As you know, I have been investigating US real estate, especially #CRE, since early last year (JustDario). Nowadays, the ginormous bubble popping up while #stocks keep hitting new ATH records is not a secret anymore. Surprisingly, despite the banking crisis that started in January 2023 and was never solved (the banks’ bodies were just put on #BTFP life support… which expires in 20 days, FYI ⚠️), the situation in the US hasn’t reached the panic stage, yet.

What about Germany? Well, during the last earnings call, the management at Deutsche Pfandbriefbank ($PBB) literally said what’s happening is the “greatest real estate crisis since the financial crisis”. There is a partial lie here. Why? The magnitude and size today for Germany are much bigger and more dangerous than in 2008.⚠️

🚩 First of all, compared to 2008, the total amount of outstanding mortgage lending in Germany today is 5x larger at ~5.8 trillion $EUR (Picture 1). For reference, this figure overall is only ~30% higher in the US versus the 2008 peak, although in the US the size is, of course, bigger (above 12 trillion $USD at the moment). However, if you compare these amounts with the respective economies, that’s when the goosebumps start coming.

🚩 The total outstanding mortgage lending alone in Germany is ~140% of its annual (now even decreasing) GDP. What about the US? That proportion is “only” ~40%. 🙈

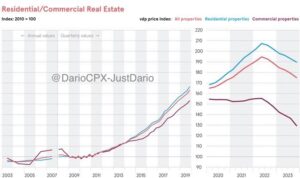

🚩 Now, everyone looks at nominal real estate prices, and there already the situation is quite bad with prices across properties in free fall (Picture 2). Please note that the Mortgage Lending growth peaked in Germany exactly when the real estate prices peaked… “ponzinomics” 😉

What if we combine the drop in prices with the lending volumes in Germany? Nominally speaking, the result is about 200bn $EUR of losses in the system, and yes, that amount in absolute terms is already larger than the credit losses estimated so far in the US! 🤯

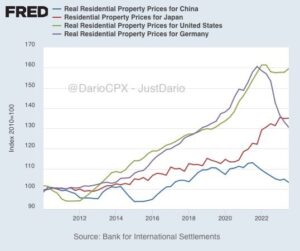

🚩 The situation becomes even worse if you shift the focus from nominal prices to real prices (the ones that truly show the strength of an economic driver). Before looking at Picture 3, please grab some 🍿.

Alright, let’s look at Picture 3. Please let me know in the comments how low your jaw dropped 🙏🏻 Personally speaking, I was shocked too when I discovered that China’s real estate crisis is peanuts compared to Germany! The mortgage lending in both economies is similar (~5.3 trillion $EUR equivalent for China too), but in the aggregate, the magnitude of the drop in residential properties’ real prices in China is a fraction of the one in Germany!

🌟 Conclusion 🌟

As you can see in Picture 4, the transactions in the German markets are about to come to a standstill, and I sincerely doubt that without “ponzinomic” dynamics, prices will remain where they are. It looks like $PBB’s CEO agrees with me since he said they expect the worst drop in property prices in 15 years, particularly in Commercial Real Estate.

Let’s end this post with a joke. Do you know how many reserves Deutsche Bank set aside in Q4 to face potential Commercial Real Estate credit losses? 123 million $EUR 🤣. Ah, sorry, it isn’t a joke.

Read on TwitterX