History never repeats, but it often rhymes. Yesterday was one of those very fascinating days in which you experience so many déjà vu moments. A few hours before #Softbank’s FY2023 results, a kitty started to roar again after more than 3 years of silence (@TheRoaringKitty), and vibes from 2021 started to come back. We will never know to what degree the 2021 #GME and #AMC squeezes contributed to the implosion of Archegos, but surely those types of events are typically the ones that change the very delicate balances of an already unstable market. 3 years later, while #GME and #AMC do have a chance of a comeback and delivering spectacular fireworks again, unfortunately, there are zero chances to see Bill “Bull” Hwang’s fund rising from its ashes. However, we have plenty of candidates that can replace Archegos, and I believe we all agree Softbank is among the best ones to fill the void.

Last week we asked ourselves, “DOES SOFTBANK NEED THE WEEKEND TO NEGOTIATE ITS BAILOUT?”, today we are going to have a look at the company’s FY2023 financials and see whether the answer is “Yes” or “No”.

1 – #Softbank’s liquidity problems can start anytime

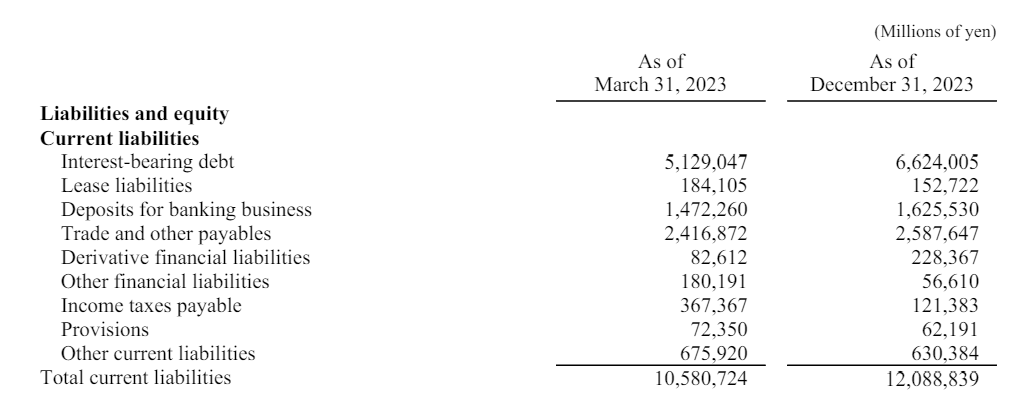

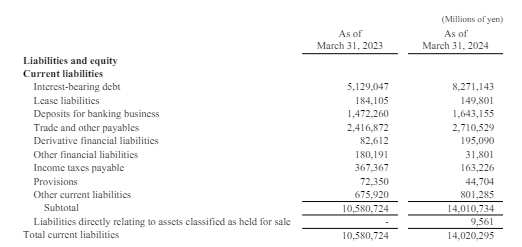

Compared to 1 year ago, #Softbank’s “Current Liabilities” increased by 32.5%, however, more than half of this happened in the last quarter, which saw this amount growing from 12,088 Billion #JPY to 14,020 Billion #JPY (~+16%). Which item contributed the most? Interest-bearing debt grew from 5,129 Billion #JPY in March 2023 to 6,624 Billion #JPY in December 2023, to 8,271 Billion #JPY in March 2024, that’s a whopping 61%!

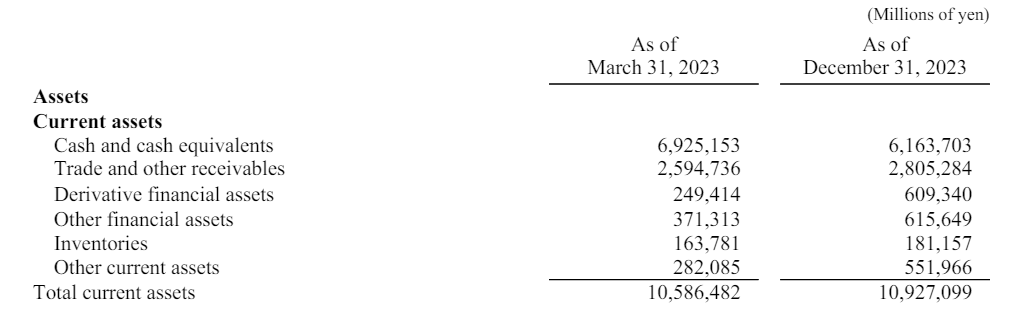

If you consider that as of March 2024 #Softbank’s “Cash and Cash Equivalent” is 6,186 Billion #JPY, it does not take a CPA to realize there is a big problem here. The problem becomes even bigger if you consider that #Softbank, which is NOT a licensed bank, is allowed to carry on “Banking Business” in #Japan through Pay Pay Bank, and precisely as of March 2024, 1,643 Billion #JPY of “Deposits for Banking Business” is in its current liabilities. That means the cash available to cover its short-term interest-bearing debt is 4,543 Billion #JPY or just 55% of the total. This is objectively pretty bad, isn’t it?

Overall, #Softbank has 14,020 billion JPY of Current Liabilities against 11,441 JPY of Current Assets as of March 2024, which is a 16.5bn #USD shortfall they are racing against time to fill.

2 – Where can Softbank fetch the liquidity they will soon need in a hurry?

I am sure someone at this point might argue “Hey but #Softbank has 35,282 Billion #JPY in Non-Current Assets against 19,466 of Non-Current Liabilities so they can just sell some of those for cash”. Unfortunately, it is not so easy. 8,159 Billion #JPY of Non-Current assets are Goodwill and Intangibles, the liquidation value of which is practically zero. 1,895 Billion is Real Estate and equipment, good luck selling that for cash in this market (and figuring out where to relocate employees in the meantime).

What about “Other financial assets” for 2,424 Billion #JPY? As you can read from the extract below, those are simply “Credits” against the doomed SVF2 that no, cannot be liquidated quickly since all those investments are in unlisted companies.

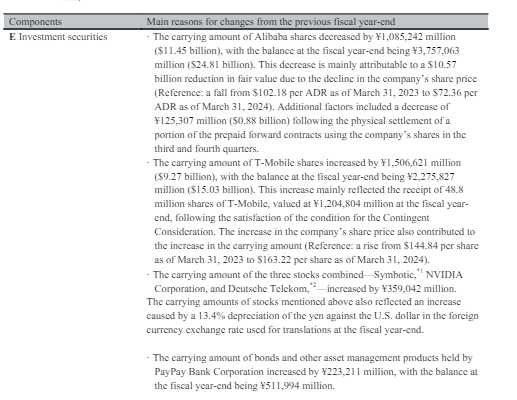

What about the 11,014 Billion #JPY “Investments from SVF”? Well.. if you consider that the bulk of it is Alibaba, T-Mobile, and Deutsche Telekom shares already entirely pledged as collateral against loans and margin loans, the chances to liquidate those at will are zero.

So let’s exclude from Non-Current Assets those we already know have pretty much zero chances to be quickly turned into cash and we get 13,685 Billion #JPY, out of which 9,061 Billion #JPY are “Investment Securities”. What’s inside here? Again, Alibaba, T-Mobile, Deutsche Telekom shares plus a big chunk of… Nvidia shares!

Hold on a second, but aren’t Alibaba, T-Mobile, and DT shares already pledged as collateral in their entirety? So how come #Softbank can account in its Assets the additional “fair value” of those (mostly a result of targeted gamma squeezes, but this is a story for another day)? This is actually a good question for their auditors.

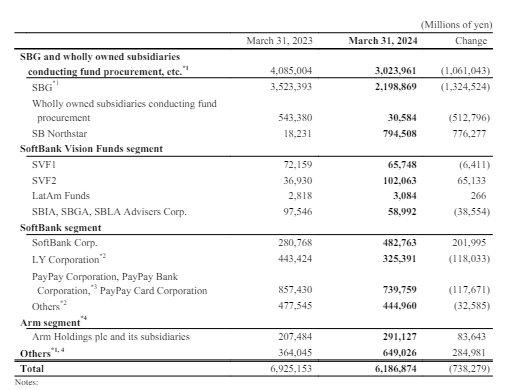

3 – Softbank Group’s cash is also scattered around its operations, not even all belonging to the holding company (that instead carries all the debt), so the real cash on hand Masa currently has to pay the soon-maturing debt is just 2,198 Billion #JPY

4 – Why doesn’t Softbank simply sell its ARM shares, the value of which is not being accounted for in its financials, to make up for its liquidity shortfall? Because 75% of those are pledged as collateral against 17bn #USD of margin loans and as we saw in “DOES SOFTBANK NEED THE WEEKEND TO NEGOTIATE ITS BAILOUT?”, when you hold 90% of all the shares of a listed company, the moment you touch them the price simply collapses (in particular when you pumped it beyond a 1,000 P/E)

At this point, it should not come as a surprise that, NET of #ARM shares, Mr. Market assigns a NEGATIVE value to the rest of #Softbank operations:

- 90% of #ARM is currently worth ~110bn #USD

- Softbank Group’s Market cap is currently 76.7bn #USD

This means that NET of #ARM’s (very inflated) holdings, Mr.Market considers Softbank to be worth a NEGATIVE 33.3bn$.

Yes, #Softbank is insolvent and it’s only a matter of time for their liquidity issues to become unmanageable and collapse this whole house of cards with ripple effects throughout the global financial system impossible to quantify. When the moment comes, Archegos will look like a walk in the park (”IF ARCHEGOS BUSTED CREDIT SUISSE, WHICH BANK WILL A SOFTBANK IMPLOSION SINK?”).