Newspapers have been cheering up the “deal” this week where Softbank managed Vision Fund successfully sold ARM 25% it owned to… Softbank.

In September 2020, $NVDA agreed to buy the whole ARM from Softbank at a $40bn valuation paying in cash and shares (NVIDIA), but it preferred to lose $1.25bn cash of penalties rather than completing the deal in February 2022. During the same period, $NVDA stock price raised from 128 to 250, applying the same multiples used when the deal was sealed it implied a ~$65bn ARM valuation.

How the hell did $NVDA let go of such a “good deal” where, on paper, they already made a $25bn profit?! The company’s official excuse was antitrust concerns… but it doesn’t take a genius to figure Softbank busted the deal since they wanted to take home more money (NVIDIA).

However , Softbank failed to sell ARM due to #stocks plunge after February 2022 and, ironically, Softbank and $NVDA were back at the negotiating table with $NVDA rumoured to be an anchor investor in ARM’s IPO one year later… ft.com

Here is the truth, buried in the FT article, “One person familiar with the discussions said Nvidia wanted to come in at a share price that would put Arm’s total value at $35bn to $40bn, while Arm wanted to be closer to $80bn”.

Since February 2023, NVDA’s stock price increased from 186$ to 433$ on Friday while Softbank acquired Vision Fund stake at a 64bn valuation when in February ARM was marketing itself at 80bn. Hold on, why did ARM not benefit from the #AI #FOMO breakneck run at all?!

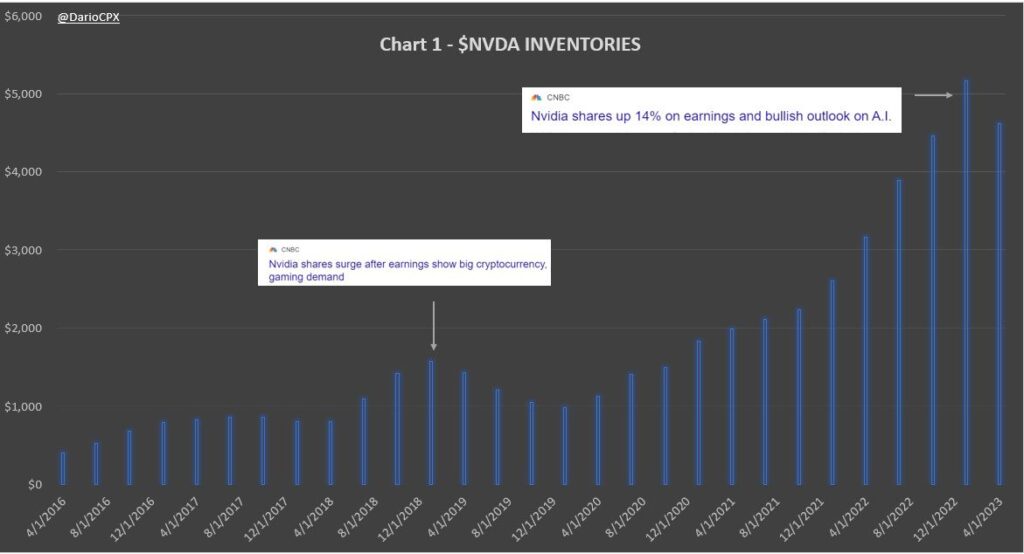

Here is why, the narrative fuelling #semiconductor #tech companies #FOMO had little to do with #AI! Every time $NVDA chip inventories build up, “coincidentally” a new “narrative” surfaces and the company can then unload its unsold products. When the #gaming one faded, they moved on to #crypto mining and then recently to #AI (chart 1). However, under the hood, insiders obviously know it’s all a bunch of BS. As a matter of fact, at the negotiating table, $NVDA’s behavior reflects insiders realistic expectations on the market real value in stark contrast to what they claim publicly.

Applying some quick math, using the multiples $NVDA’s own management applied to ARM, their stock was worth ~$125 vs. $183 market price in February 2023. Fast forward to today, with ARM agreeing to a lower valuation than six months ago, then what’s all the benefit of the #AI narrative applied to chip making #stocks? Z-E-R-O

How did $NVDA’s stock, which “realistically” isn’t worth more than $100-$125, get to where it’s trading today?

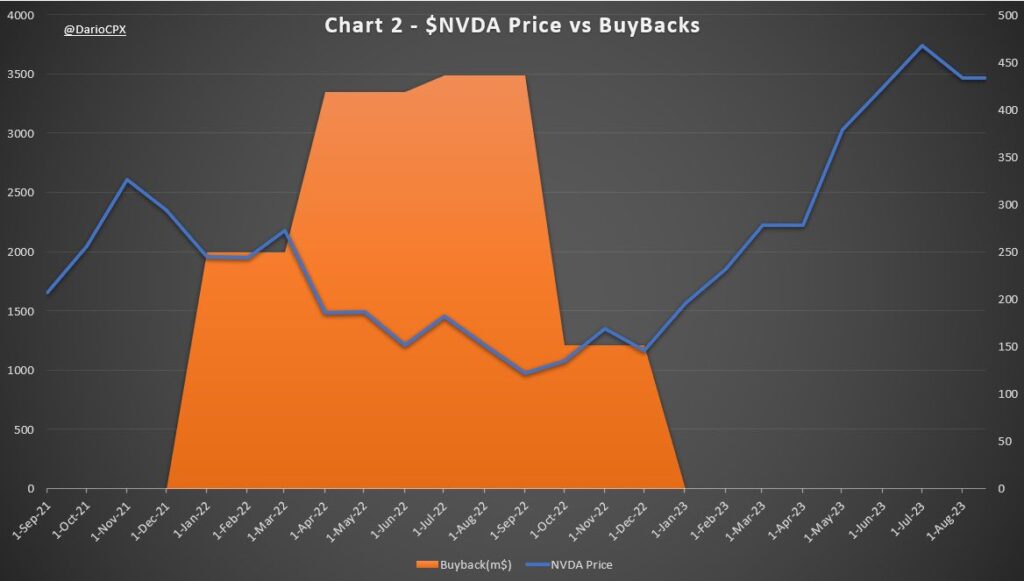

$NVDA’s timely buybacks + traders gamma squeezing to front run it sending the price to nosebleed levels to then cash out at inflated valuations. Were $NVDA and market whales coordinating? Who knows, but… as a matter of fact, $NVDA’s buybacks timing was “perfect”… Bloomberg (chart 2)

Of course, in bull bubble markets, all is legal until it’s not… As far as I am concerned the end of this story is already written, and $NVDA will need to put on a hell of a show to keep this whole house of cards from collapsing this week when they will announce their last quarter results.

Here is my view. The companies who will benefit from #AI won’t be chipmakers since the computing power available to develop it is already way more than what’s needed. Those that will thrive will be the ones who will manage to leverage on the technology to deliver meaningful cost savings replacing current “iterative” jobs in the service sector with virtual automation in the same way repetitive human factory jobs have been replaced by robots.