As you know, I am currently in mainland #China, so please forgive me if I am going to be extra careful about anything I write until next week.

Yesterday, #China #stocks suddenly started to free fall in what could have turned into a 1987 style crash if it wasn’t for circuit breakers and the big support coming from the Chinese “national team”. #Stocks indexes only started to bounce back after trading in about 25% of all listed companies in #China was suspended for the day. What could have triggered such panic selling?

Last week, I warned about a potential big dump coming for #China #stocks due to the unlock of many controlling shareholders’ shares post-IPO (TwitterX) and it looks like that is what triggered Monday’s mayhem in Chinese #stocks. In a practice very common in investment banking, many brokers lent money to company founders against their pre-IPO shares as collateral in order to secure the IPO mandate. However, what no one could have expected during the “everything is #bullish” years was that by the time the shares became tradable, all the collateral was underwater.

Imagine brokers rushing to sell altogether as fast as possible to cover their margin lending losses in a market that is completely illiquid and you have the perfect recipe for a #stocks disaster. Considering that the selling happened in many #stocks that just IPOed, the crash was more acute because of the already low market cap and razor-thin liquidity. That triggered a chain reaction of margin lending unwinding across the board that only stopped once the circuit breakers were hit one after the other, forcing the selling to stop.

As you can see from chart 1 here, not only are there still 1.55 trillion $CNY of margin loans outstanding, but traders (in particular the “Dumb & Dumbers” hedge funds) levered up big time to #BTFD from mid-September till December 2023 while #stocks kept grinding lower.

All in all, what you are seeing right now happening between #China and #HongKong is a massive liquidation of #stocks collateral (that looks like far from ending).

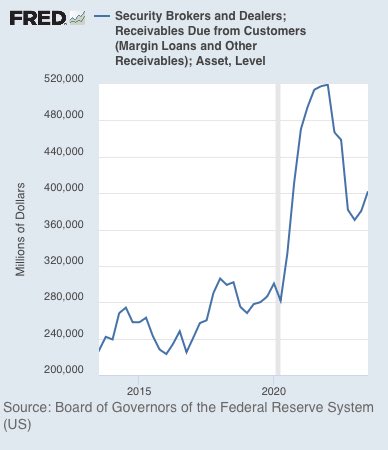

Now, do you think #China is an isolated case in the world? Of course not! Even if brokers’ margin lending eased in western countries since the 2022 peak (see chart 2) and now at about ~400bn $USD in US, in reality, the “indirect” leverage kept growing, fuelling the #stocks bubble. I know I sound like a broken record here (TwitterX), but clearly, no one out there can still connect the consumer debt dot with $NVDA and other popular retail #stocks out there that keep running against logic and gravity.

As I said in the title, what’s happening in #China is a big warning to people out there still gambling wildly with borrowed money in both the #US and #Europe. Never forget that bubbles bursting make gains disappear, but debts do remain and, like many of our parents learned the hard way during the Dot-com bust, it can be very hard to recover after that.

Read on Twitter