What the hell happened at 10:22 AM Eastern Time? Something snapped, and you can see that without a shadow of a doubt in the #VIX chart. However, as you can see, I highlighted a smaller snap that occurred right at the start of US #stocks cash trading.

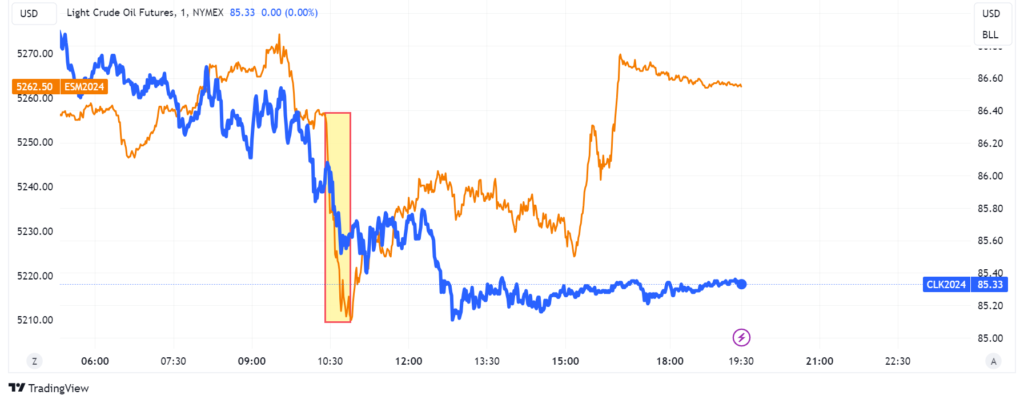

At the very first moment, I thought Iran cut the chase and pulled the trigger on the retaliation against Israel they have been threatening for days now. But no, clearly this wasn’t the reason and it became quickly obvious considering stocks and oil both snapped in the same direction (while oil should have spiked in case of an escalation in the Middle East)

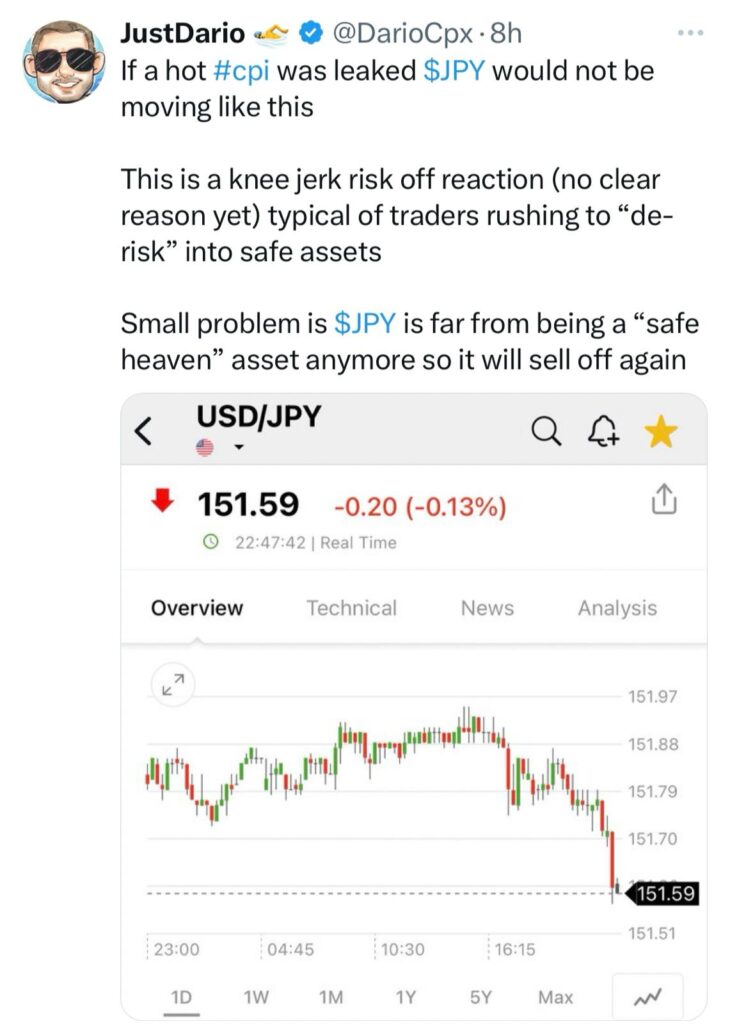

Then, was the US CPI leaked as many “VIP” accounts assumed across socials? No, it wasn’t and I pointed that out immediately.

As expected, the USD/JPY FX rate then came back to 151.75, the level the pair has been so obviously pegged to for more than a week now.

Alright, at this point we can say with a fair degree of confidence that nothing “macro-related” struck US stocks at 10:22 AM EST.

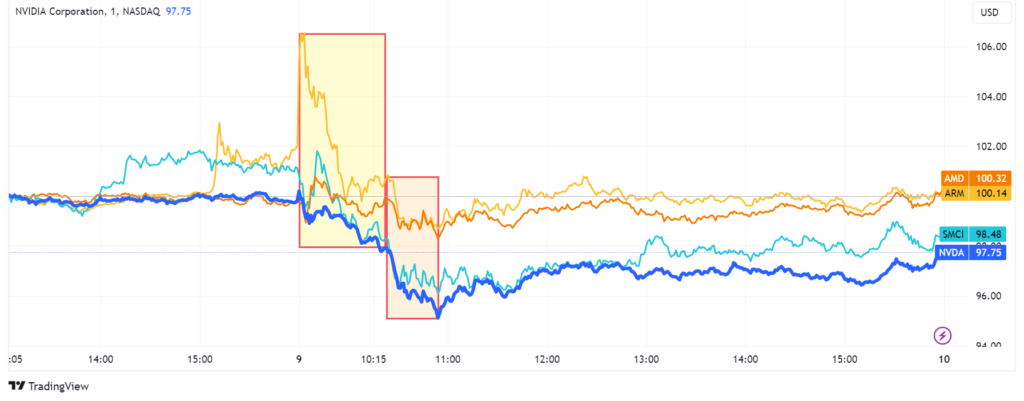

Shifting our focus to some specific semiconductor stocks that all have in common an incredible popularity among options traders (all sharing a common passion for gamma squeezing), we can start identifying a clue of what might have triggered that sudden move in the market. As you can see from the chart below, the likes of #ARM, #AMD, #NVDA, and #SMCI all started being hit with selling orders immediately from the beginning of the cash trading session, particularly via put options (that showed up in the first snap of the VIX I highlighted in the first chart above). Then at 10:22 EST, something very interesting happened, while the selling on these 4 names accelerated (but did not snap), the VIX instead spiked.

What about the broader stock market? Yes, let’s now include all the MAG7 into our chart and set in grey the previous 4 stocks as a good proxy for the market considering they represent almost 33% of it all together. Well, do you notice anything interesting? I do, #META suffered a very similar selling pressure right from the open, similar to the four stocks above. What does META have in common with them? Well, wasn’t this name another very popular one among gamma-squeezing traders for many months? Yes, it was. However, as you can see, all the other MAG7 were gingerly trading upward till 10:22 AM EST when all of them started being hit with selling orders (while the VIX spiked).

Putting all our clues together, what we likely saw happening yesterday was the beginning of the unwinding of a portfolio carrying a large number of positions (likely in derivatives) particularly heavy on the aforementioned 5 “VIP” stocks displaying a high degree of correlation among themselves as we saw. Then the liquidation was “sniffed out,” and I see a high chance HFT momentum hedge funds started to place bearish #0DTE index positions to profit from the trend. However, as I flagged even before stocks began trading in this post here (link), when a market is so incredibly illiquid during a period of the year when it is not supposed to be, that’s a pretty ominous sign something (usually not good) is brewing somewhere. As a consequence of low liquidity, it does not take a large number of trades in a specific direction to suddenly move the whole market, and that’s what we saw happening several hours ago.

As you know, I warned an incredible number of times about SoftBank and Masa Son’s habit of weaponizing derivatives trading, often piling up positions so large that they could move entire stocks if not the entire market, even the FT called them out so I have good company here (SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally). Furthermore, #SoftBank is not a “bank,” so without capital requirements to be bound by, they could leverage themselves above and beyond what they should be allowed to. In case you thought this was enough, I am afraid it isn’t. #SoftBank also put itself in a position to lose billions of USD the more JPY loses value against the American currency.

All in all, what happened yesterday might well be the second chapter of what I warned about last week in “WHY IS #JAPAN SO SCARED ABOUT $JPY CROSSING 152 AGAINST THE $USD?”. A rescue of troubled SoftBank positions would also explain why after 10:22 we saw the JPY strengthening along with a timely (and rather big) VIX dump that heavy-lifting all stocks in the market so to soothe Masa Son’s pains.

Considering how big is #SoftBank’s mess, if they won’t be able to rescue them again (because this is not the first time they needed it) before their troubles hit escape velocity, what is going to happen in the next day and weeks will make the Archegos saga look like an episode of Peppa the Pig in comparison.