Jeff Bezos, Mark Zuckerberg, Jamie Dimon, the Walton family, $AMD CEO Lisa Su are just some of the high profile insiders that have been selling big chunks of their #stocks in recent weeks. If you take a snapshot of insider volumes in the last 60 days (chart 1 – credit @Barchart), the selling stampede is undeniable.

I have a question for all those people in constant denial of anything that goes against the raging bull-ish narrative: do you think they can sell more than what they are currently doing? Of course not, for plenty of reasons like:

1 – Market Volumes

2 – % of their shares already pledged with their brokers versus equity loans they got in the past

3 – Risk of signaling a significant lack of confidence in their company

4 – Taxation

5 – Need to reallocate those billions in other investments because they cannot be kept in a bank account

Now, hoping that at this point we all agree that what’s happening is both unusual and a big deal worth paying attention to, let’s try to investigate what can be the reasons behind this.

🚩 Are banks starting to call back their equity financing loans?

According to FINRA statistics for January 2024, Margin account balances rose again above 700bn+ in the US alone and there is a high chance that, considering the stretched valuations #stocks are trading at, this is making some bank risk managers pretty nervous. Wealth Management Lending against #stocks boomed in 2020-2021 and was one of the major sources of revenue for banks that could cash out fat fees while waiting for ZIRP to end. Coincidentally, #stocks peaked in 2021 at the same time when banks took a breather on this activity. Is the same happening right now?

🚩 Are other sources of cash flow drying out?

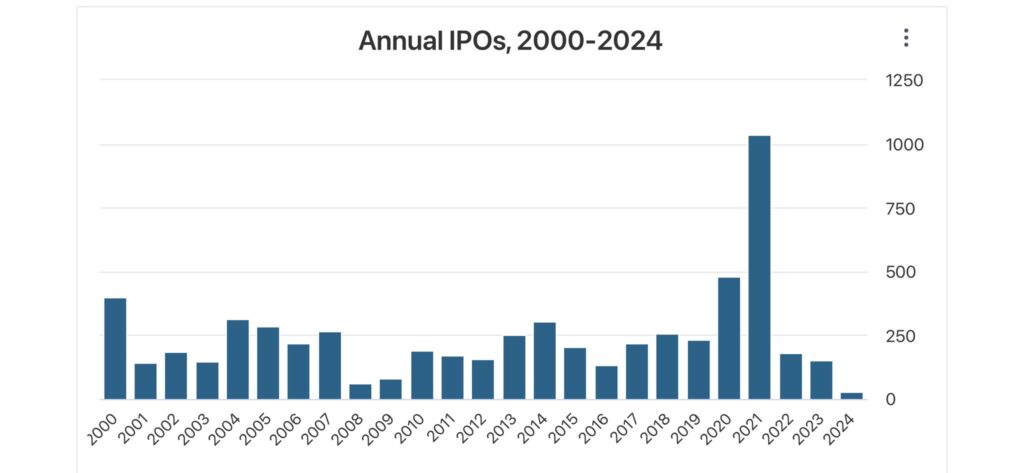

Ultra high net worth individuals (UHNWI) are notoriously one category that allocates substantial portions of their wealth into private equity funds. Despite the boom in #stocks, the IPO market is almost completely shut as a sign that current valuations might be a bit unrealistic and not everyone is #fomo blind out there.

Because of this, private equities distributions took a significant hit to the point that many of them rushed to raise debt against their NAV to keep paying their investors and raising a fair amount of concerns about the health of their assets

🚩 Are they worried about market liquidity?

Passive investing is a double-edged sword. Because of its nature, it is an incredible amplifier of herd behavior both on the way up and on the way down. However, the biggest risk it poses is liquidity since a larger and larger amount of #stocks isn’t truly part of the market float anymore. Consequently, the exit window for those who hold significant amounts of shares becomes narrower and narrower. Furthermore, it is undeniable that derivatives now drive the vast majority of trading volumes with brokers gamma squeezes a driving force of #stocks upward move (my last warning in the post below). What do you think is going to happen if the tides suddenly turn in an illiquid market?

🚩 Do they simply know “something”?

Frankly, I don’t care about speculating here, it’s a waste of time, considering it is undeniable how market, macroeconomic, and geopolitical risks are mounting. Clearly, Jeff Bezos doesn’t need 8bn$ to pay for his girlfriend’s shopping, his bills, and groceries just like Mark Zuckerberg doesn’t need billions to build himself a doomsday bunker in Hawaii. They are clearly seeing something coming that so far we cannot figure out.

Back to the question in the title, from 1929 onwards, those “who knew” walked away from danger in advance before it became too obvious and too late to make it out after everyone figures out the exit doors aren’t large enough to leave the theatre on fire and the (panic) selling stampede begins.