he S&P500 closed at new all-time highs last Friday. Yet, have you noticed way fewer people are celebrating this time around? Yes, because indeed this time is different. In all fairness, Bloomberg tried to kick off the party but published one of the articles that has good chances to make history… in the wrong way. According to Jonathan Levin, “This Isn’t Your Father’s S&P 500. Don’t worry about valuations”.

Doesn’t that sentence feel awkwardly similar to another one that made history as well? Which one? This: “ #Stocks prices have reached what looks like a permanently high plateau” [Irving Fisher, 1929] .

f you wonder why many people in the US (and abroad) aren’t in the mood to celebrate these new S&P500 all-time highs, differently from 2022 and all previous times before, the reason perhaps lies in the fact that the “negative” all-time highs are, by far, outnumbering the “positive” ones in the (real) world where they live. Let’s have a look at a few real-world “all-time highs” the S&P500 just joined.

- US Credit Card Debt Balances: 1,032bn$ – When everything is great, people don’t tend to pile up on debt they can hardly afford to pay right?

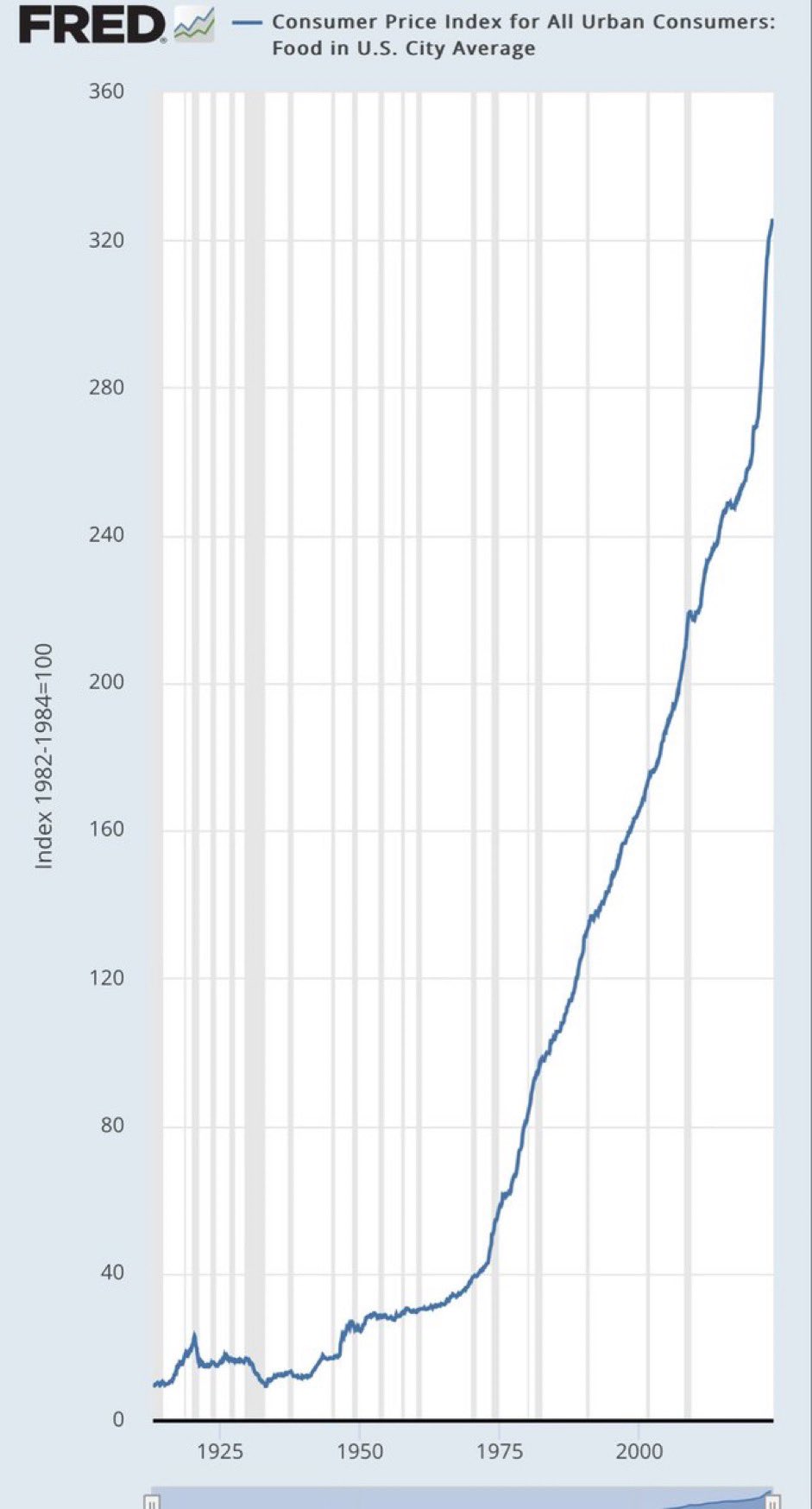

- US Food Prices (Chart 1) – No comment

- US Public Debt: 34,070bn$ – Nothing to comment here either

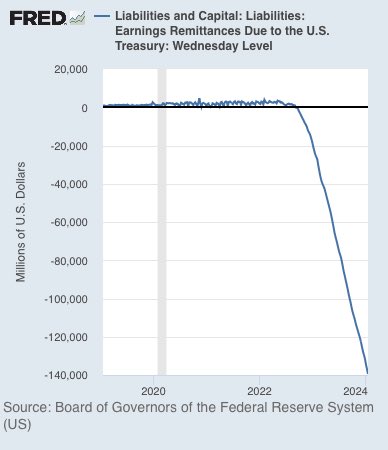

- Federal Reserve (Yes, the #FED) Losses: 139bn$ (Chart 2) – Imagine how bad things are when even those that can print money cannot run their operations profitably.

- #FED #BTFP Emergency Banks Bailout Facility: 161.5bn$ – Last time I checked, when something is on a life support for so long usually isn’t a sign it will recover very well (if it recovers at all) in the future.

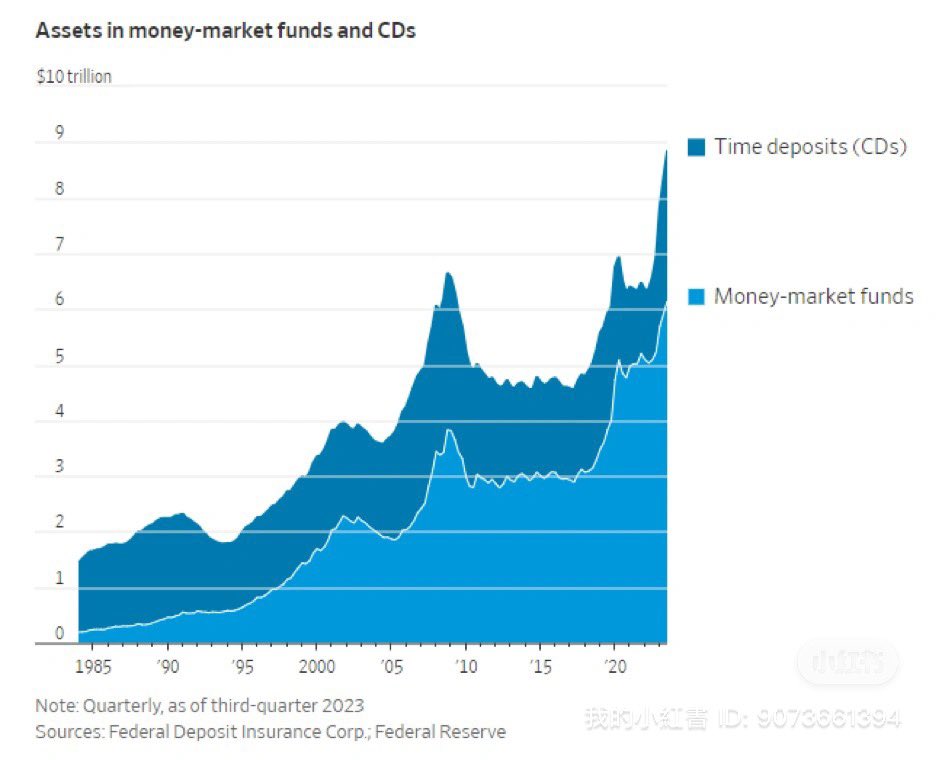

- Assets in Money Market Funds and Certificate of Deposits (Chart 3) – Why should people and companies be holding so much cash if everything is awesome in the economy and stocks investing is such a “sure win”?

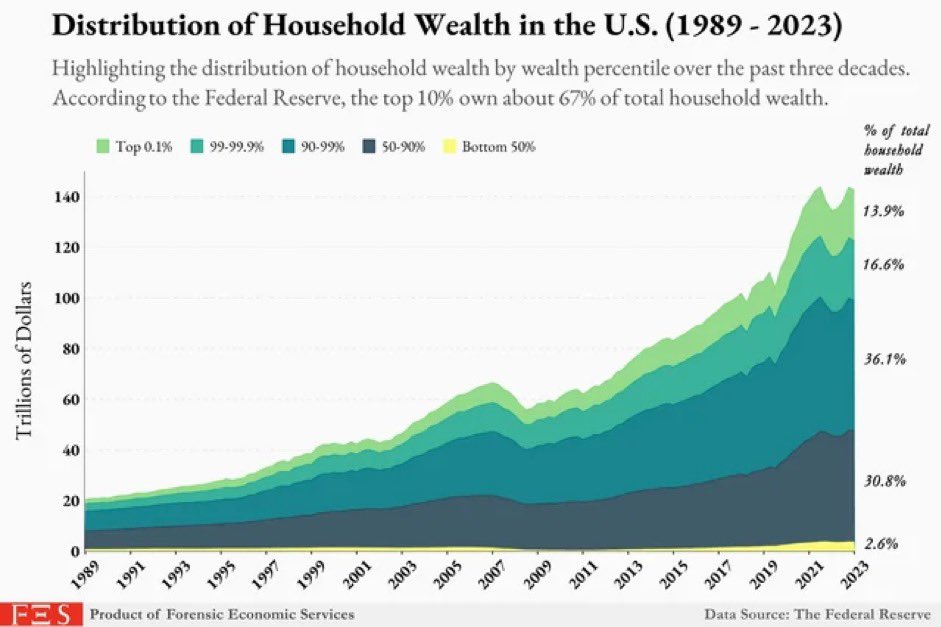

As a matter of fact, why should people be celebrating all-time highs in #stocks if objectively they are not really benefiting from them? Please have a look at the (self-explanatory) chart 4. As displayed, currently the top 10% owns 67% of the total household net worth in the US while the bottom 50% only owns 2.6% of it.

2024 is an election year in the US and many other countries in the world. Politicians still trying to sell stocks “all-time highs” as a sign everything is awesome in the economy (post below as an example) might better reconsider this strategy.

Objectively, celebrating new all-time highs in stocks is now more a celebration of income inequality than prosperity for the whole population (that will soon be called to decide whether who is in charge will stay or not).