UK #CPI was the last series of inflation data for December, confirming the month was “hotter” than expected. Is this the start of a trend back upward, or just a blip in the #FED and fellow Central Banks triumphant march to celebrate the #inflation defeat?

The truth is, #inflation never went away, it was simply hidden from the trading algorithms and gullible traders, thanks to a constant “political adjustment” of the data everyone is now familiar with (see post below from December).

Problems with shipping routes in the Red Sea unfortunately spoiled the soft landing dream or, more correctly, illusion. Will the 1970s scenario that saw inflation flaring back up repeat? The answer to this is “Yes”, what it’s hard to estimate at this stage is the magnitude and the duration of the incoming move. In the 70s, the move was brutal (Picture 1), however, the economic structure at that time was very different. In particular, countries weren’t standing straight up because a huge pile of debt was supporting them, but the industrial and commercial pillars of their economies were structurally strong and healthier than today.

Wise bond traders are already starting to pare back their bets on 6 rate cuts coming from the FED this year (Picture 2). However, most of them in the US are still hanging on to their soft landing dreams and as such, the 10y Treasury is only up 29 basis points since the 3.81% bottom reached the last 26 of December. Quite a different story on the other side of the ocean where UK Gilt yields have been roaring back. The 10y and 30y Gilt yields are up 52bp and 59bp since December’s bottom, to 4.02% and 4.685% respectively. What about Japan where rates aren’t allowed to move freely? #JPY already lost almost 5% against the #USD since the end of December

Unless something significant breaks the current pattern, and with that, I mean a widespread banking crisis that will make the one we went through last year look like an appetizer, forcing the FED to pull the trigger on emergency rate cuts and QE, the stage is set for rates to move back up again by a lot. In the same way, it just took a little more than a month for US treasury yields to come down 100bp in the long part of the curve back in the previous quarter, no one should be surprised to see the same type of move back on the way up.

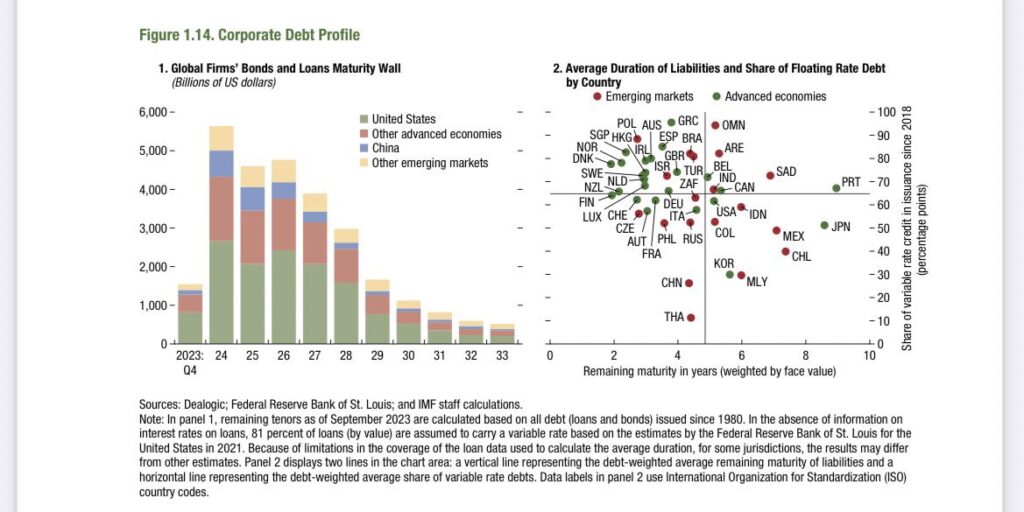

Overall, considering the current state of things, rates will come back to the highs we saw in 2023 faster than anyone thinks and not just because the FED botched its economic policy once again. As I already mentioned last year in my post “WHY, WITHOUT QE, THE US TREASURY WILL KILL A LOT OF ZOMBIES AND SPARK MASS UNEMPLOYMENT” (TwitterX) in 2024 there is a ton of debt maturing (Picture 3) and this nevertheless will put further upward pressure on yields for the simple (but powerful) rule of demand and supply balance. ?

At this point, I am sure many of you would be interested to know what I think about #stocks for the coming months. Well… objectively speaking:

1 – Considering rates coming down hard in October 2023 was what fuelled the (insane) #stocks rally in Q4, what do you expect to happen with rates coming back where they were?

2 – If another big crisis hits instead and the FED will be prompted to pull the trigger on an emergency rescue starting with rate cuts, then QE and perhaps asking for another TARP if things turn super ugly again, do you really think that is going to be #bullish for #stocks currently trading at such a huge valuation gap with the rest of the world? (Picture 4)

I won’t stop repeating this, buy insurance while it’s available if you still want to ride this market, although it would be better to be already comfortable on top of a high (T-Bills) when the tsunami will hit the shores