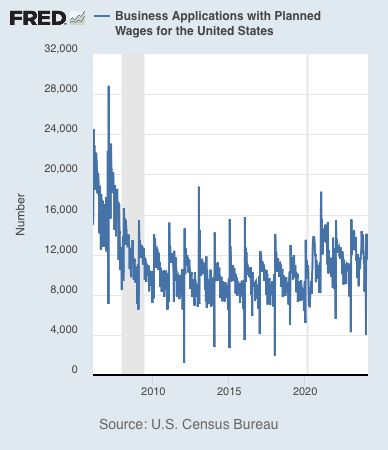

How many people have you read about or heard from lately who told you things like “hey, I am taking my savings and investing in this restaurant” or “I am so good at my job I quit and set up my own shop”? I bet very few. Indeed, new business registrations planning to pay wages (meaning not the “fake” empty shell companies for whatever fiscal purpose needed…) today in the US are just a fraction of what they were pre-GFC.

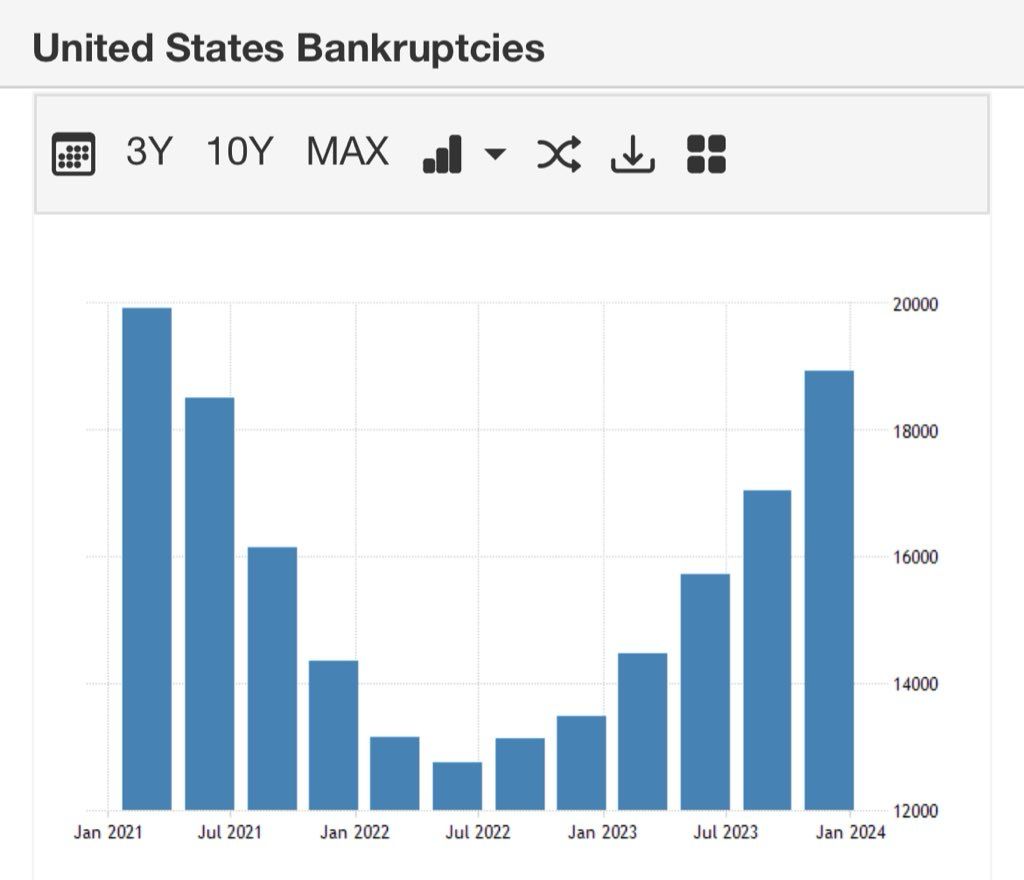

What about US bankruptcies? As you can see in the second chart, here as well the music is out of tune with financial markets. 🙈

The situation in Europe, while the ECB is busy trying to trash Bitcoin, is even worse. Germany, the “locomotive” of the continent, is imploding and their own central bank is even warning about it 🤯

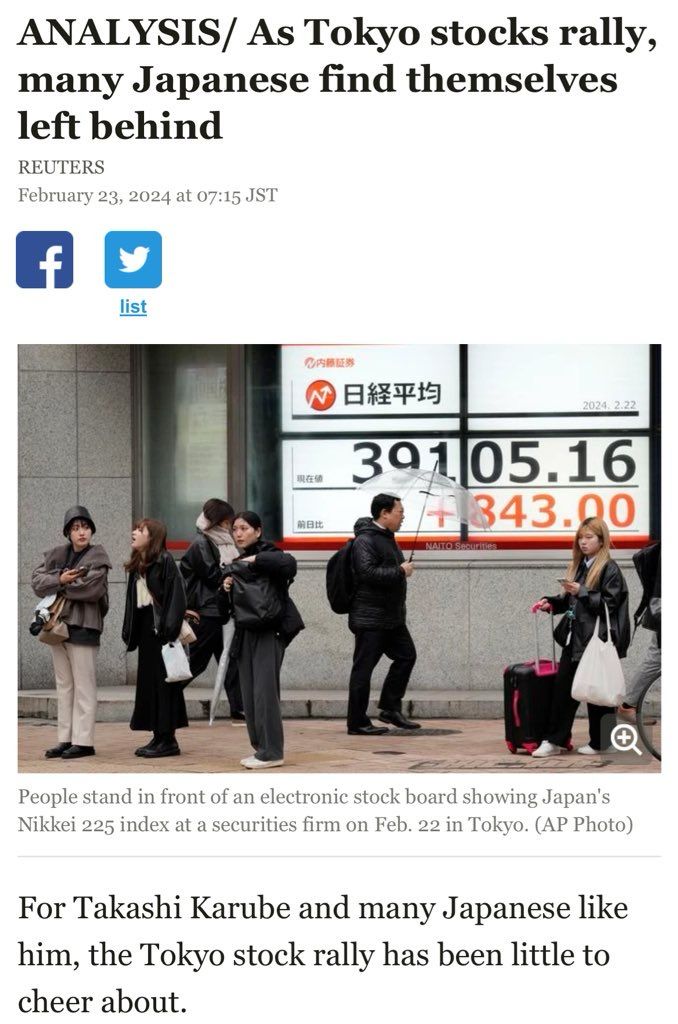

What about Asia? Yesterday, the Nikkei stocks index hit all-time highs again after more than three decades and in the article below, you can see how these new records feel compared to the one in 1989.

Let’s be honest, how many countries and their respective stock markets can we apply the same title to?

“As DAX stocks rally, many Germans find themselves left behind” – Sounds about right, doesn’t it? 😅

“As SPX stocks rally, many Americans find themselves left behind” – Same as above, right? 🤷🏻♂️

Now, what is the real problem here, and why am I saying Central Banks, starting from the FED, must hike rates, not the opposite? The whole purpose of Quantitative Easing was to inflate financial assets’ value so then this “wealth effect” could trickle down from the rich to everyone else living in the real economy. Well…I think we all agree this didn’t happen, right?

As I have reminded you many times, repeating the same action over and over again expecting a different outcome is the definition of insanity. Do you think that central banks cutting rates and running the money printers at full power once again will improve anything in the real economy? Of course not, why? Because financial assets, from stocks to bonds to derivatives, are siphoning non-stop every drop of stimulus that was meant to support the real economy. Furthermore, seeing how “easy” it is to make money investing, so many people who didn’t care about markets at all have turned into wild speculators, throwing their savings into the game in the hope of winning a life-changing 0DTE jackpot. This can only stop when the real value of money is re-established with interest rates at a much higher level so people have a proper remuneration for their savings and investments in the real economy without feeling the pressure to gamble them away in stock options to survive.

I know some people would argue “when there is a buyer in the market there is a seller”, true, but this doesn’t stop fake wealth from being created and cash from being siphoned. Want an example?

1 – I have 10 stocks of A priced at 1$ and 10$ cash and my friend has 50$ cash. My net worth is 20$ vs 50$ of my friend.

2 – I sell 4 stocks to my friend for 40$, now my net worth is 110$, right? What about my friend? Still 50$

3 – My friend’s friend sees I increased my wealth 550% overnight and wants to buy the stock, so I sell him 1 stock at 50$ because my friend wouldn’t sell for such a small gain. Now my “net worth” is 340$, 250$ in stock A and 90$ cash.

4 – I want to become even richer, so now I go to my first friend and I buy 1 stock back from him for 80$. My friend now has 90$ cash and 240$ worth of stocks for a total of 330$ vs his initial 50$! What about me? Now I will have 10$ cash left but 5 stocks “worth” 400$ for a total of 410$.

When does this cycle stop? Logically, when the cash isn’t enough to buy new shares. But what if I can print new money? Here we go… This is how financial assets are drawing away from the economy any liquidity that instead is meant to stimulate it! 🙈