Late last year, the #FED quietly added a very unique institution to its Standing REPO Facility: #Norinchukin Bank.

Like every other news against the MSM narrative, this event was quickly brushed away from public attention. In the article “WHY IS THE FED PREPARING TO BAIL OUT A JAPANESE BANK? BECAUSE OF THE “NORINCHUKIN” DANGER“, we saw how this unknown name to the Western public is a very important player on the Global Financial System chessboard.

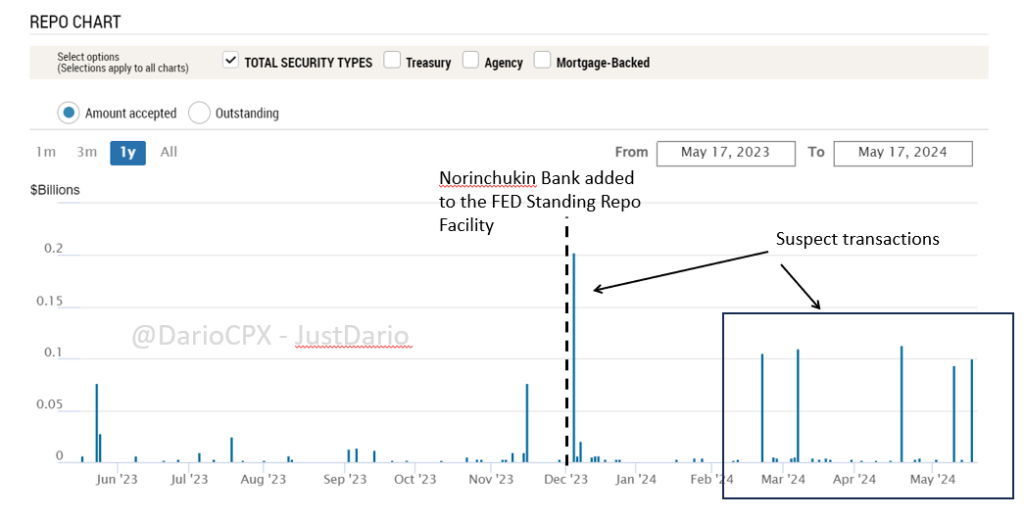

Since Norinchukin Bank was added to the #FED facility for Emergency liquidity, a very odd thing started to happen. Every now and then, a 100-150m$ overnight transaction hit the tape (chart below) and had nothing to do with the regular “Small Value Exercises” readiness tests performed by the #FED and disclosed here

I flagged several times how those odd trades could have been related to Norinchukin Bank’s struggles to manage their liquidity books (last comment shared on Thursday below).

Saturday, while it was deep night in #Japan, lightning struck the ground all of a sudden: “Japan’s Norinchukin Bank eyes raising $7.7bn in fresh capital“

Now, let’s be intellectually honest here:

1 – What was the purpose of “leaking” such news to the media when Norinchukin is an unlisted private bank that, in theory, just hit a speed bump unless… the situation is very bad and threatens other Japanese banks and International financial institutions?

2 – Why does Norinchukin need a capital raise when, on paper, it has plenty of capital and liquidity to cover what’s expected to be a manageable 500bn #JPY loss for the past 12 months?

I find this passage from Kyodo News article very fascinating:

“Norinchukin has focused on investing in U.S. Treasuries, which have higher yields than Japanese government bonds. Since March 2022, however, the United States has been raising interest rates at a rapid pace to counter inflation.

As the prices of bonds fall as yields rise, the unrealized losses in U.S. Treasuries and other bonds purchased by Norinchukin have increased to approximately 1.9 trillion yen.”

Wait a minute here, wasn’t Norinchukin keeping these investments in their hold-to-maturity books hence comfortable with not recording any loss since they would have repaid in full? Especially the US Treasuries? Yes, it was. Then why the sudden need to raise 1.2T #JPY in capital, not a straightforward endeavor for an unlisted institution, when the expected loss is only 500bn #JPY?

Norinchukin Bank is obviously facing a liquidity crisis here (as warned there was a high risk for it to happen 5 months ago), otherwise, they would never be under pressure to sell high-quality assets like US Treasuries at a loss if they could hide them, sorry hold them, till maturity like everyone else does (2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS).

Wait a second, doesn’t Norinchukin have access to the #FED standing repo facility? Then why are they selling those US Treasuries when they could repo them for cash with the #FED at will? I’ll tell you why, those US Treasuries are mostly already pledged by Norinchukin as collateral against their incredibly large book of derivatives positions with very little alternative to swap them for other assets they hold since everything else in their book is as safe as radioactive waste.

Hold on… suppose those US Treasuries are pledged as collateral and Norinchukin is booking losses against them to the point they need a substantial capital raise. What are the chances Norinchukin is being margin called and its collateral under liquidation? High.

What could be the reason prompting Norinchukin’s derivative counterparts to suddenly start liquidating one of their most prized client’s assets and try to control any potential damage on their own books?

Digging into their latest financials published in February 2024, we find hidden in plain sight the unfolding liquidity crisis at Norinchukin (because as we saw 5 months ago they were already virtually insolvent). As a matter of fact, the bank has been hiding cash losses inflating their mark-to-market value on their asset holdings and what I find incredibly hilarious is how they covered the losses of selling bonds increasing the value of the remaining bonds they held while they should have instead marked them down. However, being honest and doing that would have exposed the black hole within their books, so why not cheat? Well… sooner or later you might get caught and it looks like Norinchukin’s trading partners figured that out.

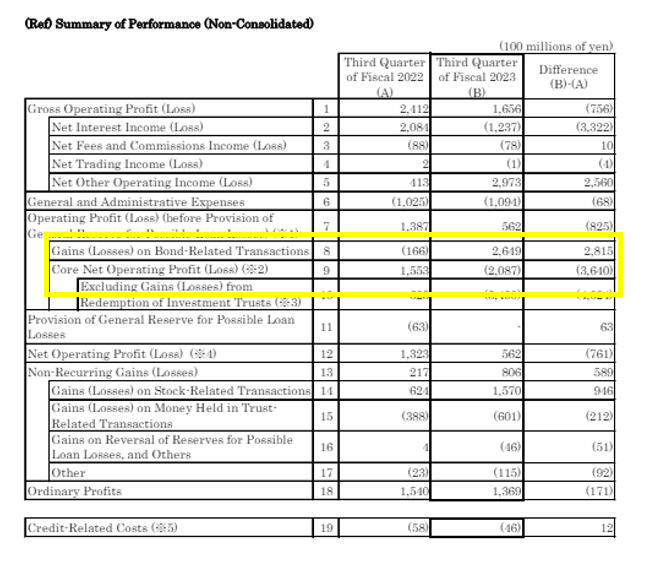

As you can see highlighted in the table below from the latest available financials (February 2024), the Net Operating Losses recorded by Norinchukin because of its poor bond investments have been compensated by… gains on “Bond-Related Transactions”!

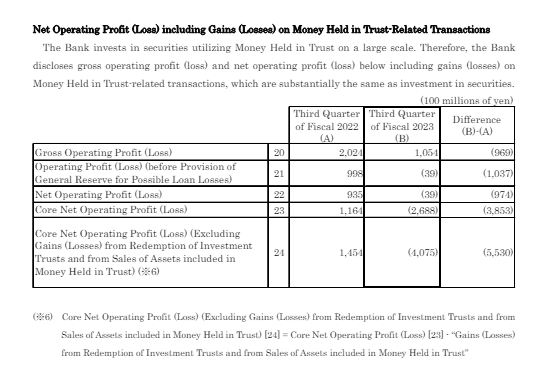

What about Norinchukin’s securities investments utilizing Money Held In Trust from their clients? As you can see they are quite underwater on that front too already using their bogus mark to markets…

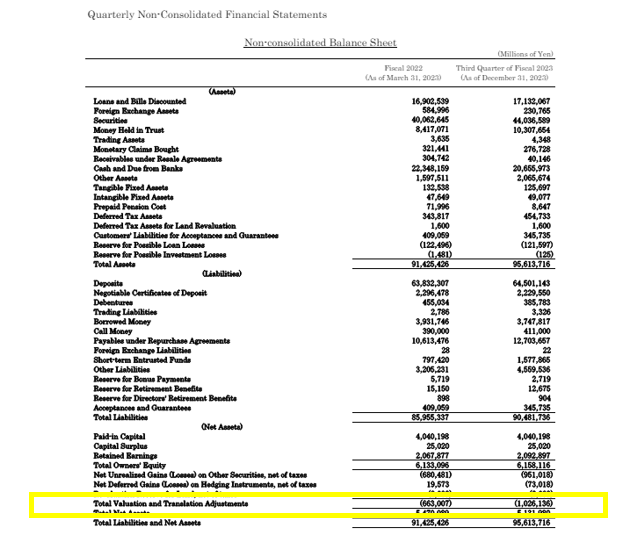

As you can see highlighted in this final table, a few months ago Norinchukin was already reporting a ~1T #JPY “Net Unrealized Gain” in their financials BELOW their equity line

In theory, recognizing that loss will still leave Norinchukin with a “comfortable” capital buffer of ~5T #JPY so why raise capital risking to draw attention and scrutiny on the books? Because when you run out of liquidity and sound assets to cash out you have no alternative left. How big of a problem can this become for the #BOJ? A 740bn #USD one and the only option available to them to orchestrate a bailout is to print even more #JPY. Guess what that would do to the currency and consequently to the #inflation in the country? (WHY A HISTORICAL $JPY CURRENCY CRISIS IS AT THE DOORSTEP OF #JAPAN)

Fascinating. An unheard of potential black swan. Now is the time for China to pile on with selling Treasuries and standing for delivery on silver, blaming it on domestic jewelry demand. Brilliant!