Despite the #BOJ panic intervention as soon as the #JPY broke 160 against the #USD, and a US Treasury QRA (Quarterly Refinancing Announcement) that has been disclosed for an amount higher than expected, the longer end part of the US government bonds yield curve did not bother to move that much in the last trading session and instead deflated like a botched chocolate soufflé. Why? For three reasons:

1 – The #BOJ intervened in the market using forward contracts that do not require the immediate selling of US Treasuries (more details in this X-post)

2 – Brokers hedging of the #BOJ transaction did not hit the spot market yet

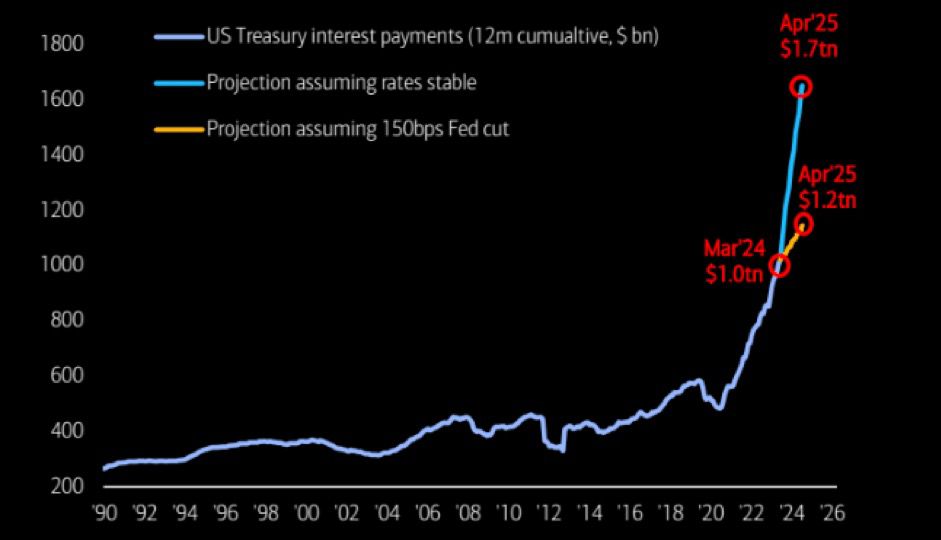

3 – The broad market still nurtures dreams of #Fed Funds rate cuts in 2024 that are projected to significantly lower the rise in US Government Debt total interest payment from a projection of 1.7 trillion #USD in the next 12 months to “only” 1.2 trillion under the assumption 3 rate cuts are delivered (chart below); according to the consensus view this should ease the upward pressure on longer-term yields.

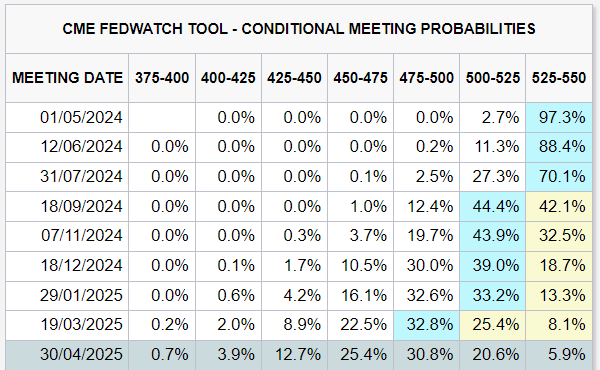

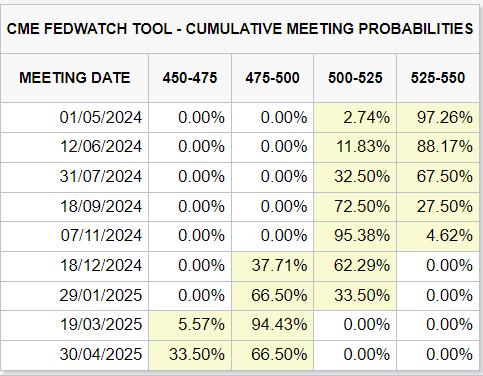

I am afraid so many people are so wrong here. Personally, I do not understand how “bulge bracket” brokers predicted 7 rate cuts only a few months ago (while I was already saying #FED should have raised rates instead in “THE GREAT PARADOX – BECAUSE OF DECADES OF RECKLESS QE, CENTRAL BANKS SHOULD HIKE RATES TO SAVE THE REAL ECONOMY NOT THE OPPOSITE”) still enjoy some credibility now that they have been forced to “predict” only 2 of them and the market is even hardly believing in one full rate cut to be delivered by the end of the year.

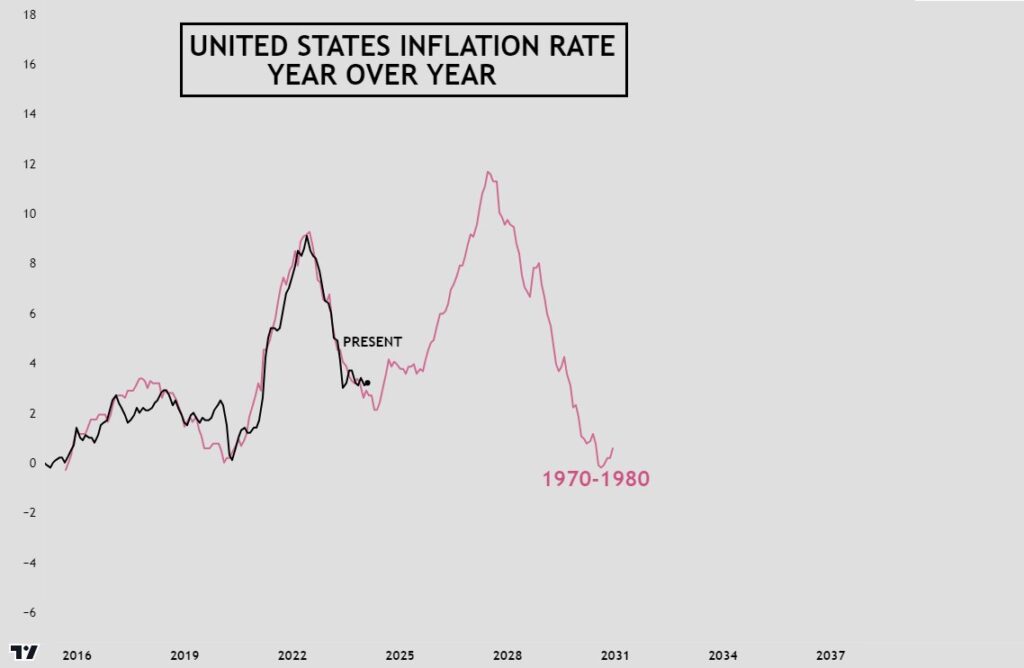

Same story for the very wrong predictions about inflation that was only slowing down in, politically seasonally adjusted, public data while it never slowed down in the real world (”THE REAL FIGHT AGAINST #INFLATION HAS NOT EVEN STARTED YET“). In the same way predictions about the US GDP will be proven wrong since the US economy stopped growing in 2021 in the real world (”STOP DREAMING – THE US ECONOMY HAS BEEN IN A RECESSION SINCE Q2 2021!”).

As if the setup was not inflationary enough already, the #FED now has 2 additional headaches to deal with:

- #BOJ interventions to prop up the value of the #JPY are a form of stealth QE.

- Illegal immigration is very inflationary and no one seems to realize that.

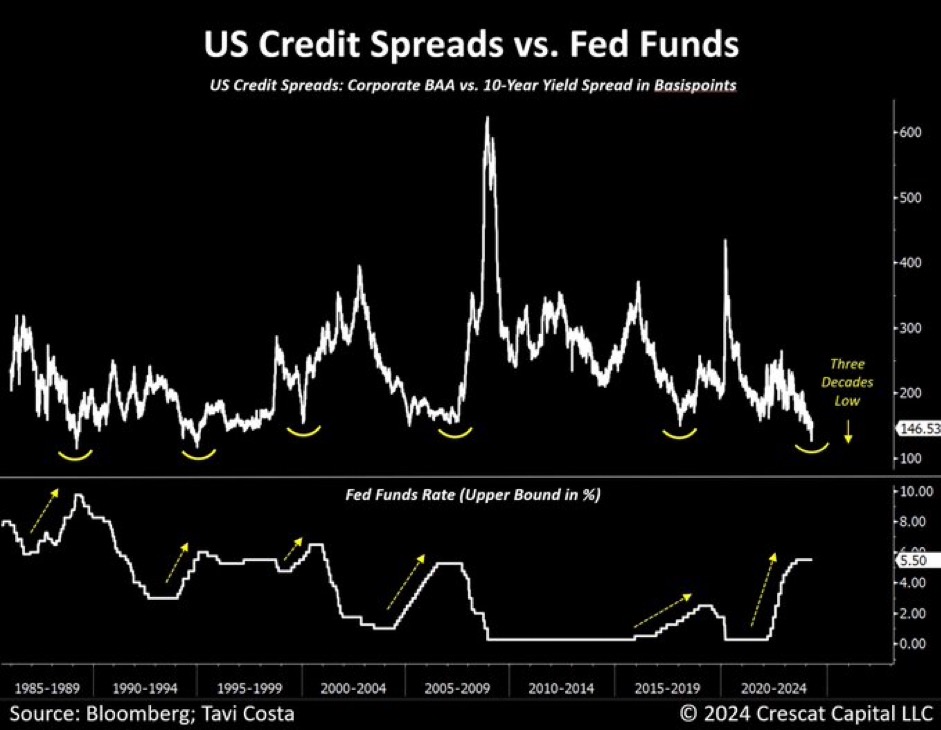

Let’s start from the first point that it should be obvious by now, but apparently, it isn’t still. When a foreign central bank holds US Treasury reserves they are effectively holding future $USD (since that is what government bonds are in a fiat currency world). Now, what do you think is going to happen when the US Treasuries are being sold in the market for #USD to then these being sold for another currency in this case #JPY? Those #USD, prior to the intervention effectively put in a corner, entering in circulation in the global financial system effectively increasing the money supply. Last year when the #BOJ and #PBOC were intervening at the same time, that huge amount of fresh #USD flooding the system has been a major contributor to the big #stocks rally we experienced in late 2023. So here we are with the #BOJ still printing #JPY as if there is no tomorrow while now flooding the market with #USD on top, if you still think this is not inflationary you are a fool sorry. The flood of liquidity is still so much that new bond issuances, even from troubled corporates like #Boeing, are still oversubscribed multiple times and despite the spike in bankruptcies and real estate defaults (in particular commercial ones) credit spreads remain incredibly compressed because of the simple consequences of supply and demand of money (chart credits to Crescat Capital LLC).

Let’s have a look at the second point now on why illegal immigration is very inflationary.

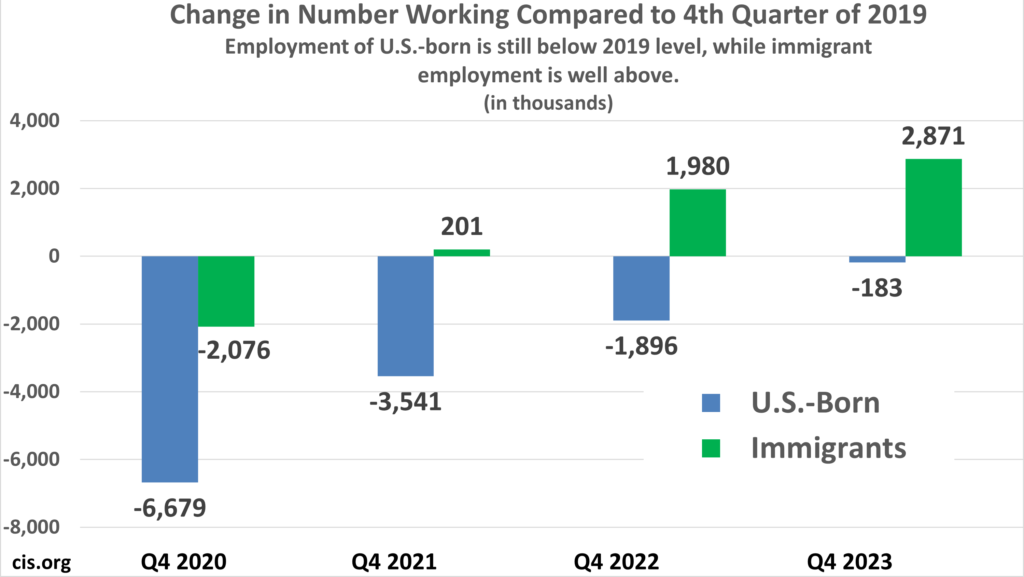

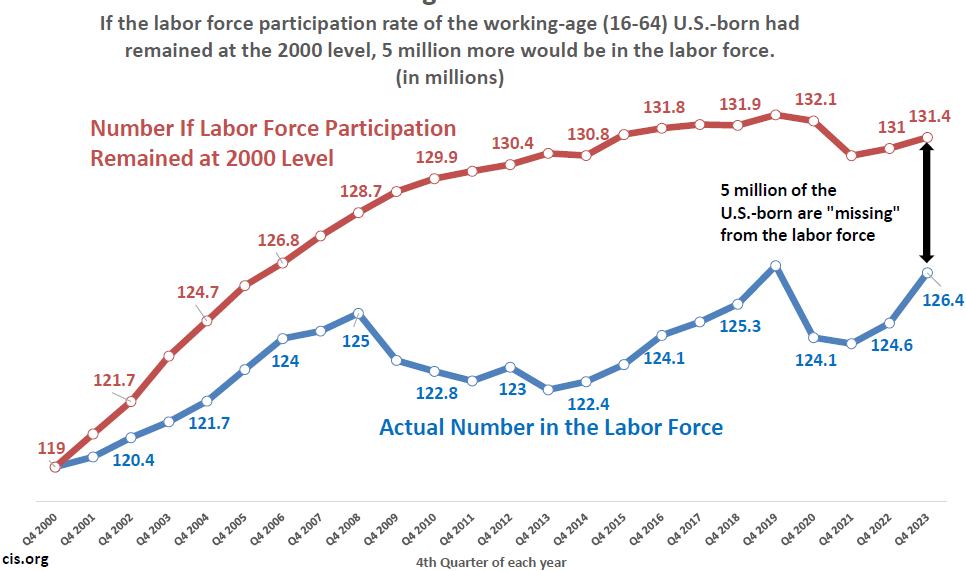

Illegal immigration is a double-edged sword, while it helps to keep the employment rates low it also takes away jobs from the local population. Why do you think this happens? Because illegal immigrants are happy to work for lower wages end employers are more than happy to reduce their costs in a difficult economic environment. However, their lower wages do not necessarily mean they make less money. Hold on a second what? Yes sir. Illegal immigrants do not pay taxes in case you have not figured it out yet and the lower salaries they are happy to work for are simply a factor of them not expecting to pay their share of taxes while they can still afford the cost of living in the area they relocated in. Employers also enjoy quite a bit of cost savings on top since illegal immigrants aren’t offered benefits like pensions or medical insurance. The charts below from the latest CIS report give a great bird’s view of what’s really going on and this report only accounts for the LEGAL immigrants!

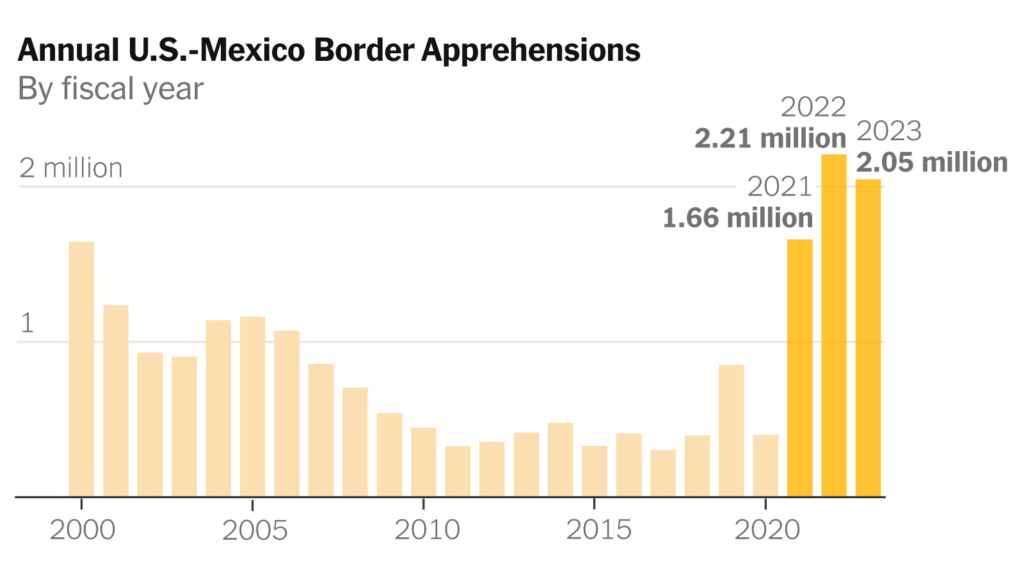

What about illegal immigrants? The numbers are literally mind-blowing

As a European, we are very familiar with the consequences of illegal immigration, in particular in Italy. I mentioned already illegal immigrants do have an advantage of being able to dodge taxation and that’s the real reason why they are happy to work for lower wages. However, this creates a huge problem for society, why? Because those who are being pushed out of the workforce will lose their incomes and no government enjoys taking the political risk of many angry voters who cannot have money to support their living. So what do these governments do? They start distributing stimmy cheques in various shapes and forms. Basically, you have a lower tax income on a country level while the government expenses do increase at the same time. How can the two of them remain sustainable? Thanks to money printing and debt monetization. Furthermore, you also have an impact on a monetary flow level since the local population gets the stimmies, and spends them in the economy, but a part of these stimmies will then outflow to the countries of origin of the illegal immigrants that wire their savings back home to support their own family that more often than not supported, even economically, their trip to the foreign country in this case the United States.

Putting all together, while the #FED virtually pretends to do QT, the overall monetary environment is still set on a QE mode and #Japan has the lion’s share of the money being printed into the system. This is the ultimate reason why to really fight #inflation the #FED must tighten now and it will be required to tighten financial conditions (now extremely loose as shown by the last chart below) to compensate for foreign allies rumbling the printing press as if there is no tomorrow. Failing to do so will result in a flare-up of #inflation that will challenge the highs seen in the 80s you can bet on it. Personally, I do not expect Jerome Burns to have the guts to do so this is why THE WORLD ECONOMY DESPERATELY NEEDS A NEW PAUL VOLCKER.