No, I didn’t get the title wrong, I meant to say that. You know why? Because that’s what’s written in $UBS Q4-23 financial statements just released.

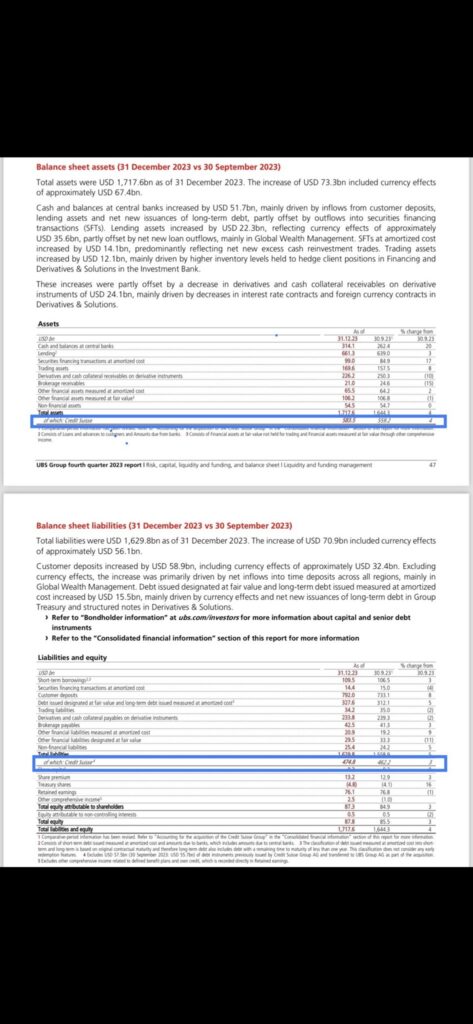

Let’s go straight into it. Please look at Picture 1 where you can see the amount of Total Assets and Total Liabilities still attached to the $CS corpse. Let’s do some simple math here: $583.5bn of total assets coming from the defunct $CS minus $474.8bn of liabilities referred to the same equals $108.7bn, right? Now, as you learn in the first class of accounting, equity equals assets minus liabilities, right?

Well, if you look further down in Picture 1, you can see that $UBS’s total equity (that combines $UBS and $CS) is…

🥁🥁🥁🥁… $87.8bn 🤯

Well… as a matter of fact, if $CS equity is $108.7bn and the consolidated one is $87.8bn, it means the one attributable to $UBS is negative $20.9bn, no?

Oops, someone screwed up the accounting big time here…

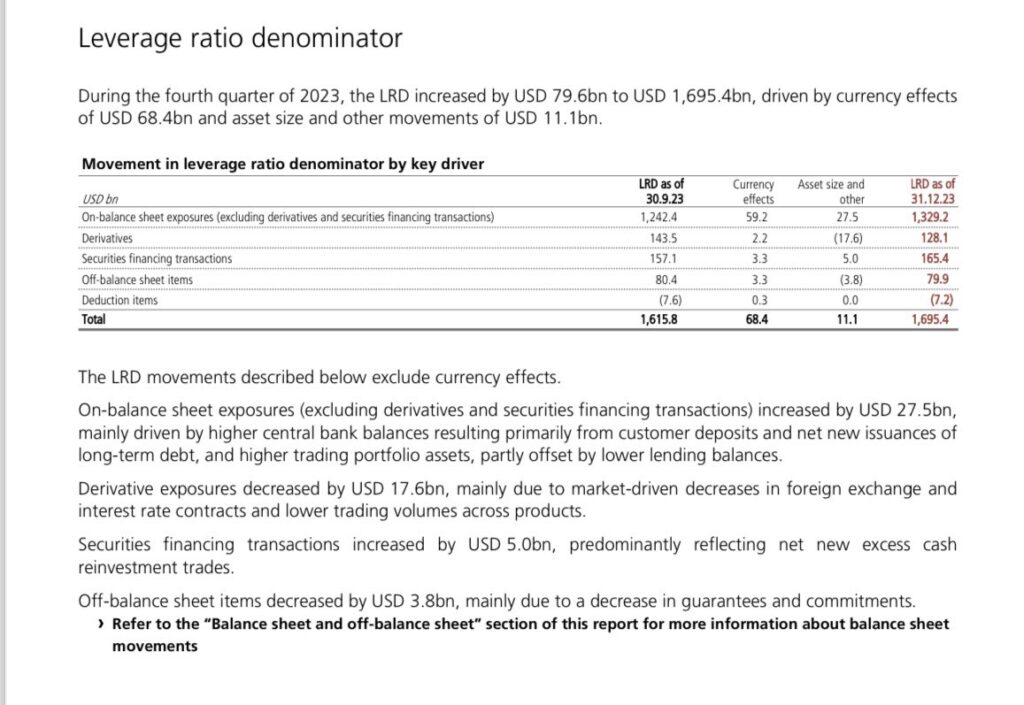

Now, when a bank is insolvent, what does the bank try to do to hide it? Of course, it will inflate the value of its assets to make them appear greater than the liabilities. $UBS, contrary to all other banks out there that have been trying all they could to cut their lending risk, instead saw it increase by $36.4bn between loans and securities financing combined in its assets. Weird, isn’t it? Well, it’s even weirder if you consider $UBS didn’t make new loans but actually cut on lending exposure as remarked several times across its report. So how the heck did that value (conveniently) blow up? We find the answer in the “Leverage Ratio Denominator” section where $UBS claims “During the fourth quarter of 2023, the LRD increased by USD 79.6bn to USD 1,695.4bn, driven by currency effects of USD 68.4bn and asset size and other movements of USD 11.1bn” (Picture 2).

Here’s the thing, either $UBS forgot to hedge its FX risk and got lucky, or there is something wrong here (cough cough some accounting cheating perhaps?). Of course, there is something wrong here because no risk manager will allow its bank treasury to carry such an amount of FX risk in its books. Imagine if the swing happened in the wrong direction, that alone could easily wipe out most of the $87.8bn of equity in $UBS’s balance sheet!

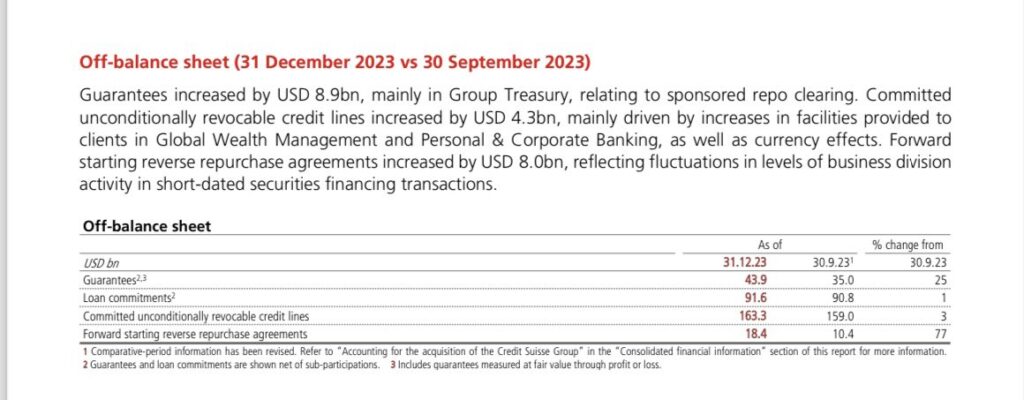

What about off-balance sheet items? Please do me a favour and compare Picture 2 and Picture 3 here, what do you see? Of the $317.2bn of $UBS Off-Balance sheet liabilities, only $79.9bn are considered in the Leverage Ratio Denominator calculation. I mean, is this a joke or what?!

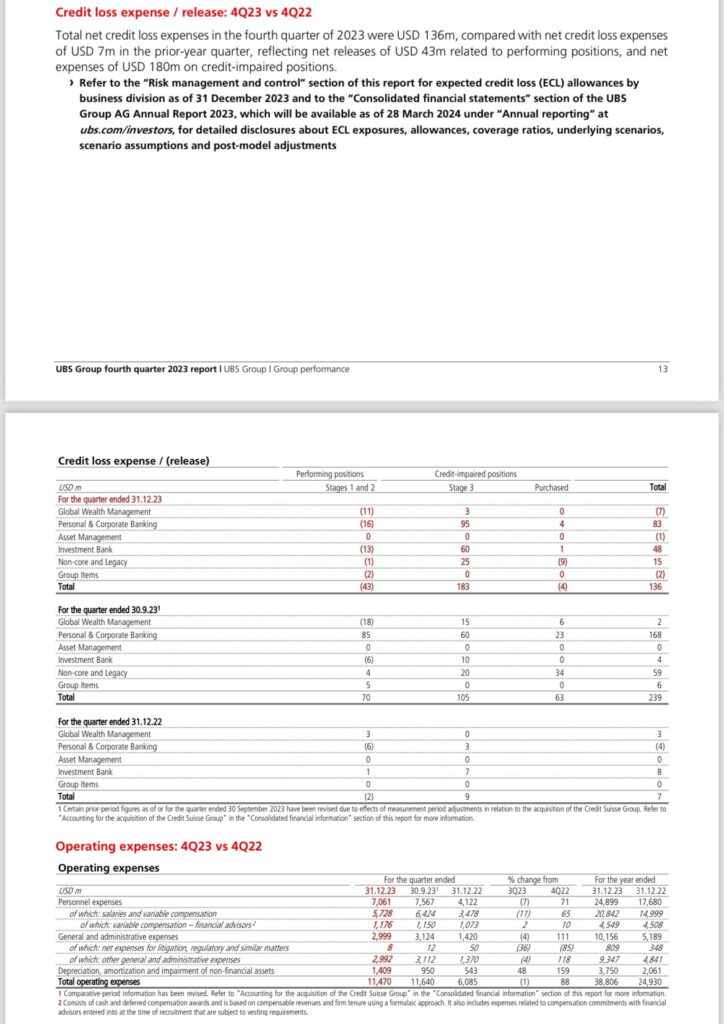

Let’s conclude with something obvious at this point. Of course, as you can see in Picture 4, $UBS sees absolutely no credit risk whatsoever in its books and only accounted for $136m of credit losses in Q4-23.

As I wrote last week (JustDario), $NYCB’s troubles really sounded like the canary in $UBS’s coal mine. Now that $UBS’s financials are out, we can barely hear the canary singing…