If you think that the semiconductor stocks bubble popping will mark an end to the speculative mania, I am afraid that won’t happen for 2 reasons:

- Regency bias: traders, both retail and institutional investors, who profited in the recent past (thanks to central banks’ easy money for the most) will quickly look for another field of action

- The FED keeps running QE (indirectly): THE FED’S HIDDEN QE – HOW BANKS ARE PROPPING UP ASSET PRICES AT THE COST OF FUTURE INFLATION

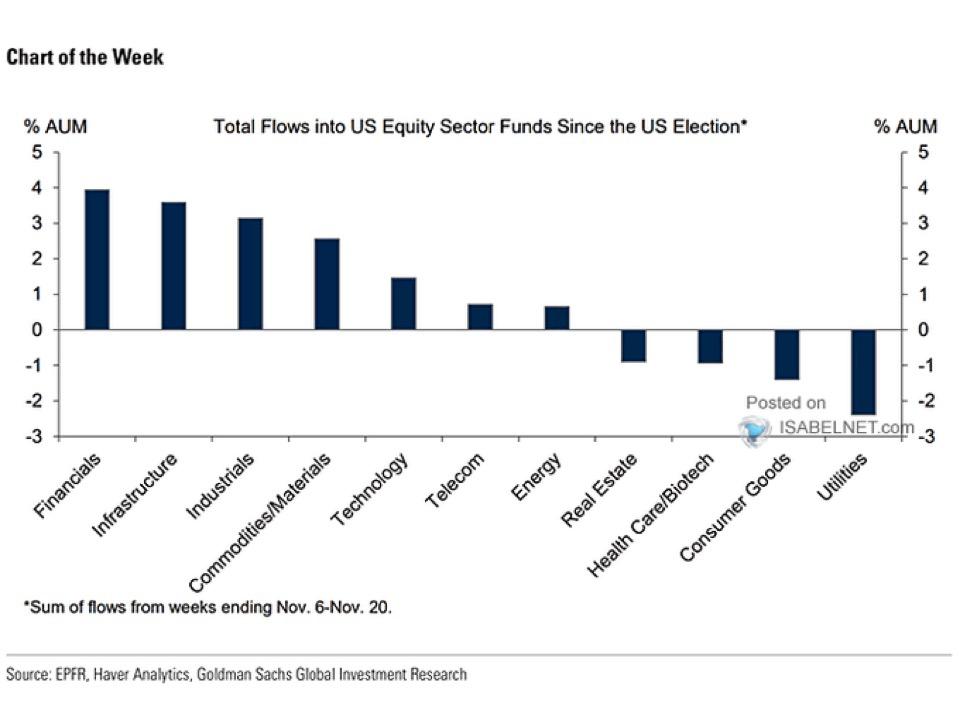

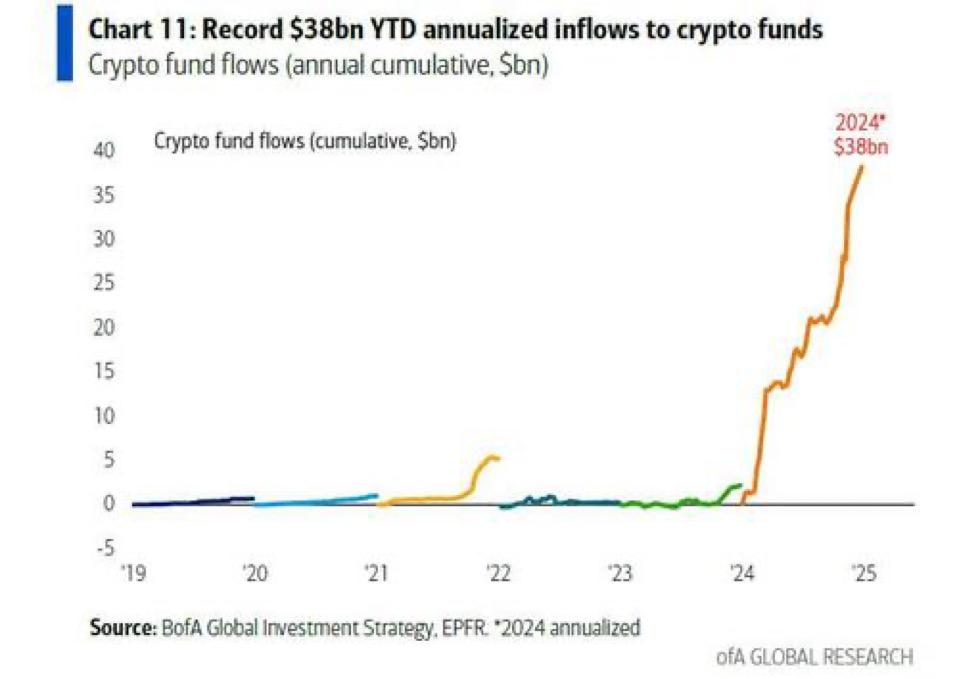

How are institutional investors going to reposition? As I already anticipated long ago, they will keep rotating into financial stocks and Bitcoin:

- NVIDIA WON’T CRASH MARKETS TOO MUCH BECAUSE TRADERS HAVE A BURNING HOUSE STILL STANDING WHERE THEY CAN HIDE

- WHY A BITCOIN ETF WILL REMOVE THE BARRIER BETWEEN CENTRAL BANKS’ MONEY PRINTING AND CRYPTO

- IS THIS BLACKROCK’S MASTER PLAN FOR BITCOIN?

Don’t believe me? These are the latest data

From the other side, what is the only asset class that right now can allow retail investors to continue chasing their “getting rich quick” dreams? Easy answer: crypto altcoins.

Stock options trading and crypto altcoins trading share some fundamental concepts but differ significantly in their mechanics and risk profiles.

- In options trading, you deal with derivative contracts that grant the right, but not the obligation, to buy (call) or sell (put) an underlying stock at a specific strike price before expiration. This makes timing essential, as the value of an option erodes over time due to theta decay.

- In contrast, trading crypto altcoins involves directly buying and selling little-known tokens (when they are already large market cap projects, the comparison with options isn’t in place anymore), that are highly illiquid like OTM call options, meaning large trades may significantly impact prices due to low order book depth.

Both offer high risk/reward potential, but the drivers are different: options pricing is influenced by variables like implied volatility and the underlying stock’s movement (even though this is more and more often highly influenced by options trading that cascades on market makers hedging buy and sell activity on the underlying stock), while altcoin prices are often shaped by speculative demand, project news, or market sentiment.

In simple terms, an investor chasing a 10x if not 100x return in a short time frame can only achieve that either trading options or low to micro cap crypto altcoins.

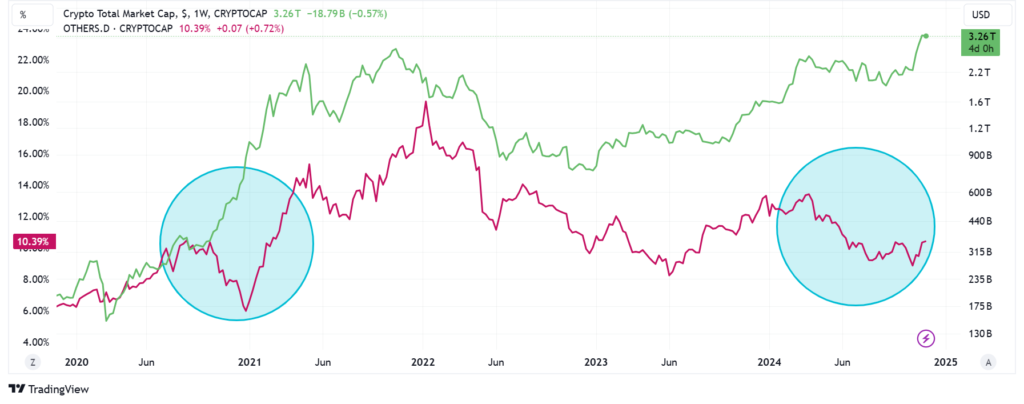

While institutional investors have already begun to rotate out of MAG7 and hyped investor stocks, retail hasn’t done it yet, as is clear by the amount of social media and MSM coverage catered to retail audiences between stocks and crypto. The latest craze you saw on platforms like pump.fun was for the most part a zero-sum game of liquidity already within crypto, and what I am saying is also supported by the altcoins dominance (crypto market excluding the 10 largest crypto cap vs total) as you can see in the chart below

Highlighted in the chart you can see a very typical characteristic of the crypto market: Bitcoin and the large market cap coins always tend to lead the altcoins season. The reason is pretty simple: the higher these large assets go, the lower the incremental returns that can be achieved by holding them. As you can see from Google Trends, as a result, the interest in “Bitcoin Investing” is fading among the population (not Wall Street though, which is more than happy with 10-20% yearly returns)

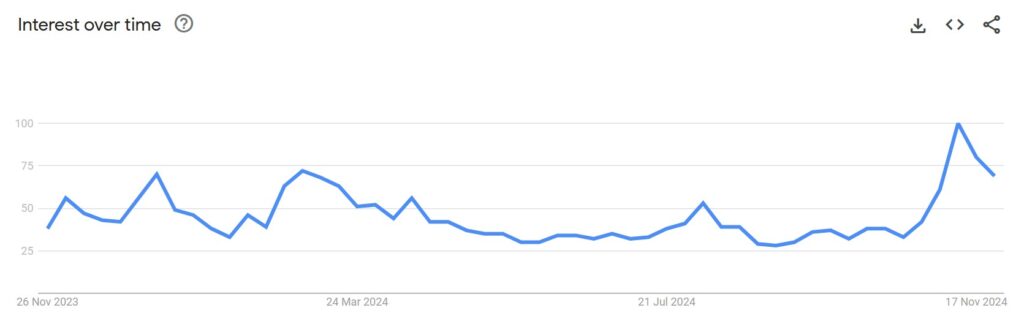

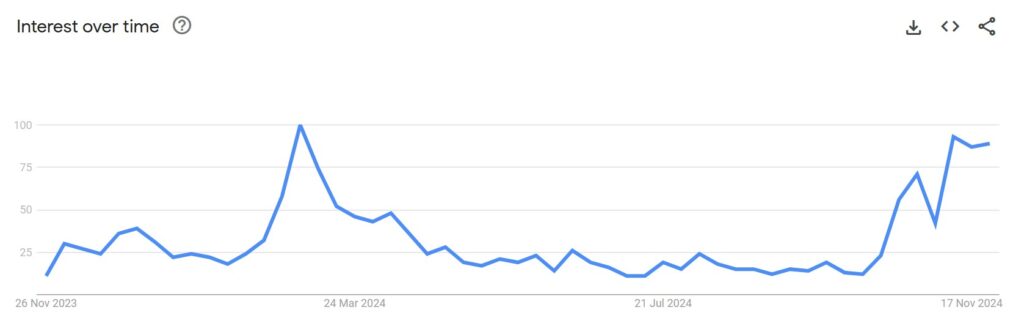

What about interest in crypto altcoins? Here you go.

To conclude, with the likes of Nvidia, Microsoft, and Apple struggling to keep rising at a breakneck pace, speculators are already looking for the next big trend and I believe now there is little doubt what’s likely going to be the next one. Just be careful though, not all projects are the same, and always apply strict fundamental considerations rather than falling for FOMO if you decide to venture into the space: A CRYPTO UPDATE TO BEN GRAHAM’S “THE INTELLIGENT INVESTOR”

Happy Thanksgiving to all my dear US readers, I wish everyone a great time with your families.

JustDario on X | JustDario on Instagram | JustDario on YouTube