As I am writing this article, SoftBank Group shares are up ~5% after the release of the latest Full Year earnings results. We know that traders nowadays only follow headlines that are carefully crafted to always deliver the most bullish narrative and hardly spend any time digging into the numbers within the financial statements taking everything the management says at face value, but holy cow! In the case of SoftBank, the situation is simply absurd.

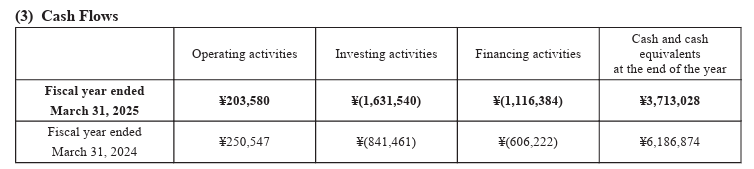

The first huge warning flag that doesn’t require any expertise in forensic accounting to spot is the massive decrease in cash SoftBank experienced from 2024 to 2025, as you can see from the first table below that can be found right at the very beginning of SoftBank’s report (and clearly a sign investors don’t even read the very first pages).

3 months ago in “HOW SOFTBANK IS FIGHTING BANKRUPTCY” I highlighted how SoftBank’s liquidity situation was deteriorating fast and how the holding company was trying to “milk” all it could from its subsidiaries, especially SoftBank Corp, to portray an illusion of being solvent while it was busy borrowing as much money as banks and investors were willing to lend through loans and bonds. At the same time Masaponzi Son was scrambling for cash for SoftBank, he was also busy making hyperbolic promises like the commitment to invest 500bn USD in the United States along with Oracle and OpenAI (SoftBank, OpenAI, Oracle to invest $500 billion on AI in U.S.). At that time I was in good company to warn about the complete nonsense of that PR stunt since the one and only Elon Musk also warned publicly that Masaponzi Son did not have the money to back his commitments (‘They don’t actually have the money’: Musk slams AI project).

The smoking gun that proves how SoftBank “did not have the money” can be found in the latest financial report:

“To fund the investment in the first closing, in April 2025, the Company borrowed $8.5 billion from Mizuho Bank, Ltd. and other financial institutions, and lent the same amount to SVF2. Of the loan to SVF2 from the Company, 17.25% of the principal and its interest is guaranteed by Masayoshi Son, Representative Director, Corporate Officer, Chairman & CEO of SoftBank Group Corp”

“On April 15, 2025, the investment of $10.0 billion in OpenAI Global was completed. Of this, $1.5 billion was syndicated out to co-investors on the same date, and SVF2 invested the remaining $8.5 billion. SVF2 retains the right to further syndicate an additional up to $1.0 billion of the convertible interest rights it acquired at the first closing to co-investors up to 90 days after the first closing. If such additional syndication is executed, SVF2’s investment amount of $8.5 billion will be reduced by the corresponding amount”

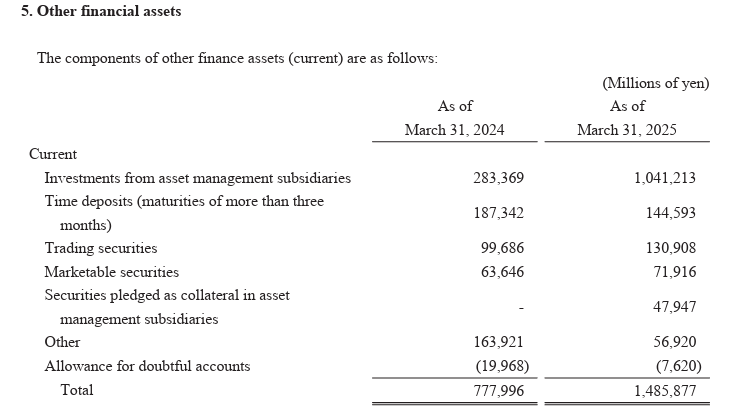

As per the latest financial report, SoftBank had ~3.7 trillion JPY left of Cash, roughly 25bn$, which still looks like a lot but in reality is dangerously low. After deducting ~1.8 trillion JPY that SoftBank needs to hold to cover the equivalent amount of deposits it collects from its banking operations in Japan, the Group is left with ~1.9 trillion JPY of available cash. Trade receivables and payables net each other, and what SoftBank has left in its current assets are “other financial assets” that mostly represent the liquid part of the investment portfolio of SoftBank asset management subsidiaries

What about interest-bearing debt? SoftBank already piled up an astounding 21 trillion JPY of it, out of which ~5.6 trillion JPY is due to be repaid in the next 12 months. Let me summarize here: on one side, SoftBank has ~1.9 trillion JPY of available cash plus ~1.5 trillion JPY of marketable securities we assume the reported amount is fair (although I would not bet on it personally). Still, SoftBank has a 2.2 trillion JPY hole to fill ASAP. In December 2024, a syndicate of banks agreed to increase the amount of loan collateralized by ARM shares from 8.5bn USD to 13.5bn USD; these additional 5bn USD equivalent to ~750bn JPY are still available, and surely SoftBank will grab this money. At this point, we are left with ~1.5 trillion JPY shortfall SoftBank has to come up with ASAP not to default on its current debt. Considering the cash flow from its operations is little, SoftBank does not have much alternative but to try to borrow this money in any way it can as soon as possible.

Clearly, rather than trying to salvage its operations and repay its debt, Masaponzi Son (a famous hardcore gambler) doubled down on his AI bets, leveraging even more and piling up future commitments for hundreds of billions of USD it cannot realistically afford to pay. His play is clear here: bet on a massive AI boom to make a truckload of profits and take him out of his troubles. However, unlike the Dotcom bubble when he did exactly the same but was lucky to be early enough to have enough assets left to pay his debt and remain in business, this time Masaponzi FOMOed right at the very top and realistically speaking, he has virtually zero chances to survive the burst of the AI bubble that has been inflated already to the stratosphere.

JustDario on X | JustDario on Instagram | JustDario on YouTube