As I write, NVIDIA is up 8.56% in After Hours trading after releasing their “monster” Q4-23 results. Compared to the Q3-23 report, there isn’t much change in all the red flags 🚩 I highlighted before [JustDario], but while I was comparing the two, my eye caught something strange.

Before I go forward, in case you don’t know, I would like to flag that NVIDIA’s Q4 is shifted 1 month forward compared to the majority of listed companies. Hence, it runs from the 1st of November till the end of January of the next year.

Alright, time to grab your 🍿 now.

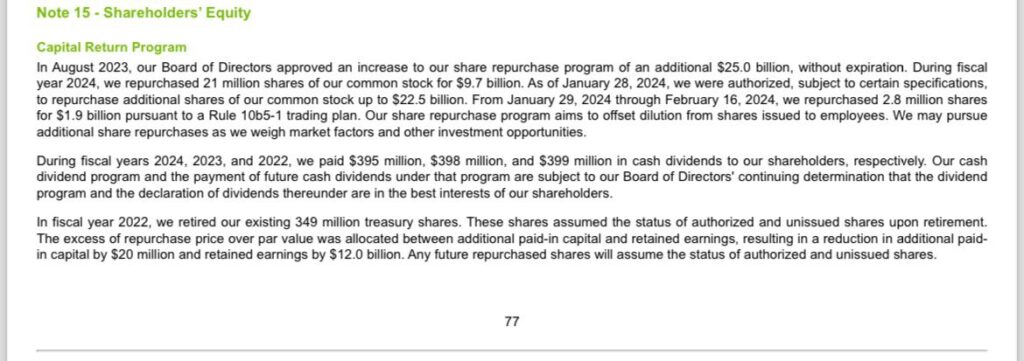

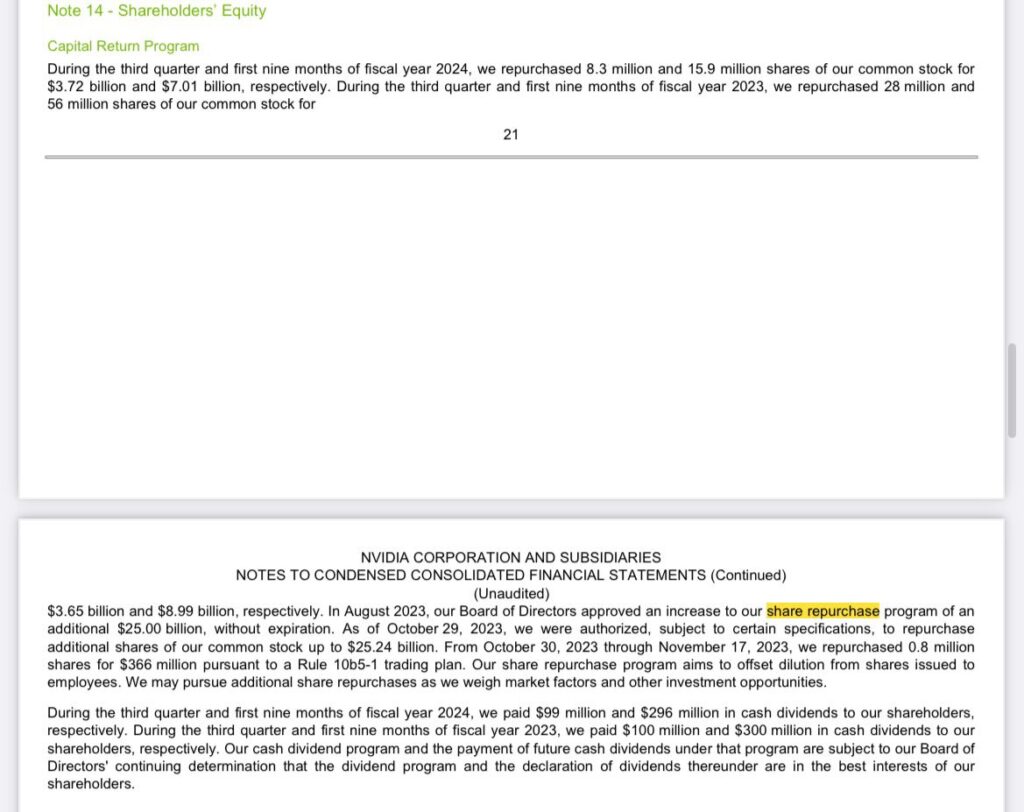

1 – In the last report, NVIDIA declared that they repurchased a total of 21m shares, paying $9.7bn throughout their latest fiscal year. What’s interesting about this? Unusually, since companies always report shares bought in the quarter and in YTD in intermediate earnings reports, NVIDIA doesn’t mention how many shares were bought back during the last quarter 🚩.

Odd, isn’t it? 🤔

2 – Alright, Jensen, let’s go figure this out. As we can see from the Q3-23 report, up until the last quarter, NVIDIA repurchased 15.9m shares, paying $7.01bn. Applying some quick math, we can figure out NVIDIA bought back 5.1m shares in the last quarter, paying $2.69bn.

Alright, what’s wrong with this?

🔫 💨- Applying some easy math again, we can quickly figure out that the average price NVIDIA paid in Q4 was $527. Do you know what was the average price of NVIDIA shares during Q4 overall? As a simple average, $492; as an average weighted by the trading volumes, $502.

In the Q3-23 report, NVIDIA kindly provided us with an extra piece of information: “From October 30, 2023, through November 17, 2023, we repurchased 0.8m shares for $366m pursuant to a Rule 10b5-1 trading plan.”

Alright, that means that in the first ~20% of the quarter, NVIDIA repurchased ~20% of the shares. Nothing uncommon here. It’s actually pretty normal for companies to run buybacks at regular schedules. Otherwise, they might easily breach SEC insider trading rules if caught in actively manipulating their stocks prices 😅

Considering what I said, NVIDIA should then continue its share buyback program regularly for the remaining 80% of the quarter, right?

Now, if we exclude the 800k shares repurchased for $366m, then NVIDIA would have been left with 4.3m shares to repurchase for $2.324bn, right? That means the average price for that buyback is $540.47. What was NVIDIA’s average price between November 17, 2023, and January 29, 2024? $510.9 the simple average, or $513.7 the volume-weighted average.

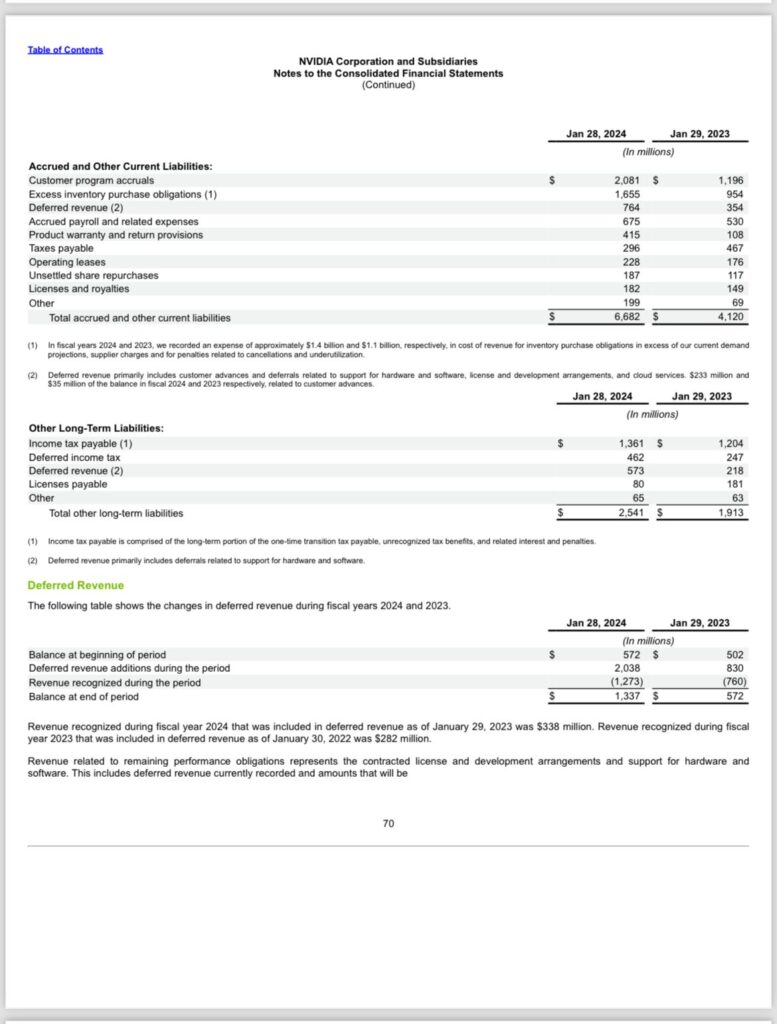

🚩 Putting it all together, NVIDIA overpaid ~6.9% to repurchase its own shares in Q4, equivalent to $187m. Now, please have a look at the line “Unsettled Share Repurchases” below. What’s the amount? $187m!

Now, as everyone familiar with buybacks knows, shares repurchased are settled immediately through your custodian. What about call options though? Well… that fits in the category of “Unsettled Share Repurchases”! 😉

Let me now ask this question: What do you think are the chances NVIDIA is overpaying its stock buybacks so someone else can, on their behalf, use that money to play the OTM call options gamma squeeze game on NVIDIA stock?

Now let’s look at things from a second perspective

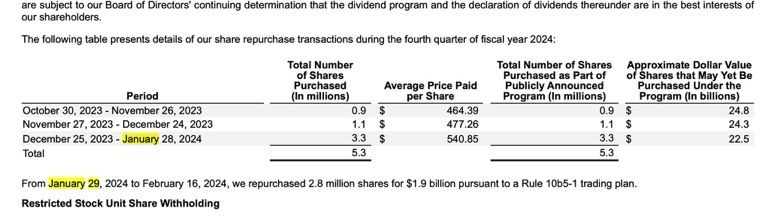

Please have a look at the table here where NVIDIA , in appearance, heavily repurchased its shares only in January. Odd isn’t it? Follow me 🍿

🚩 If you do the math comparing Q3 vs Q4 NVIDIA declares they repurchased 5.3m shares in Q4 in the table while in their “Capital Return Programme”, where they left out the detail for the quarter, the amount is 5.1m shares

🚩 If you consider the 2 weeks amount they disclosed in Q3 as repurchases made already belonging to Q4, the average share price of the remaining buybacks is 540$ for the remaining 2.5 months. What’s the average share price they declared it was repurchased in January alone? 540$!

Now from the 13-F we know that there was some heaving selling in NVIDIA stock into 2023 year-end, how come the price didn’t drop so much when NVIDIA wasn’t, apparently, actively doing buybacks?

🚩 Clearly NVIDIA was using call options for January settlement at ~540$ strike to support the price forcing dealers to delta hedge and hence compensate the institutional selling 😅

🚩 All those options in large notional started to become 0DTE into January, perfect timing to trigger a powerful gamma squeeze of the likes we saw countless times recently. As a matter of fact, through January NVIDIA price went up on a straight line with barely any down days and was constantly “boosted” by a no-stop PR campaign.

All this explains the unusually large amount of share buybacks “settled” in January.

🚩 So now we know NVIDIA has been skimming cash out from its share buybacks plus actively playing with derivatives to forward settle their purchases and leverage dealers’ books

Last 🚩 in the first 2 weeks of the new year NVIDIA repurchased ~2m shares, not accounted for in the current quarter (unaudited) numbers. That amount represents 10% of the total amount of shares they repurchased in the whole previous year and you think they bought right at the very top? Of course not 🤭 those are very likely derivatives settlement into the February OPEX…

Think about this, NVIDIA before had a pretty consistent history of buying back their shares always timing the bottom almost to the tick. What changed all of a sudden and got them to U-turn and start to buy aggressively after the stock already had a massive run? Clearly, they found a scheme they could gamma squeeze themselves, almost, “legally” 🙈