I know a couple of things here and there about running a company, from work and direct experience. One thing is how easy it is to “grow” your revenues when your clients aren’t going to pay for the goods you deliver. Another is to understand whether revenues are real or not.

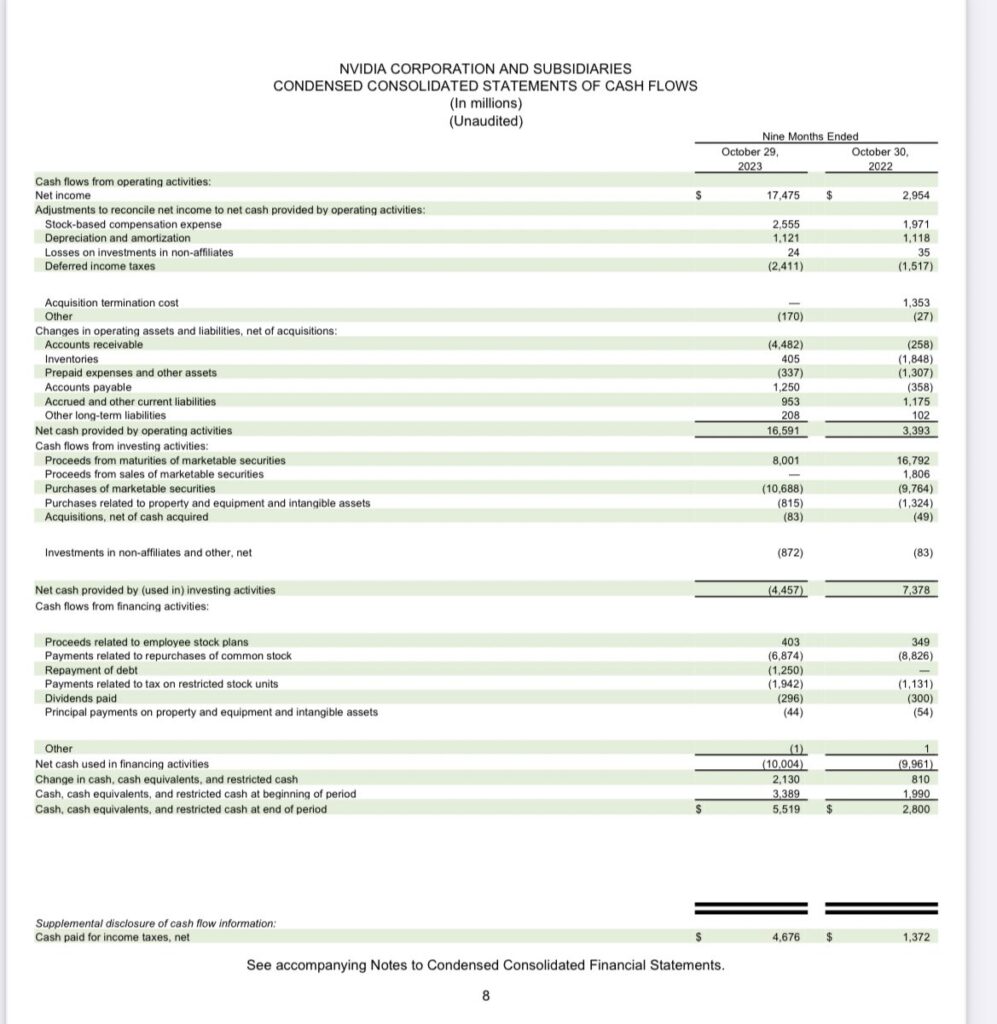

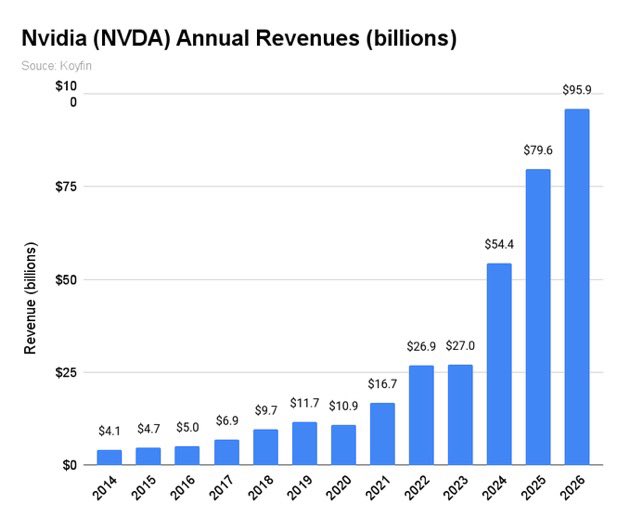

$NVDA revenues grew 85% comparing the first 9 months of 2022 with the same period in 2023 to ~39bn$. Wow, how cool! Well.. very nice if it weren’t for a couple of red flags.

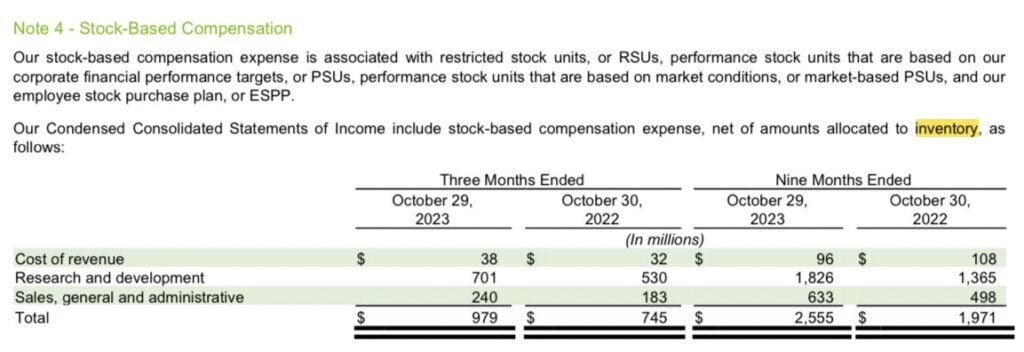

🚩 If $NVDA salespeople are doing such a spectacular job, why aren’t their commissions rising in line with the revenues?

“Sales, General & Administrative” costs for $NVDA increased only 7% in the same timeframe.

Wait, maybe the Salespeople are being paid in $NVDA #stocks? Not according to $NVDA, considering that Stock-Based compensation expenses related to SG&A increased from 498m$ to 633m$ in the period, that’s only 27% compared to an 85% increase in sales still! 🤷🏻♂️ Furthermore, it accounts for the whole growth into their SG&A items.

Wait, are you telling me that $NVDA turnover almost doubled, and their administration expenses remained unchanged? Ahaha… suuuure!

Anyhow, if sales aren’t making the sale, then who’s doing that? The management?

🚩 If $NVDA is doing so well, why did their “Accounts Receivable” explode by a whopping 1,637% to 4.5bn$ in the same timeframe between 2022 and 2023 periods we are examining.

Isn’t it because you are selling things clients aren’t paying for?

🚩 If $NVDA is doing so well, why did their inventory remain the same? When you sell so many goods and keep booking stellar future orders, there should be a physiological increase in inventory, right? Well, not in the case of $NVDA apparently.

$NVDA inventory stood at 4,454m$ in the first 9 months of 2022. Where is it now? 4,779m$. That’s only a 7% increase.

Wait, didn’t we just see a 7% increase in SG&A costs?! Ahah, this smells so much of made-up numbers.

🚩 People familiar with the chip industry know that companies pay royalties to 3rd parties for every chip they sell due to the jungle of IP patents and copyrights that characterize the industry. This item is a constant and highly correlated with revenues.

Now, despite $NVDA expecting exponential growth in its revenues for orders already in the bag, they reported LOWER “Prepaid Royalties” in the first 9 months of 2023 than the same period in 2022, precisely 369m$ vs 393m$.

What I find quite hilarious reading through $NVDA financials is that they use a sneaky trick to fool people’s eyes. Depending on what’s more convenient, they switch the comparison of the data inconsistently against either Dec-22 or Sept-22 throughout the report (so I had to dig out a few numbers from last year’s 10-Q).

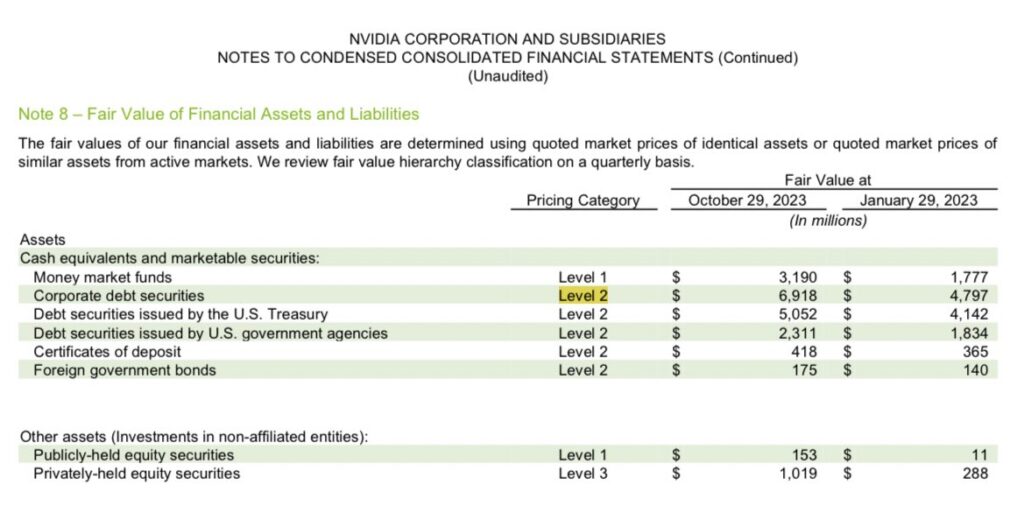

By the way, in the same $AAPL fashion, $NVDA is such a good Fixed Income trader as well. Actually, they are even better than Tim-Cooking because he still reports some ~11bn$ of losses in the “Other Comprehensive Income” while $NVDA (apparently) never lost a penny despite holding only 3bn$ in cash and all the remaining 15bn$ between Corporate Bonds and US Treasuries!

If, after reading all I wrote, you still feel confident $NVDA is a safe, sound, and legit investment, then I really did a bad job today.