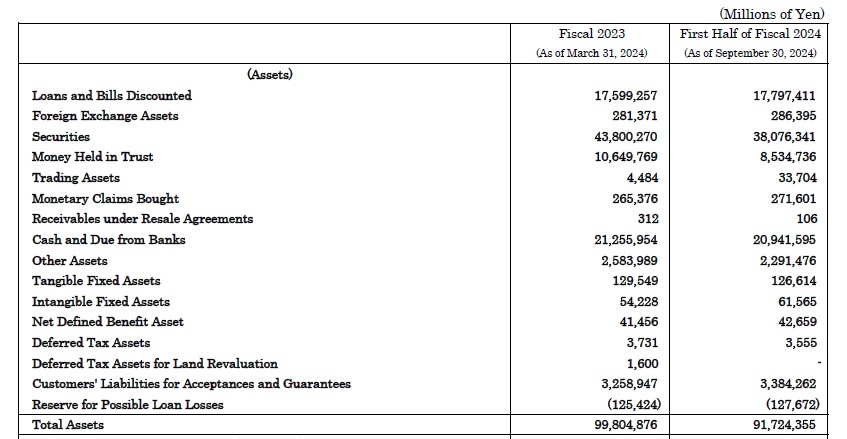

As you can see in the consolidated balance sheet below, Norinchukin as of September 30th held ~38 trillion JPY worth of Securities. This means that in the last quarter, they sold ~5 trillion JPY of them (the total amount reported on June 30th stood at ~43 trillion JPY).

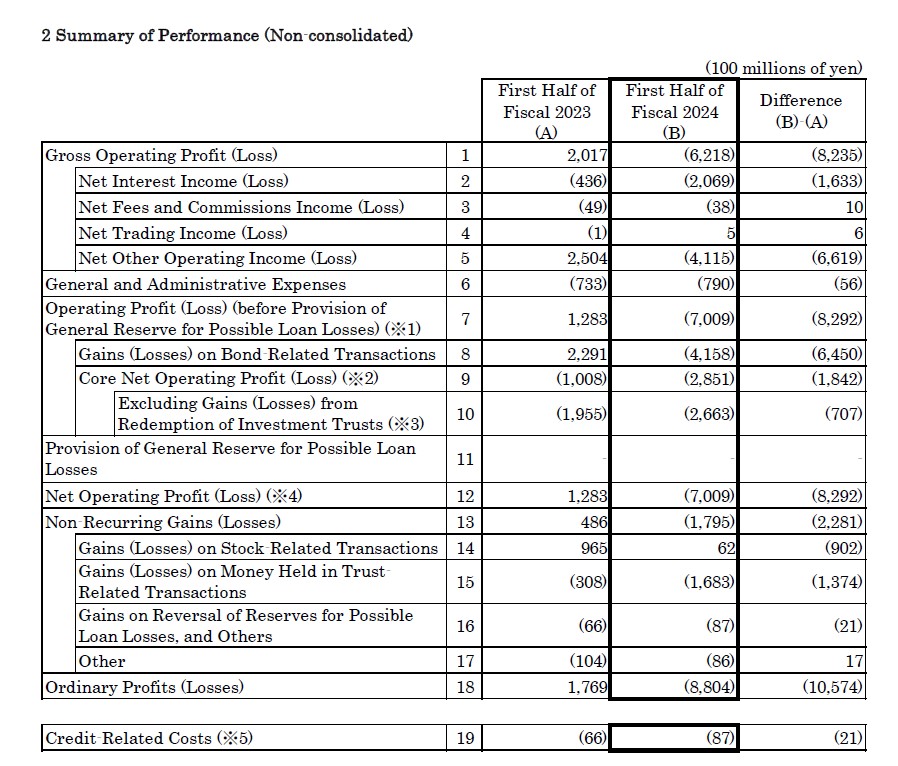

Now, how much money did Norinchukin lose? The loss reported for the first quarter stood at 181.3 billion JPY while the loss they just reported for the first six months of their fiscal year is 415.8 billion JPY. This means that in the last quarter, the bank lost 234.5 billion JPY, which compared to the total notional sold implies a ~4.7% loss on the principal.

Yes, compared to the ~18% loss on principal booked in the previous quarter, the bank did a better job. However, as I anticipated at the beginning of this article, rates are now back to where they stood on June 30th, meaning that the Mark-to-Market losses, calculated using Norinchukin (loose) criteria, are back too. As a consequence, the level of Mark-to-Market losses showcased in the latest disclosure is totally misleading and should be roughly ~1.6 trillion JPY

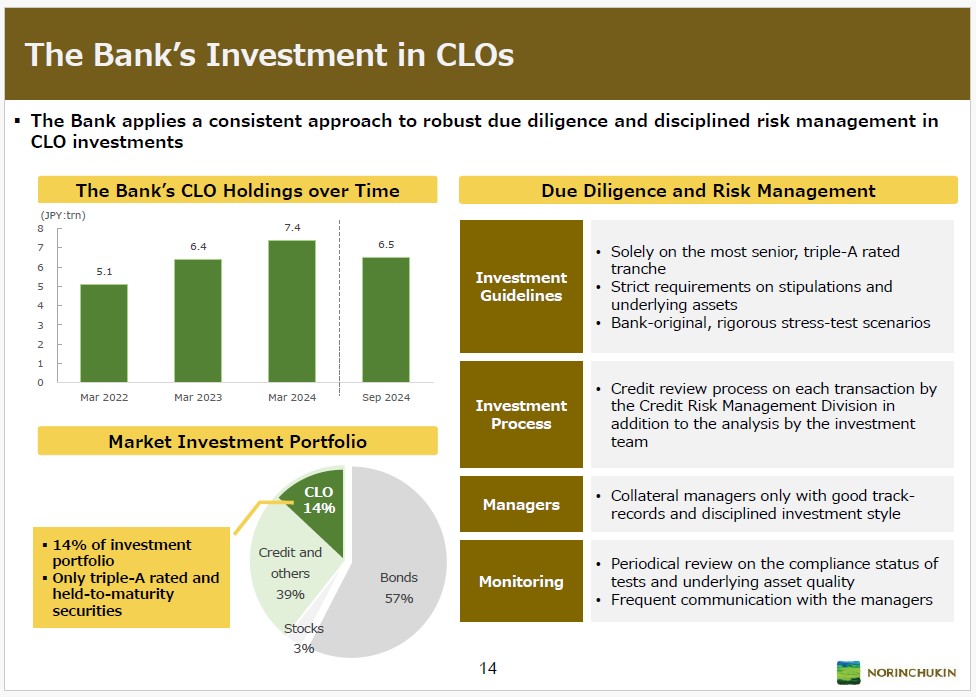

If we consider the updated Mark-to-Market calculated using Norinchukin criteria, then at the moment Norinchukin’s net capital stands at ~4.5 trillion JPY instead of ~5.3 trillion. Hold on a second, how is it possible that 6 months ago Norinchukin’s Net Capital was ~4.4 trillion JPY, they lost ~900bn JPY, and today the net capital (after updating the MtM) is ~4.5 trillion?! The answer is Norinchukin is not doing any Mark-to-Market whatsoever on the deterioration in the credit quality of its books, especially in its 6.5 trillion JPY of CLOs. How come? Because those CLOs are rated “AAA” and they consider the assets they hold as “high quality”. Yes, my dear reader, as I flagged in past articles, Norinchukin is repeating the exact same mistake that almost bankrupted them in 2008. Consequently, they are simply realising the (understated) losses they reported as “unrealized” six months ago.

Furthermore, Norinchukin accounted for virtually no allowance for expected credit losses in its ~18 trillion JPY loan book. The scariest part? If we consider that Norinchukin lost ~18% on the principal to liquidate securities when rates were at this level and we apply it to the ~38 trillion JPY of Securities left on its books, the level of unrealized losses is almost ~7 trillion JPY. How much is the total equity Norinchukin just reported? ~6 trillion JPY. Yes, my dear reader, Norinchukin Bank is insolvent and if we consider that usually banks tend to liquidate those assets where they have the least losses the magnitude of negative capital the bank is hiding is even greater. Now the question is, if it is so evident that Norinchukin is insolvent, rates are moving against it (even Japanese Government Bond ones) making the situation even worse and the bank is in no condition to raise capital as they have been trying to do for more than 6 months now (clearly investors are not that blind), how long will the market ignore this (huge) threat to the global financial system?

JustDario on X | JustDario on Instagram | JustDario on YouTube